Inside Capital One’s Auto Lending Innovation Machine

Inside Capital One’s Auto Lending Innovation Machine

Putting Capital One auto loan power into a mobile app is just one of the ways Sanjiv Yajnik and his teams have shaken up banking.

Articles about innovation in banking, exploring the latest trends, new ideas, and how banks innovate in digital banking channels, CX, technology, and digital payments.

Generative AI brings increased possibilities and increased risks to both business and consumer payments. Learn how.

Putting Capital One auto loan power into a mobile app is just one of the ways Sanjiv Yajnik and his teams have shaken up banking.

Compliance officers who can think out of the box can be the boost that takes a banking product from commodity to innovation.

Generative AI brings increased possibilities and increased risks to both business and consumer payments. Learn how.

From sensors that can improve branch experiences, to a box that pulls water from the air, U.S. Bank finds inspiration at CES.

An innovation lab in Philadelphia wrapped in an urban retail bank branch has produced valuable synergies for TD Bank.

Smaller financial institutions should invest in worker well-being and partner with universities to attract more tech talent.

There's good news: Banks and credit unions may be uniquely positioned in 2024 to pursue radical reinvention.

Special Report: In the second of a four-part series on the long-term future of the banking industry, we examine the four major industry transformations currently underway.

A combined marketing-IT experiment at Ally Financial saved thousands of hours of staff time. Next year will see bigger and deeper implementation.

Anu Sachdeva from Genpact shares the opportunities and changes that generative AI can bring to financial institutions.

Banking innovation has to balance the futuristic with the realistic. Here's how Synchrony plays to its 'strike zone' with developing technology.

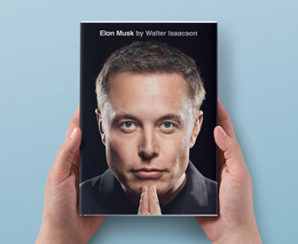

Can bankers compete with a volatile and relentless leader who thinks sleeping under your desk is a virtue? Here’s how Musk set his sights on disrupting the financial services industry.

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Chasing perfection often delays deployment and denies customers cutting-edge experiences. Bankers should embrace progress as their goal.

As artificial intelligence advances and reshapes banking, AI maturity becomes crucial for financial institutions to remain competitive.

You can tell a lot from a memoji. It’s just as much part of Apple’s strategy for reeling in Millennials & Gen Z as its marketing for Apple Pay.

Is AI stalling in your organization? Here's how to avoid the major pitfalls of artificial intelligence projects, drawn from real-life experience.

Enterprise AI projects often get derailed. An expert on artificial intelligence in banking details how Truist stays on track.

Industry veteran Jay Sidhu frets that time is running out for community banks to get serious about innovation. He has ideas for motivating change.

As digital transformation in banking booms, enthusiasm for Agile, a project management philosophy developed in the technology sector, grows.

BMO Financial talks about its use of artificial intelligence, its activity on the gaming platform Twitch and more.

Maureen Doyle-Spare of UST explains how the pursuit of technology investments regardless of broader economic conditions can ensure financial institutions will be future-ready.

Google Cloud’s former chief transformation officer is reimagining how this $26 billion-asset Arkansas bank does business.

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment