Bank and credit union executives have been trying to figure out what Apple is up to in financial services since its introduction of the Apple Card in early 2019.

Every move after that — especially its high-yield savings account — has only amped up the speculation.

A common mistake is thinking of Apple like any other competitor, as if its products are vying directly with those of traditional financial institutions.

But Apple is far from a pseudo-bank, according to Lierin Ehmke Melvin, director of insights at Mintel Comperemedia. Its edge is the ability to think very differently in its strategic approach, mixing elements in fresh ways to come up with something entirely new.

She offered a deep dive into Apple’s strategy in a webinar sponsored by Mintel Comperemedia and The Financial Brand. The presentation — called “What’s the Future of Apple in Financial Services?” — is crammed with detailed analysis and charts and is now available on demand.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Dissecting Apple’s Banking and Payments Strategies

Drawing on extensive research, including evaluation of multimedia marketing efforts tracked in the Mintel Comperemedia database, Melvin says the following picture emerges of Apple’s strategy:

• Young people with money. Apple’s growing family of financial products is aimed at affluent Millennials and Gen Zers and is being tailored to their preferences. Gen Z prefers cash to credit and this is part of the reason that Apple Card rewards are called “Daily Cash.”

Sorry Boomers and Gen Xers, Apple’s just not banking on you, Melvin says. As for the less affluent, Apple will come back for some of you later with a service enabling installment purchases of Apple iPhones and more, which will expand its financial services base, she says.

The appeal to Millennials and Gen Z goes beyond the fact that together those age groups dominate the population. “Affluent Millennials and Gen Zers are really open to something different,” says Melvin. “More than half of this audience is willing to switch financial services providers and that indicates a big opportunity to reach those customers and take their business.”

A growing body of research suggests that many Americans have no trouble with maintaining financial services relationships with many providers, but Melvin suggests the quality of Apple processes and design could be enough of a reason for many consumers to consolidate their relationships with Apple.

• Privacy and security rank high. Apple’s emphasis on data privacy and security is intentional. The tech giant understands that this is part of the appeal for its target audience and not just a “nice to have.” Promoting features such as facial recognition for access to Apple Pay and its overall effort to provide data privacy shows that Apple is using this to present itself as a challenger brand, Melvin says. Privacy and security are viewed as part of the product, not an extra that the consumer has to pay more for.

• Living the Apple way. Apple’s approach to financial services is based on lifestyle, which is reflected in the design of its banking and payments products, how they work, and especially how they interconnect with each other and with Apple hardware, Melvin says. Lifestyle thinking permeates Apple’s marketing of financial products. The angle is to promote the ability to pay for and finance goods and services that allow users to live a certain lifestyle.

“Like the rest of Apple’s products, its financial services hinge on a superb, seamless experience, one so easy and intuitive that a consumer would be apprehensive to leave it,” says Melvin.

In a sense this is a marketing funnel leading exclusively to Apple services.

• Power in the consumer’s hand. At the heart of it all is control of the hardware, most notably the Apple iPhone, which is the focal point of the company’s credit and deposit efforts. “It’s a linear ecosystem that relies on owning the needed hardware, which creates a domino effect,” says Melvin. Owning an iPhone begets using Apple Pay, which begets using an Apple Card, and so on.

This has sometimes been referred to as Apple’s “walled garden.” In time, Melvin predicts, as Apple’s offerings grow broader, the path to signup will be more circular, enabling new customers to begin with different products.

• Innovating on innovation. Apple can extrapolate from current ideas to new ones. Case in point is taking what the company has learned in health monitoring using the iPhone and the Apple Watch combination and applying it to financial health matters, Melvin says. Elements of this are already incorporated in the Apple Card’s mobile app features — there’s an emphasis on up-to-date spending tracking with color coding and even interface with Apple Maps to remind the customer where they bought something. Melvin expects to see more such tools.

Melvin says that 70% of consumers wear some type of physical health tracking device. A way to continually get updates on financial health isn’t so much of a stretch, especially when nearly half of Millennials and Gen Z say that financial matters are their greatest sources of stress.

Read More: In a Superapp Race, Apple’s Far Ahead of Twitter (& Everybody Else)

Apple’s Marketing of Its Banking Services

A graphic indicator of who Apple is targeting for financial services is the “memoji,” Melvin says. This is a custom avatar enabled in Apple’s iOS. For Millennials and Gen Z, it’s practically de rigueur. Apple has been stepping up use of generic memojis in digital marketing, a clear indicator of who it seeks as customers, according to Melvin.

“Memojis” are part of the world for Millennials and Gen Z, and so, in this frame from a marketing video, they are part of Apple’s outreach, according to Lierin Ehmke Melvin of Mintel Comperemedia.

Historically, Apple has promoted Apple Pay the most, to build demand for the rest of its financial menu. In 2023, much of the marketing of Apple Pay has been done through videos used for brand awareness, Melvin says.

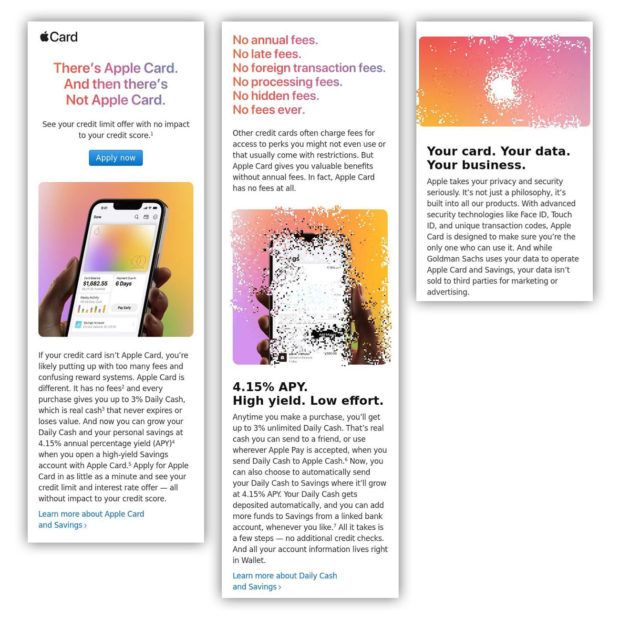

However, since the introduction of the Apple Savings high-yield account in April, greater marketing weight has gone to Apple Card in both digital and direct mail promotion. Consumers have to have an Apple Card account before they can open an Apple Savings account.

This email promoting the Apple Card underscores all that makes it appealing to Millennials and Gen Z — including privacy. (Courtesy Mintel Comperemedia)

Gen Z consumers, thus far, are more interested in building their savings than using credit cards, Melvin acknowledged. She believes that at some point Apple will add a debit card to its product mix in order to meet Gen Z’s preference for cash and cash equivalents. She points out that the “Daily Cash” cash back incentives on the Apple Card can be deposited into the savings product, which plays to Gen Z’s desire to save. (It’s worth noting that when the Millennials were younger, they also were less interested in consumer credit than they are now as older adults.)

(The webinar includes an in-depth analysis of Apple’s marketing spending and practices.)

Read More: Apple Pay Later, Tech Giant’s BNPL Entry, Off to Strong Start

If Goldman Sachs Bows Out, Who Will Apple Dance with Next?

Goldman Sachs, Apple’s partner on the Apple Card and Apple Savings, reportedly wants out of the deal because the Wall Street titan’s consumer banking operation has been a money pit. Strangely, rumors about this cropped up in late June, not long after the deal was renewed. The rumors also suggest Goldman is negotiating with American Express to take over the relationship in some fashion.

Goldman has lost billions in the foray to expand into consumer lending with its Marcus digital banking brand, which is winding down.

Melvin says her firm’s research suggests that Goldman Sachs’ customer service was considered to be subpar and that the experience American Express has with credit card programs and banking accounts could result in a better partnership.

“We think this relationship could really be symbiotic,” she says. “American Express would provide infrastructure and audience access.” She also points out that American Express has brand equity in serving affluent young consumers and extensive experience with partnerships. For Amex, there could be upsell opportunities from the initial Apple Card relationship, she adds.

Some doubt this scenario will play out, however. An analysis in The Information in late July pointed out that Goldman agreed to more generous terms than any experienced company in the business would have signed on for. The analysis also suggested that while Goldman works in the background in the Apple Card deal, it is unlikely American Express, a marketing powerhouse, would be willing to leave all the limelight to Apple’s brand.