Despite all of the talk about AI in financial services, banks and credit unions struggle to know where to start and where best to deploy resources at a time of continued economic uncertainty. Few would argue against the premise that adopting new AI technologies is essential for financial institutions to keep pace with changing customer expectations, to defend business against fintech, big bank and non-financial challengers, and to operate more efficiently.

The key is to maximize AI maturity across the entire organization, reimagining and improving products, services, and processes, hyper-personalizing communication and recommendations to customers, automating manual workflows, and proactively identifying and mitigating emerging risks.

What is “AI maturity”? The term represents the level of commitment, deployment and success of artificial intelligence initiatives in an organization.

“Banks that haven’t started to really think about AI are falling further and further and faster and faster behind.”

— Alexandra Mousavizadeh, co-founder & CEO, Evident Insights

Failing to innovate with AI is increasingly putting banks and credit unions at existential risk of falling behind the competition. The AI Innovation Report from Evident Insights found that focusing on AI innovation enables the complete transformation of banks into data-centric organizations. AI innovation also enables leading banks and credit unions to envision the future of financial services, and take the necessary steps to remain dominant players going forward. The report maintains that organizations that fail to make AI innovation core to their strategy risk being left behind in what is increasingly, at least among the largest players, becoming an AI-first industry.

Listen to the full Banking Transformed podcast with Alexandra Mousavizadeh: The Strategic Advantage of AI Maturity in Banking

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Breaking Down AI Maturity in Banking

Evident Insights’ report examines AI innovation across major banks in North America and Europe. The report analyzes AI maturity across key pillars including research, patents, ecosystems, investments and lessons for leaders.

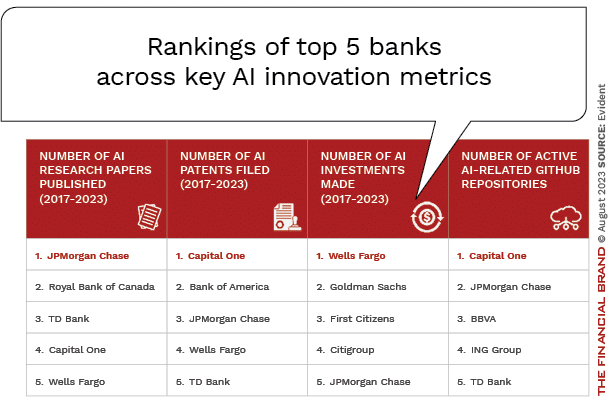

The overarching finding is clear: a handful of North American banks have sprinted ahead in the race for AI maturity, staking out early leadership positions that will be extremely difficult for lagging competitors to overcome. JPMorgan Chase, Capital One, Wells Fargo and Royal Bank of Canada stand out for aggressive, holistic pursuit of cutting-edge AI innovation.

The value to other financial institutions is that the AI leaders share common attributes and strategies that other banks and credit unions can learn from. At the core, AI leaders have made innovation in this technology an urgent strategic priority by visibly demonstrating their support. They have committed substantial financial resources and talent to AI progress.

Read More: 3 Strategies for Enterprise AI Success That Are Tried and ‘Truist’

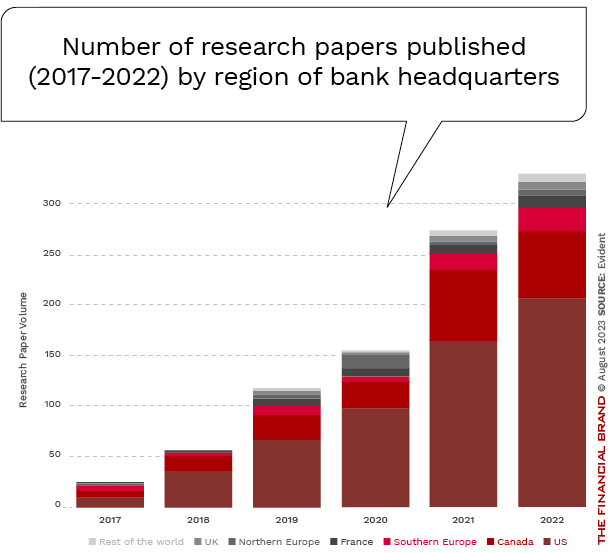

Establishing centralized AI research teams is a hallmark of the most advanced financial organizations, tasked with both pure and applied research. Many firms that don’t spend on such projects may wonder why creating research on AI solutions matters. Leading firms recognize that research teams power innovation, attract top talent and speed reaction to AI advances. The report reaffirms North America’s expanding advantage, with US and Canadian banks accounting for 80% of publications.

Leaders were also aggressive at filing patents to protect intellectual property and gain competitive advantage. Again, North American banks prevailed, with 99% of patents in the most recent years tracked residing in the US and Canada. Of special note, Capital One’s streamlined patent approval process demonstrates the cultural focus leaders can instill. While regulations differ, European banks must overcome cultural gaps to compete on patents. Similar to creating research, while patents don’t guarantee success, they do appeal to AI talent looking for progressive financial institutions.

“AI talent is a very rare resource. There are not that many out there, and they’ve got lots of other places to go other than banks. So, banks really have to think about how do we become an attractive place for AI talent? One way to do this is to be a leader in investing in pure AI research and applied AI research.”

— Alexandra Mousavizadeh

No institution can deliver AI maturity single handedly. Tapping into shared innovation through diverse collaborations is essential. Savvy banks are building web-like networks spanning open source communities, universities, accelerators and third-party solution providers. This cooperation with outside expertise gives access to greater flows of ideas, technologies and partnerships. Active open source participation also signals engineering strength, according to Evident Insights.

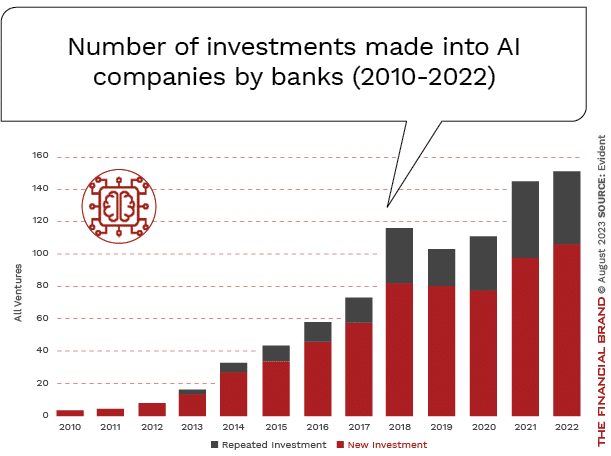

Finally, the report finds that banks have been ramping up their AI startup investments, with deal volume growing 15% annually from 2017-2022. However, there are pronounced regional differences. Historically, US banks dominated, accounting for 89% of deals in 2015. But while still leading, their share has fallen to 61% by 2022 as European banks, especially French institutions, increase their focus in this area.

Overall, the top five US banks – Wells Fargo, Goldman Sachs, First Citizens, Citi and JPMorgan Chase – account for over 50% of all AI startup investments. Wells Fargo leads, having made 157 deals. Goldman Sachs has broad exposure through over 100 deals across various subsidiaries. (First Citizens entered the top ranks after acquiring Silicon Valley Bank.)

In terms of recipients, 60% of AI startups backed by banks are US-based. However, US banks are more globally diversified, deploying substantial capital in Asia and Europe. In contrast, European banks concentrate domestically, with French institutions heavily backing local AI startups.

Read More:

- AI Maturity in Banking Lags All Other Industries

- The Hidden Risks of Artificial Intelligence in Bank Marketing

- Three Practical Applications for Artificial Intelligence in Payments

Closing the AI Maturity Gap

The importance of analyzing AI innovation in banking goes beyond simply identifying organizations that are doing the best. It is to provide insights into the industry at large, exploring trends and identifying opportunities for organizations to learn from the leaders.

“The first thing to do is to set a strategy, you’ve got to know where you’re going,” says Alexandra Mousavizadeh. “If you don’t figure out what your strategy is, do you want to be able to adopt generative AI and build machine learning and those kinds of capabilities? To make the company better, you have to know where you’re going.”

Want to go deep on AI best practices for banks?

Attend our AI Masterclass — Unlocking the Power of Artificial Intelligence in Banking — at The Financial Brand Forum 2024 on May 20-22 in Las Vegas. Led by Ron Shevlin, chief research officer at Cornerstone, this three-hour workshop will be jam-packed with lessons learned from industry leaders and real-world case studies.

For more information and to register, check out the Forum website.

For aspirants seeking to close the AI maturity gap in banking, the research prescribes 10 key strategies:

- Define an AI strategy and vision: Banks need a clear roadmap for AI innovation and adoption. This guides investment priorities and helps benchmark progress.

- Build internal AI research teams: Invest in developing in-house capabilities in both applied and pure AI research. This fosters a culture of innovation and readies banks to deploy new advancements.

- Publish research findings: Publishing helps attract top AI talent, aids recruitment branding, and pressures peers to increase focus. It can establish thought leadership.

- Partner with universities: Collaboration on pure research with both domestic and global academic institutions expands capabilities. This also aids talent pipelines.

- Develop a patent strategy: File patents to protect intellectual property advantages, especially in the US market. Patents also signal innovation leadership and provide legal leverage.

- Instill a culture of patenting: As at Capital One, incentivize patent submissions across the organization. This boosts IP assets and encourages bottom-up innovation.

- Actively build collaborations: Form partnerships with vendors, consultants, data providers and consortia to stay on the cutting edge of new solutions.

- Make strategic AI investments: Invest in promising startups for access to technology and talent, while scouting potential acquisitions. Consider “acqui-hires” (experienced AI teams who can be acquired intact in the market).

- Continuously benchmark progress: Regularly audit performance on AI maturity metrics versus competitors. This identifies gaps and motivates improvement.

- Celebrate innovation: Recognition, even for early wins, is key to building momentum. With AI now critical, even small steps count. Rewarding progress fosters engagement.

Financial institutions must take concerted action across these areas now in order to compete amid the AI revolution. Laggards risk rapidly falling behind.

Check out all of our Artificial Intelligence in Banking articles.