Banking Podcasts: Banking Transformed Podcast with Jim Marous

As the top banking podcast, the Banking Transformed podcast, hosted by Jim Marous, examines major leadership and cultural challenges in the banking industry and the impact of digital disruption on banking’s future. Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

As the top banking podcast, the Banking Transformed podcast, hosted by Jim Marous, examines major leadership and cultural challenges in the banking industry and the impact of digital disruption on banking’s future. Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

For insights and analysis of the latest digital banking trends — and to receive updates when new Banking Transformed podcasts are released — sign up for The Financial Brand’s email newsletter!

Click here to get your CEO featured on the next Banking Transformed podcast.

The Best Customer Experiences Start with Identity Protection

Keeping consumer (and business) data is at the crux of trust in banking, especially during onboarding, says the CEO of IDology, Chris Luttrell. How can that trust be fostered as more institutions invest in new technologies?

How AI is Transforming the Banking Industry

Banks need to stop getting just hyped about AI integrations, and actually invest in the technology, says AI influencer Imtiaz Adam, who emphasizes the technology is critical across an entire enterprise.

Using Behavioral Science for Financial Marketing Success

Behavioral science is critical for banks to understand how consumers will react to various tactics and strategies, says HBT Marketing's co-founder Nancy Harhut.

Reaching Digital Maturity With Continuous Product Design

Continuous product design — along with real-time data — can be institution-changing for banks and credit unions struggling to keep up with new back-end technologies, says Quantum Metric's founder and CEO Mario Ciabarra.

Leadership During Times of Uncertainty

The Covid pandemic signaled a new need for strong leadership in the modern financial institution. Charlene Li, chief research officer at PA Consulting, talks how banks can create a stronger culture of leadership.

How All Banks Can Now Offer Industry-Leading Digital Mortgages

Most mortgage experiences are painful, filled with friction, and very time-consuming. Enter mortgage-as-a-service (MaaS) solutions from Rocket Mortgage, says executive vice president Sam Schey and Q2's Jonathan Price.

Locality Bank: Using Modern Technology to Serve Small Businesses

Small businesses are hardly ever served well by the banking industry, even while they're the foundation of the American economy, says Corey LeBlanc, co-founder of Locality Bank.

Embedded Finance and BaaS: The Future of Banking

Embedded finance can be the seamless bridge between a bank brand, the consumer and ultimately the banking provider, says FIS Global's Mike Kresse and Taira Hall.

Daylight: Meeting the Unique Needs of the LGBTQ+ Community

Nearly 30 million Americans consider themselves part of the LGBTQ+ community, but how banks and credit unions market LGBTQ-friendly products? Daylight is doing that, says CEO Rob Curtis.

Synovus Bank: The Journey to Become a Digital Bank

Not every financial institution can launch a digital brand, and few can do it well. Hear from Liz Wolverton, Synovus' head of consumer banking and brand experience, on how she executed it.

Is Your Data Strategy Future-Ready?

Data and artificial intelligence are driving digital transformation in banking, and could help institutions grow their revenue — fast, says Segmint's Greg Gruning and Busey Bank's Brian Lindemann.

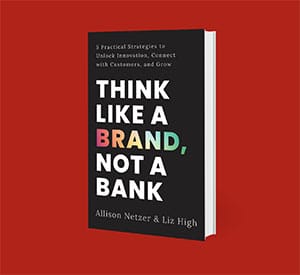

How to Think Like a Brand and Not a Bank

"Think Like a Brand, Not a Bank": This is the book no financial marketer can miss from Allison Netzer and Liz High.

Modernizing Payments for an Embedded Banking Future

Embedded payments, like embedded finance, is inevitable in the modern banking industry. However, three-fourths of banks and credit union globally still aren't prepared for the trends, says Zeta's Bhavin Turakhia.

Are Big Banks Hurting Competition, Innovation and Equality?

The largest banks have the biggest competitive innovation in today's financial industry, says author James Bessen. That's why the industry needs to democratize technology.

Identity Fraud is a Customer Experience Opportunity

As financial institutions invest more in new technologies, they must also keep an eye on identify fraud and the solutions on the market to mitigate the risks, says TransUnion's senior director of global identity and fraud Chad Gluff.

What Are The Essentials to Transformation Success in Banking?

Digital transformation is not a project or a destination. It's a constantly evolving process for financial institutions, says McKinsey & Company's senior partner Seth Goldstrom. He explains how to do it well.

How to Prepare for the Engagement Banking Revolution

Did you know you can win customers (for life) through embedded banking? It's a critical part of the new banking CX, says Backbase's chief executive officer and founder Jouk Pleiter.

From Personalization to Profits in Banking

Personalization is a key strategic priority for any financial institution wanting to distinguish themselves from other banks and fintech competitors. Jim Stapleton, senior vice president of Epsilon explains what goes into it.

An Inside Look into Morgan Stanley’s Evolving Brand Strategy

Alice Milligan was named the chief marketing officer of Morgan Stanley, after the acquisition of E-Trade. Learn how she has led the bank to its success with her brand strategy.

WeBank: A Model for the Future of Digital Banking

WeBank has over 300 million customers and 2.7 million small business banking with it. It's attracted customers through its use of AI, blockchain, big data, cloud computing and more, says chief information officer Henry Ma.

Delivering Financial Education to Customers and Communities

Financial education, while useful to provide meaningful insights to customers, can also be a great way to build trust with consumers, says EVERFI's vice president of strategic partnerships Ryan Swift.

Strategies for Banks to Withstand an Economic Downturn

There's a strong chance that there will be a recession this year, but it also presents a key opportunity for banks and credit unions to become more competitive, says Cornerstone Advisors' chief research officer Ron Shevlin.

The Unique App That Makes Financial Education Rewarding

How can banks and credit unions capture the interest, and loyalty, of Gen Z'ers? Bolun Li, the founder of Zogo thinks he has the answer, and it lies in the quality of financial education products.

How Economic Instability Will Impact the Banking Industry

If the Fed must raise rates to restore economic calm, could it start a recession that pushes the unemployment rate higher? And how does this impact banking? Hear from CUNA Mutual's chief economist Steven Rick.

How to Make ESG a Cornerstone of Your Bank’s Business Model

The importance of ESG (environmental, social and governance) investments in today's banking world can't be overstated, says banking influencer and author Chris Skinner.

How Banking Can Win Big in the Subscription Economy

Banks and credit unions can't rely on their old, legacy revenue models. They're dead. Instead, innovative financial institutions must rethink their business models and include subscriptions in their strategy, says Segmint's vice president of product Joan Clark.

How Banking-as-a-Service has Made Webster Bank Future-Ready

Why did Webster Bank pursue banking-as-a-service? It's working as a way to generate new revenue for the bank, says its head of digital banking and banking-as-a-service Matthew Smith.

Reimagining Customer Engagement with Intelligent Texts

Looking for a creative and efficient way to engage customers in a conversation? Try texting solutions, says Statflo's chief research officer Scott McArthur.

Banking on the Metaverse

The concept of the metaverse has been around for decades, but it's finally gaining a foothold as a reality, especially in banking. Ray Wang, founder and chairman of Constellation Research explains why.

Why New Banks Are Taking Over the World

The funding is coming in strong for fintech firms, who are competing for (and winning) consumer relationships from legacy banking providers, says Philippe De Backer and Juan Gonzalez from Arthur D. Little.