Max Levchin doesn’t like credit cards — in particular, the way traditional credit cards burden many Americans with interest.

To illustrate his dislike, he talks about a tourist visiting New York City who buys a vintage city snack, a big soft salty pretzel. The tourist could take out a debit card and pay, end of story — unless the tourist winds up triggering an overdraft fee and paying $30 on top of the $5 pretzel, says Levchin, co-founder and chief executive of Affirm.

Or the tourist could pay by credit card. If you’re well-heeled, he says, you’re going to pay off your bill at the end of the month, so you don’t much care. You won’t be starting the next month with an outstanding balance.

“But for most people, you’re not starting the month with a zero balance,” Levchin said at the recent Affirm investor forum. “You’re coming in revolving already, so you’re about to pay interest on a $5 pretzel.” He considers it ridiculous that people routinely spend by “piling everything onto one big debt, revolving for a very long time and paying interest.”

Levchin felt so strongly about the need for an alternative that he became one of the pioneers in the U.S. of buy now, pay later. At the time, some in the industry scoffed: Credit cards were already buy now, pay later, so what was the big deal?

On Cyber Monday, BNPL proved a very big deal.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Distinct Mini-Loans Spawned Buy Now, Pay Later Business

On Cyber Monday 2023, American shoppers spent $940 million online using BNPL, an increase of 42.5% over 2022’s Cyber Monday and about 8% of total U.S. online spending ($12.4 billion) on that day, according to a tally by Adobe Analytics. The company also reports that Nov. 1-27 saw $8.3 billion spent via BNPL online, up 17%. Adobe projects that November will turn out to be the biggest month on record for this payment method.

That news— and a 20% year-over-year rise in online BNPL spending on Black Friday weekend — are seasonal spikes, of course, but it’s also highly suggestive (and caused strong runup in Affirm’s stock price). There is significant headroom for further growth: “BNPL is still a blip compared to how much money people put on their credit cards,” says Andrew Davidson, senior vice president and chief insights officer at Comperemedia, a Mintel company.

That’s good news for Affirm, whose results have been improving and which is projecting a 20% year-over-year increase in revenue in fiscal year 2024. And many presentations at its investor event made it clear that as BNPL continues to evolve and grow, traditional consumer lenders can no longer ignore it.

But even more significantly, Affirm’s ambitions now clearly extend well beyond BNPL. The team cited the growth of the Affirm Card as an application of the company’s services at the physical point of sale and it is going to begin pushing a savings product that will tie into the card.

The card represents more just than a product or a channel. It reflects Levchin’s far-reaching ambitions.

“Five years from now, we have no intention of being the leader in BNPL,” Levchin told investment analysts at the event. “We intend to be the leader in payments — making payments more honest, accessible and better for everyone involved.”

To emphasize the point, he revealed a pro forma update of the Affirm logo on the event’s big screen: “Affirm: The leader in payments.”

Fintech hubris? A red cape to the banking bull? Maybe not. Affirm has had its lumps — in early 2023 it laid off 10% of its workforce, much like other fintechs. But payments consultant Richard Crone says what Affirm has been up to makes him think of the steps that Apple took over time to build out its growing family of financial products, from Apple Pay and the Apple Card to Apple Pay Later, Apple Savings and more.

Crone tends to be a skeptic, but he thinks Affirm’s ambitions are more than bluster. He points out that the company has been successfully growing both users and merchants, “which is crucial for the success of any new payment type.” Building both at the same time is grabbing market share from traditional players.

“Max Levchin is a true visionary with exceptional execution skills,” says Crone. “He’s amassed a great team and he’s firing on all eight cylinders.”

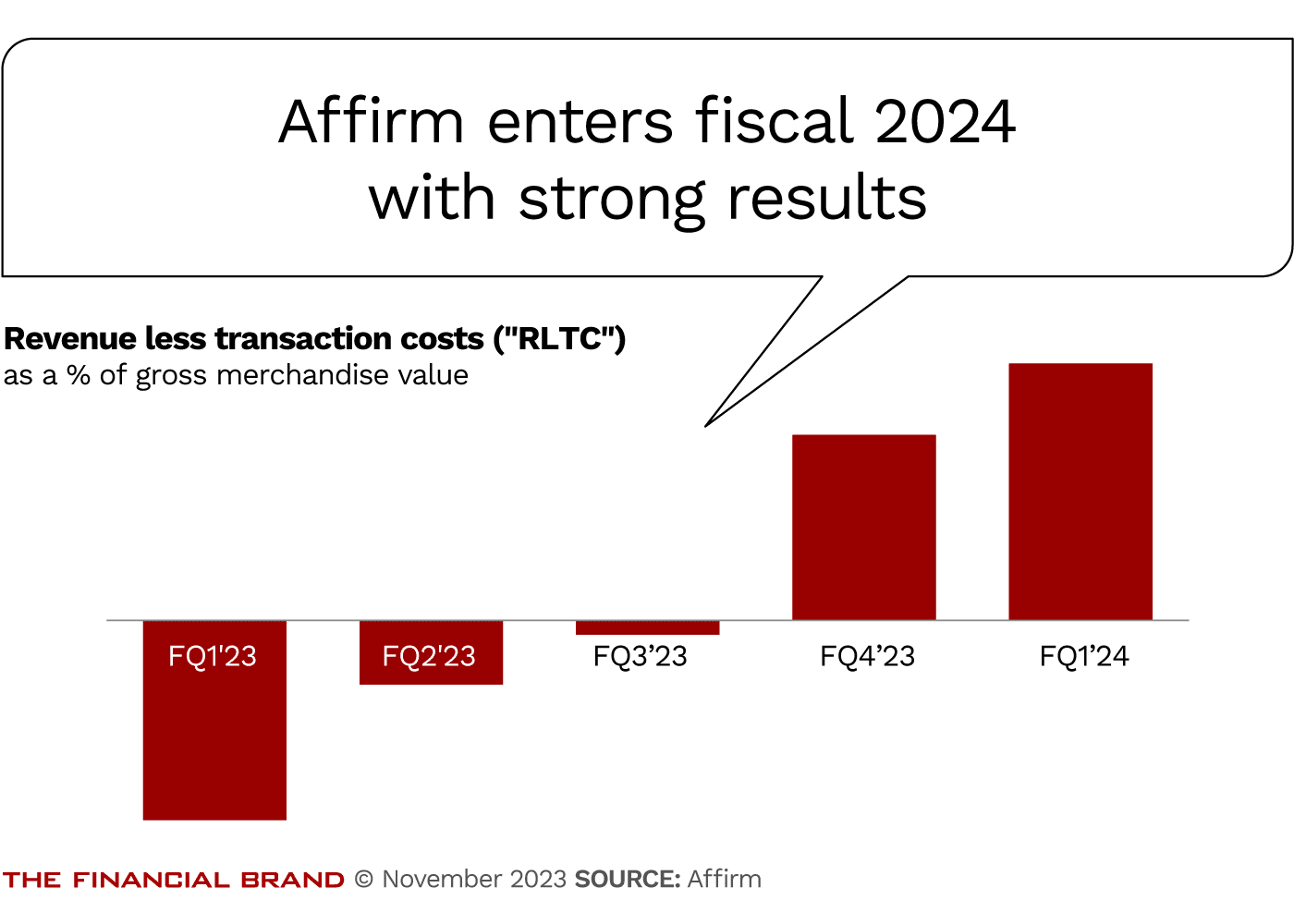

At the event, Affirm focused on how the company is building on its U.S. foundation, experiencing 60% compound growth since its fiscal 2020. Expansion into other countries, including the U.K., and a push into business-side BNPL, will also bring growth. The company also claimed a profitable fiscal 2023 (ending June 30, 2023), albeit on the basis of “adjusted operating income,” a non-GAAP measure.

“We don’t think growth and profitability are tradeoffs,” said Michael Linford, CFO. “They really go hand in hand.”

Read more: Why U.S. Bank Is Elbowing into the Competitive BNPL Space

Taking a Deeper Look at the Affirm Card

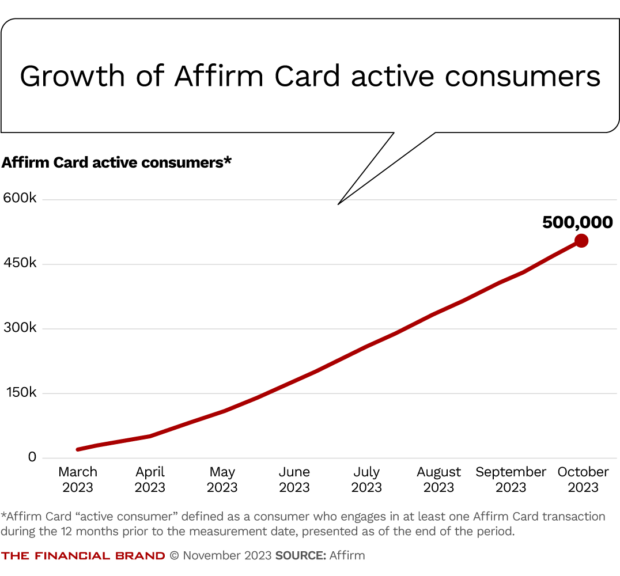

The Affirm Card differs from the online Affirm button found on websites. The latter features the company’s “adaptive checkout,” which presents options that reflect its in-the-moment credit evaluation for that shopper, as well as interest-rate support or special deals that the merchant is providing. The card is intended to enable consumers to use Affirm nearly anywhere at the physical point of sale. Over 500,000 cards have been issued, and the company reported that it has recently been adding card accounts at a rate of 75,000 per month.

The card product is a Visa debit card issued by Memphis-based Evolve Bank and Trust on Affirm’s behalf, and represents three products in one, according to Linford.

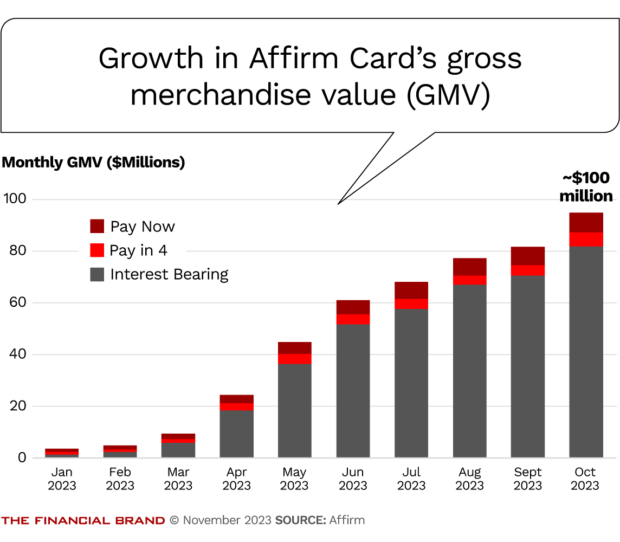

There is a “pay now” option, which allows the shopper to pay immediately by tapping a linked bank transaction account. Shoppers can also opt for Affirm’s pay-in-four plan– or they can choose a longer-term plan that permits monthly installments bearing an interest rate.

Company representatives said that consumers are making many pay now transactions. But in terms of dollars, the majority of the card’s volume is on longer-term installment plans, as shown in the chart below. Linford said about 86% of card volume in dollars were in the installment plans.

The card program’s “revenue less transaction costs” measure, which is used as an indicator of progress toward profitability, has been steadily improving.

Customers appreciate the flexibility of being able to use one card with choices regarding how they will pay, according to Libor Michalek, Affirm’s president. He said that monthly payment volume on the card product is averaging around $2,200. Michalek said that only 3% of the company’s active user base have taken the card, which management said indicates how far it can take the product’s growth. Gradually merchants are choosing to add incentives, like subsidized 0% rates, to sweeten the deal and to lean into Affirm’s goal of increasing sales for merchants that accept the card.

Looking at Incentives for Affirm Card Transactions

“Next, we’re looking at increasing frequency through everyday incentives that customers can benefit from as they use the product for everyday purchases,” Michalek said. Consumers may sometimes be offered a 0% deal even if the particular merchant isn’t supporting it. The company’s quarterly earnings report noted that such offers can be made as a reward for consumers who are using their Affirm Card frequently.

The key difference, reflecting Levchin’s bias against traditional credit cards, is that there is no overall running balance that new purchases — like his salty soft pretzel — are added to. Each plan is separate from other plans, as is the case for Affirm generally.

Comperemedia’s Davidson thinks more needs to be done, for the Affirm Card base to grow. Traditional credit cards offer cash back and other rewards that many people find irresistible. He also notes that with the long-established traditional card business having over 240 million U.S. cardholders, Affirm has a long way to go. On the other hand, Comperemedia/Mintel research has found that two out of five people who use BNPL in some way say they could see ditching their credit cards completely in favor of buy now, pay later options.

At the investor event, Levchin expressed reluctance about competing too hard on rewards: “You end up trying to scale the mountain that somebody else has already planted a flag on. … Don’t expect us to show up with quintuple miles.”

See all of our latest coverage on payments.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

How Consumers Use the Affirm Card at Physical Point of Sale

Affirm serves the broad middle range of consumers; the company isn’t competing for the business of people who have expensive, high-end traditional cards that come with lots of perks. Such consumers aren’t looking for payment plans, generally.

On the other hand, while there is more than a hint of financial inclusion in Affirm’s DNA, the company points often to its rigorous credit underwriting, performed in real-time on every transaction. And Levchin noted that Affirm doesn’t serve the bottom quartile of the market because it would have to price credit higher than it wants to go.

The way that consumers interact with the Affirm Card differs from traditional credit cards as well.

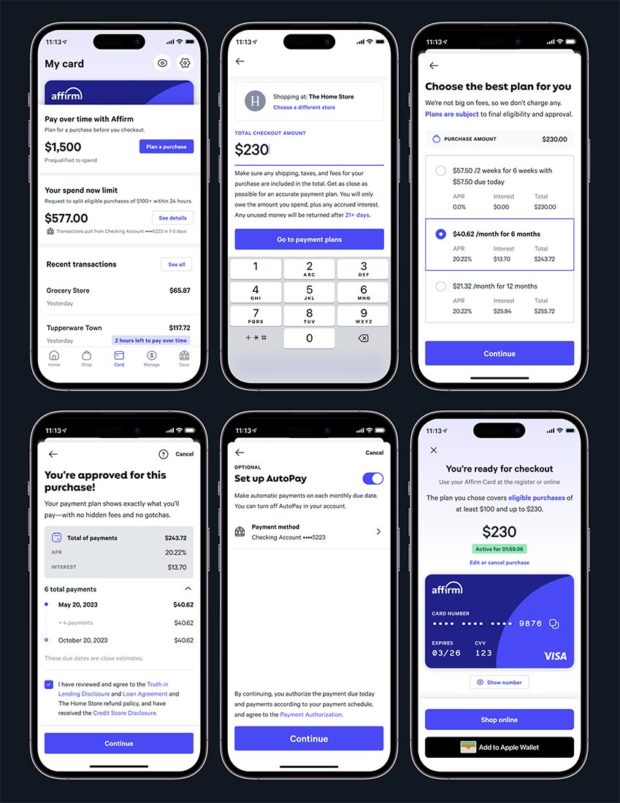

The illustrations below depict a purchase for which a consumer wants a payment plan. Before getting to a store’s checkout, the consumer uses the Affirm app to tell the company how much they are planning to spend, and request credit. The app comes back with multiple offers, if the card holder is eligible at that time.

With an approval in hand, so to speak, the consumer can then check out with their Affirm Card. The app also permits them to request to split eligible purchases after checkout, if they’ve changed their minds.

Some consumers might think of this as complicated, but Levchin says that to the modern consumer, it will not be a roadblock.

“The whole modality of ‘Let’s keep it as dumb and simple as possible — swipe the card and move on’ is up for renegotiation.”

— Max Levchin, Affirm

Read more:

- Inside Elon Musk’s Stealth Move to Build X into a Pay-By-Bank Powerhouse

- Credit Card Trends Have Bank Issuers on Alert

- Credit Cards Now: Everything You Need to Know From the CFPB’s Latest Report

Growing the Affirm Card Towards Significant Market Share

Affirm has about 40 million registered users, and 16 million annual active users, according to Michalek. Given that the card base is currently around 500,000, “we have a lot of room for growth within our own ecosystem, even though we are going after the full card market.”

Comperemedia’s Davidson think that the BNPL provider seems to have hit a sweet spot; His company’s consumer research found that 64% of consumers who like BNPL say they would like to do it through a debit card.

While it is not the only buy now, pay later program that can be used on Amazon, Affirm enjoys primacy in the checkout process, coming up as an option for eligible purchases. Both Davidson and Crone say this can serve as a subtle cross promotion for the card, because so many consumers do some business with Amazon. In addition, Affirm recently expanded to providing service to companies that want its business-side variations on BNPL on Amazon.

Richard Crone points out that Affirm’s acquisition of relationship data through its online component and its involvement with multiple payment platforms, (like Shopify) are also advantages for building the card audience. Each component can feed the other — something that the fledgling, e-commerce-only digital wallet Paze from the banking industry’s Early Warning Services consortium can’t do. While Affirm Card can help Affirm online and vice-versa, the “buck” stops online with Paze. While it is intended to bring the cards of its big bank founders into e-commerce in a streamlined way, each Paze owner maintains its own card programs.

Looking at other BNPL providers, Davidson notes that the Klarna card and the recently announced Afterpay Plus Card both carry fees ($4.99 a month for the Klarna card and $5.99 a month for the forthcoming Afterpay card). The Affirm Card doesn’t, reflecting Levchin’s anti-fee attitude.

During the investor forum Levchin said some younger companies that would compete with Affirm lack his company’s distribution network.

“Every time we launch a product, it shows up in front of hundreds of thousands of merchants and millions and millions of consumers,” said Levchin. Because everything, even the app standing behind the card, is digital, much can be pushed out instantly.

“We’re much more like an operating system than a network,” Levchin said.

See all of our latest coverage of buy now, pay later.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Turning Up the Heat on Affirm’s Savings Account

Now the latest card wrinkle is the Affirm Savings account. It’s been out for a while but Levchin said, “We never put too much weight on the product,” and never promoted it. “We used it very carefully in order to learn about consumer behaviors,” he added.

Now the company has integrated Affirm Savings into the Affirm Card. The savings account, which is held by Cross River Bank in a banking-as-a-service arrangement, pays a floating rate that, in late November, was 4.35% APY. The card offers ATM access for this account, direct deposit and more.

According to Levchin, besides holding funds consumers deposit, the account will be available as a place to hold refunds from product returns, (PayPal, which he helped found, allows users to store balances.) Doing so simplifies the return process for Affirm and also gives consumers an opportunity to let funds ride in an insured bank account that is overseen by Affirm. Many other features are planned, he said, all “to make it a top of wallet card.”

Affirm Savings begins to fill out the hand that looks similar to Apple has been building, according to Crone. He suggests that a person-to-person payment account through the Affirm Card could be next.

A Bank Charter for Affirm? Levchin Could Barely Care Less

All this brings Affirm into the small fraternity of nonbank companies that bankers often worry about as mega-interlopers. Amazon has long been in that spot and Apple has climbed to the top, while Google fell off a couple of years ago.

One analyst was all over Levchin at the forum about the savings account: Could this become a funding source for Affirm lending? He was really asking, ‘Do you want to be a bank?’

“No,” said Levchin, reading the real question, “we’re not constructing a back door to banking. We do not intend to lend from these deposits. That’s certainly not on the roadmap right now.”

An entire session at the forum had been devoted to how Affirm funds its lending. All sources are external, beyond funds raised through Affirm’s IPO. These include asset-backed securities, a large group of institutional investors, and warehouse credit lines. “We’re not looking for a bank charter right now…,” said Levchin, then, “Let me double-click on that a little bit harder: We won’t seek a bank charter until we see a feature that we have to have one for.”

From the archives: Why Consumers Don’t Think BNPL Is ‘Debt’ (and Why It Matters)