The neobank age has given traditional banking institutions a good competitive shake up, and delivered some harsh lessons about customer experience.

And the impact is undeniable.

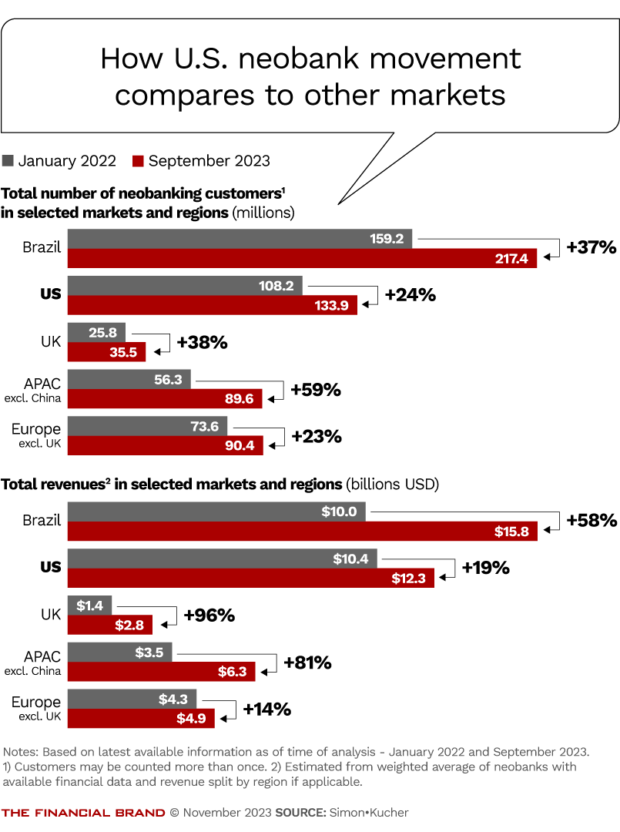

Research by Simon-Kucher & Partners estimates that the total number of neobanking customers worldwide has passed 1 billion — an increase of over 30% in just 18 months. Meanwhile, as we’ll explore, some neobanks are also (finally) cracking the profitability challenge.

Today’s bank and credit union executives have lived through a time when the neobank challenge loomed large. But history has a way of turning major events into footnotes.

“Probably 10 years down the road, I’m not sure we will still distinguish between a neobank and a traditional bank,” says Christoph Stegmeier, senior partner at Simon-Kucher & Partners. Some tremendous success stories will thrive and become very significant parts of their national financial systems. But of the 399 neobanks that the firm has been tracking worldwide over recent years, Stegmeier says perhaps 50 will survive in the long term.

Further, he says the firm’s research indicates that as spawning of new neobanks slows, launches may soon be overtaken by closures. From January 2022 to July 2023, Simon-Kucher found that 36 new neobanks started globally, with 34 giving up and shuttering. In the U.S., eight opened and five closed, according to the consulting firm’s 2023 report, “Profits at the End of the Tunnel,” and related materials.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Winners Rise Even Amid Erosion Among the Neobank Fraternity

A drastically changed world economy and the resulting pressure on funding has much to do with this. Neobanks have been shifting from an emphasis on fast and high growth to a need to demonstrate profitability. Not all have been able to hack the change in the dance music.

But the stronger neobanks have already demonstrated long-running stamina, as measured by customer base, according to Simon-Kucher. Chime ranks 11th among banking providers in the U.S., for example, while Brazil’s Nubank ranks fourth. Revolut ranks sixth in the U.K., and it’s in the top three U.K.-based players for global customers.

Referencing the previous edition of the study, the firm reports that “18 months after stating that only 5% or less of the neobanks were profitable, the number of non-profitable banks still by far exceeds the number of profitable banks. The good news is that there is evidence of a growing number of neobanks who appear to have cracked the code or are getting very close to doing so.”

Among neobanks that are achieving both strong customer growth and profitability are Nubank, Revolut, Starling Bank, Kakao Bank and Wise, according to the firm’s new Neobanking Profitability Matrix. The keys are continuing innovation and diversification — including offering more products and (specifically) credit products — and homing in on what customers need.

In time, Stegmeier thinks that each country in which neobanks operate will see at least one of the survivors become as big or bigger than incumbent institutions. Eventually, these one-time newcomers may reach revenue-per-customer levels that rival the traditional institutions, he predicts.

In Brazil, he says, there’s no reason Nubank couldn’t become the largest institution by customers. It might take another decade, but Chime or Varo Bank might reach that level in the U.S.

One could argue that the evolution of neobanks could, in some ways, parallel the development of search engines years ago. Few remember the likes of Lycos, AltaVista, and Ask Jeeves. But out of that melee came Google — which not only survived and thrived, but in many ways redefined society.

One spoiler coming along is Elon Musk’s plans for X, formerly known as Twitter. Musk wants to turn it into a banking and payments machine. X wasn’t a factor in Simon-Kucher’s study, but Stegmeier says now that Musk has begun to show his cards, X is going to look a great deal like a neobank. If X will succeed remains to be seen.

Meanwhile, U.S. banking institutions must also be alert for beachheads by robust neobanks from other countries.

Revolut is already active in the U.S. and opened a New York City headquarters in mid-November. Stegmeier thinks Revolut will hit a tipping point in the near future, and he says he would not be surprised to see Nubank attempt a landing in the U.S. as well. Banking-as-a-service arrangements would make this possible for Nubank, as it has for Revolut, which relies on three banking partners right now in lieu of a U.S. charter. (Revolut has banking licenses in its other markets.)

Read more: Neobank ‘Totem’ to Serve Native Americans with Unique Revenue Model

Drilling Down into the U.S. Neobank Experience

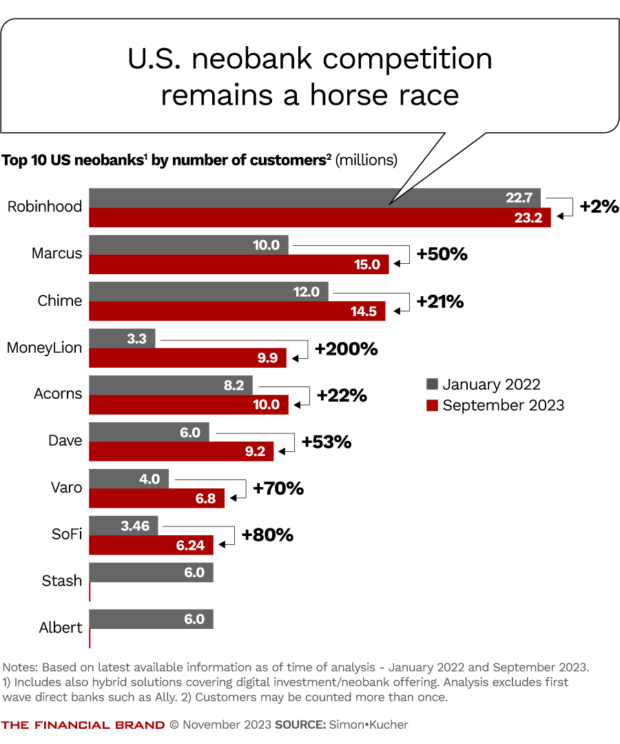

In the U.S., many more players remain in the race for customers (see the chart below). The top 10 now serve over 100 million customers, about a tenth of the global neobank customer base.

The group includes narrower players that are beginning to broaden, like Robinhood, which has added savings products, albeit with a connection to their original role. Robinhood is partnering with banks to offer 5% on idle investment balances, for example, in its “Gold” service. And it offers a retirement account that actually provides a 1% match.

The group also includes institutions like SoFi, which enjoy the advantage of a charter and the ability to hold insured deposits on their own, which have expanded in many directions.

A number of players have put more stress on credit builder products, reflecting customer bases for whom qualifying for loans has been an issue. Some have talked about having products in the wings that credit-builder candidates can graduate into.

Leaders by customer size aren’t necessarily financial winners. Marcus saw high growth and ranks second on the chart, but its performance difficulties are well-known. Stegmeier acknowledges that Marcus isn’t a poster child for overall performance, but says competitors have some things to learn from Marcus, such as how they built a huge consumer deposit base in a relatively short period.

While some players, like Chime, as mentioned earlier, seem poised to give the mainstream system a run for its money, others (no pun intended) may take the money and run.

That is, Stegmeier suspects acquisitions of some U.S. neobanks are in the wings. Not all players will adapt and find profitability quickly enough, yet their products or organizations represent brands or concepts that traditional banking players might buy to establish alternative brands. He notes that a large Australian bank bought two neobanks and is running them in parallel.

And of course, other U.S. neobanks may just become footnotes to the footnotes.

Read more:

- 9 Lessons Banking Has (or Should Have) Learned from Fintech

- Inside Elon Musk’s Stealth Move to Build X into a Pay-By-Bank Powerhouse

- Fintech Growth Strategies Impact Future of Banking

A Headscratcher: America’s Continuing Love Affair with Branches

One key difference between U.S. neobanks and those in other countries is that many Americans continue to hold accounts in both neobanks and their original, traditional banks or credit unions. There hasn’t been much consolidation of business on the neobank players, Stegmeier says. (In a forthcoming interview with The Financial Brand, Revolut’s leaders say a key goal is becoming the primary financial institution for American customers.)

Finally, a unique issue in the U.S. is the continuing role of branches. Stegmeier usually works out of Germany, but he spent a year in the U.S. recently, and he confesses that he just doesn’t get why the American banking system continues to support so many offices. Some transactions that happen easily on virtual channels still take a branch here, he says: “So my gut feel is that huge disruption has still happened much less in the U.S. than elsewhere.”

See The Financial Brand’s Neobank Tracker: