It’s looking like 2023 will go down as a pivotal year for SoFi. The fintech-turned-bank could show an overall profit for the first time in its 12-year history by yearend, as management predicts, or at some point during 2024, as analysts think is more likely.

Only a handful of fintechs have made the jump from providing their products via a banking-as-a-service arrangement with a traditional bank to getting a bank charter themselves. SoFi — officially SoFi Technologies — acquired Golden Pacific Bancorp in February 2022 and moved its charter from California to Utah, where SoFi has its headquarters.

The funding flexibility that being able to raise deposits provides, on top of ongoing product expansion, fuels the optimism that Chief Executive Anthony Noto frequently exudes on analyst calls.

“For the first time, we’ll be able to operate all of our businesses with no hands tied behind our back,” Noto said at an early June investor conference. “I’m really looking forward to that.”

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

SoFi Projects $2 Billion of Deposit Growth Every Quarter

Demand for personal loans, one of SoFi’s specialties, has been growing as consumers seek to refinance their debt, especially from credit cards.

SoFi reported that, in the first quarter of 2023, its personal loan volume increased 46% from the same period a year earlier. That more than offset volume lost in student lending — the business that SoFi started in — and mortgages.

Both of those categories had a sharp year-over-year drop in the first quarter — student loan originations by 47% due to the government moratorium and mortgages by 71% as higher interest rates threw ice water on what had been a hot market. (For a deep dive on the student loan situation, see, “Topsy-Turvy Student Loan Battle Means Lenders Need to Re-Educate Themselves.”)

But with the end of the moratorium on student loan repayments approaching, SoFi expects to return to its roots in originating and refinancing education loans, even as rates appear poised to rise more before they fall. (The company got its start in 2011, when four friends from Stanford University set out to improve student lending.)

To fund its loans, SoFi has historically leaned on its original model of securitizing them or selling them directly to other lenders, but more recently has supported growth with deposits now that it is a bank. As of the end of the first quarter, 44% of its loans were funded by deposits.

Deposit growth has been strong for the digital player, which pays higher rates than traditional banks on savings and checking accounts. Its total deposits exceed $10 billion, and SoFi executives predict another $2 billion or so of growth each quarter on an ongoing basis.

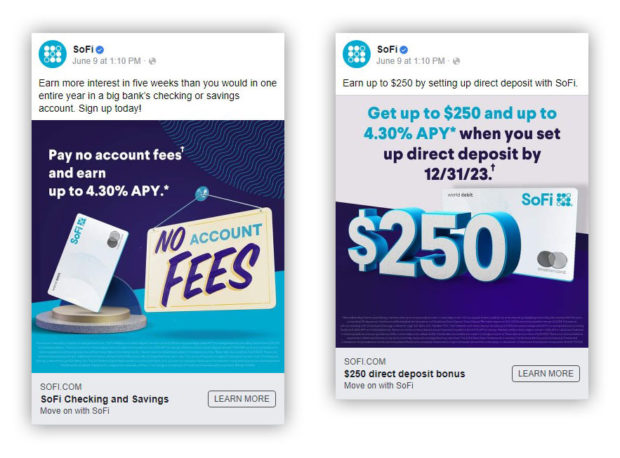

Its rate strategy is meant to encourage consumers to make SoFi their primary financial institution. Around 90% of the deposits come from direct deposit relationships, which earn preferential rates, according to SoFi executives. The digital banking model will continue to allow the company more flexibility to increase deposit rates versus legacy institutions, they said.

Read more: What Does It Take to Attract Deposits as a Digital-Only Bank Brand?

New Products Make SoFi a One-Stop Shop for ‘Members’

SoFi said that it had grown to 5.7 million customers as of the first quarter, a 46% jump from the same period a year earlier.

This suggests Noto is making headway on his long-term goal, which is to reach a critical mass of customers — or “members,” as SoFi calls them — and a wide roster of products and services to fuel cross-selling.

The “member” terminology is more than just a label. SoFi lends it meaning by giving customers free financial planning, career advice, referral fees, special access to SoFi Stadium, discounts on loan rates and other perks.

A key marketing message for SoFi is that all product relationships can be accessed via a single app.

Vying for Primary Institution Status:

SoFi has been building a menu of products to attract consumers across all of their life stages.

Back when SoFi went public in 2021, the management team talked about the “one-stop shop” idea, Chris Lapointe, the chief financial officer, told analysts in mid-June. The goal was to help consumers “borrow better, save better, spend better, invest better and protect better,” he said, with the latter referring to insurance products.

Now the idea has become a reality, Lapointe said. “We have successfully rolled out all of the table-stakes products that enable a member to do all of those things,” he said, “and we’ve started scaling them to the point where we’re going to be GAAP profitable by the end of this year.”

SoFi’s third operational leg — the first two are lending and banking services like deposits and payments — consists of technology services. The executives forecast that this operation, which serves other companies, including financial institutions, will become profitable by the end of 2023, same as with lending and banking services.

Analysts at Keefe, Bruyette & Woods are largely upbeat about SoFi’s outlook too, saying in a June note that the company has “laid the groundwork for several years of industry-leading revenue growth.”

But the analysts are more conservative than SoFi on the prospects for profitability. They anticipate the company will reach that milestone in the second half of 2024.

Read more:

- Arvest’s Digital Transformation Focuses on Customer Pain Points

- Read all of our recent coverage on fintechs

Instead of Cross Sales, SoFi Encourages ‘Cross Buys’

A key strategy for SoFi is adding products in order to prompt more of what Noto calls “cross buys.” The idea is to present customers with a big menu of offerings to encourage them to establish multiproduct relationships.

In its first expansion into non-financial offerings, SoFi has partnered with Expedia to form SoFi Travel, which offers travel discounts as well as 3% cash back for travel purchases made on a SoFi credit card.

Noto believes that as critical mass builds in both the number of customers and the product selection, the cost of marketing will decrease. In investor presentations, SoFi has indicated that the cost of acquiring new members has already shrunk by about a fifth in 2023, compared to 2022.

SoFi attributes this to a combination of customers finding what else they want on the menu and the use of customer data to make tailored offers.

“We play out that strategy every day,” Noto said during the company’s first-quarter earnings call. “Sometimes it’s driven by technology and data, sometimes it’s driven by the processes of our teams, as well as our certified financial planners. Obtaining that cross-buy allows us to bring in that second product with no customer acquisition cost and has a huge impact on unit economics.”

SoFi shared data, as shown in the charts below, to illustrate that it is moving the needle on both customer growth and product usage. In the first quarter, the company added 433,000 customers and 660,000 products were sold. (Growth in the average number of products per customer is less robust given the influx of newcomers.)

The first chart shows SoFi’s statistic of 5.7 million customers, as defined in the footnote. That’s an increase of 46% over the previous year. Use of banking and lending products also continues to increase, in part due to customer growth. The total number of products in use across all categories rose 46% from the first quarter of 2022.

More specifically, SoFi Money — which includes traditional cash management accounts and the linked checking and savings accounts made possible by the bank charter — grew 48% year over year, to a total of 2.4 million. (SoFi counts the linked checking and savings as one product in its tallies, though they are two accounts.)

Read more: Why SoFi’s Tech + Bank Deals Could Disrupt Traditional Banking

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

More SoFi Borrowers, But Lower Acquisition Costs

SoFi averages roughly 1.5 products per customer, according to Noto.

“I would expect that ratio to stay very similar over the next 12 to 18 months, because we’re driving really strong member growth,” he says. “If you think about the denominator [membership], if it’s growing really strong, it’s really hard to drive the overall portion of the products divided by the members. And that’s not a bad thing. That’s actually a good thing, because the bigger we make our member base, the bigger we’ll make our products adopted by that member base over time.”

To encourage deeper penetration in the future, Noto says that SoFi is attempting to build “best of breed” products in every category.

Lapointe told analysts SoFi is gaining more borrowers at a lower cost, thanks to its overall customer growth. The ratio of banking products to lending products that customers held in the first quarter was about five to one, a ratio that has been rising over the last couple of years. Lapointe said that the cost of bringing in new borrowers in the first quarter fell 19% year over year.

In its first-quarter earnings report, SoFi noted that sales and marketing expenses as a percentage of revenue declined approximately 475 basis points compared to the previous year.

Read more:

- Varo Disrupts Status Quo as First Fintech with National Banking Charter

- Avoiding ‘Me-Too’ Fintechs with Unusual Banking-as-a-Service Strategy

Two Perspectives on SoFi’s Growth Potential

Before SoFi obtained its bank charter, loans were typically sold or securitized. This activity was backed by capital and use of warehouse credit lines, pending the loans changing hands.

Having the ability to also fund loans from deposits, and thus be able to hold onto the loans and choose optimal timing for any sale, changes the profitability dynamic.

In addition to SoFi’s $10 billion of deposits, “we’ve got north of $8.5 billion of warehouse capacity and over $3.5 billion of our own equity capital, with $2.4 billion of cash on the balance sheet,” Laponte told analysts. “That’s well north of $20 billion of overall funding capacity.”

Noto said current loan production is at higher interest rates than past production, so it makes better economic sense to hold onto the more recent loans. The bank funding makes SoFi nimble in its buy-versus-hold decisions, he added. “It’s about maximizing return on equity.”

But there’s another way to look at this. In a June analysis, KBW points out that almost no loan sales have occurred for six months or so. “SoFi has been growing revenue by increasing the interest income earned from the interest payments on those loans,” the report says.

SoFi also increased its total assets to $22.5 billion at the end of the first quarter of 2023, from $9.2 billion at the end of 2021.

“Simply put, this growth rate can’t continue for much longer without infusing new capital or significantly increasing profitability,” the KBW report says.

But if the holding company downstreams cash to the bank level, SoFi could continue growing for a few more quarters, it adds.