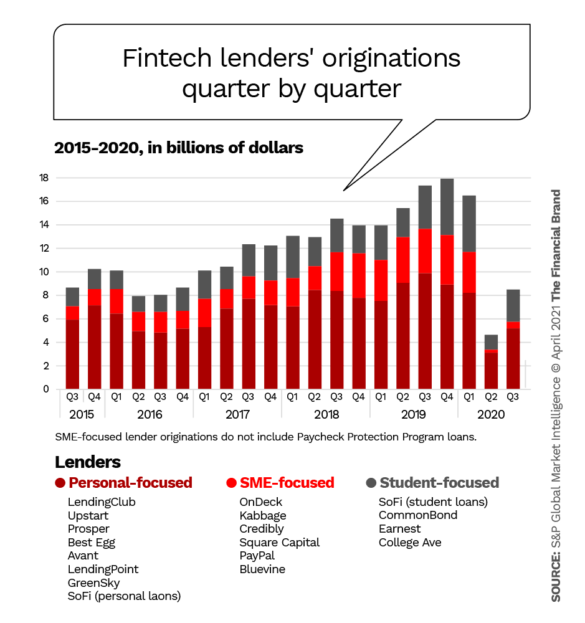

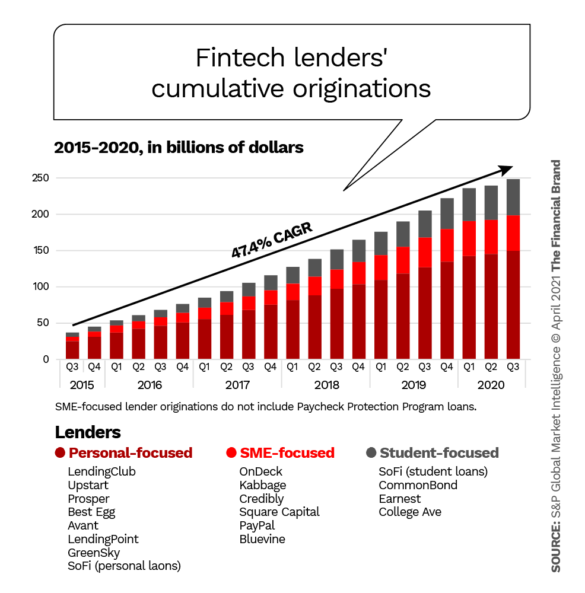

After a rough three quarters for originations in 2020 due to the pandemic, and some resulting consolidation, the fintech lending industry began a broad comeback in the final quarter and could jump by 20% or more over the new few years.

In a report S&P Global Market Intelligence analyzed the performance of three key sectors of fintech lending: personal loans, small- and medium-sized business loans and student loans. Overall these companies saw origination volume dive by 36%.

“The COVID-19 pandemic has been the most significant shock to the nonbank digital lending industry in the past ten years,” states the firm’s U.S. Fintech Market Report.

Much of the fintech lending industry has apparently made it through the worst of the pandemic, with the advent of multiple vaccines holding the promise of a resumption of strong economic activity on top of unprecedented federal stimulus spending.

What To Watch:

Assuming the economy rallies and holds its own, fintech lenders could become a greater competitive factor than ever.

S&P Global Market Intelligence is projecting that, beyond surviving, fintech lending will rise significantly, surpassing 2019’s pre-COVID levels by 2024. Personal loan fintech lenders are projected to rise by 51%, to $47.9 billion in originations annually. Small- and medium-sized business fintech lenders are expected to rise by 16.1% to $15.8 billion. And the student lenders are forecast to rise 152% to $32.8 billion. The firm believes the second wave of PPP loans, and the heavy hit small- and medium-sized businesses took during the crisis, will dampen the demand for business credit that would otherwise have been seen.

This comes at a point when many fintech lenders are morphing.

LendingClub and Square are now banks and SoFi announced its acquisition of a community bank to hasten its efforts to increasingly go mainstream. Upstart, which holds the distinction of having a “fintech sandbox” relationship with the Consumer Financial Protection Bureau, has been moving into auto lending and plans to launch an online lending platform for Spanish-speaking borrowers. SoFi, which began as a student lending specialist, added personal loans and home loans to that and expanded into other banking products.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

COVID Trial Was ‘Proof Point’ for Fintech Lending Model

The report recounts how lenders often pulled back in the face of eroding credit conditions. At the same time, many lenders — not so much the student lending specialists — saw lower demand, according to the report. On top of a slowdown in credit card spending, which often drives personal loans for debt consolidation from fintechs, more borrowers were avoiding fresh debt. Government stimulus payments and related spending also negated some of the need for credit that might otherwise have been seen.

While fintech business lenders as a group have been taking an aggressive part in the multiple stages of the Paycheck Protection Program, they saw demand fall for their standard business lending products.

During 2020 two leading fintech business lenders were acquired. In October 2020 Enova acquired On Deck Capital, which ran into credit difficulties during the coronavirus crisis. Earlier in the year American Express acquired Kabbage, as a company and with its lending technology — but not its book of loans.

“While there was some consolidation, a lot of companies survived and came out the other end,” says Nimayi Dixit, Research Analyst at S&P Global Market Intelligence in an interview with The Financial Brand. “We were already seeing some companies start to expand their originations again, to almost reach where they were in 2019 originations.”

Why Traditional Lenders Should Care:

The COVID crisis was a major economic shock and thus far most fintech lenders weathered it. This suggests their methods are worth considering.

Dixit points out that some investors had persisted in their belief that fintech lenders had not been economically tested. Many use alternative credit data and typically rely on artificial intelligence to evaluate borrowers.

For example, in a company blog Prosper discusses how ten years of proprietary data, AI and a combination of traditional and alternative underwriting had helped it maintain credit quality in 2020. For example among borrowers who did not enter into any COVID relief program at Prosper, the 30+ days delinquent rate was 44% below levels seen before the pandemic.

The survival and continuing comeback of the majority of these lenders should be drawing the attention of traditional lenders, investors and regulators.

“If the fintech lenders’ underwriting models have truly been resilient in the face of a major business cycle” and an untraditional one, at that — “it would be kind of the proof point that a lot of people have been looking for,” says Dixit.

The analyst points out that this would add credibility for the industry with regulators, as more will likely pursue bank charters.

Read More:

- Do Fintechs Scare You As Much As They Do These CEOs?

- Fintech Buys Bank in Pursuit of Radical New Business Model

- Digital Lending Requires Speed and Simplicity to Win Battle With Fintechs

- How Fintechs and Social Changes Are Radically Reshaping Banking

Attention Must Be Paid To Where Fintechs’ Money Comes From

These developments are also important for fintech lenders because they add more confidence when the companies seek funding. Fintech lenders’ funding models vary, but all rely on favorable perception. A key reason that LendingClub acquired Radius Bank, completed in early 2021, was to be able to blend its historical funding method with the advantage of insured bank deposits.

What To Watch:

The impact of Buy Now Pay Later credit on other fintech lenders remains to be seen but it is a definite force in the market.

Dixit says Buy Now, Pay Later companies and programs are a fast-growing part of the fintech universe. They haven’t been part of S&P Global’s tracking because that effort requires a company’s core product to involve at least $1,000 of debt. Much of what the retail-oriented BNPL programs finance is below that.

“Many people see them as payment companies,” says Dixit, “but from what I have seen of their business models there does seem to be an element of credit risk.”

Read More:

- Traditional Institutions Gaining Share at Digital Lenders’ Expense

- Is Stripe’s Lending and Payments Platform Move the Future of Banking?

- Intuit Muscles into Banking with AI-Powered Primary Checking Account

- Why BofA – Not Fintechs or Amazon – Should Keep Bankers Awake at Night

Fintech Lenders Could Face Some Rough Seas Ahead

Fintech lenders’ comeback over the next few years won’t be without challenges.

One is competition. New players are coming on the scene beyond the big techs like Amazon that have already been nibbling around the edges. Dixit points to Walmart, which is partnering with Ribbit Capital to develop a fintech, as a credit competitor to watch. And he notes that H&R Block announced plans at its investor day in December 2020 to launch a digital banking effort that would include not only mainstream service but would also target the wealth management and underbanked markets. Some of this would build on existing services.

Another challenge is an evolving picture in Washington. The Trump administration favored financial innovation, but the Biden administration’s attitudes are more nuanced and still being revealed.

Terminology may become an issue. “‘Fintech lender’ is a bit of a vague term,” says Dixit. “We use it for convenience. But it encompasses everything from LendingClub, which received approval to merge with a bank, to payday lenders who operate on the internet. But those are two very different kinds of companies.”

Dixit finds it significant that two legacy fintech associations, the Marketplace Lending Association and the Online Lending Policy Institute, announced their merger, to form the American Fintech Council, in March 2021. Clearly, he says, they think it is time to beef up Washington representation.