The announcement that Stripe will launch “Stripe Treasury,” a major expansion in its offering of financial services to its partners on its payments platform represents a significant new installment in the ecommerce-style reinvention of small business banking.

Stripe said very little about lending in announcing its new services to platform to partners. In an episode of the 11:FS podcast “Fintech Insider,” however, co-host Kate Moody was all over that aspect of the effort. Stripe Capital began offering business loans in 2019 using artificial intelligence methods, with no human intervention. The actual credit is held by Celtic Bank, a Utah-based industrial loan company.

“It’s part of the longer-term shift in how business lending is allocated,” said Moody, Customer & Product Lead at the 11:FS consultancy. “We’re seeing more and more fintech players and platforms trying to leverage real-time data to help better profile businesses and better understand the money that’s coming in and out of businesses.”

“That’s something that Stripe has already been doing, and Square as well,” continues Moody. “They’re both doing really smart things to use the connectivity they have to better understand who they’re lending to, in a way that incumbent banks struggle to do in quite the same way.”

During the same episode, Ali Paterson, Editor in Chief at Fintech Finance, said Stripe is a major contender for commercial banks’ classic, core business.

“It’s a $100 billion company,” said Paterson. “They’ve got the war chest, they’ve got the technology. I think they are going to definitely knock it out of the park.”

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Moody said that fintech companies like Stripe “are the businesses that will respond to post-pandemic life much more effectively.” And Stripe, she added, “is taking chunk after chunk after chunk of all the opportunities” traditionally seen at banks’.

In a Celent blog, Alenka Grealish, Senior Analyst, Corporate Banking, wrote that Stripe’s move to expand its business services in general to platform partners was more than simply an “adjacency play.”

“Rather, it is a beacon of the reinvention of small business banking and signals that the next five years will see a heated battle between the platform giants and aspiring bank innovators,” stated Celent’s Grealish. “The winners will be those that pursue an embedded banking approach which pulls in products/services and data analytics into the workflows of small businesses.”

“Think of the Amazon of finance: That’s Stripe’s ambition,” says Chris Skinner, blogger at The Finanser.

The latest Stripe moves rely in part on “banking as a service,” as have business-banking side moves by Intuit, Square and a growing group of smaller players drawing on the rails, experience and advice, in varying ratios, of traditional players.

For some players, BaaS is a growing part of their business. A key partner for Stripe in its Stripe Treasury venture is Evolve Bank & Trust, a community bank out of Arkansas with a local business in its own right that works in multiple capacities with a growing cadre of fintechs and developers. This includes the consumer-oriented Dave; Rhove, an app that gives renters a form of ownership; Earnin, which provides payroll advances; Relay, integrated banking and accounting services; and developers Synapse and Sila, among others.

While BaaS has become a major income source for a small group of players there are skeptics.

“All of these banks that are going after a ‘banking as a service’ play are positioning themselves to compete on nothing more than price,” says Chris Nichols, Director of Capital Markets at CenterState Bank, N.A., Fla. “Stripe presents a good case on why banks should think twice about this effort. If you are a single bank on a platform, great. However, the future is more like Stripe’s ecosystem, where they bring on several banks. Then you are really competing on price, as you have no real relationship.” Stripe already has over 50 financial institution partnerships of multiple kinds.

Where Stripe Is And Where Stripe Treasury Could Take It

Stripe, started by a pair of Irish tech entrepreneurs, John and Patrick Collison in 2010, offers payment processing and application programming interfaces for e-commerce websites and mobile applications. The company has become, as the commentators above suggest, a platform force that is forging into new directions far from where traditional institutions work.

In a report on merchant payment providers, Forrester top-ranked Stripe and one other company.

“Payments are the invisible valuable,” Forrester noted in the report. “Invisible because the best payment experiences are quick, painless, and, increasingly, barely perceptible. Invaluable because merchants depend on payments, to, well, make money. The problem is that the payment landscape is especially complicated: a hodgepodge of old and new technologies, strict regulations, and a revolving door of new mandates, players, and operating models.”

In that swirling world, Stripe is emerging as “banker to the cool kids.”

As Forrester describes its appeal, “Stripe’s product is built for and delights its target audience: tech-forward business pros. … Stripe is a best fit for technology-forward payments teams or for digital-first or digital-only merchants that are intent on innovating on their business model…”

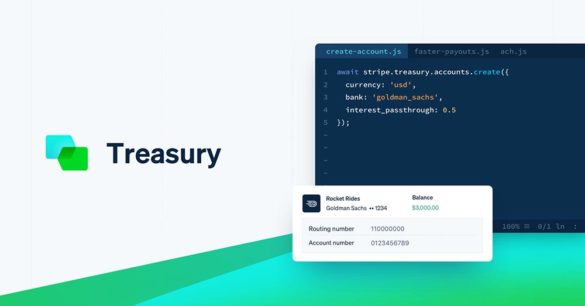

Stripe Treasury is designed to embed financial services in client platforms, to allow business customers to send, receive and store funds. More specifically, Stripe is expanding its current partnership with Shopify to create “Shopify Balance” a business account that includes a card. And it is adding Goldman Sachs Bank USA and Evolve Bank & Trust as U.S. partners — the latter is providing the account and card — and Citibank N.A. and Barclays as global expansion partners.

Here’s how to visualize what Stripe is up to: In a sense, Stripe Treasury puts banks into the position of wholesalers, Stripe into the position of distributor, and Stripe’s platform customers into the position of “retailers” to their own customers. Shopify, for example, specializes in enabling independent businesses to participate in ecommerce without having to take on a subsidiary relationship as, say, an Amazon seller.

Stripe’s idea is to reduce friction, such as in the case of opening a business transaction account. The company cites research it conducted that found it can take five and a half days to open a checking account for a traditional business and seven days for an online business. Enabling platform providers to offer this and other services within their own ecosystems enhances Stripe’s own, broader ecosystem. The company claims it will be able to set up interest-earning accounts in minutes.

“Everything about running an online business has been transformed by technology, but business banking has largely been left behind,” states Karim Temsamani, Head of Banking and Financial Products at Stripe. “But we’re changing this, just like we set out to change payments a decade ago.”

CenterState’s Nichols has a banker’s take on the development.

“Stripe Treasury is a channel play that keeps Stripe part of the banking conversation. For them, it’s an easy strategic move to build the pipes, control the products and charge a toll for the interaction — more fees and less risk,” says Nichols.

By contrast, he says, for banks, this is a customer aggregation strategy for the small business.

“If this fits your bank’s model, this is also an easy strategic play,” he explains. “I think this is an easy way for Stripe to test the market and then pull an Amazon — if the demand is there, they can start their own generic product to compete and move to a bank charter.”

Read More: What Big Techs Like Apple Can Teach Banks About Brand Loyalty

Differing Perspective Makes Stripe of a Different Stripe

A key point made by Stripe on its site and elaborated on in the blog by Alenka Grealish is that platform-based ecosystems are designed to work like a chain of functionality.

“Stripe, along with other platform players like Square, Amazon, Shopify, and Intuit, have already reinvented the small business operating model, ” writes Grealish, “migrating it from silos to a linked workflow.”

“Small businesses think about workflows and banks think about products, with most still offering ‘checking accounts’,” Grealish continues. Square will open its own chartered bank in 2021, Intuit is tapping BaaS via Green Dot, and Stripe has now introduced Stripe Treasury.

Nichols says Grealish’s description is a fair observation of the difference in perspective.

“Banks are worried about cross-selling product trying to get our products-per-customer ratio up, while the small business is not worried about functionality, but how to solve their problem,” he says.