Stephane Lintner’s Jiko Group, with an unusual logo and an intriguing name, has come onto traditional banking’s radar because it became the first fintech to complete the acquisition of a national bank. While Lintner understands the fuss about that landmark move, he seems a trifle bemused. That’s because for him and his associates, the acquisition of Mid-Central Federal Savings Bank, Wadena, Minn., was the means to a mission — and not the mission itself.

“There’s been a lot of excitement — ‘A fintech bought a bank!’,” says Lintner. “But then people come to, ‘Oh, there’s a different model with Treasury bills. Uh, um, interesting,.”

They’ve got it by the wrong end, he believes. It’s the company’s Treasury bill-related idea that has Lintner and his team most engaged right now.

Jiko Group started a broker-dealer operation — Jiko Securities — in early 2017 for part of its current project and partnered with Mid-Central to carry out the banking side of its experiments.

With the bank piece now in place, and Jiko Group stepping into the status of a bank holding company along the way, with bank and broker-dealer subsidiaries, Lintner is excited not about the milestone but for the future.

“We’ve built a perfect place for innovation to breed,” says Lintner. “We’ve got the technology, we’ve got the team, and now we’ve got the licenses.”

Lintner, who holds a PhD. in computational and mathematical sciences from Caltech, spent nine years in trading-related work at Goldman Sachs before moving into research and then Jiko’s development. (He also heads HeliCity Space, a company developing advanced space propulsion tech, but that’s another story.)

Learning how to work with banking regulators in putting together the outlines of what will be the company’s first broad offerings is a key element in Jiko’s plans, according to Lintner, Co-Founder and CEO.

“As long as you keep the dialog really tight with the regulators, we believe we can innovate at a pace that the industry hasn’t really seen before,” he explains. That has meant letting regulators from the Federal Reserve, the Comptroller’s Office and FINRA (Financial Industry Regulatory Authority) dig deeply into the company’s fledgling efforts, and getting audited in detail, according to Lintner.

He considers it worth it. That established an understanding and a level of trust that enabled the bank acquisition to happen.

“The move by Jiko represents an important milestone in the maturity and evolution of fintech companies seeking to expand the reach of their products and services by becoming banks, buying or combining with a bank, or continuing to partner with banks in other ways,” Acting Comptroller Brian Brooks stated when the deal was announced.

“While two data points don’t make a trend,” said Brooks, “the de novo charter granted to Varo Bank this summer and this acquisition by Jiko should demonstrate the optimism and positive energy for consumers, our economy and the federal banking system.”

For Lintner, the real excitement has to be earned yet. He compares where Jiko is at with development of electric cars. “OK, we’re electric, we’re running on a different fuel, but so what?” he explains. “We still have to make a really awesome car.”

In an interview with The Financial Brand, concerning the broad outlines of what will be the first of Jiko’s products, Lintner gave a sense of what an “awesome car” might look like. His hope is to begin offering products publically before the end of 2020, though many specifics remain to be determined and some Lintner preferred not to discuss just yet.

Read More: Digital-First Banking Doesn’t Mean Chasing Every Fintech Innovation

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Why Jiko Decided It Needed to Buy a Bank

Lintner came away from his time at Goldman convinced that much in financial services was clunky, utterly lacking in efficiency. In fact, in the spot where most people list a job or a specialization on LinkedIn, he simply has the motto: “Efficiency is beautiful.”

“I began to feel that if Google or certain other tech companies could get into banking, things would change,” says Lintner. “So the impetus was there to leave Goldman and start doing some homework.”

“I began to feel that if Google or certain other tech companies could get into banking, things would change. So the impetus was there to leave Goldman and start doing some homework.”

— Stephane Lintner, Jiko Group

Lintner began to understand where the blockages were.

“I saw that tech was having difficulty making it into banking,” he explains. “And even now some of the tech-oriented companies like PayPal, Lending Club and Square have made certain things more fluid, but they haven’t really made a dent in the system.”

In the near term, “the reason for buying the bank was that we wanted to be in control of our destiny,” explains Lintner. “You need to have access to the payment rails. That’s the banks. And if you don’t own one, then you are depending on one. And if you are working with a small one, the management team is not used to supervising the kind of volume you want to handle. So you can outgrow that bank very quickly or have issues left and right.”

Having direct access to payment rails was only part of the attraction, however. “What we’ve been building is a platform that can store money and then move it efficiently,” explains Lintner. “Storage is something the other networks, like PayPal, Visa and Mastercard, don’t have. They just make sure money moves from one storage place to another.”

Read More: Varo Disrupts Status Quo as First Fintech with National Banking Charter

Turning T-Bills into Quasi-Deposits for Everyday Banking

For about a year and a half, Jiko has been testing a prototype product that mixes the uses of checking and savings accounts, but doesn’t use deposits, at least not in the traditional sense.

“It’s based on Treasury bills and we’re making them spendable,” explains Lintner. At present about 1,500 people representing a broad array of demographics are part of the test group.

The essence of a bank deposit is a sliding scale of liquidity versus return. Under normal circumstances the more liquid a deposit, the lower the return. The better the return, the less liquid the deposit.

Jiko’s concept would bypass this traditional concept of banking deposits. Instead of putting money into a bank proper, he suggests that consumers could put it into U.S. Treasury securities through Jiko’s bank. And that they should be able to tap those investments pretty much like they do checking and savings accounts, especially through a dedicated debit card. The idea is that the account holder gets the bulk of the return, instead of sharing it with a traditional bank via spread.

In the prototype, people own dual accounts, one with the bank, and the other with Jiko Securities. To develop this, Lintner and associates have been experimenting for a few years with the necessary mechanisms. Jiko Securities handles Treasury security purchases and sales, and Jiko Group acquired Mid-Central Federal Savings Bank in early September 2020 for the banking. (The savings bank converted to Mid-Central National Bank as part of the acquisition.)

Consumers can already buy Treasury securities directly, either as investments in existing issues of them through the secondary market using a brokerage firm or as newly issued securities through Treasury Direct. They can also own them collectively through shares in money market mutual funds and exchange traded funds.

The return can be better than that on a deposit account, but liquidity is an issue with direct ownership. Treasury Direct doesn’t enable trading. To sell a Treasury security before maturity you must transfer it to a bank or brokerage first. In addition, you can’t sell a piece of such securities — you have to sell the whole thing.

While money market funds generally include check-writing power, transactions must typically be in amounts of $500 or more. Jiko’s prototype sweeps funds from the banking account to the brokerage account or vice-versa. Jiko’s intent is to allow transactions in much smaller amounts and to facilitate the use of debit cards to perform those transactions. To make this work, fractional ownership in the Treasury bills is set up.

Back when COVID-19 hit the markets in March 2020, some in the tester group saw significant temporary upside as a result. “When everyone else was bleeding, their accounts went up,” explains Lintner.

Generally, there won’t be as much fluctuation, but it is still a sale. “Swipe your card and you’ve just sold Treasury bills,” says Lintner. “This is live money.”

Using the federal securities approximates the safety of insured deposits. After all, if the Treasury, which backstops FDIC and NCUSIF, reneges, the deposit insurance isn’t worth much either, as it is backed by the “full faith and credit” of the U.S. government.

Lintner characterizes the idea as an evolution, rather than a revolution. The original Merrill Lynch Cash Management Account of the 1980s introduced the idea of card-based access to securities holdings. At that time Merrill Lynch was not part of Bank of America and relied on Bank One, now part of JPMorgan Chase. Jiko has already struck an agreement with Discover Card and is working on a deal with Visa.

“We will be ultra efficient and removing all intermediaries,” he says. “It’s going to be you, your Treasury bills and nothing in between but technology.”

This is still early days. Lintner says the company is still figuring out how to package its concepts for different consumer segments.

Where does Jiko make money if there is no spread?

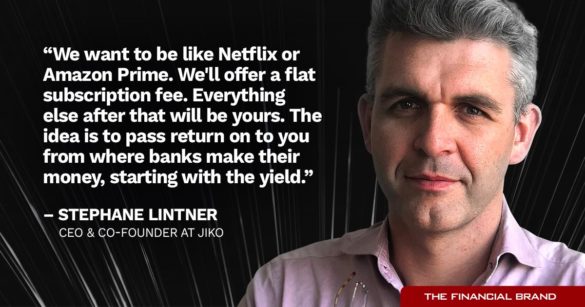

“We want to be like Netflix or Amazon Prime,” says Lintner. “We’ll charge a flat subscription fee. Everything else after that will be yours. The idea is to pass return on to you from where banks make their money, starting with the yield.”

A Note about the Name and Logo

A natural question in this day of Googling everything is what that unusual logo means and what the name “Jiko” refers to.

As Lintner tells it, when the matter of choosing a company name arose, everyone was busy and not a lot of time was devoted to it. Someone suggested “Jiko,” which is the translation of “self” into Japanese. But Jiko can also translate back into English as “accident” as well as other words, so don’t read too deeply into that.

As Lintner tells it, when the matter of choosing a company name arose, everyone was busy and not a lot of time was devoted to it. Someone suggested “Jiko,” which is the translation of “self” into Japanese. But Jiko can also translate back into English as “accident” as well as other words, so don’t read too deeply into that.

And that logo? Lintner says many of the company’s people have younger kids and at the type it was selected, some families had been watching Disney’s “Finding Dory.” The logo is a stylized version of the title character, a species of fish called the “regal blue tang.”

The idea, says Lintner, is to pick up on the idea of safety, “to let everyone swim in open waters without being eaten by the sharks or the vampire squids.”