“When a client pays me, I can keep track of my expenses by using my Square Card. I just leave it in my Square Balance and spend it down. That’s way better for me and easier than transferring money to a separate bank account” — Chef Andrea Lawson Gray.

That’s a testimonial on Square’s website. Of course every company puts glowing comments on their website, but this one has several key words highlighting the fast-moving changes reshaping banking: “Track expenses,” “Square Card,” “Square balance,” “Easier,” “Bank account.”

Plenty of headlines have trumpeted the threat of fintechs or challenger banks to traditional banks and credit unions. Some of those threats have yet to materialize and may never do so given the lack of sustainable profitability of many challengers. Yet in between big techs like Google and Amazon on the one hand and the Chime’s, Monzo’s and Varo’s of the world on the other are a handful of potent banking competitors: PayPal, Square, Stripe, Shopify among them.

Nobody disputes PayPal’s competitive power in payments — and Stripe drew attention with a new service, Stripe Treasury, to offer bank accounts to merchants and vendors that use it platform — but Square in some ways has flown under the radar of many financial institutions. The company, built by (and still run by) Twitter CEO Jack Dorsey in 2009 created that clever square “dongle” — an inch-square card reader that small merchants could plug into their mobile phones allowing them to easily accept card payments anywhere.

“Square is more than a competitor. They are the issuer and the acquirer and control everything in between.”

— Richard Crone, Crone Consulting

Since then the company has grown dramatically, with total third-quarter 2020 revenues of just over $3 billion and a market capitalization (as of early December) of $95 billion (on par with Citigroup). It has expanded into debit cards, lending, P2P transactions (Cash App), financial software for small businesses, investments (including bitcoin) and more. It acquired a tax preparation unit from Credit Karma in the fall of 2020. Further, Square received conditional approval in March 2020 from FDIC for deposit insurance on an industrial loan company charter. (ILC charters, issued by states, are eligible for federal deposit insurance.)

“Square wasn’t ever a single product but a perpetual-growth fintech ecosystem that added elements to solving their customer’s problems over time,” states a Seeking Alpha article by The Abstract Investor. Cash App alone “unlocked a whole world of retail financial services. This is a company that should be a case study for utilizing network effects,” the article states.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Epitome of a Banking Disruptor

Despite that rapid growth, only about a third (36%) of banking executives surveyed by Cornerstone Advisors in late 2019 thought Square (along with PayPal, Credit Karma and other fintechs) was a significant competitive threat. By contrast 53% considered Amazon, Apple and Google a threat.

“Two thirds of bankers are missing the big picture here,” says Ron Shevlin, Cornerstone’s Managing Director of Fintech Research in a Forbes post. “Amazon and Google are on a path to become vendors or distribution channels to banks — not competitors.” Square at this point on the other hand is a full-on competitor.

Even mighty Chase, two-thirds larger than Square by market cap, has taken steps to stem the flow of business flowing to Square and others. The megabank is rolling out a checking account paired with a new service called QuickAccept that lets merchants take card payments through a mobile app or a contactless card reader. The funds will show up in their Chase checking account the same day, at no charge.

Square doesn’t have a checking account, yet, but through the Square Card debit card (issued by Sutton Bank) it now allows sellers instant access to the funds processed through the Square point-of-sale system for free.

“Square is more than a competitor,” states Richard Crone, CEO of Crone Consulting. “It is the epitome of a disruptor because they’re going for the competitive chokehold. They are the issuer and the acquirer and control everything in between.” When a small business opens a Square account, Crone tells The Financial Brand they can literally get everything else they need financially from them. “They won’t even bother going to a community bank or a credit union or any bank for that matter.”

Read More: Is Stripe’s Lending and Payments Platform Move the Future of Banking?

Square’s Expanding Financial Ecosystem

By now banks and credit unions have likely become accustomed to dire competitive warnings. No one can predict the future, certainly, but here is a quick rundown of what Square is up to at present, that indicates their growing scope.

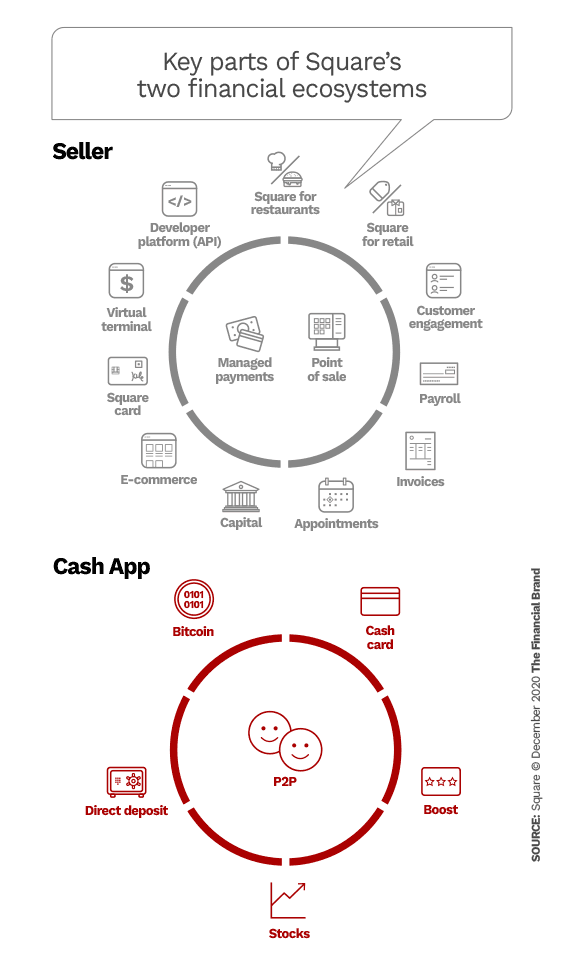

The company breaks down its products and services into two “ecosystems,” which it calls “Seller” and “Cash App.” The first is the larger and is an outgrowth of the original mobile card acceptance product, but, as shown in the diagram below, has grown to encompass many services not only for very small merchants, but mid-size businesses as well. Key elements include the Square Card debit card (more than $250 million was spent on the Square Card in the third quarter of 2020), lending via Square Capital (more on this below), and a whole range of software-as-a-service tools for business customers.

The main part of the Cash App ecosystem is a P2P product of the same name, which is number three behind Venmo and Zelle in terms of users, but growing fast. Square points out in its third quarter 2020 shareholder letter that “We remain focused on increasing daily utility for our Cash App customers to products beyond peer-to-peer payments, which helps drive higher engagement and monetization.”

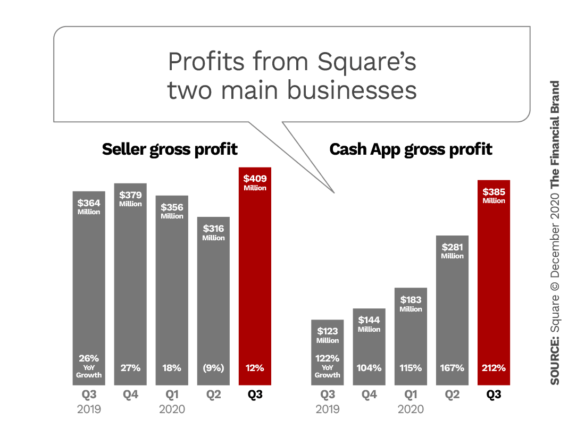

That includes using it for tax refunds, government stimulus deposits and retail investing in stock and bitcoin. 23% of Cash App customers are daily users, according to Square, which helped to generate third quarter gross profit growth of 212% year over year. That includes $32 million of bitcoin gross profit from $1.6 billion of bitcoin revenue as customers traded the cryptocurrency within Cash App.

Both lending and card-present transaction revenues declined in the third quarter. The company had paused new loan offers until the end of July and card-present transactions continued to be impacted by reduced in-store purchasing. On the other hand, the pandemic caused card-not-present transactions and P2P transactions to rise sharply. That more than offset the declines.

Square’s AI-Driven Lending Machine

The suspension in its Flex Loan program in the first quarter of 2020 when the pandemic hit punched a hole in Square’s lending growth. Prior to that it had grown from $335 million in Q1 2018 to $671 million in Q4 2019. Lending resumed but the numbers had fallen drastically — 35,000 loans totaling $155 million in Q3.

Once the pandemic impact eases, Richard Crone believes Square Capital has a significant advantage over most traditional lenders.

“They have a FICO score range that is wider than any other financial institution because they have all the information on sales that is feeding their algorithms and their artificial intelligence engine continuously,” Crone observes. “So with each new transaction it gets smarter. And so the lending net they can cast is far wider.” Crone believes the same will hold true on the consumer lending side.

If you check out the loan offerings on Square’s site, you will find that loan amounts range from $300 to $100,000 and that there is no interest rate, just a flat fee. Also, the loan can be repaid automatically with a percentage of a company’s daily card sales through Square.

The tax preparation business that Square acquired as a result of the Intuit/Credit Karma merger will provide another big boost, several people noted. Square won’t just get a tax preparation platform, they’ll get tons of data.

Read More: Intuit Muscles into Banking with AI-Powered Primary Checking Account

Will Retail Banking Be Part of this Disruptor’s Mix?

Setting up its industrial loan bank (predicted for early 2021) may not be a requirement for Square to become a bigger competitive factor in the consumer banking market. In its own words, “We continue to believe that our Seller and Cash App ecosystems are well-positioned to benefit from the acceleration of secular shifts, such as omnichannel commerce, contactless payments, and digital wallets for consumers,” the company states in its Q3 shareholder letter.

One of the reason’s Crone thinks the company may succeed in retail banking is because of electronic receipts, an option every Square merchant offers to consumers. “Every time they select electronic, Square is building a universal database on the issuing side,” he states.

“Pivoting to be a consumer brand starts to get hard for Square, particularly when you’re now effectively up against Google’s Plex marketplace.”

— Alyson Clarke, Forrester Research

Forrester Principal Analyst Alyson Clarke is more circumspect about Square’s prospects in consumer banking. “Pivoting to be a consumer brand starts to get hard for them, particularly when you’re now effectively up against Google’s Plex marketplace,” she states. “And although I don’t have an inside scoop, I really think, Apple and Goldman Sachs will do something with deposits. Plus you’ve got Facebook with Diem and its digital wallet Novi along with brands like Rakuten or Schwab that consumers know better than Square.”

On the other hand, Clarke observes that one of the reasons she has predicted that the Google Plex checking and savings account will be a game changer is because with Google’s ecosystem of merchants, it could shake up the banking market by creating amazing reward programs for these accounts, typically only applied to credit cards.

“Square also has a whole network of merchants and small businesses,” says Clarke. “So maybe there is an opportunity here for them around consumer banking rewards and things like that.”

Bitcoin and P2P transactions are key factors impacting Square’s consumer banking prospects, according to Sankar Krishnan, EVP and Industry Head for Banking and Capital Markets at Capgemini. Young Millennials and digital natives overall are the main entry point, he believes.

Although there is no interest paid on Cash App credit balances nor any FDIC insurance, still, Cash App is “arguably the easiest way to make payments and buy Bitcoin,” Krishnan states. “There is no P2P service from a bank that is as easy to make payments.”

How Traditional Institutions Can Meet the Challenge

Square by itself is not the sole factor posing a challenge to the future of traditional financial institutions. However, the kind of competition it presents is symptomatic of the broader trend.

“What’s happening is that financial institutions — especially community banks and credit unions — are losing market share one transaction at a time, one electronic receipt at a time, one P2P transfer over Cash App at a time,” says Crone.

The consultant maintains that three factors put many traditional institutions in this downward-sloping predicament:

Number one, thousands of them don’t support “the ‘pays’ ” — Apple Pay, Google Pay or Samsung Pay, says Crone.

Second, thousands of them don’t offer P2P payments. They don’t want to participate in Zelle because it costs them too much, according to Crone.

Third, and most important, they don’t have true digital account opening capability.

“You have to be able to open an account at the speed of Square, at the speed of Venmo, at the speed of Apple Card,” he insists — “that is, in less than three minutes.” Also important is the ability to instantly be able to make a transaction once the application is complete.

The arrival of the COVID-19 pandemic exposed these shortcomings in a glaring way by restricting access to branches and jamming up call centers.

The first step for any institution that doesn’t have the capability is to fully enable digital account opening, according to Crone. If not possible on their own, then they must partner with someone who does, including Google Plex. Ideally community banks and credit unions should do this through their core technology providers to reach the best agreements.