Checking accounts often don’t come with checks anymore, and many younger consumers may go their entire lives without ever writing a check.

But one thing about checking accounts that has not changed is how vital they are as a funding source for banks and credit unions. The emphasis on adding more of these accounts is at fever pitch.

But many financial institutions celebrating their success in this area need to take a second look at the data, says analyst Ron Shevlin.

In the battle for checking accounts, the war is over, and traditional banks and credit unions have lost, he says. Those who think otherwise are simply misreading the data and lulling themselves into a dangerous complacency.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Reality Check: You Aren’t Doing as Well as You Think with Checking Accounts for Gen Z

Many credit unions realized years back that their customer bases were aging and stepped up efforts to get younger consumers to open checking accounts, Shevlin, chief research officer at Cornerstone Advisors, points out. (This applies to many community banks as well.)

A higher portion of their checking accounts now come from younger consumers, which has lulled them into a false sense of security.

“My point is, ‘You guys aren’t understanding the numbers: 72% of all new accounts that are opened today are from younger consumers. So, of course those numbers are going up and the average age of your consumers is going down.'”

— Ron Shevlin, Cornerstone Advisors

Shevlin also says that a category like “young people” is too general to allow for meaningful insight. To understand what’s really going on, finer data cuts are necessary.

Take Millennials, now ages 27 to 42 years old. He recommends splitting this cohort into 27- to 34-year-olds and 35- to 42-year-olds.

“The older Millennials predominantly went to megabanks when they opened their checking accounts,” he says. “But the younger Millennials and, to a good extent, Gen Zers, aren’t going to megabanks. They’re opening up digital accounts with digital banks, fintechs and others.” Some, he adds, are opening up second and even third accounts with the newer players.

Some of these consumers do have accounts with traditional institutions and they won’t close those accounts.

But that’s actually not good news.

They will either let those accounts go dormant or they will merely use them as “paycheck motels,” a term Shevlin coined several years ago. This means that funds will reside in the account just long enough for direct deposits to be re-routed to other accounts.

“Your customers are cheating on you in that you may already have a relationship with them, or megabanks do, but they are opening up second accounts,” says Shevlin. “They want certain features. They want a higher interest rate. Or they want certain things that they’re not getting from accounts with traditional institutions.”

Shevlin noticed this trend starting to emerge back around 2019.

And it threatens to leave some institutions with hordes of “walking dead” accounts — zombie relationships that have no growth potential.

The trend of direct deposits having a short stay has become more pronounced as rates began to rise (especially given that digital banks and fintechs ramped up the interest they pay on deposits far earlier and far more so than traditional banks and credit unions).

Now for the numbers that Shevlin says indicate that digital newcomers are winning the war over attracting consumers.

Read more: Success with a Digital-Only Bank Brand Takes More Than Rate Offers

Digital Banks and Fintechs Are Winning

Shevlin took a reading on checking account trends by adding some questions to a survey of just over 3,000 consumers. The findings were so stunning that he put them into his blog on Forbes.com

Checking Accounts Dominated by Digital Players:

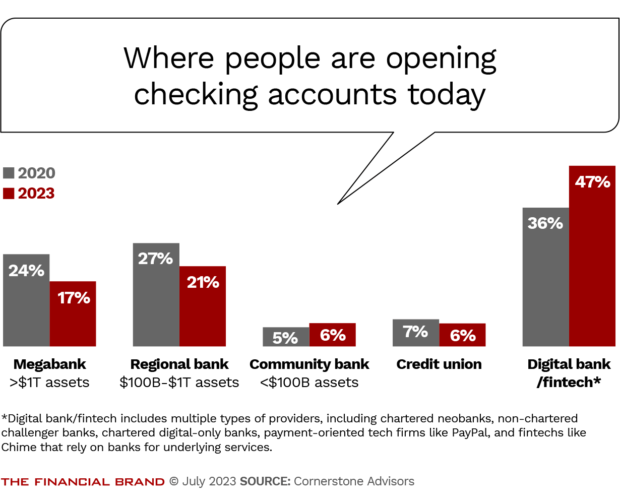

Ron Shevlin's research found that nearly half of all new checking accounts opened so far in 2023 went to digital banks and fintechs.

For the purposes of Shevlin’s survey, and the accompanying charts, “digital bank/fintech” includes a jumble of banking providers. Among them are banks like Varo and SoFi, which started out as fintechs and later obtained charters. Also in the mix are challenger banks without a charter, digital-only banks with a charter, payment-oriented tech firms like PayPal, and fintechs like Chime, which offer their products by partnering with traditional banks under “banking as a service” arrangements.

While these players are different from each other, what they have in common is that they are all digital, Shevlin says. What they offer is also closer to what younger consumers want than what they can get from traditional players, he says.

As shown in the chart below, Shevlin found that the share of new accounts won by digital players grew to 47% in 2023, from 36% in 2020. The share of new accounts going to both megabanks and regional banks shrank commensurately. (Community banks and credit unions held steady — which underscores that any sense of victory they may be feeling seems, at the very least, premature.)

Beyond this, Shevlin found that Chime and PayPal loom large in the digital category. The pair together account for 43% of the new accounts opened with companies in the digital bank/fintech category. But beyond that, they account for one out of five new checking accounts opened so far in 2023. (Most of the consumers opening checking accounts are Millennials or Gen Zers.)

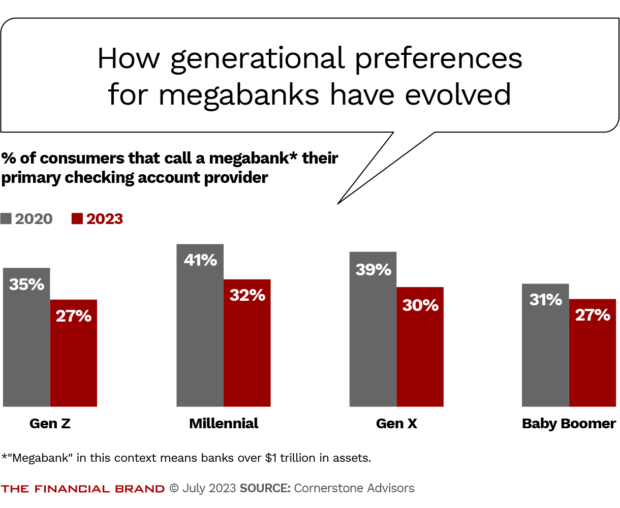

Shevlin also found that while SoFi saw its share of new account openings quadruple to 4% in 2023 over 2020, Wells Fargo’s share of market fell by more than half, to 3.5%. As the chart below illustrates, the megabanks have seen share fall across all generations, but especially younger generations, since 2020.

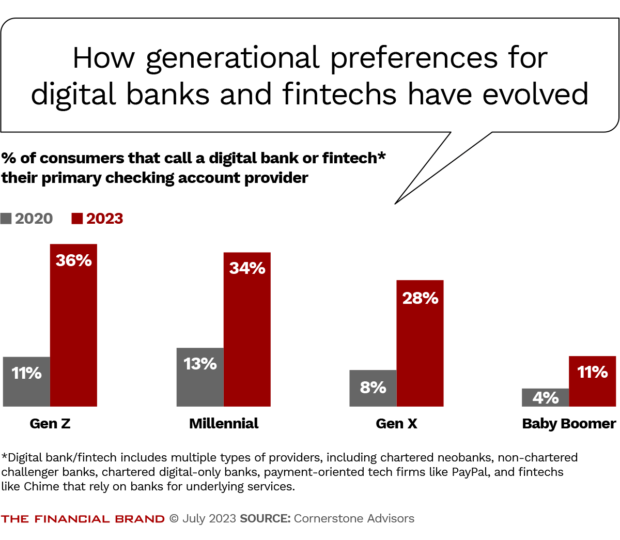

The trend towards digital providers is only going to grow, going by the data in the chart below, which tracks generational preference for the digital bank/fintech category. The younger the generation, the more likely that players from that category consider that relationship to be their primary checking account relationship.

- SoFi’s Big Plans for the $2B of Deposits It’s Scooping Up Every Quarter

- People Want More from Their Banks Amid Economic Uncertainty

A Checking Account by Any Other Name … So What If It’s Not Technically the Same

Some bankers and credit union executives might argue that what the digital players offer isn’t a “checking account.” PayPal offers payment services, which can include a balance feature, for example.

But Shevlin isn’t hung up on the technicalities.

“Someone may want to give me grief over whether, say, Cash App is really a checking account,” says Shevlin. “My answer is that I don’t know and I don’t care. Guess what consumers think it is?”

Shevlin advises traditional players to focus on the numbers, not on product labels.

Traditional Players Must Ditch Tradition:

Products from some digital players may not replicate what banks and credit unions offer, but that very well could be part of the appeal. And if consumers can store and move money the way they want, do the semantics really matter?

Digital players’ offerings “may not technically be a checking account, but consumers see it as a substitute and that’s what they are opening up,” says Shevlin. “That’s where they are putting their money. That’s what they are using to spend money.”

Shevlin says research by J.D. Power, reported by The Financial Brand, syncs with his findings. J.D Power found that 29% of all bank customers had shifted money to a deposit account at a separate institution, whether for higher rates, cash back or digital tools. On average, they moved 39% of their funds.

Salesforce studied why U.S. consumers are interested in nontraditional players in its own research. The top reason was “easy setup/onboarding” at 41%, followed by simple “curiosity” at 35%, according to its 2023 “Connected Financial Services Report.”

Read more: In the Battle for Direct-Deposit Relationships, New Technology Is a Game Changer

Why Banks and Credit Unions Are Losing to Digital Players

Opening a checking account with a new provider has gotten much easier and speedier in recent years, but why are so many consumers taking the plunge? And when they do so, why are they favoring nonbanks so heavily?

“People are experimenting,” says Shevlin by way of explaining the appeal of the digital and fintech players. “They are looking for new features.”

For some, it may be as simple as finding a mobile app that seems friendlier than the one offered by their current primary checking account provider.

There’s another reason, however. Many traditional institutions’ checking account offerings remain quite basic, same-old same-old. By contrast, digital banks and fintechs do a lot of mixing and matching of additional features and functionalities in their checking offering, making for a more distinctive product.

One example is early access to payroll funds that arrive via direct deposit, a common feature among fintech players. This has started to become more common among traditional banking institutions, but it remains an infrequent practice by comparison.

Creativity in account design can be tricky for regulated banks and credit unions.

“Banks don’t — and, to some extent, can’t — glom everything together,” says Shevlin. “That’s partly because of technology issues, partly because of legacy organizational issues and structures.” He says regulations may also be a factor in some cases.

The way features are packaged may hinge on who a nontraditional firm is trying to reach. Shevlin points out that while Chime is scooping up accounts, it tends to attract low- and middle-income customers. They don’t spend nearly as much as more affluent consumers do, so interchange income on the Chime cards is not as high as it might be. Chime customers also have lower credit scores, which makes them either not prospects, or riskier prospects, for consumer credit.

So it’s not as if simply winning checking accounts is a touchdown by itself.

Read more:

- Unique Youth Savings Account Aims to Hook Gen Z & Gen Alpha

- See all of our latest coverage of checking accounts

BaaS Isn’t Equivalent to Having Checking Account Relationships

Many digital competitors offer banking-as-a-service products in a fintech wrapper, as anyone who has read the fine print at the bottom of fintech websites knows.

Not all BaaS relationships involve deposits — many fintechs offer only credit in some form.

Shevlin points out that a key difference between serving a deposit customer via BaaS and serving them directly is not the checking account but the relationship.

How so? On the consumer side, the BaaS banks are invisible, says Shevlin. “Chime’s customers have no clue who the underlying banks are,” he says, “and neither do they care.”

The BaaS banks behind fintechs can’t just reach out on their own to a fintech’s customer and try to cross-sell something, Shevlin says. “They don’t have that direct relationship.”

So any industry players taking comfort from the idea that many fintech customers are ultimately customers of a traditional financial institution are, in a sense, lulling themselves into a false sense of security.

As Shevlin sees it, the only way to win the game is to play hard.

The strategy Shevlin advises: Institutions hoping to compete with the digital/fintech wave have to be clear on what they are trying to do and which consumers they want to attract, he says. With that in focus, then they can better target their marketing and put a larger share of their marketing dollars behind that honed offering.

Check out: The World’s Biggest List of Digital Banks