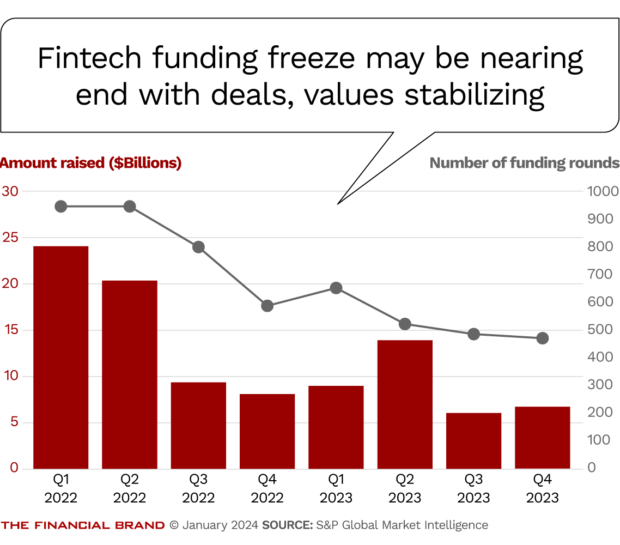

Fintech funding from venture capital firms fell 42% to $35.45 billion globally in 2023, the second consecutive down year.

However, the funding downturn that began at the beginning of the second half of 2022 may be coming to an end and a supply of “dry powder” held by venture capital firms may find its way to fintechs seeking resources for growth in 2024.

A rebound in fintech funding in the second half of 2024 now seems possible.

All this comes from a report by S&P Global Market Intelligence. The report notes that in 2022 fintech funding totaled around $62 billion, which was down 32% from the 2021 peak of $91 billion, making the 2023 drop more severe.

“The venture capital market for fintechs appears to have lost some of its bearishness. Macro signs point to a less pessimistic outlook for 2024 as valuations of fintechs bounced back.”

— S&P Global Market Intelligence report

S&P Global Market Intelligence notes that the rate of falloff in funding various fintech types began to slow in the fourth quarter of 2023, one of the signs of a bottom.

Flat to modest growth could be seen in the second half of 2024, predicts Sampath Sharma Nariyanuri, fintech research analyst at S&P.

The research tallied 472 funding rounds in the fourth quarter of 2023, for a total of $6.67 billion. In the previous quarter a greater number of funding rounds, 481, produced a smaller amount of funding, $5.98 billion. In the final quarter of 2022, 587 funding rounds produced $8 billion in investment in fintechs.

The falloff of fintech funding by venture capital firms was less severe in North America than globally. In North America dropped 27%, versus 42% worldwide. By contrast, Latin America saw a falloff of 71%.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Happy Days Here Again? More Like ‘Happy-ish’

Other researchers and industry observers have been talking about a thaw in the “funding winter” for 2024 that many in the fintech sector have been experiencing.

But the bounceback will look nothing like the days when it seemed every passing fintech notion won backers.

“Venture capital firms, traditional financial institutions, and other entities investing in fintech are making it clear that fintech firms need to demonstrate a path to profit and a ‘moat,'” write Forrester analysts in its recent report “The Future of Fintech.” The firm defines a moat as “a sustainable competitive advantage that protects against threats to market share or profits.”

Forrester also says that the return of funding will continue to be muted compared to the heyday: “The impact of lower growth in fintech funding will be felt for years.” Among the effects will be faster decisions regarding which startups have long-term potential, with investors generally being less patient and more likely to pull the plug.

Read more about one VC’s take on the next era of fintech funding:“Tough Times Breed Better Companies: Banker-Turned-VC on the New State of Fintech”

These developments are coming at a point that some say will be a reckoning for existing fintechs.

“53% of fintechs will be cash out by Q3 2024 if they do not raise or exit,” says Laura Bock, partner at QED Investors, a venture capital firm active in fintech, citing figures from a Silicon Valley Bank report.)

See all of our latest coverage on fintech banking.

In a blog rounding up predictions among QED’s team, Bock adds, “After several years of fintech startup shutdowns being few and far between, we will unfortunately continue to see more failures, including high-profile fintech bankruptcies.”

“The Band-Aids applied to keep companies alive will mostly not hold until the end of 2024,” says Chuckie Reddy, partner and head of early stage growth at QED. “It’ll be a time to make the tough choices after a couple of years of fearing the shoes will drop.”

The report from S&P Global Market Intelligence indicates that some venture capital firms made comparatively smaller follow-up investments in fintechs to extend their “runways” into the new year. Reddy’s comment suggests that some will cut off further funding if the fintechs aren’t adopting winning strategies.

On the brighter side, there’s money looking for something to do. The S&P Global Market Intelligence report that venture capital firms have $566.61 billion awaiting investment opportunities, potentially in fintech. That amount is up nearly 7% from the $530.26 billion at the end of 2022.

“The dry powder swelled amid a tough capital environment largely because sluggish dealmaking limited opportunities for the deployment of uncommitted capital,” according to the report.

Read more:

- Neobank Winners and Laggards Point to Long-Term Fintech Strategic Shift

- The Future of Fintech: 2024 Forecast, Trends & Risks

- What Banks Can Learn from Plaid Study of Fintech Apps

Artificial Intelligence Will Produce Dual Impact on Fintech Funding

Funding for companies in various aspects of AI will be a challenge for fintech, on one hand, because it has venture capital firms and investors excited in a way once reserved for fintechs. In a research piece about the outlook for fintech funding, Crunchbase analyst Gené Teare notes that AI attracted more venture capital investment in 2023 than fintech did — “a first in the last six years.”

However, in a TechCrunch podcast, Teare said that AI capabilities would “seep through” other industries. That could enable fintech firms to tap into some of the popularity and investor interest that AI firms are enjoying.

“The promise of artificial intelligence has swayed many venture capitalists to pile into fintechs touting their focus on the frontier,” says S&P Global Market Intelligence. In 2023 alone, 188 funding rounds involved fintech firms that say they are working on ways to apply AI to fintechs.

“As over 85% of them are operating in seed to growth stages, we will likely see some of these companies knocking on the doors of VCs for bigger checks in the next 12 months,” according to the report.