When Rakefet Russak-Aminoach, now a venture capitalist, stepped up to become president and CEO of Israel’s Bank Leumi in 2012, she already knew that the bank needed a deep digital transformation. But she had come up on the bank’s commercial credit side and felt she needed to better understand the consumer part of the company. So, she began visiting branches to observe and talk to customers.

What she saw annoyed her. She watched as younger customers waited in lines for over half an hour to get their banking done — while texting, scrolling and more on their smartphones. When she spoke to them, she found many had come to the branch to do something that Bank Leumi — now Israel’s largest bank at approximately U.S. $190 billion in assets — could have been providing on mobile.

Spending Doesn't Solve the Problem:

The Israeli banker did the math and realized that improving traditional service by hiring more branch staff and opening more locations would be a vicious cycle — just adding heaps of expense and not measurably improving customer experience or service.

As part of a multiple-front effort to digitally transform the bank, she spearheaded the development of Pepper, the mobile banking app that Bank Leumi introduced in 2017. Her intent was to put everything meaningful to retail banking customers into the app, which she hoped would function much as a startup neobank.

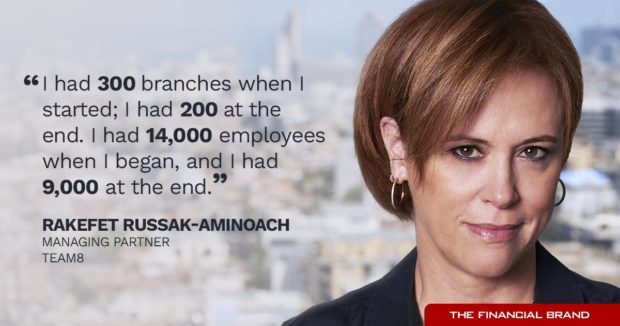

Russak-Aminoach also believed that the launch of Pepper and the larger digital transformation of the bank had to be accompanied by rethinking the branch system. “I had 300 branches when I started; I had 200 at the end. I had 14,000 employees when I began, and I had 9,000 at the end,” says Russak-Aminoach.

Anger from customers and employees was palpable.

“They hated that we were closing branches,” says Russak- Aminoach. She says once she gets hold of a mission, she plows ahead, even if it’s unpopular and, in this case, causes “a huge trauma.” The successful launch of the Pepper app was her consolation: She says that facet of transformation gave her “joy” — her word for it.

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

Redefining CX Through Innovative Social Media Strategies for Financial Services

Learn how Sprinklr is redefining success in the financial sector by harnessing the potential of tailored content and personalized engagement.

Read More about Redefining CX Through Innovative Social Media Strategies for Financial Services

Transforming the Banker, Not Just the Bank

Bank Leumi’s transformation also transformed Russak-Aminoach. A native of Israel, she had started out in accounting, first as a senior partner and later as CEO of KPMG Israel. After shifting to banking, she spent eight years working up the ladder to the CEO post at Bank Leumi.

But after seven years in the crucible at Leumi, Russak-Aminoach realized she didn’t want to be a banker anymore. Helping to launch Pepper had pulled her towards fintech, and in 2020 she became a managing partner at Team8, an Israeli venture capital firm with extensive involvement in the U.S. and Israel tech communities, including fintech.

Russak-Aminoach’s personal history gives her a banker’s eye on fintech. The Financial Brand talked with her about the current state of fintech funding —why the drought has made the industry stronger; how she sees banking and fintech collaborating in the future, including the future roles of embedded fintech and embedded banking; and how she thinks artificial intelligence will transform what both banks and fintechs do.

Read more: Neobank Winners and Laggards Point to Long-Term Fintech Strategic Shift

Fintech Funding — and Brainpower — Looking Up After the Drought

“I’m a banker and before that I was an accountant,” says Russak-Aminoach. “When I looked at the valuations we were seeing on fintechs in 2021, it was crazy.”

Being in the trenches with investors in both the U.S. and Israel over the past two years was tough days all over again for a banker who had switched fields seeking fintech joy.

“I like to say that we moved from FOMO — fear of missing out — to FUD — fear, uncertainty and doubt. Everything you showed investors, they were afraid to touch.”

— Rakefet Russak-Aminoach, Team8

But she believes that much of the drama in fintech is over, for now. “We see good fintech companies raising money again. Yes, valuations are sometimes half what they were. That’s because valuations were not in the right place, in most cases beforehand. So, in my opinion, this is healthy,” she says. (Dive Deeper: Fintech Funding Freeze May Thaw in 2024. But Failures May Multiply, Too)

“Healthy” not just in the sense of bringing things a bit more down to earth after the heady boom times, but also because the lack of fintech euphoria demanded focus.

“My philosophy is that in bad times, you can build better companies,” says Russak-Aminoach.

Part of the benefit is selectivity: Not everyone wins. “In 2021, every idea was good. Everyone who wanted to raise money could. In that kind of ecosystem, where you create lots of companies, many will end up with nothing. Now it’s much more rational.”

But Russak-Aminoach adds something that you don’t often hear in the conversation about capital for fintech founding and expansion: The intertwined relationship between funding availability and talent. When fintech funding was flooding in, she explains, courting talent became difficult.

“Investors were pouring money on everyone. It became very difficult to get to the best talent with a rational offer that would make sense for them. Now, with everything calmed down, it’s much easier. Everything makes more sense,” says Russak-Aminoach.

Read more:

- Banks May Be Ready for Digital Innovation: Many on the Staff Aren’t

- Why U.S. Bank Invests in ‘Human Connections’ While Pursuing Digital Innovation

- Why It’s a Good Time for Community Banks to Hire New Talent

Innovation Isn’t Just About Funding and Brains

“In financial services it’s very difficult and very costly to acquire market share and to find new customers,” Russak-Aminoach says. She believes that embedded banking and embedded fintech will prove to be strong strategies for both banks and fintechs.

Many neobanks still struggle because their customer acquisition costs remain high and take too long to pay back.

“In the crazy days, they could raise more and more money and then pay hundreds of millions of dollars to Google and Meta in order to acquire market share,” says Russak-Aminoach. “But they never got to have a plan on how to make money.”

Post-drought, she continues, “Everyone is looking for profitability or a plan for getting there.”

Finding ways to embed fintech in other financial offerings will be essential to finding those profits. Rather than marketing from scratch, integrating a fintech’s services with a partner’s existing products and customer base should produce better results.

As an example, she cites one of Team8’s portfolio companies, April (officially, April Tax Solutions). April claims that its software, embedded into banking, payroll and other financial apps, can prepare people’s taxes in 40 minutes or less. She says the software relies on earlier forms of generative artificial intelligence. The advantage for the host company is that the software enables refunds to be deposited directly into the bank or fintech’s app. (At present most of April’s 20-odd partners are fintechs. She says embedding with large banks is coming.)

Russak-Aminoach thinks embedding banking services into the sites of merchants and fintechs makes more sense than providing banking services through a banking-as-a-service arrangement. The latter increasingly appears in regulators’ sights.

The difference, in her thinking, is that with BaaS, the bank is handing over functionality it can provide through its charter to a nonbank company. This puts the onus of compliance on the nonbank or fintech BaaS customer, though the bank can’t disassociate itself. By contrast, she continues, embedding the bank’s services — plugging into the other company’s website or mobile app — maintains full control of the functionality and back end.

Cultivating “hubs” of distribution capability will get both bank tech and fintech products into the field faster and more successfully, according to Russak-Aminoach. She believes a byproduct of embedded relationships is stickier relationships for both companies with the consumers they serve together.

See all of our latest coverage on banking as a service.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

How This Former Banker Thinks GenAI Will Help Banks

Among bankers the thinking about generative artificial intelligence, even among large players, ranges from cautious enthusiasm to a strong willingness to hold back until the pioneers have proven the case (and endured the regulatory gauntlet).

Ex-banker though she is, Russak-Aminoach finds it hard to contain her enthusiasm about GenAI. She acknowledges that she is not an expert on the technology by any means. But she sees GenAI as enabling the next major wave of cost-saving, the first being from the digitization of banking that enabled staffing and branch networks to be reduced.

When asked for an example, she doesn’t choose marketing or compliance but instead an essential, workaday aspect of running a bank — contracts.

She points out that in banks like Bank Leumi huge numbers of contracts must be vetted, analyzed and tracked. Applying GenAI techniques to these tasks can help cut out the errors humans can make dealing with such arcane documents. GenAI could replace hundreds of staffers, she says.

Building fintechs will change as GenAI takes on more tasks, she predicts. She notes that the software behind two of the last three fintechs Team8 has helped build was based on GenAI.

“It’s a different world. It changes the nature of the beast,” says Russak-Aminoach. “It’s much more accurate. It’s much more efficient.”

Read more: