Not so long ago pundits were vying to write the most dramatic obituaries for the fintech industry, after the funding frenzy came to a sudden halt.

But funding is starting to rebound, at least for some types of startups, according to Stuart Sopp, the founder and chief executive of Current, a fintech that caters to low-income consumers.

High growth and a realistic path to profitability are the key criteria.

Sopp counts Current in the group with those characteristics — not that it is out to raise capital immediately, but the privately held fintech does have investors it needs to keep happy.

He projects that Current will achieve profitability for the first time either in the fourth quarter of 2024 or the first quarter of 2025. And in contrast to what he’s said in the past, he sees a possibility that Current will seek a bank charter at some point. This would put it on a path shared by fintechs-turned-banks like SoFi and Varo.

Taking this step would hinge on developing a sizable and profitable lending business, which is one of Current’s priorities.

One advantage Current enjoys is its strong appeal among Gen Z consumers, says Andrew Davidson, senior vice president and chief insights officer at Mintel. “More Gen Z cardholders are coming up every day.”

Davidson also points to Mintel research in late 2022 in which 12% of consumers expressed interest in opening accounts with challenger banks, saying this suggests growth potential for fintechs like Current.

Here’s an overview of Sopp’s plan for Current to roll out more products, add customers more quickly and generate more revenue. He thinks the steps it is taking could lead to growth as strong as 1 million additional accounts within a year.

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Fintech Veteran’s Take on Funding: Frenzy, Crash and Cautious Rebound

Sopp says fundraising is starting to pick up for fintechs. “Everyone has been sitting on their hands for a good year,” he says. “Private equity investors are getting itchy and the macro risks that kept people on the sidelines and out of fintech have been abating somewhat.”

What’s emerging is a new normal, with a more rational approach in place of the former free-for-all, according to Sopp. That’s partly because growth-chasing venture capitalists who lack banking expertise — dubbed fintech “tourists” — have exited, probably for an extended period. “Everyone got funded in the bull market days,” says Sopp. “There wasn’t any differentiation, but now there will be.”

The rebound in funding is happening gradually, but Sopp thinks fintechs that are well-run, with strong business plans and high growth, will get money. “There will be fewer players and more concentrated bets,” he says.

Current, founded in 2015, is old enough that it has endured rough times before. Early on, Sopp, who used to work as a trader, had to make a case that fintechs could be viable businesses. He considers the crash in funding as just another part of the cycle.

In the first half of 2023, venture capital funding for fintech startups globally plunged 49% year over year, to $23 billion, according to S&P Global. North America saw the most activity in the period: Fintechs raised $12.4 billion from this region, a 30% drop from the first half of 2022. But more than half of that amount went to one company — Stripe — and the $50 billion valuation placed on the payment processor in the mid-March fundraising round was a dramatic discount from its peak of $95 billion in 2021.

Still, the mood is changing, Sopp insists, adding that many fintech leaders are breathing easier.

“There was genuine panic last year and at the beginning of this year in the industry. But I think that panic has subsided,” he says. “People have credible plans in place now and the market is starting to value some fintech companies.”

Current has raised a total of $404.2 million across five rounds, the most recent in 2021, according to Crunchbase. Its 20 investors include Andreessen Horowitz and Tiger Global Management.

Read more:

- Funding Squeeze Fallout: Will Neobanks Have to Scale Back Innovation?

- Fintech Slump Gives Banks a Great Shot at Closing the Talent Gap

Why Sopp Believes Fintechs Like Current Have an Advantage

As Sopp sees it, a couple of factors underpin the favorable shift for fintechs.

First, he believes the federal government’s skepticism of the fintech sector has eased somewhat. He points out that a recent report from the Federal Deposit Insurance Corp. on the risks facing banks did not mention the word “fintech” once. It’s true that banking-as-a-service arrangements face more oversight, but that is “a tightening, not a closing” of the window, he says. It means getting started will be more costly because of compliance, regulation and legal expenses.

Second, while the Biden administration has tightened many aspects of financial regulation, it has a strong interest in bringing financial services to the underserved, says Sopp. This is exactly the market segment Current caters to — “people who have traditionally been overlooked by the business model of banking.”

“There’s always this frenemy sort of business going on. We’re all competing for the same dollars, often competing for the same kinds of customers.”

— Stuart Sopp, on the fintech sector

Current has been “sifting for gold” in the sub-600 FICO credit score area, while traditional banks typically don’t delve below 620, says Sopp.

“I know from talking to some of our competitors that everyone has a similar roadmap, which is to nail down the banking side — which we’ve done — and then start to build,” he says.

He points to SoFi as a good example for fintechs to study, given its expansion beyond its original student lending business. “They have been rewarded for diversification,” he says.

Sopp adds, with a smile, that fintech players don’t share all their thinking. “There’s always this frenemy sort of business going on,” he says. “We’re all competing for the same dollars, often competing for the same kinds of customers.”

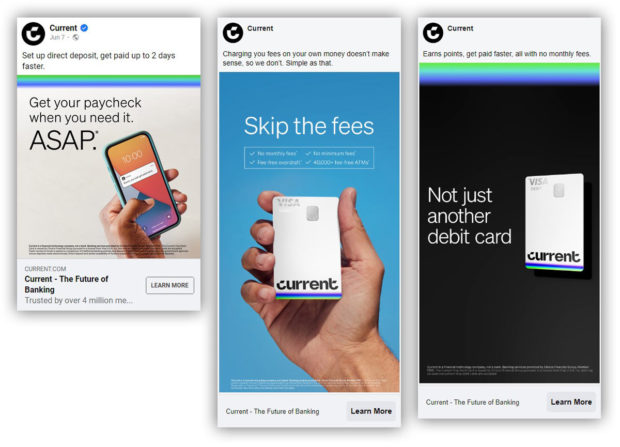

Current relies heavily on social media channels to appeal to Gen Z customers. (Ad samples courtesy of Mintel Comperemedia.)

In Current’s bid to get out of the red, it has several factors already working in its favor. Sopp says that many of its 4.5 million accounts are profitable on a standalone basis. Current also has started its own processing operation to deal directly with Visa — rather than going through an outside processor — which saves it some money.

See more coverage of fintech banking strategies.

Moving Beyond Deposits with a Secured Credit Card

Current began with a teen banking product and expanded into personal banking accounts a couple of years later. Its revenue comes chiefly from credit and debit card interchange at present.

The features that have been its selling points include early access to direct deposits, fee-free overdrafts and 4% APY on up to $6,000 in deposits (subject to certain other requirements) — all of which have become table stakes for fintechs serving consumers.

Growth Potential:

The share of consumers who say they are interested in opening accounts with nonbank digital challengers, according to Mintel research: More than 1 in 10

Now Current has embarked on a multipart expansion into consumer credit. Technically speaking, the first part of the expansion does not involve extending “credit” per se. But it’s a step towards that.

In July, Current did a soft launch of a new product, the Build card. Build is a new take on the secured credit card concept. Typically, to use a secured card the consumer has to establish a deposit account that serves as collateral for the credit line associated with the card. Build uses funds that the customer has on deposit in their Current banking account, either one they already have or a new account if they haven’t banked with the fintech before.

Balances are not carried over from month to month, making it effectively more of a charge card. The deposit balance retires the total amount charged on the card each month.

But spending on the Build card is reported as a credit card transaction, helping people to establish a credit history with a record of on-time payments. (Current reports to one of the three leading credit bureaus, TransUnion.)

Sopp says introducing this variation on a credit-building card is timely given how inflation has raised many consumers’ spending levels even for necessities. Current’s target audience doesn’t have the depth of savings that higher earners do and lacks access to credit cards that many consumers have been leaning on as prices rise.

The intent behind the Build card is to increase cardholders’ credit scores and enable them to move on to other forms of consumer credit. In addition to allowing them to access credit, the higher scores also will make credit cheaper for them.

“It’s never been more important to focus on the cost of money, and the cost of money is your credit score. Many Americans need to borrow from their future earnings to make ends meet.”

— Stuart Sopp, Current

When rates were ultra low, the cost of money wasn’t as significant a factor, but now that rates are way up, the cost of money really matters, Sopp says.

The BaaS partner that Current is working with to offer Build is Cross River Bank in Fort Lee, N.J. The fintech also works with Choice Financial Group in Fargo, N.D.

Read more:

- Upgrade Expands Credit Card, Loan Lineup for Wider ‘Mainstream’ Appeal

- Uh-Oh, Consumers Growing Comfort with Fintechs Is Costly for Banks

How Current Is Marketing Its Build Card

Current began developing Build in late 2022 and a full marketing launch started in August. The company is targeting existing customers to get them to switch their accounts to a linked Build account instead. It is also seeking fresh signups from noncustomers.

The focus is largely on conversions right now, but once more customers adopt Build, Sopp expects to see a 50/50 split in the marketing mix. (He says the level of conversions so far is “amazing,” but gave no detail.)

Current tries a variety of pitches on social channels to demonstrate how its new Build Card can help improve customers’ financial health. (Ad samples courtesy of Mintel Comperemedia.)

Secured cards have come a long way since they were introduced years ago. They were initially available from just a handful of specialized institutions and often carried a bit of a taint for both the lender and the cardholder. Now they have become more commonplace, with traditional banks and credit unions as well as fintechs offering them.

Mintel’s Davidson says Current’s new product joins a growing list of secured cards, including Chase Freedom Rise, Varo Believe and Chime Credit Builder.

Even when consumers open a credit card account, they are often doing so to improve their credit score, Davidson says. This is the case for about 41% of all consumers — and 59% of Gen Zers — who obtain a new credit card, according to research Mintel conducted in June.

Read more about fintech competitors:

- Dave Pays 4% on All Accounts in Its Pursuit of ‘Primary’ Relationships

- Green Dot Goes All-In on GO2bank Mobile App with Huge Marketing Push

Loan Products for Build Cardholders Who ‘Graduate’

In reviewing the fledgling product, NerdWallet praised some aspects of Build but criticized the lack of an “upgrade path.”

“Current doesn’t offer an unsecured card that Build cardholders can graduate to after responsible use. Instead, when cardholders are ready for an unsecured card with better benefits, they’ll have to apply for a card from another issuer,” the NerdWallet review says. This drawback applies to similar fintech credit-building products as well, it says. One of the challenges is that, in moving on to mainstream cards, the “graduates” remain inexperienced with the high interest rates that they’ll get hit with, it adds.

Asked about NerdWallet’s criticism, Sopp replies that the Build card is just the first in what will be a progression of two or more products.

“We want to be sure we’re solving the credit-building problem first, and then fast-follow it with some other forms of lending.”

— Stuart Sopp, Current

The next will be a small-dollar loan product, likely set up as a cash advance program, which would be an upgrade from the secured card. He expects this will be available in late 2023. In the third stage, Sopp plans to add unsecured personal loans, likely sometime in 2024.

“We just want to focus on doing this right,” he says. “We want to be sure we’re solving the credit-building problem first, and then fast-follow it with some other forms of lending.”

People who need to build credit face a variety of challenges, Sopp adds. Some may be new to credit. Some may have a history of deliquencies. Some may be engaged in full-on credit repair. He says Current still needs to see how much Build can improve the ratings of various consumer types.

How people improve their rating also matters, Sopp says. There are hacks that can help gain some ground, but they typically aren’t a long-term fix because the consumer hasn’t committed to a change in spending behavior.

See The Financial Brand’s Neobank Tracker: