Green Dot Corp. has long been known as a financial hybrid, combining elements of fintech with a coveted bank charter, and in the process helping many Americans get access to basic financial services directly or through its banking-as-a-service partnerships.

It is a heavyweight in payments: a BaaS provider to such major brands as Amazon, Apple and Walmart, and the company behind those big racks of reloadable prepaid cards at local merchants.

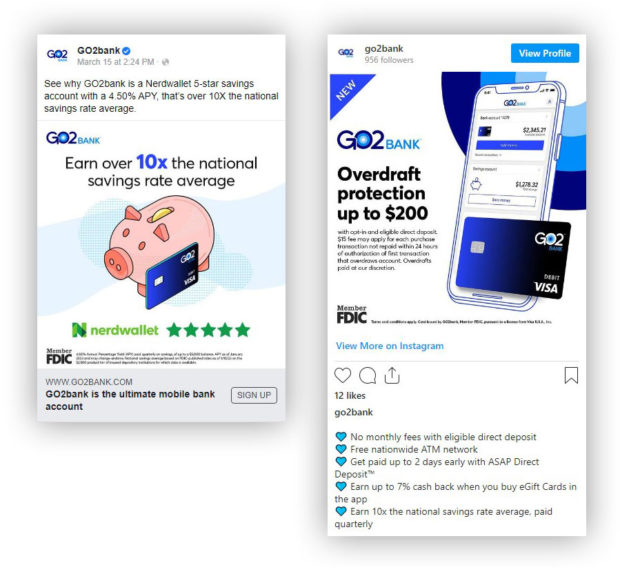

It also started offering a direct-to-consumer financial brand about two years ago: the GO2bank mobile app. GO2bank is based on a checking account with a debit card, but accountholders can also add a high-yield savings account and a secured credit card if they want.

But even as it evolves, Green Dot argues that it has been leaving money on the table, either through operational and technological inefficiencies or missed opportunities. Increasingly management has been talking about seeking ways to capture a larger share of the “total addressable market” for the businesses it’s in — an opportunity that it estimates is worth more than $200 billion.

Redefining CX Through Innovative Social Media Strategies for Financial Services

Learn how Sprinklr is redefining success in the financial sector by harnessing the potential of tailored content and personalized engagement.

Read More about Redefining CX Through Innovative Social Media Strategies for Financial Services

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

The Big-Picture Strategy from Green Dot’s CEO

“We are very focused right now on enhancing our ability to provide vertically integrated solutions to third-party partners and consumer products directly to consumers,” George Gresham, Green Dot Corp.’s president and chief executive, says while discussing its strategic plans in an interview.

Gresham stepped up to his current role in October 2022, after the departure of Dan Henry. He had been the chief financial and operating officer since October 2021 and, prior to that, served on the board.

Gresham is getting everyone in Green Dot’s pool into swim lanes to better take advantage of the potential in each of the markets that the company serves. The challenge is to tackle the company’s overall complexity, imposing more consistency on operations that grew, or were acquired, as separate silos, and working out the path to improved profitability for every ongoing operation.

Green Dot, based in Austin, Texas, earned $64.2 million in 2022, up 35% from $47.5 million the previous year.

Gresham sees plenty of opportunity to enhance those results by phasing out some offerings and growing others. Green Dot has discontinued its Account Now Visa prepaid debit card, for example, and hopes to transition those customers over to its GO2bank mobile app to obtain a new debit card.

The intent is to weed out underperforming products, freeing up resources to invest more heavily in products with greater profit potential and a larger role in the company’s overall strategy.

Not all of the products Green Dot is pulling away from will be eliminated like Account Now was. Some will stay active for existing customers, but will be in “attrition mode,” as Gresham puts it. They’ll be winding down over time as those customers leave.

Those brands will no longer receive marketing dollars, with that spending instead going to the brands that management sees as having maximum value within its overall strategy.

Read More: Are You Fighting Yesterday’s Checking Account War Instead of Today’s?

Gresham Aims to Capitalize on Green Dot’s Bank Charter

One area of heavy focus going forward is the bank charter Green Dot picked up in 2011 when it acquired a small Utah institution, Bonneville Bank. Today that institution’s charter enables Green Dot to do business under multiple banking flags, including Green Dot Bank and the direct-to-consumer GO2bank brand.

“The bank charter has not been monetized in a way that I’m sure was originally envisioned 12 years ago when the charter was acquired.”

— George Gresham, Green Dot Corp.

Green Dot was not only a pioneer in this regard but is one of only a handful of fintech companies that has a charter. The much-discussed “fintech charter” out of the Office of the Comptroller of the Currency — which was not even discussed until long after Green Dot had its charter — ultimately never happened, leaving companies like Green Dot, Varo and SoFi with a valuable advantage.

Gresham points out that most of the $3.7 billion in deposits held by Green Dot Bank is in investments. Exploring lending opportunities is just one of the steps Gresham and his team will be looking at to boost profitability, though this particular step is a longer-term idea.

Other BaaS banks that engage in lending have higher net interest margins than Green Dot Bank has, Gresham notes.

A change to the restrictions Green Dot had long operated under will facilitate the potential to get into lending. When the Federal Reserve approved the Bonneville Bank acquisition, Green Dot, which was largely concentrated in prepaid cards at that point, agreed to hold 100% of those deposits in cash or cash equivalents. In 2020, the Fed lifted this requirement.

A secured credit card, intended as a credit-builder product, is available with the GO2bank account. That will be the only credit card product that the mobile banking brand offers for now, though Gresham says that could change within five years.

The Breadth of Green Dot’s Banking Activities: Cards, Taxes and More

Green Dot’s plan to get its sprawling operations in order comes as both the banking and fintech sectors are undergoing turmoil and evolution of their own.

But rather than contracting, as many of the nonbank fintechs are, Green Dot is looking to expand — not necessarily into new niches, but deeper into the ones where it is already active. It wants a larger piece of markets that combined represent upwards of $237 billion in potential business.

The company breaks out the opportunity as follows:

• Money movement: This category, which includes cash deposits and digital money transfers, generated 9% of Green Dot’s revenue in 2022. The company estimates the total addressable market for the category at $115 billion. One of the advantages it has in trying to grow this business is its Green Dot Network, which operates more than 90,000 U.S. retail locations. These function as quasi-branches for Green Dot’s own customers as well as customers of third parties such as digital banks and digital wallet providers that have partnerships with the company.

• Banking as a service: Green Dot’s major partners include Amazon (for Amazon Flex drivers), Apple (for Apple Cash payment service) and Intuit (for Intuit Quickbooks), among others. A new BaaS partner is also in the wings, according to management. By its estimate, the total addressable market in BaaS is $75 billion. BaaS activities accounted for 36% of the bank’s overall revenue in 2022.

• Direct and Retail: Its retail operations include providing merchants with embedded banking solutions that they offer to their own customers, and this area represented 29% of revenue for the company in 2022. Direct operations such as GO2bank represented 12% of revenue. Another notable example of the latter is the Walmart MoneyCard, discussed in more detail later. Green Dot pegs the total addressable market for these activities at $41 billion.

• PayCard, which includes payroll cards, early wage access service, and Green Dot’s own “rapid! PayCard” brand, represented 6% of the company’s revenue in 2022. It estimates the total addressable market for paycards at $4 billion.

• Tax: Green Dot processes millions of tax refunds annually on behalf of online tax services providers and independent tax preparation firms. This generated 7% of the company’s revenue last year. The size of the total addressable market is $2 billion, according to the company.

Read More: Where Are Bank-Fintech Relationships Headed?

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Getting the Moving Parts to Mesh Better, With Cross-Selling as a Priority

Many fintechs grew aggressively and spent heavily on innovation when capital from investors was cheap and easily replenished, Gresham says. But with capital more scarce and more expensive, many are now under pressure.

Green Dot isn’t in that position because it’s profitable, Gresham says. Instead, the challenge has been reducing the company’s complexity.

Chris Ruppel was designated as chief revenue officer in November 2022 in large part to rationalize infrastructure across Green Dot’s business lines. His role is also to spot opportunities to cross-sell Green Dot services across its business lines.

For example, Gresham believes that the company’s paycards will be adopted by more businesses in the next couple of years, especially given widespread interest in early wage access. In addition, many companies that distribute Green Dot’s retail products are not signed up for paycard services. These types of disconnects will be remedied, per his plan.

Similarly, during an earnings call, Ruppel said he sees a growth opportunity in providing the convenience of Green Dot Network services to the consumers and small businesses that are customers of BaaS clients.

“We have a tremendous amount of cross-selling opportunities across our business lines that are not being leveraged,” says Gresham.

Green Dot’s management also hopes that integrating key business functions — rather than having them operate in their traditional silos — will foster more innovation. The thinking is that there will be more cross-pollination, while also making priorities clearer.

In addition, as part of its effort to break down silos and increase efficiency, Green Dot is in the midst of moving more of its processing to cloud computing. Gresham says this is being done on a product-by-product basis, where it makes the most sense.

Looking to GO2bank for Growth and Brand Expansion

GO2bank, introduced in early 2021, has grown sufficiently that Gresham calls it the centerpiece of Green Dot’s direct-to-consumer effort.

“We see GO2bank as a brand that can elevate over time into a much larger community, the paycheck-to-paycheck community, which encompasses over 100 million Americans,” Gresham says.

In the first quarter of 2023, the revenue produced by GO2bank was up 40% over the year-earlier quarter. Gresham says the company will continue to invest in GO2bank to support its growth, both by making digital improvements and marketing it.

“It will require continuous investment in the user interface, the product features, enhancements of credit activities, distribution alternatives and certainly direct-to-consumer marketing capital,” he says.

“We’ve told our investors that we’ll spend some $40-$50 million on marketing annually, and the vast majority of that is on GO2bank.”

Read More: Personal Financial Management Is the Next Must-Have for Mobile Banking Apps

Where Will GO2bank’s Tens of Millions in Marketing Dollars Go?

Broad brush brand marketing doesn’t appeal to Gresham.

Green Dot favors marketing that can demonstrate “a direct, measurable return on investment,” he says. “We have very specific cost of acquisition numbers and tailor that investment, using things such as direct-to-consumer mail or search engine optimization work.” He particularly likes direct mail because it can be targeted to recipients based on their demographics.

Gresham envisions a circular pattern: market GO2bank, get returns, and then plow some of those returns back into marketing to further fuel growth.

“Never expect to see Green Dot running promotions like some of our competitors, putting our name on a basketball uniform or something like that. We don’t think that’s an efficient use of our marketing dollars.”

— George Gresham, Green Dot Corp.

In other words, no “Green Dot Stadium” in the near future?

“Not in my time here, no,” Gresham replies.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

A Positive for Go2bank? Consumers Favor Lots of Banking Options Now

GO2bank’s growth should get a boost from consumers’ growing tendency to open multiple accounts, rather than have just one or two, Gresham says. “Younger people might have eight, 10 or 12 different accounts that they will use throughout their financial lives,” he says.

He believes this trend also will facilitate expansion beyond the low-to-medium income demographic that GO2bank has attracted thus far.

Fees are the chief sources of revenue from these relationships. Some of those fees seem intended to encourage users to stick with mobile deposit and withdrawal options. Cash deposits can incur a charge of as much as $4.95. A $3 fee applies to teller cash withdrawals.

Fees also apply to out-of-network ATM transactions unless the user goes to one in a surcharge-free network. Overdrafts of up to $200 are covered for a fee of $15 per occurrence. But customers have up to 24 hours to cure an overdraft before the fee is applied. Even so, in 2022 use of overdraft services increased year over year.

The marketing of what Gresham calls “legacy brands” (like the discontinued Account Now) has ceased, and those dollars have been allocated to promoting GO2bank instead. Gresham says some of those brands continue to be serviced for existing customers, “but the portfolios are in attrition mode and they’ll attrite over time.”

A Special Relationship: Walmart Is Green Dot’s #1 Sales Point

Walmart stores are the largest single distributor of Green Dot products. Sales there contributed 21% of Green Dot’s overall operating revenue in 2022. Those sales include Walmart MoneyCard, which is a prepaid card and app, along with Green Dot-branded products.Walmart also offers ONE Finance accounts in its stores, a product rolled out in 2022 after the retailer and Ribbit Capital together acquired One Finance and Even, both fintechs, through a fintech joint venture. The BaaS partner that facilitates these accounts is Coastal Community Bank in Everett, Wash. — not Green Dot.

Despite Walmart’s new ONE Finance accounts, Gresham believes the relationship with the retail giant will continue to thrive, because its shoppers are big users of Green Dot products. “There’s a very large customer base, a loyal customer base,” he says. “It’s a customer base that’s valuable to Walmart and to Green Dot.” (Walmart owns restricted shares in Green Dot, so the retailer benefits directly from its partner’s success.)

Gresham says ONE Finance is also a potential opportunity for Green Dot to expand its relationship with Walmart in the future, “because ONE needs to procure services of the type that we offer.”

Why Green Dot’s Gresham Welcomes Banking Regulators’ BaaS Guidance

In June, the Federal Reserve, the Comptroller of the Currency and the Federal Deposit Insurance Corp. issued final guidance on how banks must manage the risks of third-party relationships. The guidance is part of a larger interagency effort scrutinizing banking-as-a-service arrangements.

Gresham sees these developments as being beneficial for Green Dot, which has a longer history in BaaS than many others. In his view, the extra scrutiny will not only keep rivals in check, but also fintech partners.

“If you think about the entire value chain — from banking to processing to card management systems, distribution, risk management, customer service — it’s really quite complex,” says Gresham. “Weaving all those things together is difficult.”

He has seen some “regulatory arbitrage” develop, with BaaS providers shopping around for the most favorable regulatory option. He views the new guidance as sending a message: “The regulators are now taking this regulatory arbitrage seriously and they intend to address it vigorously.”

Gresham says the routine exams Green Dot has had since publication of the guidance suggests examiners are paying a lot of attention to the details that it covers. “I think they’ve got a mandate from the policy apparatus in their agencies to increase their focus,” he says.

The change in the regulatory temperature may be taking some time for fintechs to pick up on, though. One fintech leader was talking to Gresham recently and point blank said, “Why do you own a bank? We can do all these things without a bank, plus you don’t get the regulation.”

Gresham thinks the CEO is miscalculating. “It’s my strong view that that CEO, within a year, is going to start to feel the full brunt of regulation,” he says. “And, of course, from where we sit, that is a very positive development. We want consistent regulation across the entire value chain and we want the third parties that don’t own banks to have the exact same type of regulatory expectations that we have. So, from our perspective, this is a very positive development.”