To steal an old marketing slogan from another company, J.P. Morgan is bullish on the metaverse. They’re hardly alone. There is a veritable flood of investment money pouring into this new virtual world. But does that mean that your bank should be too?

J.P. Morgan, the investment banking arm of JPMorgan Chase, made a big splash when it opened the first bank office in the metaverse, which we’ll give you a taste of later. Less noticed was a paper released by the company’s Onyx blockchain financial operation that details the business potential of the metaverse. The paper is titled, “Opportunities in the Metaverse: How Businesses Can Explore the Metaverse and Navigate the Hype Vs. Reality.”

The February 2022 report states that many well-known companies, like Walmart, Nike, Gap, Verizon, Hulu, PwC and others are busy finding their own ways into the metaverse. The paper says managers and directors globally are asking themselves three key questions:

- What is my metaverse strategy?

- What am I supposed to be doing in the metaverse?

- What is the metaverse, anyway?

Many banks and credit unions may be tempted to answer: “Don’t have one.” “Don’t know.” “Who cares?”

Are they going to miss the boat? Or will they be just as happy letting the likes of J.P. Morgan sail first?

What is the metaverse? The J.P. Morgan report defines it as a collection of virtual worlds that enable people to “deepen and extend social interactions digitally” in “an immersive, three-dimensional layer to the web, creating more authentic and natural experiences.”

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Debating The Importance of the Metaverse

Whether financial institutions should launch themselves into the metaverse depends in large part on whether businesses and consumers go there.

“We are not here to suggest the metaverse, as we know it today, will take over all human interactions, but rather, to explore the many exciting opportunities it presents for consumers and brands alike…,” the paper states. “The metaverse will likely infiltrate every sector in some way in the coming years, with the market opportunity estimated at over $1 trillion in yearly revenues.”

J.P. Morgan’s paper is a good primer to what makes the metaverse what it is. Beyond the $1 trillion figure, the company cites persuasive numbers regarding the volume of business the metaverse could represent. For example, it cites a venture capital firm’s statistic that people spend $54 billion annually on virtual goods, nearly twice what they spend on music.

That begins to sound like real money, spent on things like custom clothing for “avatars” — metaverse visitors’ proxy figures — and on extra lives for characters in war games. As consumers and companies begin to buy up “land” in metaverse worlds with real money, and developing on it, and real-world companies begin using metaverse platforms to demonstrate and sell real-world machines and processes, this virtual, three-dimensional world begins to sound like something every banking institution will want to be in on, or at least, can’t ignore.

But hold on. Some observers say virtual reality’s potential requires a reality check.

“Despite the hype around the metaverse, few consumers surveyed by Gartner are confident that they know what it actually is. Those that are ‘meta-aware’ mostly have no opinion or are concerned about what the metaverse might evolve into. It might be time to temper our expectations.”

— Gartner report

Kyle Rees, Senior Director Analyst at Gartner clarifies that the viewpoint expressed above ” isn’t an opinion borne of personal or professional belief, but one that’s built on the perspective shared with us by consumers. Simply put, they’re just not that into the metaverse (yet).” [Emphasis added.]

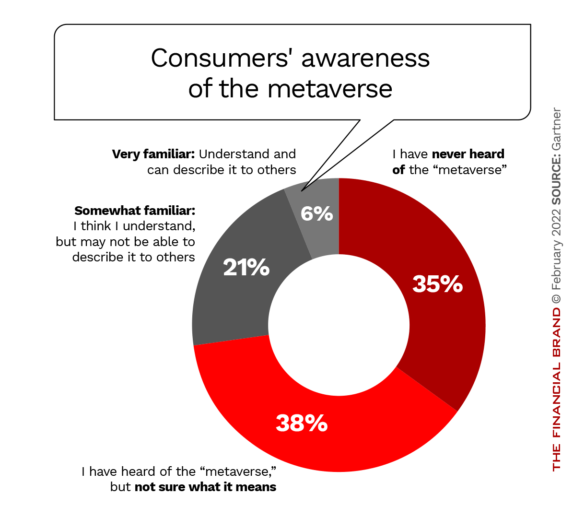

More than one in three consumers surveyed by Gartner in its metaverse report haven’t even heard of the metaverse. Three out of five consumers who know about the metaverse have no opinion of it. While 18% are excited by its possibilities, slightly more — 21% — worry about its potential impacts.

Rees also notes that consumers at the time of the survey had significant real-world worries that take precedence right now: the Ukrainian situation, economic uncertainty and the lingering pandemic.

J.P. Morgan’s Onyx Has An Unusual Vantage on the Metaverse

Onyx by J.P. Morgan, to use its full branding, was founded in late 2020 to take the company into blockchain and related products and services. While JPMorgan Chase Chairman and CEO Jamie Dimon grabbed a lot of headlines badmouthing Bitcoin, the organization sees potential in many other aspects of digital assets and related spheres.

Among the activities that Onyx is engaged in are the JPM Coin virtual currency and Blockchain Launch, which monetizes new blockchain capabilities. Onyx also offers Liink, a blockchain-based approach to payments solutions.

“Onyx is not providing traditional products and services,” writes Alenka Grealish, Lead Research on Emerging Tech, in a blog about J.P. Morgan’s metaverse moves. “Rather it is building a platform and applications that other financial institutions and corporations can use. ” She wrote that the company is working to support tech, media, telecom, gaming and ecommerce clients as they venture into the metaverse.

Metaverse Land Rush:

The average price for a parcel of virtual land doubled to $12,000 from June to December 2021, according to figures from Republic Realm.

Ron Shevlin, Chief Research Officer at Cornerstone Advisors, explains in a blog that he believes the future opportunity for banking in the metaverse will be lending. He notes that J.P. Morgan expects that virtual real estate will in time drive credit, mortgages and other services much like those used for genuine real estate.

Read More:

- Headed for the Metaverse: Banks’ Use of Virtual Reality Is on the Rise

- Will Augmented and Virtual Reality Replace the Bank Branch?

- Capital One Doubles Down on Chatbot with New Features and Marketing

A Quick Visit to the Onyx Lounge in Decentraland

Decentraland is one of the leading metaverse platforms, complete with its own currency and approximately 500,000 monthly active users at the end of 2021. (The name derives from “decentralized,” one of the applications of blockchain technology. It is run by a “DAO” — decentralized autonomous organization.)

One of the Decentraland locales — owned by Republic Realm — is called Metajuku, a virtual shopping district inspired by a real Tokyo district called Harajuku. The Onyx lounge sits across the street from a virtual clothing store, DRESSX —Your Digital Closet, in the shopping area.

The Financial Brand visited the lounge after building a temporary avatar and learning (more or less) how to make it walk around. On the ground floor, the visitor may see other visitors’ avatars, followed by their screen names, and a tiger who constantly paces around the room. Just what the beast is doing there isn’t explained.

Just another day in Decentraland’s Metajuku shopping district. Clockwise from top left: Approaching the “Onyx by J.P. Morgan Lounge”; viewing the timeline of J.P. Morgan’s blockchain innovations (mind the tiger); watching a presentation introduced by J.P. Morgan’s Christine Moy; and the main floor at the lounge, again with the tiger.

On the ground floor one can inspect a timeline of J.P. Morgan blockchain innovations. Other avatars may bump into you as fellow visitors learn the controls. A portrait of Jamie Dimon on the wall eventually changes to one of Christine Moy, Managing Director and Global Head of Liink, Crypto & the Metaverse at Onyx. She invites you to walk upstairs.

Upstairs, multiple screens display videos about Onyx services and related topics, and literature can be “picked up” from nearby conference tables. Not exactly a hangout, but an illustration of what life in the Metaverse can be like.

Quips Shevlin in his blog: “J.P. Morgan doesn’t appear to believe that its metaverse lounge will service random metaverse visitors who will, on a lark, decide to open a checking account.”

Also from Shevlin: “Banks have developed a competency in evaluating real real estate lending. Smart and entrepreneurial banks will develop the capability to evaluate virtual real estate lending, as well. Many of the same principles apply to both types of assets.”