Until now, the “What’s in you wallet?” and “Banking Reimagined” taglines, along with its cafe-style branches, were probably what most people associated with Capital One Bank. But when you’ve spent three years and millions of dollars building a natural-language chatbot that understands 2,200 different ways someone might ask for their balance, you want people to know about it … and to use it.

A high-profile ad campaign using TV spots, digital audio and other media aims to make “Eno,” Capital One’s chatbot, as memorable as its credit cards and trendy branches. The ad campaign was launched after the country’s eighth-largest bank added many new features to the chatbot’s functionality, among them sophisticated fraud and transaction alerts and free-trial subscription monitoring. (We use “chatbot” and “digital assistant” interchangeably in this article to mean software using natural language processing.)

Peter Wannemacher, Principal Analyst with Forrester Research, says that Capital One’s fraud alerts, many of them delivered via Eno, are the best in banking in the U.S.

With Eno, Capital One “has something that the vast majority of financial institutions don’t have and it works well,” the analyst states. “It would be foolish not to drive awareness of that asset.”

Where Eno Stands in the Banking Chatbot Field

Any financial institution contemplating adding a digital assistant will be up against some heavy hitters. In addition to Eno, the major platforms in North American banking include Bank of America with Erica, Royal Bank of Canada with Nomi, Ally Bank with Ally Assist, and USAA, whose digital assistant is unnamed. Of these, fast-growing Erica is considered the leader of the pack. As of December 2019, Erica had passed ten million users.

Capital One declined to disclose Eno’s user numbers, interactions or growth rates when asked, but did reveal a figure that gives some indication of the reach of its virtual assistant. The measure relates to one of Eno’s capabilities — providing users with a charitable donation summary. As described by Ken Dodelin, Capital One’s VP of Conversational AI Product Development, Eno, without being asked, reviews the transactions of Capital One’s credit card customers for the year and summarizes the ones that may be eligible for deduction at tax time.

In 2019, the bank states, Eno sent nearly five million customers an email summarizing their personal charitable donations, identifying almost $2 billion in contributions potentially eligible for tax deductions. Since Eno can be used by Capital One customers that may not be credit card customers, it’s possible that the Eno user base is somewhere north of five million.

Whatever the Eno user base is, it’s reasonable to conclude that Capital One would not invest in a national television ad campaign promoting a product that had not already proven to be a successful differentiator. “As a company, we’re really excited about the Eno brand and its possibilities,” Dodelin states. “We’ll continue to invest in that and expand its capabilities.”

Read More: BofA’s Surging Digital Assistant Signals a Turning Point in Retail Banking

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Factors That Set Eno Apart

Eno is available in Capital One’s three primary digital channels: website, mobile app, and SMS (text). The three channels enable different capabilities for Eno, which is not an app itself. If a consumer is in the bank’s mobile app and asks Eno a question, for example, the digital assistant can present things like buttons and widgets that are not available in SMS, according to Dodelin.

Eno responds to voice questions or questions entered via computer keyboard or on a mobile device. Currently Eno only responds by text, no matter the channel. Dodelin declined to comment when asked if Capital One is developing the capability for Eno to also respond by voice. Capital One created Eno initially in 2017 just for SMS interactions and then expanded it to be used with other channels.

The fact that Eno does not respond by voice (for now at least), is part of what sets the chatbot apart from Erica and some other digital assistants, according to Forrester’s Wannemacher.

“Eno is transparently a bot,” he says. “Although none of the [major banking] chatbots pretend to be a person, some, like Erica, try to replicate the experience of talking to a human.” Eno is much more of a rules-based chatbot experience, says the analyst who has studied Eno and other chatbots.

“Eno is a really good fit for the current state of the market,” Wannemacher tells The Financial Brand. If consumers want something closer to Erica in the next few years, he adds, Eno will not be sufficient. “But humans tend to adapt and evolve their behaviors and expectations more slowly than many companies realize.”

In any event, Capital One will keep developing Eno.

“The appeal of a virtual assistant is that it can take some of the cognitive load and stress out of money management,” Dodelin states. “We have seen that resonate with customers. But we believe we’re in the early days of this AI journey and we’re excited about where we can take this.” Machine learning in particular, he adds, has great potential for personalization.

Read More:

- Digital Banking Success Requires Conversational Engagement

- Banking Chatbots Need More ‘Advisor’ and Less ‘Robo’

- How Bankers Can Slice Through Chatbot Hype And Get it Right

New and Popular Features Eno Provides

The proactive transaction alerts featured in Capital One’s ads (e.g. “Did you mean to leave a 150% tip?”) are very popular with customers, Dodelin states. “Eno is working on our customers’ behalf in the background, 24/7, and reaches out when it finds something important,” he says. Another example is when Eno spots a double charge, or when a recurring charge is unusually large.

A staple of Eno right along has been features like quick access to account balances and recent transactions, and the ability to pay their Capital One credit card bill by sending Eno a text message.

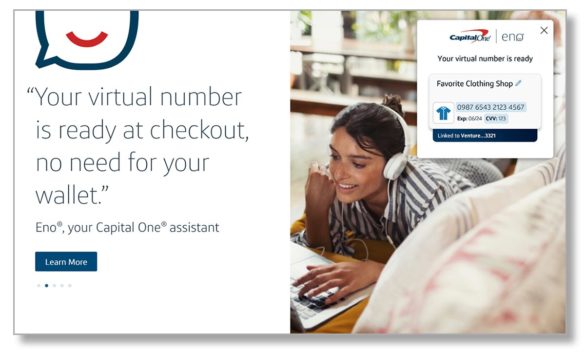

About a year after launching the chatbot, the bank gave it the ability to help customers easily create temporary virtual card numbers to use when shopping online as a way to help reduce online card fraud. By using a web browser extension, Eno detects when a user is on a merchant’s checkout page and provides a virtual card number in a popup window to use in place of their actual card.

An Eno feature that Capital One launched in the fall of 2019 addresses one of consumers’ most stressful situations: a declined card transaction. Eno instantly recognizes when that occurs, Dodelin explains, and reaches out to the customer saying “Here’s why this transaction was declined,” and offers a way to resolve it whenever possible.

The newest Eno feature, according to the bank, is a free-trial reminder. Typically when a consumer signs up for a free-trial of, say, a new streaming service, they have to enter a credit card number. When Capital One cardholders do that, Eno sends a text message saying, “Hey, I noticed you signed up for this free trial, would you like me to remind you before it expires so you can take action?” This has been very popular, Dodelin states. “People just have to tap ‘Yes’ and they don’t have to worry about remembering to cancel before ‘free’ becomes a real charge.”

Read More:

- 16 Must-Have Mobile Banking Features that Raise the CX Bar

- Digitizing Banking is All About Engagement and CX, Not ‘Tech’

- Why The Banking Industry Must Get Digital CX Right

Chatbot Challenge: Not Fumbling the Handoff

While chatbots and digital assistants like Erica, Eno, and Ally Assist by and large accomplish what people want to do, according to Forrester’s Wannemacher, the ability to smoothly and correctly hand off (or “escalate”) a customer to a human or to a different digital option remains a work in progress.

“The ability to escalate easily is absolutely crucial for today and for the foreseeable future for chatbots in banking,” Wannemacher maintains. In Forrester’s view, however, Capital One’s escalation from Eno could be better.

HelpShift, a digital customer service platform, did an extensive test of Eno, rating it highly in several areas, but not in the efficiency of support. The firm found Eno lacking in transferring a user seamlessly to an agent or to another bot for further assistance. The chatbot only links to customer support numbers, according to HelpShift’s assessment.

Ken Dodelin told The Financial Brand that “depending on the topic, Eno will direct customers to our customer service agents whenever appropriate.”

Wannemacher states that the question of how and where to escalate depends on your brand positioning. Some financial institutions only want to escalate to a human, he says, adding that live phone still earns higher satisfaction scores.