The traditional bank branch network is in a massive state of transition. Offices are shrinking or closing altogether, with digital tools being introduced to support both transactional and advisory roles. But, while more than 8,000 U.S. bank branches have closed over the past decade, and as many as 90% of transactions taking place online, the number of bank employees has remained relatively stable. According to the FDIC, there were 2,110,276 employees in 2012, and 2,043,480 last year. This stability is about to change.

The Bureau of Labor Statistics (BLS) projects that the number of tellers working at American banks will decline by as many as 40,000 through 2024 (from a current workforce of 520,000). The move to digital channels is driving this decline, as bank customers conduct many of the traditional transactions handled by a teller on a phone or their personal computer.

There are many banks and credit unions looking for alternatives for the customers still using branches. For instance, Bank of America is experimenting with hybrid banking, supplementing traditional branch offices with small unstaffed mini-branches, that offer a direct link to branch personnel via video conference. The question is whether these hybrid branches will be replaced by chatbots or at-home banking capabilities that digitize the 1:1 customer experience?

At a time when face-to-face communication can be done on a mobile phone, home computer, or television set, why should a financial institution continue to support a massive brick-and-mortar presence? Especially when Millennials and other digital banking consumers are used to not stepping foot into a branch, the ongoing transition to digital channels is a forgone conclusion.

Read More: Why Designing Digital Banking Strategies Only for Gen Z is a Big Mistake

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Branch Augmentation: Chatbots and Voice Recognition

The move to supporting simple transactions with AI-driven chatbots has already begun. The only reason chatbots don’t already dominate customer support in banking is because of the involved nature of many transactions and the infancy of the technology. To date, the use of chatbots has been limited to voice-activated search engine activities and simple transactions. This will undoubtedly change as is all learning technology … quickly.

Banking bots will soon be able to support most banking queries, with 24/7/365 access benefits afforded the consumer and significant cost savings being the driving force for the banking industry. Once the transition is complete for simple teller transactions, will the technology be used for full-function robo-advising as well?

Another significant change is the movement to voice-first technology. USAA was the first to offer limited voice banking, with Capital One enabling banking by voice, connecting via Amazon’s Alexa – embedded in devices like the Amazon Echo, Amazon Dot and newly introduced devices. Capital One customers can check balances, review transactions, make payments and more using simple voice commands.

Bank of America is also working on voice recognition technology called Erica (as in Bank of Am-ERICA), that will allow people to do virtual banking by voice with a computer, similar to how people already use Amazon Alexa or Apple’s Siri. The bank’s Merrill Edge investment service is also allowing customers to use a robo-advised platform to invest without speaking with a human.

Other financial institutions such as ING, Barclays, Santander, Wells Fargo and others are also moving quickly to support conversational banking. Barclays has introduced voice recognition software for their phone customers, eliminating the need for multiple security questions and passwords. Going a step further, Santander provides a service in their SmartBank app that allows customers to verbally ask simple questions about their transaction history, eliminating the need to search manually.

According to Temenous, “With a sophisticated, learning, voice-powered platform able to make app usage, including banking apps, more convenient and user-friendly than ever, the advantages of branch banking will continue to diminish, with stylish, tech-heavy branches unable to compete with the ease of access and scope of emerging digital channels.”

Read More: Banking’s Interest in Conversational AI Jumps

Branch Replacement: VR, AR and MR

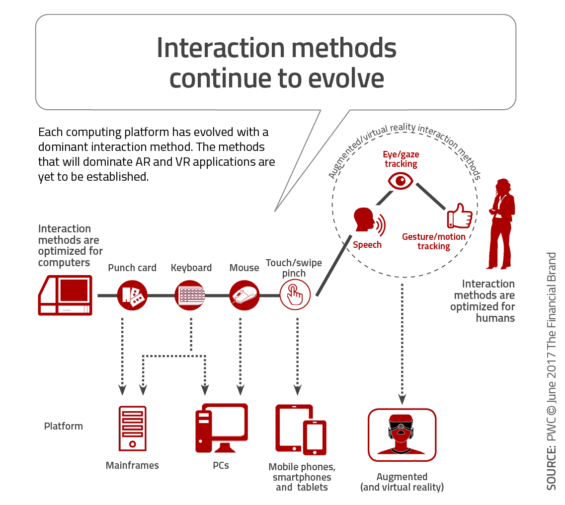

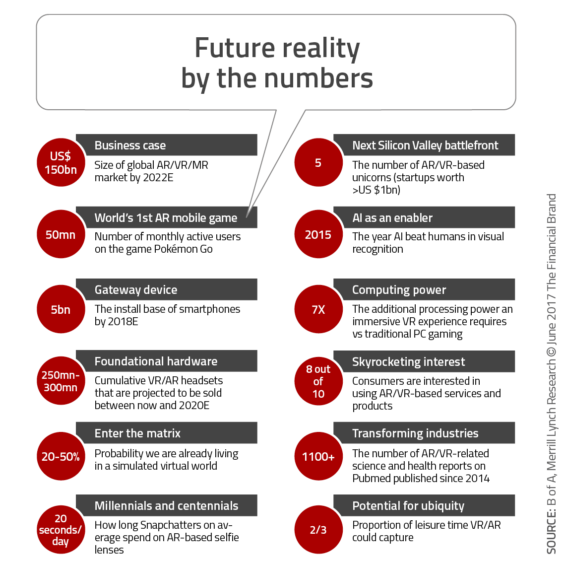

Augmented reality (AR), virtual reality (VR) and mixed reality (MR) are the foundation of a 4th wave of computing power that integrates sensors, big data, the cloud, artificial intelligence (AI), and wearables. According to a Bank of America report, “It [AR/VR/MR] has the potential to become the “form factor” for nextgen computing as a universal, smart, and intuitive interface for the internet of things (IoT) ecosystem. It could be the technology that disrupts the rules – bridging the digital and physical worlds.”

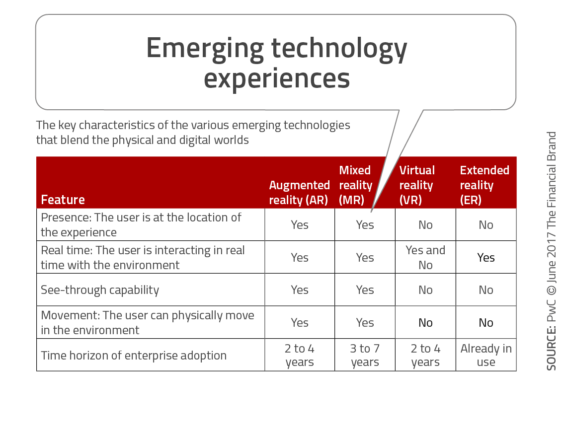

Artificial reality (in the general sense) includes all of the technologies that bridge physical and digital experiences, including augmented reality, virtual reality, mixed reality, and extended reality.

- Virtual reality (VR): An artificial environment which is experienced through sights and sounds provided by a computer, and in which a person’s actions partly decide what happens in the environment. In order to replace a user’s existing reality with a digital one, VR occludes the user’s natural surroundings.

- Augmented reality (AR): An enhanced version of reality created by the use of technology to superimpose digital information on an image of something being viewed through a device (such as a smartphone camera). AR lets you see both synthetic light and natural light bouncing off objects in the real world.

- Mixed reality (MR): A system that merges of real and virtual worlds to produce new environments and visualizations where physical and digital objects co-exist and interact in real time. Virtual objects are meant to look believable, aiming to take the best combination of VR and AR.

- Extended reality (ER or XR): A superset of all the technologies ranging from entirely real to entirely virtual. Common use cases could be the flying of drones, undersea exploration, or surgical robots.

With a desire for engaging design, simplicity of use and multichannel support, digital consumers want an alternative delivery alternative than traditional brick-and-mortar banking. Implemented correctly, AR/VR/MR can transform financial data into a visual, engaging experience and can eventually bring the face-to-face experience into a customer’s home.

With a desire for engaging design, simplicity of use and multichannel support, digital consumers want an alternative delivery alternative than traditional brick-and-mortar banking. Implemented correctly, AR/VR/MR can transform financial data into a visual, engaging experience and can eventually bring the face-to-face experience into a customer’s home.

Breaking into the public consciousness in unique ways (such as Pokémon Go), these technologies will ultimately impact every industry by transforming how we communicate, design, manufacture, and sell products. According to the Bank of America analysis, adoption will be a curved line, with an inflection point occurring around 2019-20E. This will correlate with the timing of a seamless form factor, smarter software, stronger content, longer battery life, and greater cellular capabilities.

Artificial intelligence (AI) and big data is at the foundation of artificial reality, especially augmented and mixed reality. According to the BofA research, “Branches of AI including vision, speech recognition, natural language processing (NLP), and machine learning facilitate the form factor that AR/MR is trying to become. For instance, embedding virtual objects is at the core of AR/MR, requiring identification of real world surroundings enabled for AI machine vision. Speech recognition and NLP facilitate a seamless and intuitive interface with the computing platform.”

Early Testing of AR and VR Technologies

In a rather rudimentary use of the available technologies, several banks have created AR apps to help consumers find the nearby branches and ATMs. While navigating through the city and looking at a smartphone screen, a user can see real-time information on the nearest locations, including the distance and additional details, or to book an appointment.

In the same way, banks such as Halifax and Australia’s Commonwealth Bank have used real estate data to enable potential home buyers to view detailed profiles of properties for sale as they pass them in the street. A user might find an app like this even more engaging if it provides a mortgage calculator or shows a 3D overlay of the interior in a virtual environment.

Read More: AI’s Real Impact on Banking: The Critical Importance of Human Skills

Citibank and Fidelity Investments have been testing more advanced VR technology to view and analyze data sets. With a headset on, a wealth customer can view multiple data sets all at once, zooming out to see high-level patterns and zooming in for a closer look.

According to research from Oxagile, Citibank addresses traders’ most painful experiences such as navigating through windows and tabs, prioritizing data, recognizing critical market changes, and collaborating with clients. Fidelity Investment Lab created a tool called ‘StockCity’ that applies virtual reality and data visualization to turn a portfolio into a virtual city, where each stock is a building with the height and footprint representing the price, trading volume and outstanding shares.

The Potential of Virtual Branches and Bankers

Video conferencing with bank representatives is an option used by many banks to connect with customers remotely regarding their relationship. While this is one option for creating the context of face-to-face communication, it is rudimentary compared to what is down the road. There is no doubt that video conferencing provides efficiencies, eliminating the need for key private banking or commercial officers to travel to multiple branches or to the homes/businesses of key clients.

While there is face-to-face interaction, product details are difficult to showcase, explain, and present clearly through an online camera. As mentioned by Temenos in their study, ‘The Future of the Branch‘, “It is nearly impossible for customers to show the branch representative clauses they may not understand in a physical document for example, with a home webcam or branch camera lacking the resolution and immersion to show the bank representative their papers and clauses they may not understand.”

The solution to the shortcomings of video conferencing could be in the form of virtual reality, augmented reality, mixed reality or even holograms. As technology advances, a headset or projection device could project visual holograms onto physical space, such as a home, office or any customer defined space.

In this virtual reality, a virtual bank and/or virtual banking officer could be created, with the ability to interact in much the same way as is available in a physical branch. Account openings, loan application processes or investment advisory services could all be presented with the use of digitized visuals and simulations, personalized with AI to fit the customer’s specific needs.

According to Temenos, “VR is arguably a more viable successor to the physical branch than AR, due to VR already being used regularly on smartphone devices for gaming, with customers already possessing the medium required to make use of VR banking.” A major benefit of virtual reality is that it is cost-effective means of bringing the bank to the consumer. It is also a much more efficient way of leveraging the talents of specialized banking officers, with 8-10 calls a gay possible instead of 2-3 currently.

Finally, this technology can also be extremely effective in emerging markets, where trust in banks and bankers may be lacking or where there is less ability to visit a branch. “Creating an immersive, comprehensive banking environment using a smartphone or a VR headset, could provide a service to rival that of a traditional branch, requiring less time and cost,” says Temenos.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

A Branch Technology Tipping Point

The bank branch continues to rank high with consumers as a channel of choice, especially for account openings and advisory interactions. The questions is whether the consumer desires a physical branch or the interaction a branch provides?

In a digital world, where digital banking channels are growing in popularity and becoming better designed and easier to use, we need to determine whether the consumer wants to visit a physical branch or if they simply believe they need to? And will the digital consumer accept an interaction in a virtual world as opposed to a physical world.

The advancement of digital technologies, data, advanced analytics, computing power combined with changing consumer preferences and new competition is creating a branch technology tipping point. As other industries move forward with artificial reality, the banking industry will need to determine if they will move forward as well.

This could be the biggest decision the industry makes to meet the needs of the digital consumer.