The banking industry is at the crossroads of digital transformation opportunities and the challenges of an uncertain economic reality. While the industry seems to understand what is required to compete with alternative digital banking providers and meet the needs of an increasingly demanding consumer, a hesitation to fully embrace the change needed to move forward at speed and scale remains.

In many instances, legacy culture becomes a barrier to required change needed to become digital banking organizations. In several banks and credit unions, the fear of risk or a focus on cutting costs limits the potential of digital banking transformation.

New research, 2023 Retail Banking Trends and Priorities, sponsored by Q2, found that the pandemic increased the understanding of what was needed to compete in the future. The progress made to date, however, varies widely based on the asset size of institutions, the commitment to change, and the level of resources committed to become digital financial technology organizations.

This is the tenth year for this highly anticipated report, which will be offered soon to the marketplace at no charge for the first time ever. Digital Banking Report surveyed a panel of global financial services leaders from Asia, Africa, North America, South and Central America, Europe, the Middle East and Australia for their thoughts on retail banking and credit union trends and strategic priorities. The report will include a crowdsourced panel as well as in-depth interviews from industry analysts, advisors, authors and fintech influencers who provide deeper understanding into the key trends.

DOWNLOAD TRENDS REPORT FOR FREE:

2023 Retail Banking Trends and Priorities

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

2022 in Review

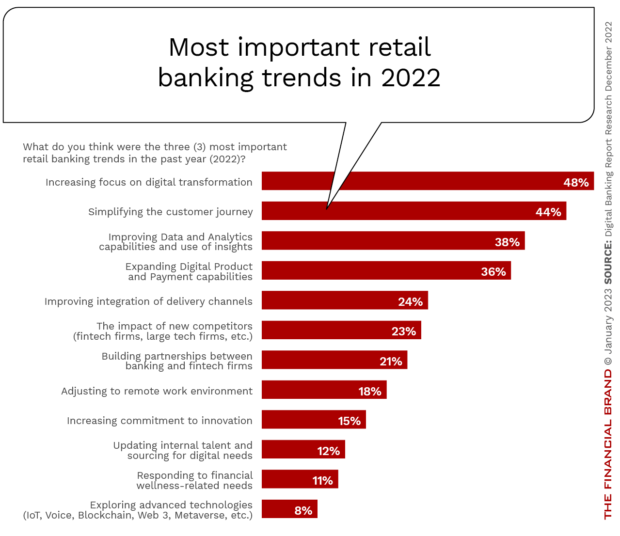

To get a foundation for 2023, Digital Banking Report asked financial institution executives to provide the top three trends they considered most important in 2022. Below are the top 10 trends for 2022 as compiled from the responses. Looking back, respondents saw four trends being of more significance than all others: Increasing focus on digital transformation (48%), simplifying the customer journey (44%), improving data and analytic capabilities (38%), and expanding digital product and payment capabilities (36%).

When compared to the top four trends, financial executives did not consider innovation (15%), upgrading talent (12%), responding to financial wellness needs (11%), or exploring advanced technologies (8%) to be trends that were significant in 2022. While we would not disagree that these four trends were not a top emphasis last year, each should increase in significance in the future for financial institutions to become more future-ready.

Read More:

- Digital Banking Transformation Trends for 2023

- Top 5 Customer Experience Trends for 2023 and Beyond

- Top Retail Banking Innovation Trends for 2023

- 5 Payment Trends to Watch in 2023

Top 12 Retail Banking Trends for 2023

DOWNLOAD TRENDS REPORT FOR FREE:

2023 Retail Banking Trends and Priorities

To determine the ranking of the top ten trends and priorities for 2023, we provided a list of trends identified by a panel of leading industry influencers and asking banks, credit unions and the supplier community globally to provide their top three choices.

The trends and priorities reflect significant changes in the level of prominence compared to previous years. Unlike previous periods, where most organizations simply modified previous strategies, the industry as a whole seems to be significantly increasing the focus on some key trends that will have lasting benefits and help organizations become increasingly future-ready. Other trends, such as removing friction from the customer journey and improving the multichannel delivery, while still important, may have less prominence due to already being addressed in the period immediately following the outbreak of Covid.

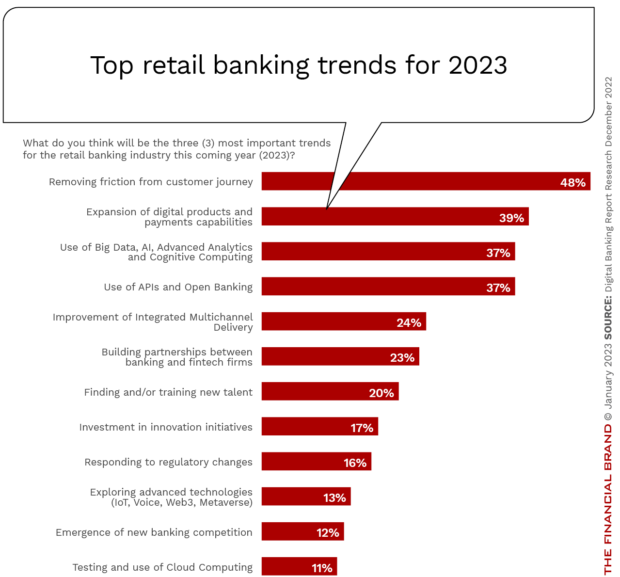

While the overarching theme for the top trends focused on digital banking transformation, the top priority for 2023 was the improvement of digital banking experiences through the elimination of friction. As mentioned, while being the most mentioned trend, removing friction during the customer journey was mentioned at a far lower rate than in our last report (48% in 2023 vs. 58% in 2021).

Other major shifts from 2021 included:

- Expansion of digital products and payments capabilities (Increase from 26% to 39% in 2023)

- Use of big data, AI and advanced analytics (Decrease from 43% to 39% in 2023)

- Improvement of integrated multichannel delivery (Decrease from 32% to 24% in 2023)

- Finding and training new talent (Increase from 12% to 20% in 2023)

- Investment in innovation initiatives (Decrease from 28% to 17% in 2023)

The low ranking of testing and use of cloud computing is most likely the result of many cloud computing solutions already being in place at many organizations.

Disruptive digital banking transformation within the banking industry will require a continued commitment to developing partnerships or expanding collaboration with third-party organizations. It will also require modernization of outdated technologies and the rethinking of legacy processes and organizational structures. The timing and speed of this transformation will differ from one organization to another, but the need for future-forward thinking is non-negotiable.

Read More:

- Back-Office Overhaul Critical to Digital Banking Transformation

- Critical Strategies to Meet Increasing Digital Banking Expectations

- 5 Digital Banking Strategies & Products Critical for Future Growth

Top 10 Strategic Priorities for 2023

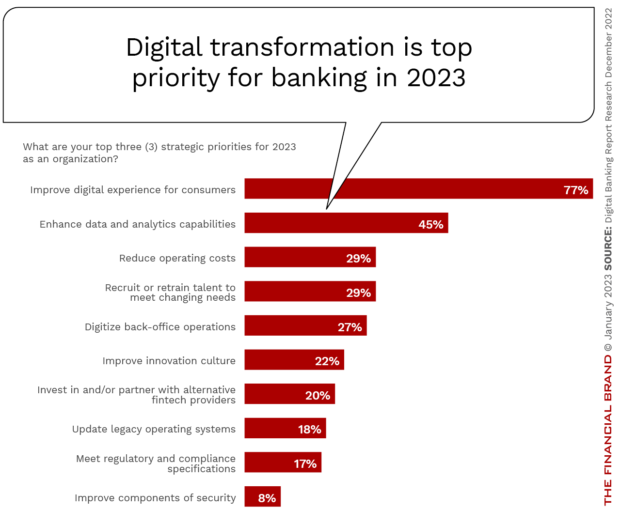

When we asked financial services organizations worldwide about their top three strategic priorities for 2023, the order of priorities remained relatively consistent from 2020 to 2023, with three significant exceptions in the level of emphasis. Interestingly, despite an uncertain economy in the near future, the number of organizations stating a strategic priority of reducing costs dropped from 38% in 2021 to 29% in 2023. This can be explained by the uncertainty during the Covid crisis.

The other two major changes in the emphasis of strategies in 2023 occurred around the recruitment and retention of talent, resulting in an increase in strategic importance from 23% in 2021 to 29% in 2023. In addition, there was a massive increase in the mentioning of partnering with third party providers, with 20% of organizations placing this strategy in their top 3 compared to only 12% in 2021.

DOWNLOAD TRENDS REPORT FOR FREE:

2023 Retail Banking Trends and Priorities

tfbpromo]

Digital Transformation Maturity Improving

The fact that most organizations are putting significant emphasis in their digital transformation efforts is beginning to generate results according to global banking executives. According to the research conducted, 41% of organizations indicated that they were in the early stages of digital transformation compared to 46% in 2020. The good news is that organizations that considered themselves in the mid-stages or say they have fully achieved their digital transformation objectives reached 49% this year, compared to 43% two years ago.

Banking Industry Challenges Continue

While it is good news that earnings continue to be positive for virtually the entire banking industry, this dynamic actually works against the sense of urgency needed as the entire financial services industry focuses on improving the customer experience amid greater competition. These earnings could be at risk because markets are more vulnerable than at any time since the economic crisis of 2008-2009.

Competition continues to be strong in areas of traditional strength for legacy banks (payments, lending, small business), with digital players making inroads despite a significant softening of venture capital being available. Bottom line, digital transformation efforts must be continued, but at a more rapid rate.

Financial institutions must continue to move from an iteration mentality to embracing disruption of legacy banking models. New partnerships and alliances should continue to increase, with an increased emphasis on the speed and scale of innovation – leveraging data, advanced analytics and contextual delivery of services. Banks and credit unions should also focus on building customer engagement around financial wellness.

As we move forward as an industry, banks and credit unions must modernize their technology infrastructure, enhance their data management strategies, upgrade their talent, and improve the customer experience.

DOWNLOAD TRENDS REPORT FOR FREE:

2023 Retail Banking Trends and Priorities