Two thirds of consumers say most companies they do business with need to improve their customer experience, according to research from Broadridge. That sobering finding should make CX improvement a top priority for executive leadership in every industry.

To support experience initiatives in banking, financial institutions need to eliminate silos and accelerate digital transformation to enable a shift in focus from customer communications to customer experiences.

Today, a great customer experience goes beyond not making errors. Consumers increasingly judge their financial institution on such qualities as ease of engagement, responsiveness, empathy and transparency. Excelling in these areas will help financial institutions acquire new customers and grow relationships. Falling short in any of these areas can result in diminished trust and loyalty or the loss of a long-tenured relationship.

To achieve great CX, bank and credit union executives must engage all levels of the organization to focus on improving experiences at every touchpoint, across the entire customer journey. Changes must begin at the operational level, rethinking existing processes while working on user experiences.

The Bar Has Been Raised:

CX changes must receive high priority in banking now. Customers are increasingly reluctant to give second chances if expectations aren’t met.

“Companies that effectively organize and manage customer experience can realize a 20% improvement in customer satisfaction, a 15% increase in sales conversion, a 30% lower cost-to-serve, and a 30% increase in employee engagement,” McKinsey finds. This is why more than 70% of senior banking executives rank CX as a top priority, according to the Digital Banking Report.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Customer Experience Expectations Rising

Customer journeys in banking have grown increasingly complex. Shopping for a new financial product, service or provider no longer begins and ends in a branch. Customers want a simplified and streamlined experience – on the channel(s) they prefer, at the time that is most convenient to them.

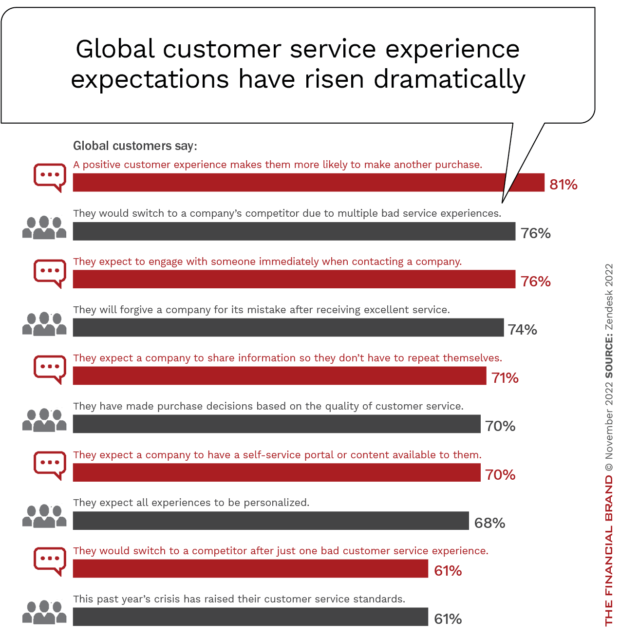

More than 80% of customers say a positive experience will drive a future purchase decision, according to Zendesk, while 61% say a single negative experience will result in immediate relationship abandonment … a 22% jump from the previous year. Two negative experiences will result in 76% customer attrition.

A customer is willing to share personal information if doing so simplifies future engagements. More than three-quarters of customers want to be able to engage with a human at the touch of a button, but 70% also want to be able to find the answers and information they’re looking for – on their own terms, the Zendesk research found. More than two-thirds of customers expect all experiences to be personalized.

Consumers expect service to be quick, easy and personalized … and they’re willing to look elsewhere if this level of services is not delivered. In fact, more than 60% of consumers say they have higher customer service standards since the pandemic.

Read More:

- 7 Proven Ways to Deliver Exceptional Customer Experiences in Banking

- Mobile Banking Apps Need Personalized Experiences to Hold Consumers

- Better Banking Experiences Require Real-Time Data Insights

Bank Customer Experience Implementation Lagging

While banking executives consistently rank improving customer experiences at the top of priorities, few have invested and/or implemented the changes needed to deliver exceptional experiences. More than three quarters of banking leaders say that their organization views customer experience as a critical business priority, but fewer than half consider their organizations to have a high level of CX maturity. Furthermore, investment in customer experience initiatives continue to rank in the bottom third of priorities, according to the Digital Banking Report.

Heart of the Problem:

Many institutions still view customer service as a cost center rather than what it should be: a revenue-generating engine.

Without a financial and organizational commitment to improved customer experiences, financial institutions risk missing opportunities to differentiate their organizations in an increasingly competitive environment. Focusing on customer service opportunities requires a strongly communicated commitment from top to bottom.

Five broad trends will shape customer experience in banking in the year ahead.

Trend 1: Humanized Digital Experiences

In 2023, financial institutions will focus more on partnering with the customer around their financial objectives and life journeys as opposed to simply transactions and product sales. There will be a shift from an internally-centered efficiency strategy to a more customer-centered engagement strategy, creating positive change in the financial lives of their customers.

“Although focusing on making shopping online faster or simpler for customers is important, brands must also take an experiential approach by building new ways to interact with customers on a human level,” states MIT Sloan Management Review. “It’s this focus — digital humanization — that separates truly revolutionary brands from those just trying to get by.”

Beyond traditional self-service solutions, augmented reality (AR) will become a bigger component of humanizing self-service options as consumers seek more immersive ways to interact with their financial institutions. Through well-designed digital experiences, financial institutions can replicate the sense of exploration and discovery that consumers have at traditional brick-and-mortar branches while also providing personal virtual assistance. The goal will be to maximize digital engagement while becoming more human at the same time.

Trend 2: Omnichannel Experience

Omnichannel experience strategies prioritize customer engagement by providing a seamless experience, whether customers visit a physical branch or engage with a bank or credit union on any digital channel. According to Segment research, 69% of customers want a consistent experience with a company across all physical and digital channels. Unfortunately, few companies are delivering on this desire. Modern omnichannel strategies in banking include multiple contact channels, such as app-based platforms, in-branch transactions, and social media marketplaces.

Applying measurable customer data throughout the omnichannel delivery strategy gives financial institutions a comprehensive view of customer behavior, driving seamless engagement and customer loyalty. Sharing the insights across the organization, allows all customer contact points to engage from the same perspective.

38% of customers expect service agents to know who they are and their queries, according to research from Forrester. Consumers want matters to be dealt with quickly, but you can never be sure they’ll contact support through the same channels. Financial institutions must ensure all contact employees can access the correct data at all times. This means they can produce customer account and query information no matter the platform the request comes from.

Trend 3: Enhanced Personalization

In 2023, banks and credit unions will increasingly harness customer data to deliver a higher level of personalization at every touchpoint. This will include targeted product recommendations via chat support, predicting consumer needs based on behaviors, and delivering content that can improve a customer’s financial wellness.

With 80% of consumers more likely to purchase from a company that provides a personalized experience, personalization is no longer optional. Brands will also begin to use technologies that enable customers to build hyper-personalized solutions online, without the traditional product parameters. The flow of funds between products will be seamless, with integration within and outside the primary financial institution.

“Companies don’t achieve the impact of personalization without changing their internal operating model to be agile, focused on key customer KPIs, cross-functional, and driven by rapid decision making.”

The key dynamic with personalization is that the collection of insight and the development of “living profiles” (very detailed customer profiles) is considered valuable by the customer … if they are used to provide a more personalized experience. In other words, a direct value exchange. Financial institutions can collect data from every step of the customer journey — including web chat, calls, emails, social media or apps — and integrate these data points into future learnings.

Read More: Digital Banking Transformation Requires Speed and Scalability

Trend 4: Increased Support of Self-Service

69% of customers want to resolve as many issues as possible on their own, through self service methods as opposed to speaking with a customer service representative, according to Zendesk. By offering them ways to solve their problems, banks and credit unions may make their consumers’ interactions easier and improve the overall experience.

On top of more traditional self-service solutions, augmented reality (AR) can become a bigger component of self-service options as consumers seek more immersive ways to interact with brands and their products. Microsoft research indicates that more than 90% of customers expect firms to provide self-service choices, ranging from a knowledge base, product FAQs, tutorials, AI-powered chat and messaging, and automated contact centers.

Advancements in natural language processing and conversational intelligence have made chatbots more effective than ever, and automation can help customers find the right information without ever having to speak with a human. As a result, financial institutions will get even closer to providing an effective human experience without involving a human.

Trend 5: Emergence of the ‘Total Experience’

Many believe that factors beyond just CX contribute to the success of a company and its relationship with its customers. For example, employee experience and employee engagement are believed to have a direct impact on how satisfied customers will be.

Gartner suggests that organizations in all industries embrace an integrated total experience (TX) perspective that brings together the four disciplines of experience: the multi experience (MX), customer experience (CX), employee experience (EX) and user experience (UX). Gartner says that by 2024, organizations providing a total experience will outperform competitors by 25% in satisfaction metrics for both CX and EX.

“Many organizations have successfully transitioned from being project-focused to product-focused. However, to be competitive today, they must transition yet again to become experience focused.”

— Gartner

In the future, more banks and credit unions will invest in technologies to support and engage employees. This especially likely as more organizations allow hybrid and remote work.

Despite a significant economic downturn, many companies have decided to invest in customer experience tools and as a result are predicting an increase in their budgets. According to Acquia’s, 2022 Customer Experience Trends report, 62% of companies surveyed predict their budgets will increase by 10%.

Overall, everyone surveyed expects their budgets to increase by an average of 7.6% in the next year. While not significant, this trend counters many other areas within organizations.