The positive impact of a good customer experience is undisputed. In fact, companies that invest in improving customer experiences outperform those who don’t across multiple metrics. The challenge is that the expectations of consumers have increased exponentially in the past several years. Beyond simply avoiding errors and enabling fast and easy transactions, consumers expect their bank to use data and insights to help them save time and money and improve their financial wellbeing.

According to research from Salesforce, financial institutions are not meeting these increased expectations. As the demand for digital engagement continues to increase, most banks and credit unions are missing opportunities to build deeper relationships because of slow deployment of automation and modern technology, and the lack of leveraging customer insights to partner with customers for a better financial future.

Bottom line, customers want financial services that are easy, transparent, intuitive, and empathic to their personalized needs … across the entire customer journey. Missing this opportunity will negatively impact customer interactions and will open the door to alternative financial providers.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Ease and Transparency Are Digital Banking Table Stakes

In a world where consumers can purchase a car on their mobile device, engage in a video call instantly, and plan an entire vacation on a single platform, ease and transparency are foundational expectations for banking customers. The easier and more transparent the engagement, the greater likelihood of trial and adoption.

Unfortunately, many financial institutions lose potential customers to competition because of the time and effort required to open a new checking account or apply for a new loan. Most fintech and big tech firms have mastered this early stage engagement by simplifying these processes, reducing the time to complete them to less than three minutes (as opposed to the average of 15+ minutes at traditional financial institutions).

In the Salesforce research, 47% of respondents said easy and fast setup, verification, onboarding, and first-time use of the app were pushing them to try out alternative providers. Similarly, 41% cited an easy and intuitive user interface and navigation as reasons to test out non-traditional financial apps. More than one in three respondents said they switched banking providers because of ‘hidden fees and fine print’.

Read More:

- Top Five Customer Experience Trends in Banking for 2022

- 7 Proven Ways to Deliver Exceptional Customer Experiences in Banking

- Why Most Banks Struggle to Deliver a Killer Customer Experience

Customers Expect Banks to Anticipate Needs

When a consumer watches a show on Netflix, Hulu, or other streaming alternatives, the platform anticipates what the viewer will enjoy next – without asking the viewer. When a driver uses a GPS program, they expect it to inform them about congestion down the road and to determine the fastest way to reach their destination.

Similarly, customers expect their financial institutions to go beyond fulfilling requests to anticipating and delivering what they will want or need next to reach their financial destination. This is increasingly being done with predictive personalization based on unique insights from both primary and secondary data.

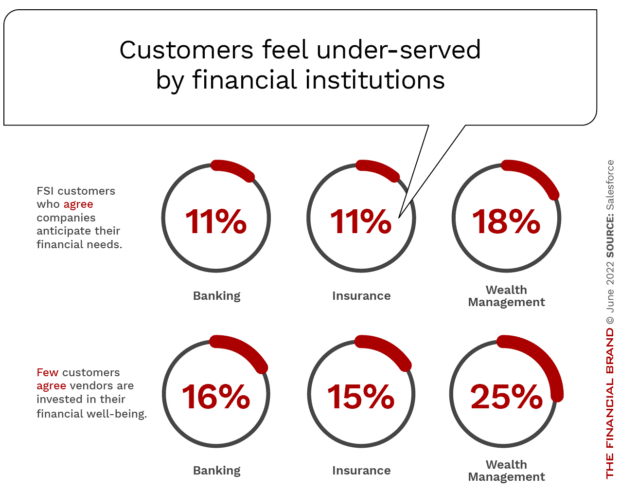

The Salesforce research found that only 16% of banking customers strongly agreed that their financial institution was looking out for their financial wellbeing. In addition, only 11% of banking customers thought their financial institution anticipates their financial needs.

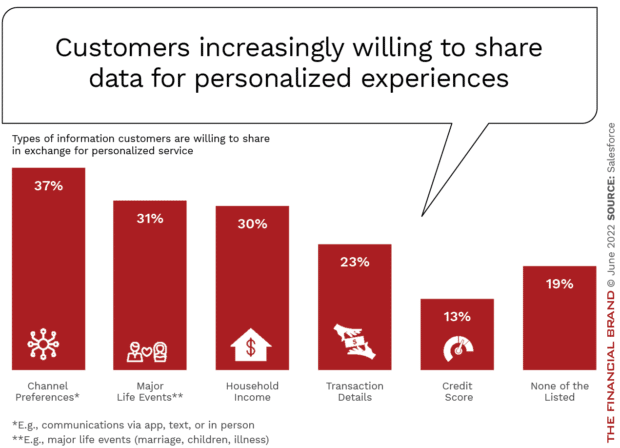

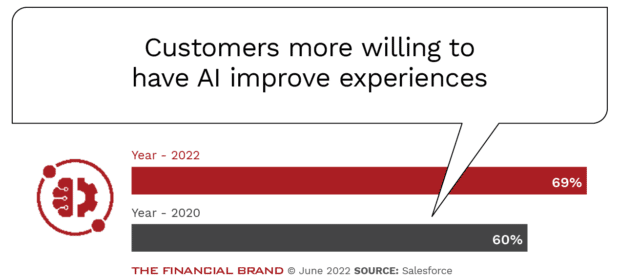

To be able to anticipate customer needs, financial institutions must use data more effectively to personalize experiences. In fact, three of the top five pain points in digital banking experiences related to poor personalization, according to Salesforce. To this end, consumers are willing to share data for personalized experiences and have AI used to improve experiences, but still want transparency as to how this is being done.

Automation and Modern Technology Required

More than ever, automation and the use of modern technology will differentiate the winners from the also rans. Automation and modern technologies can improve both the speed and accuracy of back-office processes and transactions as well as provide the easy and transparent digital experiences that customers want. The focus should be on the customer experience (as opposed to simply cost-reduction efficiencies) and should be approached from an incremental basis.

“End-to-end automation is too complicated, expensive and uncertain. Automation that is selectively applied to certain problematic spots is where you get immediate ROI.”

— Salesforce

With automation, financial institutions also can benefits from the ability to create reports that can drive data-driven decisions to avoid inefficiencies in the customer experience.

The Power of Partnerships

The cross-generational shift to digital has reset expectations around the type and depth of engagement that financial institutions must provide to customers. This highlights the importance of collecting the right data, at the right moments, to gain insights into customers across the entire customer journey. The move to digital also has greatly increased the amount and type of data available to address these enhanced expectations and the ability to deliver services more efficiently.

Organizations must be able to pinpoint when a customer is satisfied or disappointed, when they move part of their relationship to an alternative provider, and when a customer has challenges with a process they want to perform. This requires tracking of all types of interactions, including logins, website engagement, human and chatbot sessions, content views, and competitive engagements. This goes beyond the transactional and relationship tracking that is the foundational component of personalized engagement.

To achieve this level of data collection, analysis, and engagement enhancement at speed and scale requires partnerships with third-party solution providers. These outside partners can assist with the organization of data, the democratization of insights across an organization, the building of an effective customer engagement process, and leveraging previous partner engagements for generating ROI faster than if an organization was to ‘go it alone’.

Likewise, creating contextual engagements and continuously fine-tuning the priorities and processes usually requires partnering with specialized third-party providers. This is especially required during a time of economic uncertainty, when the allocation of resources must be focused on opportunities with the greatest chances of success.