Electronic signature (e-signature) sounds like a simple-enough proposition: Provide people a tool to sign digitally, kiss wet signatures goodbye, and say hello to banking with anyone and anywhere. It’s a great vision, so why are banks and credit unions still developing their use of a technology brought to market just after the turn of the century?

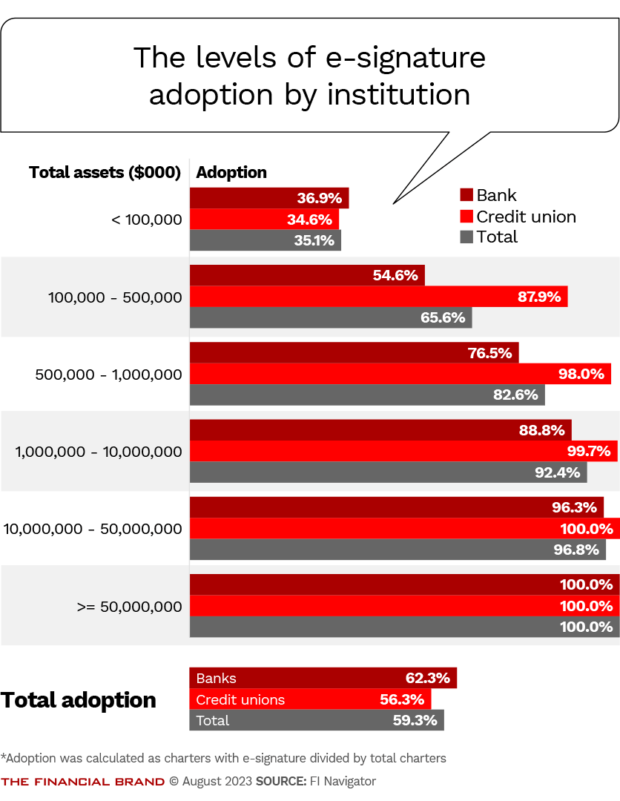

When you look at the industry as a whole – across asset size and charter type – less than 60% have any technology for remote signing, according to data provided The Financial Brand by FI Navigator. While larger banks have a higher likelihood to own signing software, for an innovation from the days of compact disks that’s pretty low adoption.

Signature protects institutions from a host of risks: relationship, compliance, legal, and credit-related. They are the backbone of banking without which institutions cannot originate products, nor can consumers or businesses use them. They are the period required for a complete banking sentence. They are the final stop, aside from funding the loan, on the road to asset growth.

It begs the question: Can the industry be too risk averse about a legally-binding step that protects them from so much risk?

Some of the problem lies in the fact that they can buy the technology, but it may not be built to work well in banking. If it’s not adopted by staff and account holders to close loans, open new accounts, or a provide a great servicing experience, then the investment isn’t worth it. Using that measuring stick, the industry likely has less than 60% adoption if the metric were adoption by staff and account holders.

In that case, those who bank with about half the industry still see signature processes that crawl at the speed of pen and paper.

- How Digital CX Technology Gives Local Banks an Edge

- A Banker’s Guide to Digital and AI Transformation Success

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

A Case Study for Successful E-Signatures: Fine Tuning All the Little Things

Before 2000, the year Congress implemented the ESIGN Act, the physical signature was banking’s bottleneck. Once the act was passed, financial institutions could use knowledge-based authentication and a one-time password to validate signers and gather signatures. Only a few industries, like pharmaceuticals and healthcare, now use the more-secure “digital signature” which requires a physical key to authenticate a signer.

It was a great step in the right direction for the banking industry. Since then, however, nothing has changed more than how we interact with the written word.

Simply buying an e-sign software (adding the extra cost of technology) leaves that bottleneck intact.

On the other hand, the tech investment if executed correctly has a sizable payoff. Banks report the benefits of adopting e-signatures show up in annual interest income, loan quality, the efficiency ratio, and even new product offerings.

The case studies for the best e-signature banking strategies are those using it with account holders who hail from all over the world, such as AMOCO Federal Credit Union. Based in Houston, the credit union has a membership of 103,000, who work in the oil and energy industry and often relocate globally.

“Our members work and live in Europe or Asia, you name it,” Nathan Ashworth, who led AMOCO Federal Credit Union’s launch of e-signature in 2009, tells The Financial Brand. “We needed to make it easier for them to complete loan or maintenance documents, or to open membership remotely. It’s great if you have the technology to start the process, but if you have to mail the documentation in the end, it negates the whole experience.”

“Why don’t you just send it over on a dinosaur?”

— Michael Scott, Dunder Mifflin

Even small breaks in the experience are big problems for remote signature, Ashworth says. “A really important piece of the puzzle is a device agnostic experience.” The first remote signature company they worked with had little to no congruity between different kinds of devices. “It’s just too difficult to service the variants of devices when you’re not sitting there with a member. That does not meet the consumer expectation.”

Device idiosyncrasies completely derail adoption, Ashworth says. “If members try to open up the documents and struggle to sign them, they will give up,” he says. “The consumer expectation is set by Amazon. Once they kick the process off, people expect us to capture all authorizations from them in that one fell swoop in a way that’s really easy to digest and execute.”

Staff are the same way, Michael Ball, EVP of direct sales at Kinective (a purpose-built e-signature provider for banking), tells The Financial Brand. “When employees hit an unknown, and it’s not easy to figure out, they just don’t use it,” he said.

Food for Thought:

Make new technology simple, and easy to use. Otherwise, it'll be a wasted investment.

These friction points can be as simple as an employee adding multiple signors to a loan document. If they don’t understand the digital process, they’ll resort to the old methods, Ball explains. “Now you’ve invested in a platform for a banking experience upgrade that’s not used at all.”

Given today’s rate environment, financial institutions are now upgrading to e-signature for account opening, just as much as lending, Ball says. “They want to make onboarding quick and easy for a new customer. It creates a great first impression about the financial institution.”

E-Signatures Add 24-Hour Turnaround to Loan Products

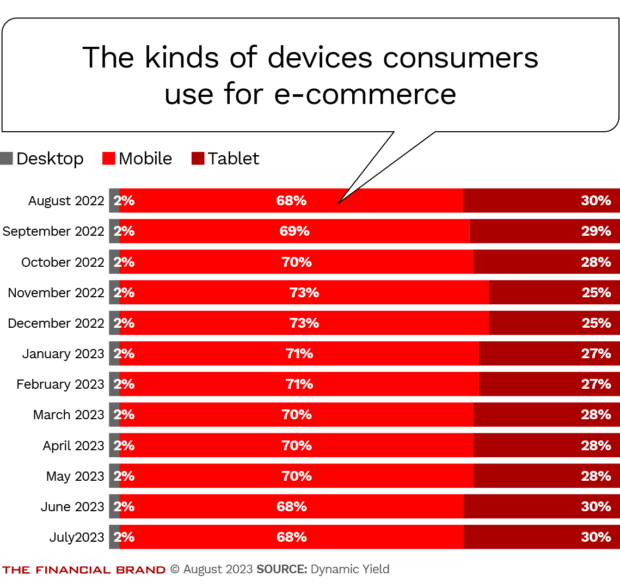

Overcoming idiosyncrasies on devices — especially mobile devices — has never been more critical. According to data aggregated by Dynamic Yield, mobile commands about 70% of ecommerce traffic, and has since August 2022. Desktop isn’t a close second at 29%.

Shoppers search online offerings by smart phone, often at night, perhaps after work, or even later after their kids go to bed. Branches aren’t open. Retailers that accept credit card for most purchases used to be unique in enabling online shopping anywhere and anytime, all the way to the transaction, regardless of device.

Now, ecommerce has stretched into mortgage, account opening, and auto loans.

Take car loans for example. Waiting at the end of shoppers’ multi-step process (which includes vehicle research, financial information gathering, and online checkout) is signing the loan documents. If their bank or credit union’s application portal has any friction, the consumer will follow the path of least resistance to another institution to access the funds they need.

With services like Carvana.com, where an AMOCO member can buy a vehicle online, e-signature as well as other AMOCO experience upgrades serves digital car shoppers quickly when they need an auto loan.

“If you’re applying at 2 a.m. and have a question, we provide that for you,” Ashworth says. “We absolutely make that commitment to a 24-hour turnaround when it comes to a response to an application for certain loans.”

In 2013, AMOCO switched to Kinective eSignature. Since then, Ashworth says certain AMOCO loans have accelerated nearer to the speed of ecommerce. “We’ve come a long way in that regard,” he says. “Loan and account origination turnaround has been cut down to 30% or 20% of what it used to be.”

Learn more:

- 6 Steps Before Adding E-Signatures to Your Lending Process

- Transforming Digital Customer Acquisition in Banks [Webinar]

Making A Good Impression on Consumers

In account servicing, adding a spouse or child to an account, removing someone from an account, changes of name or address, a new deposits certificate, debit card certificates, and stop payment requests, are all activities that require signature, says Eric Soya from Grand Rapids, Mich.-based United Bank.

“I worked in our client service center for several years where I was on the phone with someone who needed a change requiring signature,” Soya, who is the vice president of branch operations at United, tells The Financial Brand. “I had to email them a form, and they would need to print, sign it, scan it, and email it back, or it was print-sign-mail-back, or I even had to mail the form to them.”

“If you’re applying at 2 a.m. and have a question, we provide that for you. We absolutely make that commitment to a 24-hour turnaround when it comes to a response to an application for certain loans.”

— Nathan Ashworth, AMOCO

When United Bank implemented an e-signature tool, the experience didn’t change for customers, Soya says.

“The provider wanted to serve all e-sign needs for all types of companies, they didn’t have the industry knowledge to help us,” he says. “We met with IMM (now Kinective) because it was a provider focused specifically on financial services.”

Soya’s team left the first provider after three years because the platform could not perform essential (and promised) functions to e-signature, such as connecting to Fiserv. “It was a tool we knew was there but staff could not use it for anything,” he adds.

Moving More Interest Income into 2023

Closing loans in 70% less time is a big deal. “The first day of loan interest is the best day after all,” Ball says. “It’s about getting to revenue faster.”

Commercial loan officers also quickly pick up on the effects for their commission, Ball says. “They want to get that loan on the books quickly. And that incentives adoption, even for commercial, multimillion-dollar deals.” He adds that his customers generally get 80% of their documents signed within 24 hours, and the vast majority of those done within 24 hours are within 4 hours.

“The first day of loan interest is the best day after all. It’s about getting to revenue faster.”

— Michael Ball

Moving quickly can cause more mistakes. The need for speed at AMOCO, though, meant developing a consistent internal workflow to accelerate, but also to control, the path of documents on all their necessary stops through several departments. “Before you can ever finalize a loan with us, everything’s got to be right,” Ashworth says. “The quality assurance piece is automated at this point.”

Automation, too, has become a regular part of the e-signature process, Ball says. “We see it become a quality control guard rail,” he says, noting institutions still obtain a wet signature on promissory notes, especially for commercial loans. “Once institutions are through our implementation, the platform helps guard against human error because it knows where all the signatures need to be, and on which documents. Traditionally for loans originated with pen and paper, if a key signature is missed, and no one sees it in loan audit, it’s not a positive situation.”

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Amplified Importance of E-Signatures

Some of United’s largest depositors have added FDIC coverage to their uninsured deposits through IntraFi, a service that boomed in relevancy earlier this year. “They’ve got all their regular accounts with us. But it’s a whole other set of paperwork for IntraFi,” Soya says. “Collecting their signatures electronically is much more than window dressing, it was important to them to sign up easily and quickly.”

When leaders think of e-signature, it fits intuitively into strategic initiatives to extend branch foot prints, but Soya notes the value, even for business down the block. “Even if you’re two blocks away, it’s still a nuisance to need to go in,” he says. “You can be a mile from the branch, but if you work third shift, it’s hard for you. It’s about better service; offering the customers the ability to decide when and where they want to sign.”