When it comes to digital transformation, executives at many banks and credit unions understand what needs to be done, but far fewer understand how to get it done.

That’s not just a challenge for banking. Across all industries, 87% of firms have pursued some form of digital transformation in the past two years, but have captured only 31% of the revenue lift they expected, according to a global survey of senior leaders by the consulting firm McKinsey & Company. Furthermore, they realized just 25% of expected cost savings.

However, there are success stories in the marketplace that financial institutions of all sizes can learn from. One of these is DBS, a bank based in Singapore that we’ll discuss in more detail below.

There is even a playbook for improving digital transformation results. In the new book, “Rewired: The McKinsey Guide to Outcompeting in the Age of Digital and AI,” the authors found that long-term success comes when leaders are willing to embrace changes related to talent, their operating model, technology and data capabilities.

Definition of Digital and AI Transformation:

The process of developing organizational and technology-based capabilities that allow a company to continuously improve the customer experience, lower its unit costs and sustain a competitive advantage.

McKinsey looked at what the top performers in its global survey were doing differently than the rest. It found that senior leaders at these companies, when asked how they would differentiate their business strategies from competitors’ over the next two years, often cited a focus on customer engagement and innovation strategies. They were less likely than peers to focus on operational efficiency.

Eric Lamarre, senior partner, McKinsey

In addition, the majority of top performers said tech would be a key differentiator for their companies.

Two of the common mistakes that impede successful transformation are not investing enough in core capabilities and not focusing the effort on a specific journey, according to Eric Lamarre, a senior partner at McKinsey, one of the authors of “Rewired” and a guest on the Banking Transformed podcast.

Listen to the podcast with Eric Lamarre here.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Six Capabilities Needed to Create Digital Banking Differentiation

Leadership alignment is crucial for digital and artificial intelligence transformation. Financial institutions should have a clear vision and strategy informed by business objectives.

The authors of “Rewired” contend that no digital and AI transformation can be successful unless the following six capabilities are mastered.

- Creating a Transformation Roadmap. As a foundation, organizations must reimagine the existing business model with technology. As part of this process, there must be a clear consensus of the impact expected and the new capabilities needed to deliver results. Organizations must avoid efforts that are too small to deliver meaningful results. Likewise they must avoid making plans that are too large to deliver in an appropriate timeframe. The key here is focus and commitment.

- Having Access to Talent. To succeed, organizations must develop technologists and inspire existing employees to embrace the new digital agenda. This means more than just hiring the right people. Collaborations with firms that can deliver digital solutions at speed and scale can be worthwhile.

- Adopting a New Operating Model. Creating a digital organization should start in the back office, with a focus on improving the speed, agility and flexibility expected by customers. This is the most difficult component of digital transformation because it requires an upheaval of every area of the organization and how teams work together. “Agile teams – or pods – are the most effective way to develop a new operating model,” says McKinsey.

- Building a Distributed Technology Environment. Modern technology should make it easy for the entire organization to access data, applications and tools to innovate and deliver solutions at speed. The cloud, APIs, composable solutions and AI empower the entire organization to innovate digitally.

- Embedding Data Everywhere. Data and insights are the most powerful tools for competitive advantage. As such, they can no longer be siloed within legacy IT systems. They must be curated, available and consumable across the entire organization.

- Unlocking Adoption and Scaling. Just because digital transformation is taking place does not mean it will be adopted (at scale) within the organization or by customers. Too often technology is purchased or built without the work needed to ensure the solution will deliver the value anticipated. To achieve this, employees need to buy into the underlying business model, and the design must allow for replication and reuse. Ongoing measurement of results will be required as well. What gets measured is, ultimately, what will matter to employees.

See all of our latest coverage on the topic of digital transformation.

Getting a Competitive Advantage from Digital Transformation

Digital and artificial intelligence technologies enable financial institutions to optimize and automate various processes, leading to increased operational efficiency. Automation eliminates manual tasks, reduces human errors, and speeds up processes, resulting in enhanced productivity. AI-powered algorithms can also analyze vast amounts of data in real time, providing valuable insights and enabling data-driven decision-making.

“Digital and AI is not a strategy. Digital and AI enable a strategy, augment a strategy, make a strategy better, but that initial strategic direction is actually quite important.”

— Eric Lamarre, McKinsey

With the proliferation of digital platforms, banks and credit unions can reach their target audience more effectively and provide personalized experiences and deeper engagement. AI-driven chatbots and virtual assistants enable around-the-clock customer support.

Digital and AI capabilities also empower financial institutions to adapt to changing market dynamics swiftly. The vast amounts of data generated and collected through digital banking channels can be analyzed to uncover valuable insights and identify emerging trends, allowing for rapid product innovations and responses to consumers’ evolving preferences.

Want to go deep on AI best practices for banks?

Attend our AI Masterclass — Unlocking the Power of Artificial Intelligence in Banking — at The Financial Brand Forum 2024 on May 20-22 in Las Vegas. Led by Ron Shevlin, chief research officer at Cornerstone, this three-hour workshop will be jam-packed with lessons learned from industry leaders and real-world case studies.

For more information and to register, check out the Forum website.

McKinsey found the top-performing companies in its survey on digital transformation efforts generated the best results across a myriad of metrics. For instance, 70% of top performers used advanced analytics to develop proprietary insights, with 50% using AI to automate and improve decision-making.

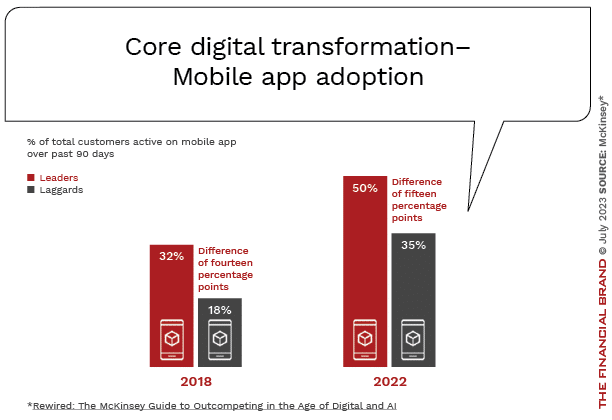

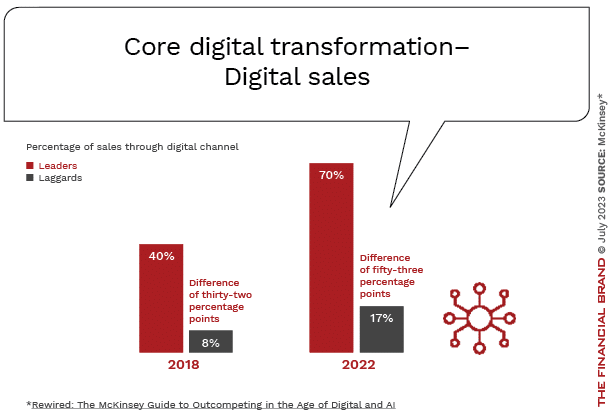

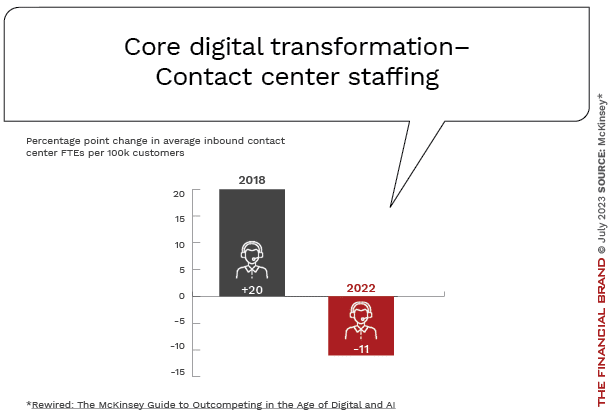

The firm found the gap between digital transformation leaders and laggards was significant, in research covering 2018-2022. McKinsey used 80 global financial institutions in developed markets as the data set. The analysis determined that digital leaders outperformed laggards in return on tangible equity (ROTE), price-to-earnings ratios and return to shareholders. As shown in the charts below, while there were positive business results for all financial institutions during the test period, digital transformation leaders generated significantly better results.

Part of the success of digital banking transformation leaders was their early response to digital and technology trends. These financial institutions committed to digital and AI functionality years before most laggards. More importantly, the commitment came from the top. Leaders were bolder in reimagining new digital operating models and included employees across the organization in the process.

Read more:

- Digital Transformation Success Demands CFO’s Evolution

- Digital Leaders Differ from Other Banks in Talent Strategy: Research

DBS Bank: A Case Study in Successful Digital Transformation

DBS Bank’s digital transformation journey began in 2009 when Piyush Gupta was appointed as the chief executive. Under his leadership, DBS Bank adopted a “Digital First” strategy, prioritizing digitalization as a key driver of growth and innovation.

The CEO’s challenge was: “Think like a startup, not like a bank.” Being a leader in the banking space, top management looked to tech giants like Google, Amazon, Netflix, Apple, LinkedIn and Facebook for inspiration.

The bank’s transformation into a digital powerhouse can be attributed to a combination of strategic initiatives, including the adoption of innovative technology, a customer-centric approach, and a vision to “make banking joyful.” Instead of trying to transform the entire organization at once, they focused on customers’ biggest pain points: digital account opening and ATM wait times.

With early victories under their belt, they expanded to more than 100 other customer journeys both within and outside the organization, with each of those efforts being led by a business executive and a technology executive.

Collaborations with fintech companies, technology providers and digital platforms helped DBS accelerate its digital transformation and offer differentiated services.

“DBS is committed to measurement of performance. And it was never about big steps. It was small incremental steps that got made day in, day out. Over a month, it didn’t make a difference. Over a year, change started. Over five years, it was a game changer.”

— Rewired: The McKinsey Guide to Outcompeting in the Age of Digital and AI

Making improvements come to life required the development of a deeper talent bench of current and new employees, a move to the cloud, an aggressive commitment to automation and the democratization of data and insights across the organization.

An institution-wide, modular learning process called DigiFy provided baseline education to employees for them to understand the vast changes that were occurring and find their place in the new digital organization. This ‘live’ curriculum is continuously updated and was supported by the DBS Tech Academy that focused on the needs of the firm’s technologists.

Roughly 65% of DBS customers use digital tools and services, the book reports. In addition, digital customers are producing twice the revenue of traditional customers, resulting in a cost-income ratio half that of traditional customers with an ROE of 39% (15 percentage points higher than nondigital customers).

In summary, DBS Bank’s journey to digital banking leadership has been shaped by a strong vision, a customer-centric mindset, a commitment to a seamless user experience, technological innovation, strategic partnerships, an agile approach and employee empowerment.