Marketing spending among U.S. financial services companies is projected to finish the year down about 22% from 2022, returning to the levels seen in 2020, when the pandemic was in full-force.

Economic uncertainty is the key factor driving the cutbacks at banks, credit unions, fintechs and other players, according to Comperemedia, a Mintel company. And the firm believes this trend will continue into 2024.

Following the trend could be a mistake, however. Comperemedia’s recommendation? Invest in more marketing. Their reasoning— and the major trends that Comperemedia sees driving the financial services market in 2024 — should steel marketing officers to push for funding in the new year.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Where Marketing Spending Will Wind Up (and Why More Would Be Better in 2024)

The company’s research found that the industry spent over $9 billion on marketing in 2022. Based on the average of the spending recorded in the first three quarters of 2023, Comperemedia projects that 2023 will be down to around $7 billion — just a bit above 2020’s total.

The customary move is to cut back, especially as originations in multiple loan types have slowed. But during a November webinar, Biota Li Macdonald, director of marketing strategy, argued that the company’s recent consumer research suggests that banks should be going on offense. She said that consumers have been taking the following actions in response to industry marketing:

- Researched a product or service online 29%

- Clicked on a social media ad 20%

- Responded to an email product offer 18%

- Responded to a mail product offer 16%

- Followed a company on social media 16%

These numbers are all higher than usual, Macdonald said.

“This presents an opportunity. As your competitors are pulling back in this space, your [potential] customers are much more likely to respond to marketing,” Macdonald said. “So leaning into marketing now is actually a really smart strategy.”

Macdonald said it does make sense to consider exactly which products and services to push with extra dollars. Deposits and other noncredit banking products, as well as credit cards, have been getting more marketing funding in 2023 than in 2022 versus spending on promotion of mortgages and other loans and investments. She said that deposits have been top-of-mind for consumers and the industry. Likewise, interest in credit cards has been strong, reflecting consumers’ increasing reliance on cards to make ends meet.

As 2023 progressed, marketers have focused on tactics that could clearly demonstrate a return on the investment, methods that can show conversions from leads, according to Macdonald. That has meant less brand advertising in 2023.

“But we expect the pendulum to swing back in brand marketing’s direction in 2024,” Macdonald said.

Why? Macdonald notes that many regulatory issues, from open banking to lending rates will be in play in 2024, amplified by the impact of the presidential election. A wave of consolidations among community and regional banks is also likely.

In light of those developments, Macdonald thinks that bolstering trust among consumers will be important in 2024. That’s a job for brand marketing.

Moreover, Macdonald suggests that bank marketers facing these challenges with less funding will be fighting (and losing) a multi-front war.

Read more: Marketing Boosts Deposit & Loan Growth for Community Banks: Study

It’s All About the Customer, Again

Marketing efforts in 2024, from product design to media and messenging decisions, will focus intensively on putting customers first, Macdonald predicts. Some traditional institutions and some challengers have already made some moves in 2023, including the reduction or elimination of charges. Macdonald thinks the Consumer Financial Protection Bureau “war on fees” will accelerate this and also hasten a trend to “perk not punish” consumers.

Fees Positive, Not Punitive:

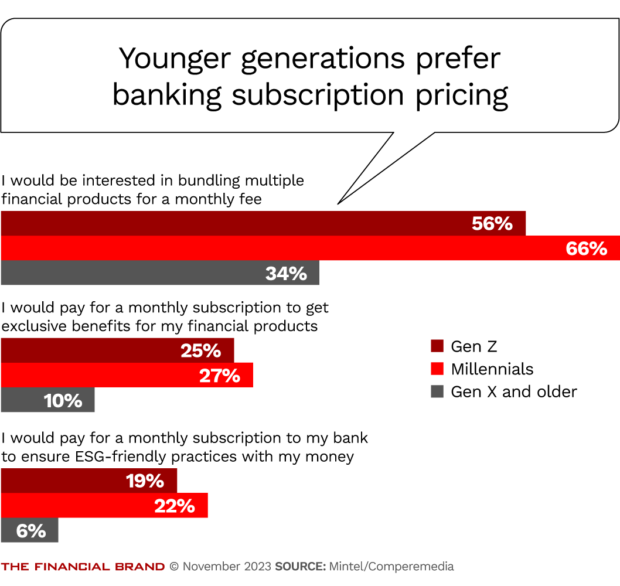

A growing trend among both banking institutions and other players: Pricing models that produce fee income from bundled services that consumers want to opt into.

“Recast fees as subscriptions, and market premium memberships as time- and worry-saving features with a predictable cost instead of surprise charges that disrupt customers’ financial plans,” advises Macdonald. Comperemedia’s research indicates that many consumers, especially Millennials and Gen Zers, say that they would like such offers for financial products.

“We’re already seeing that a lot of fintechs are tapping into this idea,” said Macdonald. Sometimes fintechs offer a free level and a premium level, sometimes a range of tiers.

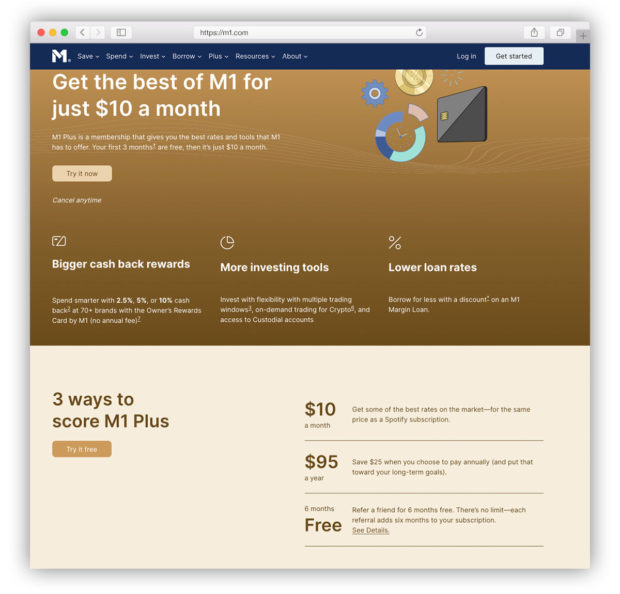

For example, M1 Finance offers “M1 Plus” for $10 a month. Members of M1 Plus receive higher cash back rewards, access to more investing tools, lower margin loan rates and other perks.

Revolut, subject of a recent profile on The Financial Brand, offers multiple tiers, starting from no charge. Customers are permitted to move easily from one tier to another if their needs change over time.

Read more: Digital Marketing Tactics, Trends and Tips to Know About for 2024

Finding Impactful Features that Mean Something to Consumers

Many consumers want their financial brands to demonstrate beneficial impacts on society in some way, according to Macdonald.

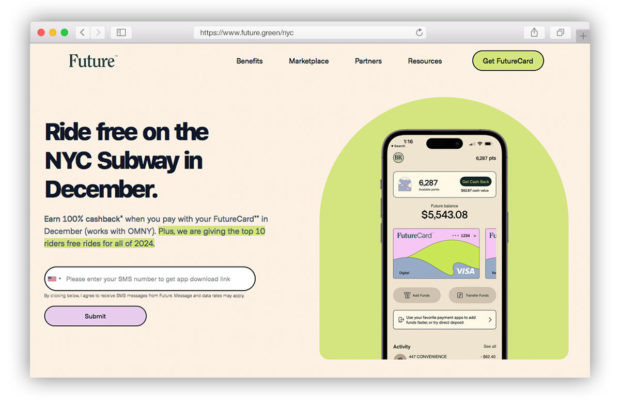

Among firms that work to demonstrate their impact is Future, which offers the FutureCard and its app. An example of its green appeal: During December, cardholders will ride free on the New York City subway when they pay with their FutureCard.

That’s a special deal, but the company routinely provides features with an ecological spin, such as cash back rewards of 5% or more on debit card spending on environmentally friendly alternatives like electric vehicle charging.

SoFi, which started as a fintech but is now a bank, picked up on consumers’ worries that adoption of artificial intelligence could wind up pulling old biases into multiple forms of AI. This could negatively influence loan decisions, marketing text and imagery driven by genAI, and more.

SoFi made a pledge, backed by an explanatory video, to “change the face of finance.” As part of this, it promised to train AI with input showing women doing well in finance and to provide AI with equal gender representation.

Read more: How OpenAI’s Turmoil Could Impact Banking’s Use of Generative AI

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

No Longer Optional: Streamlining and Redefining Services to Reduce Friction

Friction remains in banking offerings but the CFPB’s pending open banking proposal may change things, Macdonald predicted. She also believes developments of instant payment offerings, such as FedNow, will increase “interoperability,” relieving a major consumer pain point.

“Open banking will make it easier for consumers to walk away from bad service.”

— Biota Li Macdonald, Comperemedia

And that is coming at a time when people are already scrutinizing new providers to see if they can get better deposit rates than their current institution is paying.

To counteract this, she said, providers will need to look for ways to make connections with financial partners work more smoothly, all part of efforts to make relationships stickier.

Streamlined approaches have been one of the key appeals of fintechs since their debut. As Klarna evolves from its original basic buy now, pay later focus, it is promoting ease of use, Macdonald noted.

Macdonald also held up the growing Apple “walled garden” of financial services as an example of a selection of products that synch with each other.

From a marketing perspective, she predicted some role reversal for 2024. Fintechs have driven much of their success by marketing in digital channels and Macdonald expects traditional banks to beef up their use of channels like paid social media in 2023. On the flip side, she thinks that fintechs and neobanks will take a page from traditional banks’ approach. They will put more priority on national TV and on direct mail promotion.

Macdonald also suggested that open banking could facilitate better management of consumer debt. Many people don’t have a clear idea of what they owe and when, something experts have said has been exacerbated by the advent of buy now, pay later. Consumers may have multiple BNPL plans outstanding at one time, with multiple providers and on multiple schedules.

Read more: Digital Transformation: Pursue Progress Now, Perfection Later

‘Life Milestones’: They Aren’t Your Parents’ Life Stages Anymore

Increasingly the marketing of financial services to couples, families and children will be driven by emerging societal trends that are only slowly being recognized, according to Macdonald.

Take having kids, later rather than sooner — or not at all.

Macdonald pointed out that both many Millennials, as well as older Gen Zers, have pushed off parenthood, waiting until they can afford kids and a better lifestyle. Many other households have decided not to have children, ever. She said that with the cost of raising a child from birth to age 18 now coming to $237,000, some have decided they’d rather spend on themselves.

Specialized providers are beginning to crop up that cater to that segment. One example is Childfree Wealth, an SEC-registered financial planning firm founded by a couple that is childless who saw the need for planning services that took this choice into account.

Macdonald points out that traditional financial planning often assumes the cost of parenthood in computing household costs, future needs and more. She suggested that financial institutions must adapt, pivoting to serve the needs of these households too.

Read more:

- Why Elon Musk Wants to Disrupt Banking Next

- Unique Youth Savings Account Aims to Hook Gen Z and Gen Alpha on This Bank

- Faster Access to Funds Could Reshape the Battle for Deposits

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

You’re Not Just Marketing to the Parents Anymore

Even marketing financial services to families isn’t going to be the same old targeting of children and adolescents through the parents.

Social media has changed up the old mix.

With the proliferation of influencers on multiple platforms, it’s not necessarily the parents that financial providers try to reach. Macdonald said financial marketers are aiming directly at younger and younger ages now.

Marketing of 529 education savings plans is evolving so that banks and other providers are going to find themselves marketing to children.

Macdonald thinks 529s will become more of a lifelong product. Parents and relatives can start and contribute to these accounts to fund children’s college education. New rules, effective in 2024, will permit up to $35,000 in funds not used for education to be rolled over, without tax penalty, into Roth individual retirement accounts.

Gen Z and Millennials tend to be tuned into money issues at a younger age than their parents and grandparents, and this will affect how they manage their own children’s financial affairs. She predicted that they will be very involved in trying to train their kids in financial wellness and financial literacy.

The market is changing to meet these shifts. In Canada, CIBC offers “Smart Start,” a saving and investment package that is free until the holder turns 25. It’s not just a digital account. Macdonald said it comes with access to new retail spaces that features interactive and immersive financial experiences.

Fidelity has relaunched its Fidelity Youth program, incorporating the Roblox online game world to teach financial skills. And Greenlight, initially solely a competitor to traditional banks and credit unions, is now offering integrations with those institutions to enable them to offer its form of family banking.

Read more: Enthusiasm for Apple Savings Account High Among Millennials and Gen Z