Neobank Revolut landed on U.S. shores in early 2020, after launching in the U.K. in 2015 and spreading throughout much of Europe. The super app is now closing in on its first 1 million customers in the U.S., a still-small subset of its 35 million users worldwide. But management thinks the neobank can scale up its operations here even as it adjusts the typical lineup of services that Revolut brings to most new markets.

Revolut currently serves 38 markets globally, 29 of them with a banking license.

In time, “we want to build a truly global product that is borderless,” says Sid Jajodia, Revolut U.S. CEO and chief banking officer at the parent company. “Our object is to be 24/7 around the globe. The more scale we have, the more unit costs come down and the more valuable we can make things for the end user, or put more value back in their pockets.”

Revolut continually seeks out footholds in more countries even as it builds out existing markets. Current expansion markets besides the U.S. include Australia, New Zealand, Japan and Singapore, with Brazil — home of the hugely successful Nubank — recently going live as well. Moving into India is coming up and after that, according to Jajodia, Mexico may follow.

The company’s usual plan of attack is to deploy a smorgasbord of digital financial services to each new market, focused on easing pain points that consumers and small business operators encounter from traditional bank and credit union offerings. The U.S. consumer selection at present includes financial products with a fintech twist, including ways to send person-to-person payments both within and outside the Revolut system; interest-bearing savings vaults for separate purposes; commission-free stock trading; subscription management and budgeting tools; early salary availability; and travel services that can include up to 10% cash back.

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

A 2021 article on The Financial Brand observed that “Revolut is a product juggernaut. By the time you finish reading this article, it’s conceivable the company may have launched another service.”

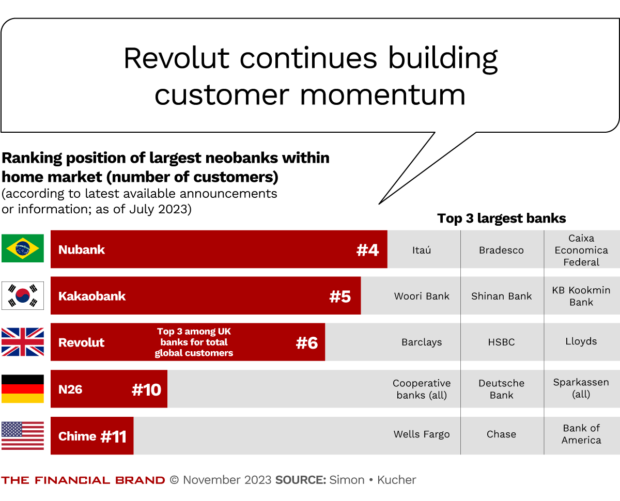

A recent study by Simon-Kucher concerning neobanks tallies over 20 products on Revolut’s menu overall. Available products depend on country and what tier of service the customer selects. In the U.S. there is standard, at no charge but fewer services; premium, at $9.99 monthly; and Metal — which includes a metal debit card — at $16.99 monthly. Tier can also determine such factors as rates received in savings vaults.

When asked if he prefers Revolut be called a super app or a neobank, Jajodia reflects that neobank means different things to different people. Some “neobanks” have charters and some don’t. So he prefers “super app.”

“I want consumers to think about us as an app,” he explains. “We’re an easy-to-use app for most things that they want to do in their lives, whether it’s saving, investing, spending or borrowing.” That range already exists in Europe and he says it is coming soon to America.

Building on Revolut’s U.S. Beachheads

Right now in the U.S. Revolut has tended to succeed in urban markets on the east and west coasts. Many fintechs tend to appeal to younger consumers who like the digital-only experience, but Jajodia says that Revolut also has appeal to customers over 40.

“More and more customers have less and less use for branches and they’re more and more comfortable with doing everything on that computer in their pocket, the mobile phone,” says Jajodia.

“As customer behavior changes, there will be room for three or four large fully digital banks to be the bank for the next generation,” says Jajodia. “That’s what we aspire to be.”

Jajodia says that the company’s different markets share commonalities, but there are also notable differences in needs and attitudes. In Europe, for example, Revolut’s ability to deal in multiple currencies sees strong demand because of the mix of countries an individual may visit. (The Revolut wallet can hold up to 30 different currencies.) In the U.S., this service appeals to expatriates working in the U.S. and immigrants, but doesn’t connect to Americans who don’t travel frequently abroad for business or pleasure.

On the other hand, Americans love their credit cards, much more than debit. In addition, “they are very attuned to the idea of getting rewards every time they spend money,” says Jajodia. “Even if they are paying off their charges every month, you need to have some sort of rewards-based card product to be first-in-wallet for many U.S. consumers. So we’re building that out.”

Some credit products, like cards and also personal loans, have a higher priority for Revolut product developers than others. Jajodia notes that the company has not moved at all into mortgages in any of its markets, though he says this will come in time.

An updated version of the app Americans and other Revolut customers use — Revolut 10 — began rolling out in mid-October. The company intends this version of the app to offer greater customization to customers, based on how they use Revolut and the user experience they prefer. Transitions between the many Revolut services are smoother as well.

Read more: Neobank Winners and Laggards Point to Long-Term Fintech Strategic Shift

U.S. Bank Charter Not on the Immediate Horizon

In Europe, Revolut enjoys the ability to “passport” a charter throughout the European Economic Area. The company has license application pending in multiple international markets as well. At present it doesn’t have one on its home turf, the U.K. In the U.S., early plans to apply for a charter have been put off for the time being.

“I can’t speak to a specific time frame,” says Jajodia. “But absolutely, our ambition is to be a fully licensed bank in the U.S. ”

[Obtaining charters has become increasingly difficult in the Biden years and in some cases institutions have explored buying banks instead. A recent analysis on The Financial Brand by Michele Alt of The Klaros Group goes into this in more detail. Deeper Dive]

Currently Revolut’s U.S. services are provided through three different banking-as-a-service (BaaS) arrangements. The banks include Sutton Bank, Cross River Bank and Metropolitan Commercial Bank.

Some licensing activity has gone on in nonbanking areas. For example, Revolut Securities has been licensed by FINRA, the Financial Industry Regulatory Authority, and the company is also registered with the Securities and Exchange Commission, enabling Revolut to offer equity trading and a robo investment advising product. The company has started a state-by-state effort to obtain licenses for credit collections and servicing in advance of its launching credit cards and other consumer credit services.

“Our end objective would be to be a national brand in the U.S., serving customers across the nation, across a variety of properties,” says Jajodia.

Meanwhile, Revolut is still working out some kinks. It released its 2021 annual report in March 2023 with a “qualified audit” from its accounting firm. The firm cited difficulties with the company’s internal controls systems. The firm has not issued its 2022 annual report as of mid-November 2023.

Read more:

- Where Ribbit Capital Sees Fintech Opportunities

- Fintech Growth Strategies Impact Future of Banking

- Why the CFPB Proposal for Big Techs May Affect the Entire Industry

Looking at Elon Musk and Financial Services from X

Revolut has in the past scoffed at banks and Jajodia makes a point about the breadth of Revolut offerings versus the many “skinny” fintechs that are out there. But many in financial services are now watching Elon Musk and his efforts to turn X, formerly known as Twitter, into a financial super app himself.

“Obviously, any time Elon is doing something, you don’t ignore it,” says Jajodia.

Jajodia adds that having a digital app where the consumer or small business can manage their financial life “is very close to our heart. So to the extent that Elon is trying to do the same thing, that’s interesting and we’ll look at it What we want is to focus not on what he’s doing, but where we are in that journey, what we need to build out, where we need to get better, and can solve for that.”

Read more: Inside Elon Musk’s Stealth Move to Build X into a Pay-By-Bank Powerhouse