As a veteran consumer marketer, Ally Bank’s Andrea Brimmer understands a great deal about what makes people tick. But she scratches her head over a conundrum: Why do so many people, especially couples, not talk about money?

“Often we don’t have ‘the money talk’ with our partners until it is too late,” says Brimmer, Chief Marketing and Public Relations Officer at the direct bank. “It’s the second leading cause of divorce. I wondered if we couldn’t help solve for that.”

The idea of encouraging people to talk about their finances fits nicely with the bank’s “North Star,” as Brimmer terms it, of being “an ally to our customers.”

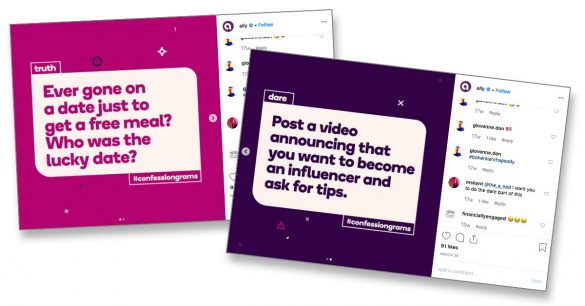

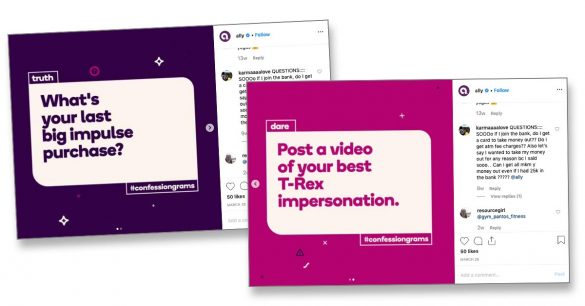

#Confessiongrams is Ally Bank’s serious attempt to bring some fun with insights for consumers to a ticklish subject: money. The Instagram campaign uses a “Truth or Dare” approach.

“I’m super fascinated by the idea of money taboos,” explains Brimmer. “Why in this country are we so afraid to talk about money? Even in my own household, we differ. My philosophy is that I’m very open with my kids about money. But my husband has a completely different point of view. He feels we shouldn’t share a lot with regard to our finances with them.”

Even without children on the scene, major financial surprises can have huge impact.

“Let’s say you find yourself deep into a relationship,” says Brimmer, “and you discover that your partner has $50,000 worth of student loans that you had no idea about. That’s going to lead to a pretty big conversation — probably one that you should have had before you got really deep into the relationship.”

What Brimmer wanted was a way of stimulating conversations about money between couples that would be serious fun. Serious, in the sense of money being an important subject in most households, and fun, in the sense of broaching this often ticklish subject while creating an opportunity for a few laughs. The program, released on Instagram, is called #Confessiongrams.

( Read More: Why Ally Bank’s CMO is Really Their ‘Chief Disruption Officer’ )

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Debuting New Idea on an Unfamiliar Social Media Platform

Between Ally’s marketing staff and its digital agency, R/GA, a way to help couples get to know each other financially was hammered out.

The effort is a variation on the theme of “Truth or Dare.” A financially oriented question — samples appear throughout this article —is posed to a couple, each of whom is looking at the Ally Instagram page on their mobile devices.

The person whose turn it is has the option of answering the question, such as “Do you think your partner is overpaid for his/her job?” or declining. If someone declines, they swipe away the “Truth” on their phone, and expose the “Dare.” In this case, the dare is “Channel your inner beauty blogger and give a tutorial on how to do makeup.”

Ally periodically adds new truths and dares. People who complete a question are encouraged to tag their partner and to post their thoughts on the Instagram sub-page for that posting.

To come up with the questions, Ally had R/GA research the kinds of financial topics consumers should typically be discussing with their significant other.

“These were purposefully written, to lead people into the kinds of conversations they should be having,” says Brimmer.

The flip side was the dares. This was a challenge in its own way.

“We wanted them to be fun dares that were Instagram worthy,” says Brimmer, “the kinds of things that you know people would have fun watching, that were silly, but that wouldn’t be harmful. We didn’t want to shame anybody, but we wanted visual eye candy on a platform that people would watch and engage with even if they aren’t playing the game.”

Many dares were proposed, but Ally and its agency picked the finalists carefully. “We didn’t want anything mean-spirited or that could have the wrong connotation,” Brimmer explains.

While this has been an unusual effort for a banking brand, it is not unusual for Ally to try very different promotions. It has used gamification before, including the “Big Save” virtual reality mobile phone game, modern treasure hunts, and more. The bank even invented its own holiday — “National Online Bank Day” — on Columbus Day, when most other banking institutions are closed. The bank also sponsors “Banksgiving,” an invented holiday when staff is empowered to grant the wishes of selected customers.

But what was unusual here was the use of Instagram. Ally was already active on Facebook, Twitter, YouTube and LinkedIn, but hadn’t tried Instagram. While her team had urged it, Brimmer says she resisted it for some time.

“I hesitated to push us onto Instagram because I’ve got this philosophy that each social media platform has a very different use,” says Brimmer. “Too often brands feel like they’ve got to have a presence on every social platform. They don’t think through what the value is to the end user. We had to consider the real value to us as a financial services company of a platform that is largely a visual one. And until we could crack that code, I held the team back.”

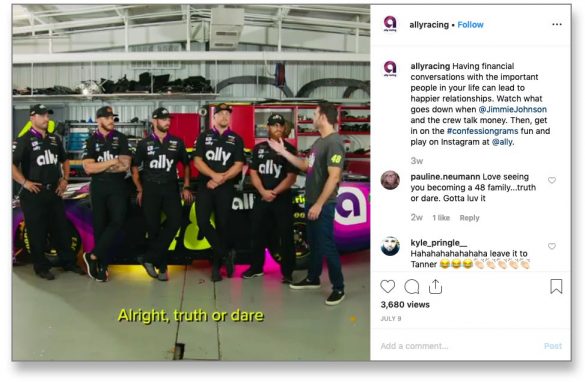

Brimmer says #confessiongrams was the first application that she felt really worked for Ally for its introduction to Instagram. To get things rolling, Ally invested in some paid Instagram spots that posed questions from its #confessiongrams collection to people on the street.

The woman on the right has just answered, “When should you tell your partner your salary?” (“Before the ‘I love you comes’,” she answers.) The man on the left is answering the question, “Ever flirted for a discount?” (“Hell yeah. Who hasn’t?” he answers.)

“There’s many flavors of disruption,” says Brimmer. They don’t always have to be massive programs — she allows that #confessiongrams is a relatively modest investment. But what she likes most about it is that it doesn’t preach, but teaches people by engaging them in conversation with each other. What about single people? Brimmer says most people at some point in their lives are in a relationship. Even if someone encountering #confessiongrams is alone for now, she suggests, they can pick up material for reflection in the future.

“Sometimes, simple, smart ideas can come to life, intersecting a user’s journey at the place where they are looking for information,” Brimmer adds. “Ally can do really big, interesting, disruptive things, and also really small disruptive things like #confessiongrams.”

Read More:

- Ally Bank Pokes Rivals’ Negative Online Reviews in Fun Campaign

- Digital Giant Ally Bank Smacks Branch-Loving Rivals With New Ads

- Consumer-First Strategies Pay Off For Ally, Umpqua and First Bank

- Direct Banks May Be Good, But They’re Not Unbeatable

Connecting Social to the Marketing Funnel

While a major theme for Ally is being that financial helper, all marketing eventually must move the needle for the brand in terms of conversions or some other measure.

Well over a million people have interacted with the #confessiongrams postings proper. The paid promotion launch campaign with the “people on the street” interviews, along with special posts using the Ally NASCAR Racing team, with the driver Jimmie Johnson and his crew, generated 8.9 million unique impressions as of late July 2018. (Among the “dares” undertaken in the one spot was a pretty mean T-Rex imitation by a crew member.)

Followers increased 60% since the start of the campaign, and Brimmer says the bank has been working to bring them into its customer fold. “They seem to be showing a strong propensity to learn more about our products and services,” says Brimmer. “We do a lot of conversion marketing, and we analyze very detailed social journeys where we’re targeting consumers who use our social media feeds.”

Brimmer says she wants to take this ongoing campaign in additional directions. She and her internal and external teams are considering ways to adapt the approach to specific life stages, such as the retirement years and the higher education years.

As has become usual, very little about Ally marketing is bankerly, but that’s by design.

“We’re a growth company, rather than a typical financial services company,” says Brimmer, “so I feel like we need to behave more like a digital startup.”