The payments moves that Apple announced at its June 10 annual developer conference are being hailed as competitive coups on multiple fronts — one-upping Visa’s announcement of its Visa Flexible Credential, overtaking Early Warning Services’ fledgling Paze wallet, and yet also as offering a potential benefit for card issuers and ecommerce merchants.

Apple dropped a second shoe only days later, announcing that it is discontinuing its Apple Pay Later BNPL program, executed through its Apple Card accounts. But Apple added access to BNPL loans from Affirm inside Apple Pay, as well as access to BNPL through participating payment cards in the digital wallet.

The announcements, and their implications, drove speculation of a strategic shift for Apple. The company may be subtly shifting away from being a provider of financial services while operating a payments network, to focus on the latter alone.

“There was never any chance Apple was going to try to be a regulated bank, but they were a direct financial services provider,” says Alex Johnson, consultant and creator of the Fintech Takes newsletter.

In early 2022, Apple produced an internal strategy called “Breakout” for expanding the company’s participation in payments. The recent news seems to be the latest act in the Breakout script, but we are still far from the culmination of that plan. The underpinning of many of Apple’s new services, iOS 18, will be launched in beta in July in the U.S. and made available broadly in September. (Developers already have a version of it.)

“Apple Pay is going to become the Switzerland of digital wallets,” says payments consultant Richard Crone. “They are facilitating selection of every payment type with their moves. And when they do this, they’re not doing it as a charity. They’ll get a piece of the action every time.”

Michael Abbott, global banking lead at Accenture, says Apple is redefining what’s really important in financial services.

“For years banks have been worried about their data being taken by the fintechs,” says Abbott, who in a previous life founded a payment fintech that was sold to Google. “But I don’t think it’s the data that’s valuable — it’s the payments experience. When you look at it that way, you don’t need to own banking. You just need to own the experience.”

Increase loan volume through embedded financing

Discover the strategies behind Silver State Schools Credit Union’s transformative journey in today’s competitive lending marketplace — enabling sustainable growth and connecting with 500+ new members.

Read More about Increase loan volume through embedded financing

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Drilling Down: What Apple is Going to Do in Payments

The payments moves came amid a blizzard of announcements, many under the umbrella of the latest iPhone operating system as well as Apple Intelligence, the company’s new GenAI offering. Timing of rollouts, and the details of how things will work, may differ by country and the participation of card issuers.

Key is the rollout of the ability to use Apple Pay for website-based ecommerce checkouts in every browser using a cross connection with the iPhone. (Apple Pay can already be accessed for payments in Safari, Apple’s own browser.)

Apple is putting a door in one side of its “walled garden” to enable its iPhone to serve as a key for purchasing through web pages on non-Apple computers and alternative browsers to Apple’s Safari.

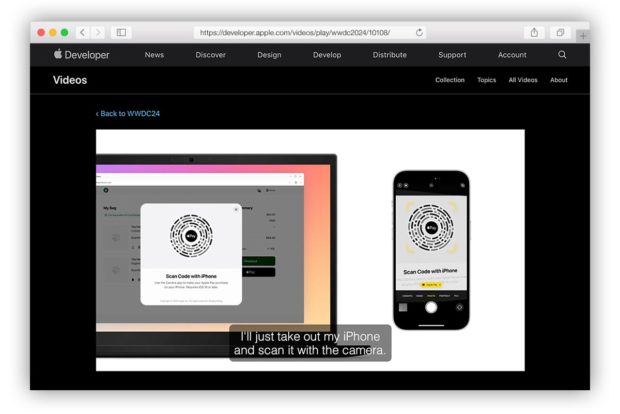

The photo above, taken from an Apple video created for developers, gives the general idea. Transactions can be accomplished, notably even on browsers outside of the Apple ecosystem. After a transaction is initiated on Google’s Chrome, Microsoft’s Edge or other browser, a visual code is generated. The user scans this with their iPhone to continue the transaction. From that point on, behind the scenes, the transaction proceeds like a typical iPhone-based purchase. The process has been designed to avoid the need for much re-coding by sites’ developers.

In addition, this capability will be included on iPads for the first time — a major gap in Apple Pay purchasing ability within the company’s own ecosystem. More broadly, purchases with rewards will be facilitated for customers of participating issuers. In the U.S., the first to offer this will include Discover, Synchrony and institutions that work with Fiserv.

“Apple owns the toll booth now,” says Accenture’s Abbott. “And someone else is paying for the highway, the infrastructure and all the other stuff behind it. But Apple owns the toll booth.”

For much of Apple’s history in financial services, frequent reference was made to its “walled garden” of services tied to the iPhone. The new efforts still require an iPhone, of course, but seem to be putting a gate in one of the garden walls.

Enabling this functionality accomplishes several purposes, says Crone.

First, it nearly doubles the potential for Apple Pay as a website-based payment channel. “Apple Pay will become accessible to 89% of the ecommerce market controlled by Google Chrome, Microsoft Edge and Apple Safari,” says Crone. “They’ll increase their addressable market to nearly all of it,” says Crone, potentially breaking the wall between iPhone-land and Android territory.

Second, because the setup pulls in the iPhone, Apple is able to utilize both the biometric and multi-factor authentication technologies that the phone offers.

Crone says this addresses an interesting contradiction. Many people prefer to make higher-ticket purchases on their desktops and laptops using browsers, yet the risks of fraud are higher there than on the iPhone. Apple’s move adds layers of security by merging the two digital platforms, addressing a key worry of issuers, merchants, consumers and others in the payments chain.

A process that will ideally have those protections and fewer frictions could see less abandonment. More completed sales is something that ultimately both merchants and issuers want, adds Crone.

Apple generally gets 15 basis points for purchases made through Apple Pay, according to Crone, and will likely get more for its BNPL efforts.

“I estimate Apple Pay’s ecommerce market share to be around 3% of GDV [gross dollar volume] today,” wrote payments expert Tom Noyes in his payments blog. He estimates that the company’s announced shifts in ecommerce “will set them on a path for 20%+ in the next three years.”

Read more: Where is Visa Headed with its ‘Flexible Credential’ Concept?

.no webinar found.‘Tap to Cash’ Favors Face-to-Face Reimbursements, Payments and Bill Sharing

Back under the iPhone umbrella, Apple is introducing “Tap to Cash,” a way to pay out from Apple Cash accounts to other iPhone users with Cash accounts. (Apple Cash accounts are provided by Green Dot Bank.)

The new service stands out because it doesn’t require knowing a cell phone number or any other information typically required for a P2P payment. Noyes points out in his blog that the service won’t require QR (quick response) codes nor use of NFC (near-field communication). Instead, Tap to Cash will use Airdrop, a utility Apple has long provided for transfers between Apple devices, where permission for access has been granted.

“The Tap to Cash CX is just amazing and visually cool,” says Noyes. He indicates it is smoother to use in this way than Venmo.

Speaking strategically, Crone sees competitive impact once Tap to Cash picks up momentum.

“This is important because most of the value in P2P is in in-person sharing of payments,” says Crone. “And so I see this is going more after Zelle than it is Venmo or Square Cash.” In the mid-term, Crone expects Apple to expand on such payments services, posing additional competition for Zelle and other P2P players.

From the archive: Read some of our past Apple coverage:

- How Apple Can Keep Growing in Financial Services Without Ever Becoming a Bank

- In a Superapp Race, Apple’s Far Ahead of Twitter & Everybody Else

- Enthusiasm for Apple Savings Account High Among Millennials and Gen Z

- Inside Green Dot: The Bank Behind Walmart, Apple, Amazon & Intuit

Apple Moves Should Stoke Volume of BNPL Purchases

Apple is offering two different ways to obtain Buy Now, Pay Later credit even while dropping out of direct participation in the BNPL race.

The first is direct access to payment plans provided by Affirm. Inclusion in Apple’s digital wallet is a major distribution opportunity for Affirm.

“The more we’re in wallets, in addition to being integrated on merchant sites, the more consumers have a chance to see us. So you may be a user of a wallet and then see us as an option within that wallet in a way in which you would have never seen us before,” Michael Linford, Affirm’s CFO, told analysts during a fireside chat sponsored by Barclays in mid-June. He said the deal with Apple would substantially open more potential market for Affirm’s plans.

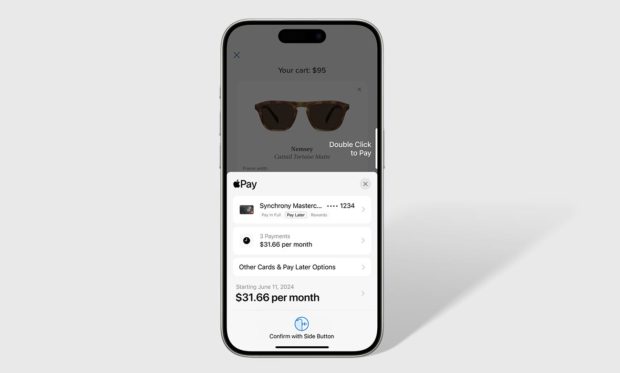

The second enhancement is enabling participating debit and credit card issuers whose customers have uploaded their cards to Apple Pay to obtain BNPL credit from those card issuers. In the U.S. the plans will initially be offered via Citibank, Synchrony and institutions that work with Fiserv.

iPhone users will have options to use buy now, pay later financing rather than completing a credit card transaction.

The decision to kill Apple Pay Later came as a surprise to some. Apple began phasing in the service in March 2023. Research by J.D. Power found that Apple’s offering had a favorable response, which the firm credited in part to its strong brand recognition. The service was subsequently extended to all Apple Card holders.

Why the decision to get out of BNPL on its own? Increasing regulatory attention to the installment plans may be part of the reason, says Accenture’s Michael Abbott. The Consumer Financial Protection Bureau issued an interpretive rule in late May, essentially declaring BNPL to be a form of regulated consumer credit subject to existing federal laws and regulations.

Abbott sees little appeal for Apple to stay in an activity the CFPB clearly intends to regulate and examine in a hardball way. Apple Pay Later is the only activity Apple undertook as an actual provider and where it was actually booking and funding the transactions with its own resources. Goldman Sachs continues to run the Apple Card credit card operation, which has been losing money, though the Wall Street firm has been trying to drop the relationship for some time.

“Why do I want to be in a capital-intensive industry when I can be the toll keeper?” says Abbott. Apple can generate revenue without taking any credit risk, he notes.

“It’s a brilliant move, actually, failing forward, knowing firsthand what it takes to be successful in BNPL, and using that experience to empower all others,” says Crone. He sees this as the beginning of becoming an “App Store” for new payment applications, such as pay-by-bank and instant payments. Apple gets one third of purchases in the App Store.

Read more: Shocker: Amex, Chase and Citi Top BNPL Satisfaction Rankings

Register for Discovery2024 Conference

Join us August 8th for Discovery2024, your gateway to the strategic insights and human connections you may need to navigate the evolving financial landscape.

Increase loan volume through embedded financing

Discover the strategies behind Silver State Schools Credit Union’s transformative journey in today’s competitive lending marketplace — enabling sustainable growth and connecting with 500+ new members.

Read More about Increase loan volume through embedded financing

Is Apple Undergoing a Strategic Shift?

Alex Johnson sees the exit from Apple Pay Later as “a huge pivot” and possibly a harbinger of more such moves.

“You can be a network or you can be a financial services provider, but it’s very difficult to be both,” says Johnson. Discover and American Express can pull that off, but they had years to build up both sides of the business.

Johnson suggests that in the scheme of things Apple, the big tech’s BNPL foray may have been more of an experiment.

Johnson also says he wonders if something has changed inside Apple to put more emphasis on the network aspects of Breakout. If so, he believes Mastercard and Visa should be worried.

Apple is working directly with payment companies through some of its moves, which somewhat supplants the payments companies. He says the overall flavor of the BNPL relationships makes him think of Google’s aborted Google Plex project. In that, multiple banks, credit unions and fintechs were establishing special checking accounts to operate under a Google umbrella. At the eleventh hour the whole thing got scrapped.

Crone admits that he can’t figure at this point why Apple doesn’t simply buy PayPal, adding to the strength of its budding network. That would shortcut much of what he thinks Apple is attempting to do. That would abet the company’s push for more volume for fees.

In any event, Crone thinks increasing volume through Apple’s mechanisms “may reach the ‘hockey stick’ growth rates that they’re hoping for.”

The competition and cooperation blend brewing at Apple reminds Crone of predictions made decades ago by then Visa chief Dee Hock. The gist of Hock’s argument was that “competitors would begin to collaborate in order to build out the market,” says Crone.

Abbott thinks the banking side of the payments industry has come full circle and needs to start cooperative efforts to compete with the likes of Apple. There’s precedence for this: Mastercard and Visa. Before they went public and independent, both firms were owned by their banking users.

“I think payments is heading into a sort of Cold War,” says Abbott. “No shots are being fired, but everyone knows it’s out there.”

Read more: Buy Now, Pay Later Needs to Pay Off in 2024

And Where Does This Leave the Apple Card?

How quick the journey from cool to cold. Will the titanium cards Apple sent out to make a physical manifestation of a digital credit card become collectors’ items?

Goldman Sachs wants out of the painful deal and Apple seems ready to move on, says Johnson. Retiring the Apple Card could be a way of emphasizing that Apple now wants to be a network, and won’t run its own horse in the race it’s sponsoring.

Alternatively, Johnson says, Apple could find a way to get Goldman out and find a co-brand partner, maintaining the relationships but taking Apple further away from being a provider, and more towards a concentration on the network strategy.

It’s worth remembering that as the Apple Card lineup of products grew, Apple Pay Later is the only one where the company was playing with its own chips. Apple Savings, for example, for which a consumer has to have a card relationship, generates funds for Goldman Sachs, not Apple.