Apple’s high-yield savings account is on its way to being a hit, especially among affluent younger consumers, according to new research from Morning Consult.

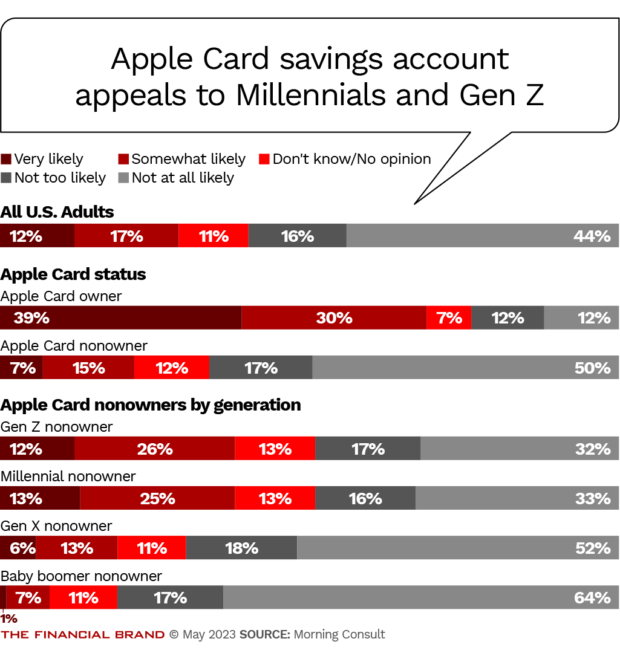

Nearly seven out of 10 consumers who have Apple Cards told the research firm in an April poll that they are likely to open an Apple Savings account.

Among consumers who don’t have Apple Cards, about one out of five said they are likely to open the savings account, which, in turn, would require getting the card too.

That’s because only consumers holding Apple Cards can open the savings account, which launched with a 4.15% APY.

Though not the highest rate available in the market, it’s still competitive, and Apple devotees find the features of the account appealing. The big tech firm ties the features into other Apple financial products and observers say more such ties are likely coming.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Apple’s Financial Products Pose Risks for Traditional Banks

The survey results suggest that Apple’s savings account will be a double threat — or worse — to traditional banking institutions.

Apple will be able to make deeper inroads with its cardholders, as a majority intend to explore opening a savings account, broadening their financial relationship with this savvy banking competitor. Plus, the interest among those who don’t currently have an Apple Card means that many more consumers would be starting multiple-product relationships with Apple. (The banking functions behind the card and savings products are provided by Goldman Sachs, but Apple provides the customer experience.)

Of course, being able to have any financial services relationship with Apple requires having an iPhone. Both the Apple Card and the savings account help make the phones stickier and vice versa.

Purchases made with the card earn “Daily Cash,” and the Savings account — it is, in fact, named “Savings,” simply enough — is where those cash rewards are meant to be stored. For those with the account, Daily Cash will automatically go there. Or it can be put into their Apple Cash, where it can be tapped for immediate spending.

Apple’s highly interconnected products support its “walled garden,” helping to keep customers within its own ecosystem for all their needs, while also providing hooks to lure new users in, notes Jordan Marlatt, lead tech industry analyst at Morning Consult. “That’s been the play for Apple for years,” he says.

Additional interconnected products include the Apple Pay digital wallet and its buy now, pay later offering, called Apple Pay Later. Apple Cash is the payments service it offers in partnership with Green Dot.

Marlatt points out that Apple checked off two key selling points with its savings account.

First, separate Morning Consult research indicates that 3.9% is the average rate consumers were looking for in mid-March, making Apple competitive enough to encourage account switching.

Second, Apple’s savings account was unveiled in the wake of the banking crisis. During that time, many bank customers began looking around and considering other places to move their deposits to, Marlatt says. The savings account’s introduction plays to those still shopping around.

As shown in the charts below, younger consumers in particular — Millennials and Gen Z — favor the Apple Card and are attracted to the new savings account. Among the Millennial and Gen Z survey respondents who don’t already have the Apple Card, 38% say they are very or somewhat likely to open Apple Savings.

Apple’s Strategy Gets Consumers into Multiple Products at Once

For consumers already inside the financial services section of Apple’s walled garden, there’s just one move to make: opening the savings account. People who have done so report that it takes only minutes.

But, even for consumers needing to apply for an Apple Card first, the Apple/Goldman combination has become known for enabling a quick and painless process that can result in nearly instantaneous opening of a card account. Because the card resides in the Apple Pay digital wallet, consumers can begin using it as soon as approval is granted. They don’t have to wait for the physical titanium card to arrive.

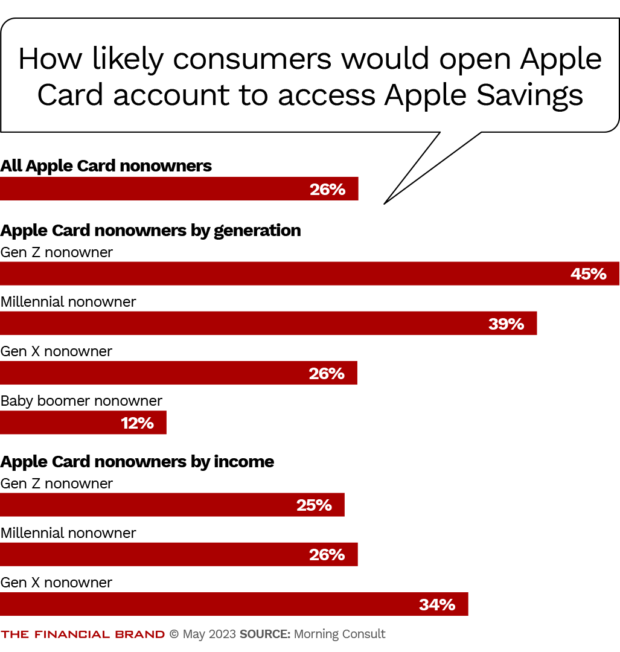

“There’s a lot of willingness to jump through both hoops,” says Marlatt. Among people who don’t currently have an Apple Card, 22% told Morning Consult that they were very likely or somewhat likely to open the Apple Savings account in the next six months. In answering a separate question, 26% of consumers said they were likely to apply for an Apple Card specifically to be able to access the new savings account.

Part of what is working for Apple here is consumers who are believers, according to Marlatt. “People who have Apple products tend to trust the brand,” he says.

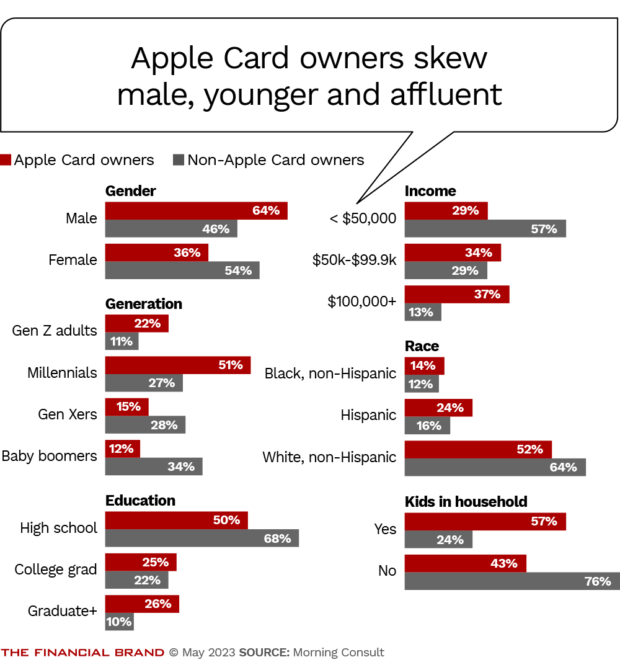

He says that fans of all things Apple tend to be male, Gen Z or Millennials, highly educated and high earning. These same characteristics apply to frequent users of Apple computers, iPhones and Airpods as well.

In late 2022, Interbrand ranked Apple as the top global brand for the 10th year in a row. The top five brands in the 2022 study were all big tech firms — Apple, followed by Microsoft, Amazon, Google and Samsung. JPMorgan Chase, the highest-ranking banking firm in the study, came in at number 24. Factors in Interbrand’s ranking process include consumer loyalty and the influence the brand has in purchasing decisions.

The fact that the savings account has no fees and no minimum balance to open or maintain adds to the appeal, Marlatt says.

What’s next for Apple’s financial services? Marlatt says current economic uncertainty has narrowed its likely next moves. For example, he suggests that now wouldn’t be the best time to launch a securities trading function.

Building on Apple Savings is more likely. “A savings account is one of the safest things they could have introduced,” says Marlatt.

He speculates that the next move could be product features that blur the line between what a savings account is and what a checking account is.

Read More:

- Understanding the Retail Bank that Apple Has Quietly Built

- Deposit Stability Matters More Than Low-Cost Money Now

- Deposit Competition Is On, But Should CDs Still Be the Go-To?

Will Apple’s Growth and Potential Success Draw Federal Scrutiny?

A lingering question is how long Apple can continue to enjoy its in-between status.

It’s not a bank, though it increasingly has the features of a bank within its walled garden. In some ways, offering the opportunity to get a high-yield savings account in exchange for opening a card account replicates a strategy some large banks are using. And grouping multiple relationships in one place, in this case the iPhone, follows the new-age “club account” concept epitomized by Amazon Prime.

In spite of much conjecture, Apple shows no signs of wanting to be an actual bank. However, Apple is already among the big tech firms that were asked for extensive data by the Consumer Financial Protection Bureau in 2021 as part of a probe of big tech incursions in the payments business. In late 2022, the CFPB asked for further public input into that probe after issuing a preliminary report.

Morning Consult research indicates that three out of five consumers surveyed favor regulating big tech firms that offer banking products as financial services companies. This trend was seen consistently across political affiliations, being favored by 65% of Democrats, 61% of Republicans, and 59% of independent voters. And with banking turmoil continuing, once Congress opens the legislative box to make changes, all sorts of things can wind up in the mix.

Perhaps there will be some weeds in the future of the Apple walled garden.