The FedNow instant payments system creates opportunities for banks and credit unions of all sizes, facilitating new ways for them to generate revenue from both business and retail customers. But it also creates strategic, pricing and marketing challenges.

FedNow — a set of payment rails run by the Federal Reserve — went live with a group of early adopters in July. It competes with the private sector’s Real Time Payment Network, which launched in 2017.

The RTP network processed 58 million transactions in the second quarter of 2023, and use has been increasing rapidly since early 2020.

Backers of instant payments point to this trend as evidence that the concept is catching on. They contend that widespread adoption by financial institutions is not a matter of if, but when.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

FedNow Adoption: No One Is Twisting Your Arm

Unlike much that comes out of the Federal Reserve, taking part in FedNow isn’t mandated by any law or regulation. Each financial institution can decide whether it wants to participate.

But experts expect that a majority of institutions will opt to participate, if perhaps only in “receive mode” at first.

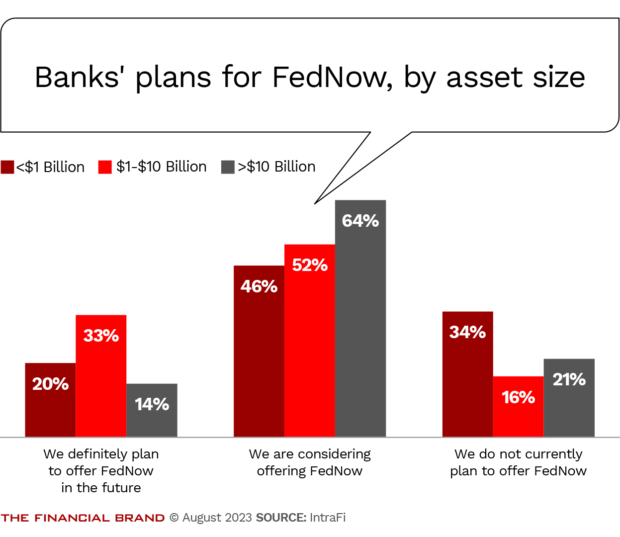

An IntraFi survey conducted about the time of the FedNow launch shows heavy interest in the service. IntraFi found that 23% of the banks in its survey “definitely plan” to offer FedNow and 48% are considering it. The remaining 29% have no plans to do so. (See the chart below for more detail.)

Where will those numbers stand a year from now? Payment services often make for tricky competitive decisions.

The RTP network is run by The Clearing House, which is owned by 22 big banks. The service is available to all insured banks and credit unions, so nonmembers can, and do, use it. But compared to the size of the industry, it’s a small number.

By The Clearing House’s estimate, RTP is available to about 65% of the nation’s checking accounts.

The Independent Community Bankers Association, a frequent anti-big-bank voice in Washington, has been promoting FedNow. The trade group said in a recent blog post that getting aboard instant payments should be seen “as a requirement to keep pace with changing times and customer expectations.”

“To not participate may put your financial institution at risk,” as many small and midsize businesses will expect this service and will switch banking providers to get it.

— Richard Crone, payments consultant

Payments consultant Richard Crone agrees. “To not participate may put your financial institution at risk,” he says. “More than 60% of community banks’ revenue comes from serving small and medium-sized businesses, and many of those businesses are looking at electronic invoice presentment and payment, especially on the business-to-business side.”

An early FedNow adopter, the $1.9 billion-asset INB in Springfield, Ill., has a similar message for its community bank peers. “FedNow is an opportunity for smaller banks to take a step up the ladder in terms of payments relevance,” says Mark Donovan, the chief operating officer at INB.

Many community banks focus on commercial customers, a segment that is very interested in faster payments, says Donovan.

Most of INB’s promotion so far has been one-on-one through its treasury sales staff. Donovan’s skeptical that other types of marketing would work well for this service. “It’s hard to make news out of this. This is an inside-the-wall plumbing improvement that we haven’t seen since the likes of FedWire in the 1970s.”

‘Robust Roadmap’ of More FedNow Features to Come

FedNow is going to get a lot better over time, according to Mark Gould, chief payments executive for the Federal Reserve System.

“We have a pretty robust roadmap of features and functionalities that we want to add,” Gould said during a “Fintech Recap” podcast with analysts Alex Johnson and Jason Mikula around the time of FedNow’s launch.

This type of approach — releasing a basic version then improving it afterward — is unusual for the central bank, Gould added. “We will tend to think about everything, roll it out, gold plate it, and then get it into the market,” he said. “We’re taking a fundamentally different approach to this.”

How bankers feel about FedNow generally sorts out into three camps, according to Linda Fischer, chief operating officer at CSI, a bank technology provider heavily involved in helping financial institutions with FedNow adoption. Some, like INB’s Donovan, believe it’s helpful to jump in early, for a competitive edge. Others see getting involved as an opportunity to learn about what’s happening in the market. The rest are taking a wait-and-see approach.

Many getting on board still need to be set up, and “the queue at the Federal Reserve is starting to get full,” says Fisher. But she suspects that a year from now, nearly all of the institutions CSI works with will be signed up for at least receive mode.

To say that it is still early days borders on understatement. Donovan is among those who believe the first step for many institutions will be to operate in receive mode. Things won’t get going in earnest until institutions also become senders, on behalf of both their business and retail customers.

Read more:

- Will FedNow and BNPL Dent Credit Card Use?

- What Instant Payments Will Look Like in the Age of FedNow

FedNow Poses a Learning Curve for Consumers

Talking to consumers about FedNow is going to be a challenge. Getting paid faster sounds great, but making payments faster sounds less attractive.

Besides that, bring up instant payments, and “consumers believe it’s already here,” Donovan says. But he suspects they’ll gradually pick up on the advantages, given that FedNow is on 24/7/365 and operates even when banks and credit unions are closed.

For now, the service seems too abstract to lend itself to a marketing pitch in retail banking. “It’s not an interface. It’s not an app. It’s not a website,” Donovan says. People won’t see a FedNow logo on their mobile phone.

Who Dat?:

The term 'FedNow' isn't one consumers are likely to see much, and its irrevocability is going to be an adjustment. Sending money with this service is the equivalent of handing over a wad of cash — no stop payments, no reversals.

CSI’s Fischer says the service could gain traction with consumers similar to the way Zelle did, with banks and credit unions incorporating the functionality into their own mobile apps. “FedNow is not going to be a consumer term,” she says.

Nor is it going to replace the options already out there. Gould suggested in the podcast that asking for instant payments will be like going to a UPS Store or an ecommerce site and choosing the speed of service you want based on need and price.

Gould also said instant payments will be an adjustment for consumers because the service isn’t just about speed and urgency, but also finality and irrevocability. It’s the equivalent of handing over a wad of cash — no stop payments, no givebacks, no reversals.

See all of our latest coverage of payments trends.

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

What Would Entice Consumers to Use FedNow?

There are a variety of uses for instant payments that will appeal to consumers, predicts Joshua Siegel, a partner at Capco, a digital transformation consulting firm.

For example, gig workers, a growing segment of the U.S. workforce, could be paid right after every job, rather than waiting for their money. The value of that can’t be underestimated, given that nearly a third of 18- to 29-year-olds depend at least in part on gig income, Siegel says.

Major transactions that depended on cashier’s checks, wires and such would be ideal use cases. Buying a car over a weekend could be simplified. Taking advantage of an investment tip that requires moving cash from a deposit account at one institution to a brokerage account at another institution could happen instantly, even on a weekend.

In a sense, the potential benefit for the consumer is that their money will no longer sleep. That will be an adjustment even for younger consumers and a major change in thinking for Baby Boomers and Gen Xers.

Siegel suggests bill pay as one angle for banks to use. “Consumers usually want to pay their bills at the last possible minute, and many of them now go to their service providers’ websites to make those payments,” he says. Some providers make money off this consumer proclivity by charging for the service of treating such transactions as if they had happened instantly.

“Banks want to repatriate that volume, to bring the customer relationship back,” Siegel says. Being able to demonstrate that the bank or credit union can facilitate payments at 11:59 p.m. when they are due at midnight would be a selling point.

Crone, the payments analyst, says that bank bill pay has long been plagued by a slow turnaround experience and that “banks never offered expedited payments to consumers.” He agrees that ubiquitous availability of instant payments could breathe new life into bank bill pay, but says that there is a great deal of technical work to be done before that can be made a reality.

Experts also expect aspects of digital wallets and pay-by-bank functions to be enhanced once FedNow gets wound into the industry.

One skeptical note here: “Consumers never pay extra for anything,” says INB’s Donovan. He suspects they won’t want to pay to avail themselves of faster payments either. Attempts to monetize innovations such as mobile banking over the years have only ended in frustration for bankers, he notes.

Read more:

- ‘It’s Game On:’ Paze’s Push to Reshape the Future of Digital Payments

- TD Bank’s No-Interest Credit Card: Niche Product or Trendsetter?

Instant Payments Will Be a ‘Must’ for Business Customers

Providing instant payments on the business side will be of more immediate interest for many banks and credit unions because it is something that these customers are already primed for. Money is lifeblood for businesses and keeping it at work at speed is a priority.

“If you’re on the accounts receivable side, you definitely want real-time payment support,” says Crone. He predicts that as institutions adopt FedNow, the laggards will see some of their business customers go elsewhere. It’s that important.

“There’s a yin-yang relationship in all invoice payments,” Crone adds. The yin of accounts receivable is matched by the yang of accounts payable, he says.

People who work in accounts payable rise on their ability to control disbursements, delaying to the last possible moment the transfer of funds. They often attempt to do that while taking advantage of any discounts for early payment.

“This is why so many business invoices are still paid with paper checks. It’s so people can say that the check’s in the mail and otherwise pay at the last minute.”

— Richard Crone, payments consultant

It’s brinksmanship, and even more important now that rates are high again. Crone anticipates that instant payments will be used by people in accounts payable to hug the deadlines even more closely.

“Bankers will be pretty much forced to participate in instant payments now,” he says. “If they don’t, they risk some other bank claiming the feature and the benefits of either charging for it or not charging for it to move market share their way.”

Read more: What Is RfP and Why Does It Matter for Instant Payments?

Redefining CX Through Innovative Social Media Strategies for Financial Services

Learn how Sprinklr is redefining success in the financial sector by harnessing the potential of tailored content and personalized engagement.

Read More about Redefining CX Through Innovative Social Media Strategies for Financial Services

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

What U.S. Bank Says About RTP vs. FedNow

Instant payments will be a modality for business accounts, as U.S. Bank suggested in a blog post on instant payments for businesses. The bank, which is participating in both RTP and FedNow, indicates that it will treat the two systems much like a shipper having a choice of freight carriers.

“At U.S. Bank, clients won’t have to tell the bank they want to send a particular payment through the FedNow service or by the RTP network,” the blog post says. “All they will need to do is instruct the bank to make an instant payment.”

It goes on to say that U.S. Bank “will then use the two rails, in tandem, to offer a seamless instant payment solution with broader coverage than either could provide on its own.”

Competition or coopetition? That may wind up being in the eye of the banking provider.