The digital wallet Paze has a big selling job ahead on multiple fronts: merchants, consumers and financial institutions across the country.

A major summer push aims to get merchants to offer Paze as an ecommerce payment option, and it reveals some new details about the wallet.

Early Warning Services, a company owned by seven of the largest banks in the country, is slated to launch Paze in the fall, just ahead of the holiday shopping season. Merchant acceptance will be key to its success, and the company has published an ebook as a promotional tool.

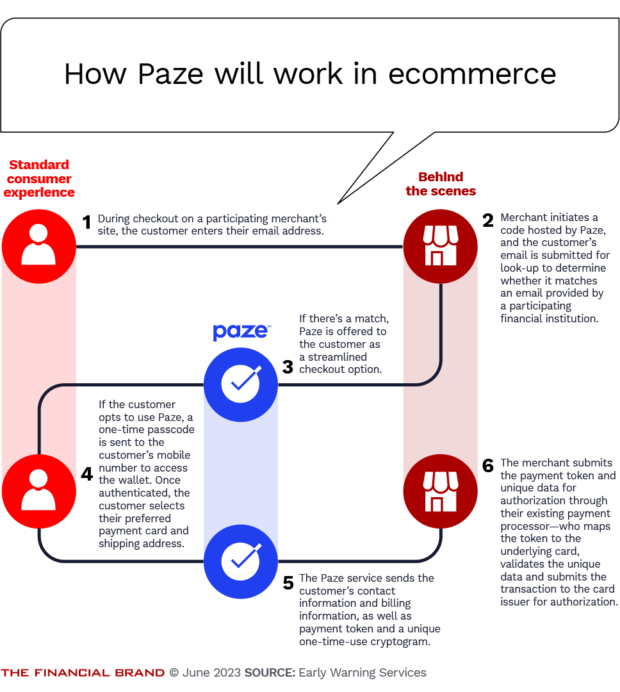

A schematic in the Paze ebook, shared below, explains how the checkout process will work when consumers use the wallet for the first time.

The consumer push comes next, and new data on digital wallets from J.D. Power, also shared below, illustrates how much entrenched competition Paze faces in that effort. PayPal and Apple Pay especially have a huge head start.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

Overview of How Paze Works, With Some New Details

Two things set Paze apart from its digital wallet competitors—its ecommerce focus and its foothold with major banks.

Paze is meant to be used only for ecommerce, not at the physical point of sale, though as James Anderson, who leads the initiative for Early Warning Services, has pointed out, the lines between the two are beginning to blur with services such as curbside pickup.

Neither is Paze a product from a single entity, in contrast to all of its major competitors — ranging from phone providers like Apple and Samsung to large fintechs like PayPal and Cash App. Paze will be incorporated from day one into the offerings of the seven founding banks. The group includes U.S. Bancorp along with its Elan Financial Services subsidiary, which issues cards on behalf of credit unions and community banks.

Early Warning Services is encouraging other banks and credit unions to offer Paze, just as it has done with its popular person-to-person payments service Zelle.

To be successful, Paze has a chicken-or-egg challenge to overcome. For consumers to start using it, a lot of merchants will need to accept it. But to add Paze to their payment options, merchants will want to know that a lot of consumers will use it to make online purchases.

Paze has simplified things on the consumer side. Participating financial institutions will pre-load the credit and debit card information for all of their customers into Paze — that amounts to at least 150 million cards at the initial launch. This will spare customers any manual input of card account information.

The ebook for merchants, titled “Paze: Don’t Get Left Behind,” explains the steps for a consumer using Paze. Participating merchants would display Paze as a payment option at the time of checkout. As shown in step 1 below, consumers would enter their email address and, if any of their cards are enrolled (step 2) they would be offered Paze as a payment choice.

If it is their first time using Paze, they will select the card they wish to be their default choice for transactions from among the cards pre-loaded by their bank (or multiple banks).

Paze provides a carrot for merchants to adopt Paze as a checkout option:

“Customers build relationships with you, not with Paze. You can even turn on the functionality to allow your customers to use Paze to establish an account with you.”

— Paze, in a message to merchants

Presumably this step would favor Paze being the default payment choice for that consumer’s account with the merchant.

Making the Case for Paze with Merchants

The Paze ebook touts the advantages of digital wallets generally, arguing that having a digital wallet available at an online checkout can result in a sales lift of 10% to 20%. Digital wallets eliminate the need for consumers to input card numbers manually, avoiding a friction point that can lead to higher cart abandonments.

Paze also makes a case for its digital wallet specifically, saying it offers benefits that competitors don’t for both consumers and merchants. Consumers don’t have to do anything to set up the wallet. There’s no app to download, no usernames and no passwords. For security, Paze tokenizes payment information, so personal data never resides in merchant systems.

The ebook targets banks and credit unions as well. It contends that offering Paze — participation beyond the initial seven banks is expected to be enabled quickly after launch — will “position your financial institution as forward-thinking and innovative.”

As another selling point, it says that Paze’s use of tokenization helps reduce fraud costs.

Read More about Digital Wallets:

- How the ‘Paze’ Digital Wallet Aims to Win Over Merchants and Consumers

- ‘Paze’ or Pass? What to Consider Before Joining the Digital Wallet

- Digital Wallets Could Cost Banks Billions in Lost Payments Income

- Digital Wallets Will Dominate Global Ecommerce Payments by 2025

Assessing the Competition: Paze vs. the ‘Pays’

In an analysis of digital wallets for J.D. Power, Miles Tullo, managing director of banking and payments, wrote that “the future of the digital payments landscape” will be decided in the battle between the banks and the technology players that have gotten a major head start.

“It is officially game-on,” he wrote.

Tullo draws on J.D. Power research for its U.S. Retail Banking Satisfaction Study and its U.S. Merchant Services Satisfaction Study to assess what Paze is up against. He looks at existing wallets from two perspectives, brand awareness and online usage.

Paze must achieve the first in order to enjoy the second. And habit plays a role in payment choices. Even though Paze will be presented as an option at the merchant checkout to credit card and debit card customers of participating banks, they can select a different means of payment.

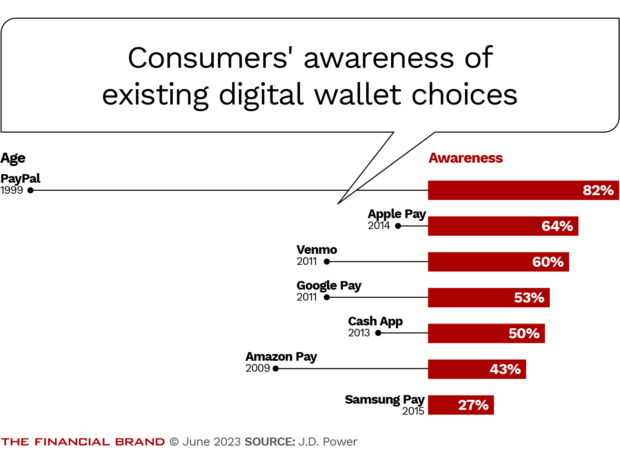

The chart below looks at when the various wallets were introduced and overall consumer awareness of the brand. PayPal, the leader in awareness at 82%, debuted in 1999, nearly a quarter of a century ago. Though it has evolved — the service existed in different forms over the years — that is a lot of time in the market to build awareness.

Even so, tenure by itself isn’t everything.

Apple Pay came on the scene in 2014, but it is already second in brand awareness among digital wallets. Notably, it is ahead of Google Pay, an earlier arrival that launched in 2011. And Amazon Pay, designed to allow consumers to make purchases on non-Amazon websites with their Amazon accounts, has achieved just over half of the brand awareness of PayPal, in spite of its position as one the largest online retailers in the world and its technical prowess.

Read More about Apple in Financial Services:

- Enthusiasm for Apple Savings Account High Among Millennials and Gen Z

- Apple Card’s Newly Launched Savings Account Is Another Brick in the Walled Garden

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Digital Wallet Awareness Skews Younger, Cash App Especially

Tullo produced a special run of data for The Financial Brand to examine awareness levels among consumers based on their age groups.

He found that awareness of digital wallets tends to be stronger among consumers under 40 years old compared with consumers generally. This effect was most pronounced with Apple Pay, Venmo and Cash App. (Cash App, originally called Square Cash, is part of Block.)

Among the younger consumers, 84% said they were aware of PayPal (compared with 82% for all consumers); 73% for Apple Pay (versus 64%); 68% for Venmo (versus 60%); 67% for Cash App (versus 50%); 54% for Google Pay (versus 53%); 45% for Amazon Pay (versus 43%); and 29% for Samsung Pay (versus 27%).

At 27 percentage points, Cash App had the widest age-based consumer awareness gap of the seven digital wallets (67% among the under 40s and 40% for the over 40s). Tullo says this is likely because Cash App’s marketing leans especially heavily on influencer marketing and social media.

PayPal Leads in Online Usage of Digital Wallets

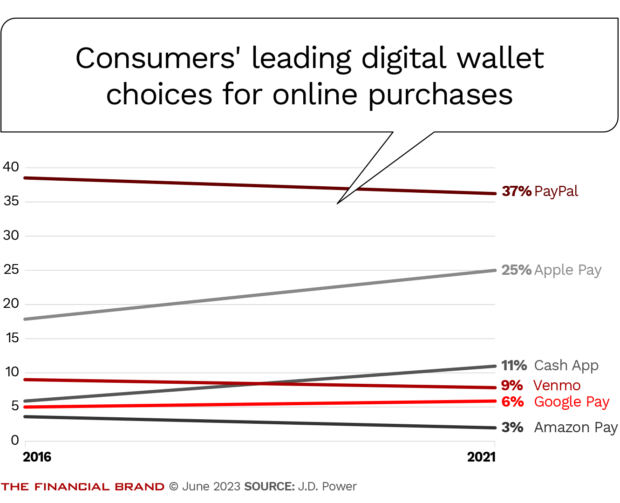

In the J.D. Power research, survey respondents were asked which digital wallets they currently use when making online purchases. PayPal is the leader, as the preferred online option for 33%, while Amazon Pay is favored by only 3%, as the chart below shows. (In-store trends are not shown, but Apple Pay is the leader there.)

The dominance of PayPal likely stems from its longevity and widespread merchant acceptance. During a first-quarter 2023 earnings call with analysts, Dan Schulman, PayPal’s president and chief executive, said that 80% of the top U.S. online retailers accept PayPal.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

‘Wild Card:’ The Rise of Digital Wallet Incentives

One of Paze’s selling points to merchants is the 150 million-strong base of credit and debit card accounts spread among its inaugural group of banks. But whether that unrealized potential can be turned into a genuine advantage remains to be seen.

Just having an entry in the digital wallet race isn’t going to make Paze a winner, Tullo says.

Despite the massive number of individual cards, this doesn’t translate into individual Paze users on a one-to-one basis. Many people have multiple cards, often from multiple issuers. In addition, the plan is for the Paze homepage to enable customers of participating financial institutions to completely opt out of the wallet if they so choose.

Early Warning Services itself will need to spend big on building the Paze brand, according to Tullo. It needs to create awareness before it can even get to consideration.

Tullo believes the consumer push also could entail offering incentives to use Paze.

“The wild card that is likely to start becoming a bigger factor in consumer adoption of digital payments and digital wallet technologies is incentives.”

— Miles Tullo, J.D. Power

At present, most consumers “are stumbling into a provider through a combination of general brand awareness and convenience,” he says. But as incentives become more of a factor in digital wallets, this could change.

The incentives would be for using a specific digital wallet, regardless of the underlying card and separate from any points or cash back that the card pays.

Tullo points out that Google Pay has already been trying to encourage more usage through incentives, though J.D. Power’s research, as shown in the chart above, doesn’t indicate that this has paid off yet for Google Pay.

Apple, on the other hand, looks to be a more formidable player, as it continues to build out its “walled garden” of financial services on the foundation of Apple Pay, Apple Cash, Apple Card, and the two most recent additions, Apple Pay Later, a buy now, pay later offering, and Apple Savings, a high-yield savings account. Apple Card has cash back incentives called Daily Pay, which users can opt to have deposited automatically into the savings account.

Apple Pay and the rest of the family all live within the world of the iPhone, the biggest single-hardware base among digital wallets. There’s no “bankphone” and no need for one in an ecommerce-only program. On the other hand, there is no constant reminder that Paze is a payment option, just an icon among other icons seen whenever someone is making a purchase from a participating merchant’s website.

If Paze begins to scale, then incentives are likely to gain more momentum among digital wallet providers, according to Tullo.

What the individual banks may have in mind to promote Paze remains to be seen. Of the initial seven, only JPMorgan Chase has posted information about Paze for customers, and even that is not much. Its Chase Bank website has only a short FAQ page going over the basics.

As with some of the other digital wallets, there is a dual status for consumers, a relationship with both the card issuer and with Paze itself. Chase’s FAQ, for example, notes that managing Chase cards on Paze can be done through Chase channels. Managing the overall digital wallet relationship can be done through the Paze website. (There’s no Paze phone app at present.)