Banks and credit unions will both step up their participation in instant payments in 2024, but many may wind up leaving money on the table.

That’s the prediction from Cornerstone Advisors in the consulting firm’s “What’s Going On In Banking 2024” report.

Specifically, the study indicates that while a growing number of institutions will sign up for FedNow, launched last summer, and the Real Time Payment Network of The Clearing House, launched in 2017, actual volume of instant payments “won’t make a dent” in overall payments volume for some time.

The study found that most institutions that have joined FedNow, for example, are in receive-only mode.

“As a friend joked on LinkedIn recently, ‘Everyone has a mailbox but no one is sending mail,'” the report says. According to Cornerstone, 86% of banks and 73% of credit unions are in receive-only mode, or plan to be, once they begin participating.

In other words, they aren’t implementing instant payments in a way that will facilitate it becoming a revenue center.

Blowing the Faster Payments Opportunity:

So far, many banks and credit unions seem to be treating faster payments as a commodity service. (Only) about one in five banks plans on commercial-side instant payments to be a revenue generator within three years. Half as many — one in 10 — expect consumer-side instant payments to produce revenue.

Among the credit unions responding, only a handful — 7% — expect instant payments to produce a return on either the commercial or consumer side.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Instant Payments Capabilities Aren’t the Same as Solutions

Ron Shevlin, author of the report and Cornerstone’s chief research officer, says that bankers at a recent payments conference called FedNow a “solution” for customers. Shevlin disagrees, instead describing FedNow as a “capability.” What institutions do with the capability is the point, he insists.

“You don’t price — and sell — capabilities,” says Shevlin. Instead, he explains, an institution should see capabilities as components that can be combined with others to create “products” or “service offerings.” Banks and credit unions will then be able to price and market those combined offerings to the appropriate market segment. That’s when revenue comes.

It will take some time and effort for banks and credit unions to get this right, says Shevlin. And he believes successful product design may require partnering with fintechs.

Read more: How and Why Navy Federal Got Aboard Instant Payments

Instant Payments Snapshot By Institution Type

Cornerstone’s research broke out instant payments data by charter, showing the participation and plans of banks and credit unions separately. The survey sample consisted of 359 institutions, 54% banks and 46% credit unions. Participants ranged in size from $250 million to $50 billion.

Among respondents, 18% of banks and 14% of credit unions are already offering real-time payments in some fashion. The study found that an additional 32% of banks and 36% of credit unions plan to implement real-time payments in 2024, with 28% more banks and 34% more credit unions planning to adopt it in 2025 or beyond. At the time of the study, 20% of banks and 16% of credit unions didn’t know when they would get into instant payments. A tiny share of both groups doesn’t plan on adoption.

The study also looked at the organization or organizations that each industry was tapping (or plan to tap) to offer real-time payments — institutions can participate in multiple systems. The Clearing House RTP Network accounted for 23% of banks and 12% of credit unions, while a much higher percentage of both samples seems attracted to FedNow — 51% of banks and 52% of credit unions.

Other vendors’ solutions were being used by 14% of each industry. A good third among both banks and credit unions — 34% apiece — haven’t decided which way they’ll go.

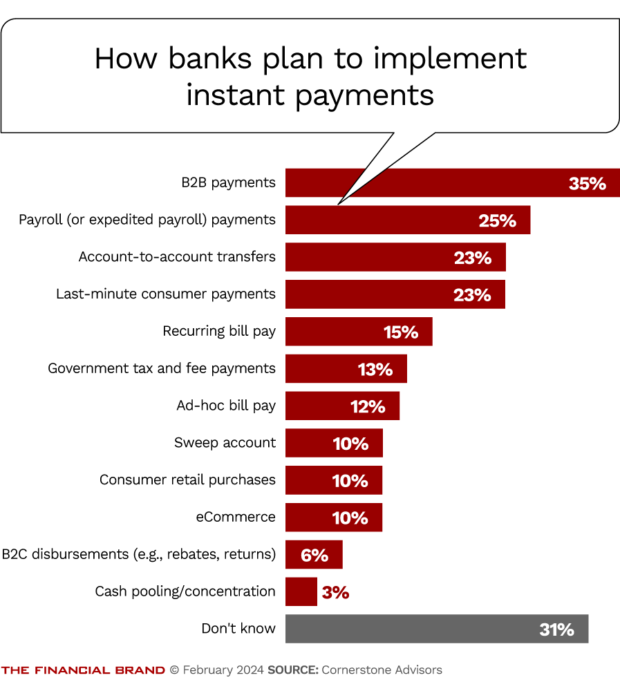

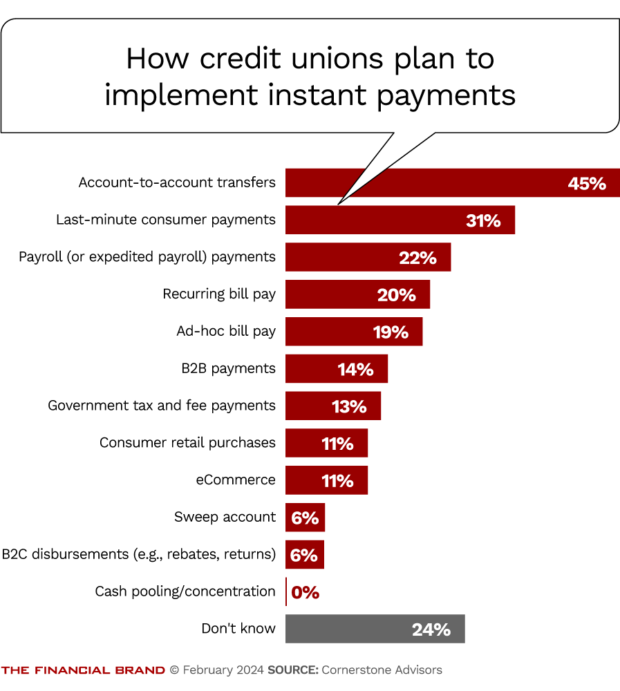

Banks and credit unions differed somewhat in how they are or will be using instant payments capabilities. The top use among banks: business-to-business payments. The top use among credit unions: account-to-account transfers. These and other use cases are detailed by industry in the pair of bar charts below.

Read more:

- FedNow Turns Instant Payments into a Must-Have for Banks and Credit Unions

- Instant Payments Are No Longer a Nice-to-Have. Are Your Core Systems Ready?

- Instant Payments: How to Navigate the FedNow Revolution

What’s Getting in the Way of Making Money from Real-Time Payments?

During a webinar about the research, Shevlin said that he agreed that consumer-side instant payments might not be a revenue driver; “The commercial side, the B2B side, is where the opportunity and action is.”

Steve Williams, president at Cornerstone, thinks a couple of factors have hobbled thinking about instant payments as a money maker.

One is that banks still make a lot of money on wire transfers. “This is a major killer of wire-transfer revenue,” says Williams. Giving up a sure thing for a possibility doesn’t have much appeal. Other research indicates that businesses would be willing to pay something for speed — say, $2.50 for every $1,000 sent.

Another factor is nonbank competition. Williams thinks some banks and credit unions expect fintechs like Chime and neobanks to start offering instant payments as a freebie to consumers as a way to build market share.

“They think they won’t be able to charge [consumers] for the convenience because there will be too many innovators wanting to use it” for promotion, says Williams.

Williams is convinced that the key to make real-time payments pay is to design solutions specific to market niches, rather than to cobble together generic real-time payment solutions. He says restaurants would be fertile ground. Medical claims processing would also be improved via instant payment solutions.

Read more: As Business Payments Go Digital, Banks Must Keep Up with Fintechs

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Build Faster Payments Offerings with an Eye on Pricing

The report also suggests that institutions should be thinking more holistically: “Commercial banking clients — small businesses, in particular — don’t simply want ‘faster payments.’ They want better cash management, simplified payments processing, automated invoicing, less cumbersome accounting processes, etc.”

Cornerstone predicts that smarter institutions will start making more of commercial-side faster payments by the end of 2025.

The company makes several suggestions for making more of the opportunity. Among them is getting creative with pricing options. Variations aren’t infinite, the report says, but there’s room for ideas beyond bare transaction price lists. One idea from the consulting firm is to adopt subscription pricing — unlimited instant payment transactions for businesses willing to pay a monthly fee. Tailoring pricing to the needs of different types of businesses is another option.

Williams thinks fintechs will move faster with instant payments than traditional institutions and believes staying in sync with potential partners will be critical.

There’s also this reminder in the report: Accenture research found that while six in 10 businesses favor banks for faster payments service, nearly 40% would prefer to obtain it from fintechs or big techs.