Caution lights going off among bank credit cards suggest that lenders in general and card lenders specifically will have to watch spending trends closely as the return of inflation continues to exert new pressure on purchasing patterns.

As consumers lean more and more heavily on credit cards, the effects of marketing efforts hatched during the pandemic and before may produce unpleasant side effects. And the impact of credit limit increases intended to promote “top of wallet” usage, a continuing marketing practice especially in higher credit tiers, must be closely monitored in the current economic uncertainty.

Consumers are leveraging their existing credit account lines more than ever, even as the cost of credit has accelerated, according to TransUnion’s credit insights report for the third quarter of 2023. The company finds that utilization of bank credit card lines has mostly returned to pre-pandemic levels, even as more and more card accounts have been approved in recent quarters. Many are seeking additional cards to expand credit they can draw on.

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

Looking at Bank Card Trends Both Macro and Micro

Aggregate bank credit card balances have risen 15% year-over-year in the third quarter, the credit bureau reports, to a record $995 billion, according to TransUnion. (The higher $1 trillion-plus card balances reported by the Federal Reserve earlier this year reflect spending on credit cards including additional issuer categories.)

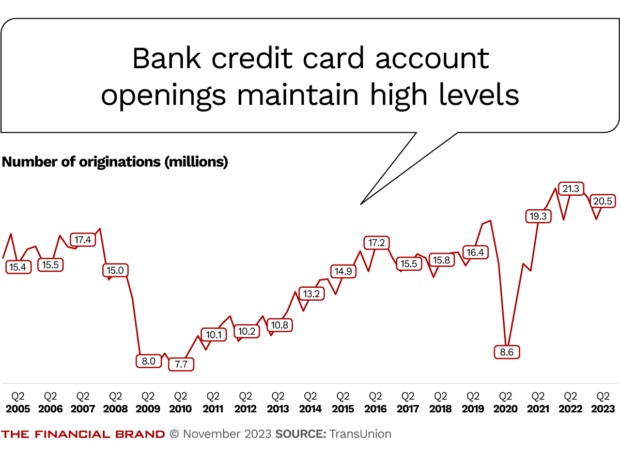

TransUnion reported a slowdown in the pace of growth of new bank credit card accounts for the quarter, compared to the second quarter. But new account openings continued to be at an elevated rate: In the second quarter 2023 20.5 million accounts were opened, down 3.8% from the 21.3 million a year earlier, but still far above the 8.6 million opened in the second quarter of 2020. This trend is illustrated in the chart below. (TransUnion issues account origination figures with a one quarter lag to account for reporting time.)

Both trends — increasing balances and high account openings — will continue for some time, predicts Charlie Wise, senior vice president of global research and consulting at TransUnion. The company’s analysts contend that high interest rates and higher-than-expected costs for goods and services are squeezing the American pocketbook and driving more desire for credit. This compounds the impact of increasing levels of consumption.

“The higher costs that are with us today are going to be with us for quite a while, even as the inflation rate comes down,” says Wise in an interview with The Financial Brand. “We’re still paying $12 for a sandwich we paid $8 for a few years ago.”

The average outstanding credit card balance per consumer hit $6,088 in the third quarter, an 11.2% increase over the year earlier and an increase of 20.1% over the third quarter of 2020, when credit card usage depressed due to pandemic isolation and ready cash from government stimulus payments.

Balances in the third quarter were considerably different among credit tiers: prime and near-prime averaged $8,900, super prime just $3,800. Balances held by subprime borrowers recorded the highest year-over-year growth rate— 29.8% — to an average of $5,200.

Card Normalization Has Finished:

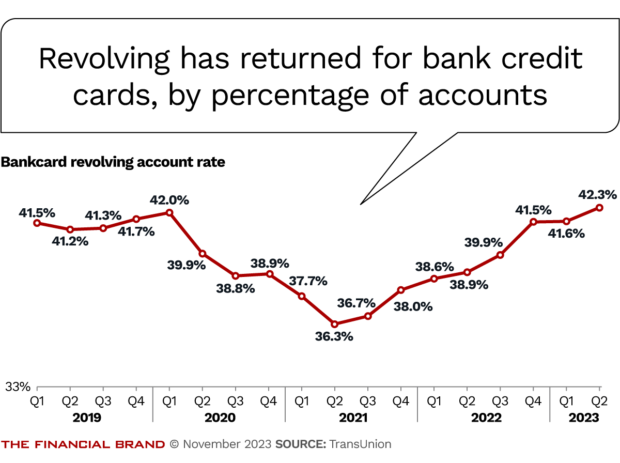

TransUnion research finds that average account balances have returned to pre-pandemic levels in all credit tiers.

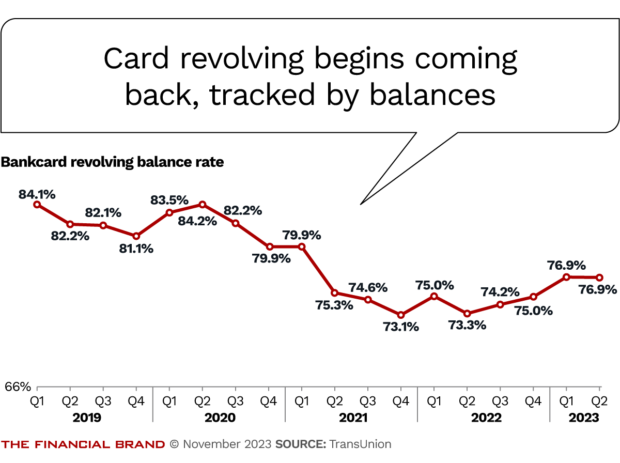

TransUnion reports that the percentage of accounts with unpaid balances, which had declined significantly during the pandemic, has bounced back and now slightly exceeds pre-pandemic levels — even though the percentage of users whose balances revolve remains below pre-pandemic levels. (“Revolvers” are cardholders who typically let their balances roll over, accruing interest, while “transactors” usually pay off their balances when due.)

Read more: Credit Cards Now: Everything You Need to Know From the CFPB’s Latest Report

Meanwhile Delinquency Rates Are Rising

TransUnion reports that overall portfolio risk has decreased as bank credit card issuers have trimmed the percentage of originations for below-prime consumers, while originations for super prime consumers has increased.

However, there are risks already embedded in card portfolios as the result of past spending and card issuer marketing.

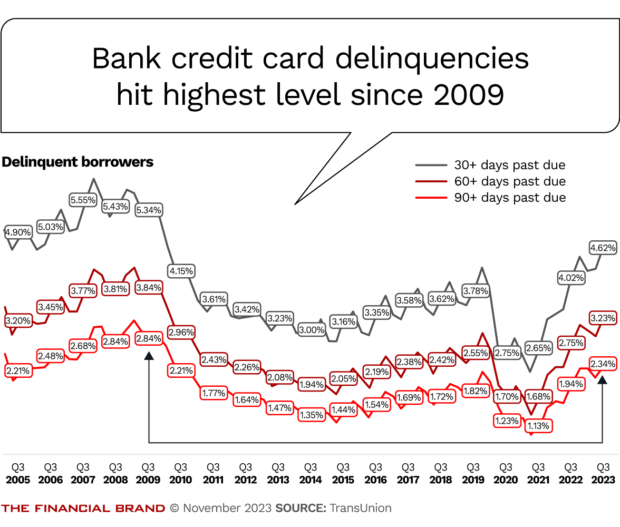

Delinquency levels are rising, though they have not yet reached the levels seen during the 2000s. (See the chart below.) Cardholders 30+ days past due hit 4.62% in the third quarter, the highest third-quarter level since 2009. Holders 60+ DPD hit 3.23%, the highest since 2009. And the most severe delinquencies, those 90+ DPD, hit 2.34%, the highest level in that tier since 2009.

“Delinquencies continue to tick up on the card side,” says Wise. “This is something we’ll be watching really closely,” particularly as payments on student loans resume.

During the pandemic and immediately afterward, many consumers saw their credit scores and their place in the hierarchy of credit tiers improve, thanks to government aid, rent moratoriums, student loan freezes and more.

Wise says this resulted in major improvement for many in 2020-2021. The good news is that many consumers are hanging onto their gains — so far.

“We have not seen a wholesale reversion of consumers back to where they were,” says Wise. In part that’s because any change will be gradual and also because some people, gaining more experience with credit, were able to clean up their credit accounts. How scores will settle out remains to be seen.

Read more:

- Credit Card Lenders Should Look Past the Almighty Credit Score for Growth

- NerdWallet Launches into Banking with New NerdUp Secured Credit Card

- Why U.S. Bank Is Elbowing into the Competitive BNPL Space

Factors Bank Credit Card Lenders Should Watch For

While the average bank credit card balance has been growing, a related number has also been going up: the credit limit that issuers give each card holder, subject to adjustment.

In the third quarter, the average new account credit lines granted by single issuers came to $5,777, up 15% year-over-year and 44% above the 2020 level.

There are two behaviors that lenders must monitor.

First, unlike many other types of consumer credit, it’s increasingly common for people to have multiple credit card accounts simultaneously.

Many cardholders tend to have a “top of wallet” choice that gets the majority of their buying volume. Other cards in their wallet may have significant credit lines attached to them, but those lines may rarely be tapped much — normally.

However, says Wise, if a consumer suddenly begins drawing significantly on a secondary card’s credit line, that can be a warning sign that the consumer is getting in over their head, or that they’ve maxed out their usual go-to card.

“Do you have dormant accounts that have suddenly awakened?”

— Charlie Wise, TransUnion

Second, watch out for the creeping use of generous line increases given out in more buoyant times.

Wise explains that many issuers use hefty credit line increases as a form of marketing. People like having a card on them with a big slug of credit attached. The psychological appeal of buying power can be strong. It’s a tried-and-true method of building card volume, according to Wise. That fat credit line and its card become the card used for special big purchase or that fancy night out, he explains.

TransUnion figures indicate that usage of bank credit card lines has been ticking up since falling to a low of 19.8% in the third quarter of 2021. In the third quarter of 2023, it rose to 22.3%. This is more in line with usage between 2012 and just before the pandemic.

Going forward, Wise suggests lenders need to keep an eye open for signs of credit card triage. This is when consumers get into difficulty making payments and begin choosing which card to pay down and which ones to roll over. Generally they do their best to keep the one they consider indispensable in good standing. Wise says understanding this dynamic is becoming more important than ever for managing card portfolios.