As more consumers get overextended and delinquencies tick up, credit card lenders tend to pull back. But they’re up against a math problem.

If they approve fewer credit card applications amid rising delinquencies, “the percentage of delinquent loans will increase,” says Charlie Wise, TransUnion’s senior vice president of research and consulting.

“If you want to protect your portfolio, find prudent growth opportunities as opposed to shutting off lending,” he advises.

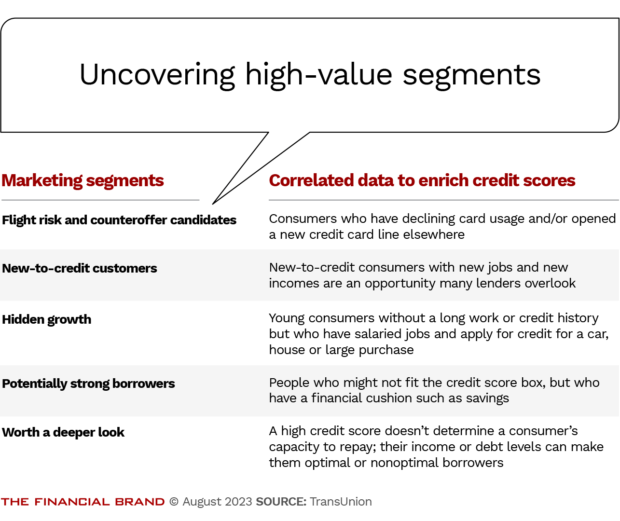

To assess how to find this growth, Wise details some ways to go beyond using the credit score as such a blunt instrument. He suggests thinking strategically about how to surface good risks that may be hidden in key customer segments, like those who are new to credit.

He also offers an overview of the factors that make credit cards such a hot opportunity at the moment.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Secured Lending Is Not an Option for Most

Rising energy, food and housing costs have reduced consumer spending power. Most consumers looking to shore up budget shortfalls have only two options: credit cards or home equity lines of credit.

Cash-out refinances are of little interest, according to TransUnion’s “Mortgage Credit Industry Insights Report” published in May 2023. Most people who could refinance their mortgage did so during the past three years. Only under duress will they abandon that historic low rate to access cash.

For those taking out new mortgages, higher interest rates and higher home prices have driven payments far above 2021 levels. And “increasingly fewer consumers can afford to buy,” Wise says.

These dynamics make home equity lines of credit a bright spot. Higher home prices mean all those homeowners who are staying put have seen the value of their home increase, creating more equity to borrow against.

But there’s a hitch with the lines of credit: the vast majority are floating rate.

As rates have continued to rise in 2023, demand for HELOCs, while still high, has cooled compared with 2022.

But for most of those needing to meet budget shortfalls or making large purchases, this is one of the few alternatives to credit cards in the near term.

Read more:

- TD Bank’s No-Interest Credit Card: Niche Product or Trendsetter?

- How Citizens Bank Became the U.S. Home Equity Leader

The Boom in Credit Card Demand

The same economic conditions that have caused mortgage volume to nosedive are creating a need for credit in unsecured lending, such as credit cards and personal loans, Wise says.

Credit card balances rocketed to a record high in the second quarter, surpassing $1 trillion for the first time ever, according to the Federal Reserve Bank of New York. Balances increased by $45 billion, or 4.6%, from $986 billion in the first quarter. This marked the fifth consecutive quarterly rise.

In comparison to other debt categories, credit cards also had the most pronounced worsening in performance during the second quarter.

Delinquency rates on credit cards had been extraordinarily low in the wake of the pandemic, but have now returned to pre-pandemic levels, New York Fed researchers said in a blog post. Even so, consumers remain resilient for the most part, they said.

“Despite the many headwinds American consumers have faced over the last year — higher interest rates, post-pandemic inflationary pressures and the recent banking failures — there is little evidence of widespread financial distress for consumers.”

— NY Fed researchers in a blog post

During the pandemic lockdown, consumers spent less. Many also received additional income from government stimulus efforts. Unsecured debt balances dropped. Now, government support has ended, inflation is taking a toll, and savings accounts are dwindling. So more consumers need to borrow.

“The cost of everything is sharply on the rise, including everyday, vital necessities like gas, electricity, heating, and rent,” Wise says. “When the cost of these increases by 20% to 30%, you’re almost guaranteed there will be some tightness in bottom-line budgets.

“Unfortunately,” he adds, “this is exactly when lenders start tightening their standards.”

Analysis Beyond Credit Scores Facilitates Safe Growth

As financial institutions tighten lending standards, they naturally shift their focus to borrowers with higher credit scores. But a singular focus on credit score may cause them to miss borrowers who can and would repay what they borrowed, Wise says.

“I think this is where we get into the question of ‘Is the credit score the single point of truth about a consumer?'” he says. “In my opinion, it really should not be in many markets.”

Institutions need to push deeper into their data, especially data gathered during the application process, to know which consumers are more vulnerable and which are more resilient.

“It is an art,” Wise acknowledges. But, “a credit score alone isn’t always the best indicator. It doesn’t tell you the consumer’s income or debt levels — critical aspects for determining who has capacity to pay and who doesn’t.”

Banks and credit unions “must overlay on top of credit scores to get deeper insights that enhance your ability to identify borrowers who may appear just ‘OK’ from a credit score perspective — but actually represent prudent lending decisions and smart additions to your portfolio,” he says.

“A credit score alone isn’t always the best indicator. It doesn’t tell you the consumer’s income or debt levels — critical aspects for determining who has capacity to pay and who doesn’t.”

— Charlie Wise, TransUnion

Credit scores also miss borrowers who are at higher risk of default, Wise warns. Consumers can have a sufficient credit score but have significant unreported debt-to-income ratios.

One example is buy now, pay later usage. “In some instances, they can get no interest money if they pay in four or five installments,” Wise says. “Plus BNPL services often don’t require a credit report. In many markets, this data is not yet reported to credit bureaus, so it doesn’t impact a consumer’s credit score.”

In the United States, the total value of purchases made through BNPL in 2022 was an estimated $1.64 billion, according to ResearchAndMarkets.com.

Read more:

- How To Win Over the 45 Million Customers Most Banks Neglect

- Revolvers vs. Transactors: How to Optimize Credit Card Marketing

Credit Profiles as Marketing Segments

Marketing departments at financial institutions are uniquely positioned to translate credit profiles into target audiences for a campaign, Wise says. This is especially true for consumers who are not as impacted by inflation or who have a more substantial financial cushion, he adds.

“The post-pandemic recovery and corresponding jobs reports also suggest people are headed back to work or beginning work for the first time. This could mean someone without a long work or credit history is looking for credit for a car, house or large purchase as they start out on their financial journey,” Wise says.

“Lenders need to make informed decisions on these consumers as they enter the workplace and credit market. New-to-credit consumers with new jobs and new incomes are also an opportunity that lenders overlook simply because they’re invisible on most common reports.”

Institutions looking to sustain growth in their credit card portfolio also must play effective defense.

The competition for new credit cardholders is high, which often stirs aggressive credit card marketing tactics, Josh Turnbull, vice president of card and banking at TransUnion, said in a Banking Transformed podcast.

Institutions can use credit monitoring to head attrition off at the pass, added Craig LaChapelle, TransUnion’s vice president of market development, in the same podcast.

LaChapelle shared how he had opened a new credit card line, which offset how much he used his primary credit card from a different company. The latter company noticed. “And guess what?” he said. “They reacted impressively and quickly with a counteroffer on a new type of card as well as new incentives.”

If cardholders indicate they might be getting ready to stop using their credit card — often observable in declining usage — LaChapelle says issuers “can respond with usage offers or cross-sell offers based on what they’ve seen in terms of traditional spend and how that spend has changed.”

See all of our latest coverage of credit card marketing.

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Give Up on ‘Spray and Pray’ Credit Card Marketing

Turnbull anticipates issuers will have to market smarter and become more innovative to attract and retain high-value credit card customers.

“How do you stand out from the crowd when you’re trying to get someone to come on to your card? How do you make that offer stand out?” Turnbull asks. “How do you use the data to demonstrate to that consumer that you understand them, you understand their needs, and make sure you’ve matched the offer that consumer?”

He says some credit card issuers tackle this well, while others fall short and lack the know-how to adequately put their aggregated data to work.

As a credit card customer, he sees this regularly. He’s a “transactor,” meaning a cardholder who racks up high balances, which he then pays off in full every month. But, Turnbull says, he gets credit card offers that aren’t relevant to him all the time.

“It’s a total waste of money for the person sending those offers to me,” he says. “It demonstrates that a financial institution doesn’t understand who I am and doesn’t understand my needs.”