The report: The Consumer Credit Card Market

Published: October 2023

Source: The Consumer Financial Protection Bureau, which inherited responsibility for the biennial report from the Federal Reserve Board

Why we picked it: The CFPB provides an exhaustive review not only of credit card industry trends, but also the evolving nature of unsecured consumer credit. The report pulls together the CFPB’s own data and analysis, input from the public and credit providers, and media citations. Most sections begin with general observations and then drill down deeply enough to please a policy wonk. In many places of the 175-page report, the bureau compares recent conditions and consumer behavior to pre-pandemic years.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Executive Summary of the CFPB Report

Three out of four American adults have at least one credit card account. Nearly 4,000 companies issue cards in the U.S. today, working with dozens of co-branded merchant partners and the four major networks (Visa, Mastercard, American Express and Discover). The top 10 issuers account for 83% of overall credit card debt, but the next 20 in size are increasing their market share.

While much has been made about credit card debt exceeding $1 trillion for the first time at the end of 2022, the report indicates that when outstandings are adjusted for inflation they remain below pre-pandemic levels.

The report digs into nearly everything that makes the credit card world spin — consumer usage patterns, interest and fee structure, revenue and profitability, marketing, competitive trends, rewards, the cost of credit to consumers, and debt collection.

A new section in this report — CFPB’s sixth — examines the dynamics of the credit card market, offering a detailed summary of all the key players and how their activities relate to each other.

A red flag in the report concerns “persistent debt:” “With the average minimum payment due increasing to over $100 on revolving general purpose accounts in 2022, more users are incurring late fees and facing higher costs on growing debt. We find one in ten general purpose accounts are charged more in interest and fees than they pay toward the principal each year, indicating a pattern of persistent indebtedness that could become increasingly difficult for some consumers to escape.” [Emphasis added.]

Read more: The Coming Credit War as Gen Z Finally Embraces Plastic

Key Takeaways about the Credit Card Market

• Approval rates for new credit card accounts had been falling, year over year, from 2015 to 2020. That trend reversed in 2021 and 2022, fueling the recent rise in total new credit available. The average size of credit lines for new accounts has not shifted much.

• Interest income remains the main revenue source for major bank card programs, followed by interchange income.

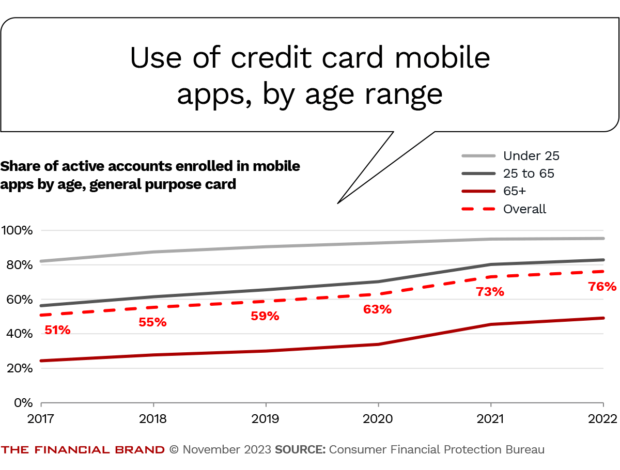

• Three in four general purpose cardholders are now registered users of issuers’ mobile apps.

• Third-party comparison sites like Credit Karma and NerdWallet are producing a lower portion of credit card applications than pre-pandemic, though they remain a significant producer for issuers. Comparison sites generated about one-fifth of the applications for general purpose cards from 2020 to 2022, down from 28% in 2019.

• The use of artificial intelligence got mixed reviews from the CFPB. “The development and implementation of technology marketed as AI has the potential to improve the customer experience, but also carries some risks for cardholders,” the report says. The CFPB criticized AI-driven chatbots in particular, saying they pose problems for consumers, including inaccurate information, inability to reach a human and the sheer volume of wasted time.

• The report identifies several emerging trends — discussed in more detail below — including an increase in balance transfer offers and in soft pulls for credit card applicants instead of hard pulls.

See all of our latest coverage on payments.

Our Take on the CFPB Report

What we liked: The report pulls together a great deal of data in one place. But even better, it often discusses what all those numbers show in a way that makes them more meaningful and highlights what the trends are. In multiple places the CFPB concludes sections with a cautious note along the lines of “we’re worried about X in this area and we’re going to be watching card issuers.” No one can say they weren’t warned.

What we didn’t like: The CFPB frequently presents charts without clear sources noted. Early on, there are references to the various places where the data in the report comes from, but indicating explicitly what the data source is on every chart and table would have been helpful.

Things that made us go “Hmm:” “Many cardholders with subprime scores are now paying 30 to 40 cents in interest and fees per dollar borrowed each year.”

Also this: The average rewards-earning card account redeemed $167 in 2022. As low as that is, it’s a 44% increase over 2020’s $115.

Read more: Why JetBlue Cards Soar Even as Reward Satisfaction Falls

Balance Transfer Offers Make a Comeback … But

One of the meatiest parts of the report is Chapter 6, “Practices of Credit Card Issuers,” which runs 60 pages, or roughly a third of the report. This is full of interesting data, with a section on balance transfer offers standing out.

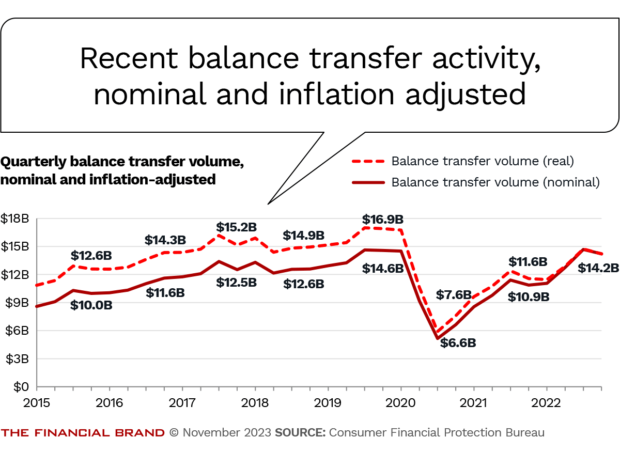

The CFPB notes that balance transfer offers and consumer use of them began to fade during the pandemic. That’s because card issuers were less interested in buying market share at the time, given their worries about the economy.

However, balance transfers have been approaching 2019 levels again. (The chart below shows the trend before and after adjusting for inflation.)

Balance transfer offers become more attractive to consumers when interest rates are higher. The report points out that borrowers who set out to reduce their debt can gain ground with a promotional balance transfer rate, though typically there’s an upfront fee for transfers to a new credit card.

But the resurgence in balance transfer offers may not continue, based on private-sector marketing monitoring made available to the CFPB for the report.

“Issuers may be pulling back on balance transfer offers, possibly due to rising interest rates and the potential for consumer financial stress as borrowing costs increase.”

— CFPB credit card report

Read more about payments:

- Paze Digital Wallet Launch Delayed Until Early 2024 – Here’s the Plan

- Could ‘Amazon One’ Palm Payments Get Upper Hand On Digital Wallets?

Credit Card Lines Now Have More Flexible Uses

Multiple parts of the report look not just at credit cards but also products that expand their use or that compete with them, such as buy now, pay later programs, point-of-sale installment plans and personal loans.

A trend that appears to be gathering momentum — and something that The Financial Brand has traced as well — is credit card lines being used for more than just card purchases and cash advances. Some issuers allow cardholders to tap the credit line for other forms of borrowing, including installment loans, variations on the theme of buy now, pay later, or personal loans.

This typically can be done online through the card account itself. For example, a purchase made on the credit card can be switched afterward, whether online or in the mobile app, to buy now, pay later financing instead.

One of the newer wrinkles is installment plans through the cards that can be activated at the point of sale, rather than after the fact. Multiple issuers are running a version of this with Amazon.

In 2022, about one in 10 of the card-linked installment plans were initiated at the point of sale, according to the CFPB report.

That said, there’s not much volume in these card-linked installment plans overall, according to the CFPB. Of those who do use it, they tend to set up only one plan at a time, though some heavy users have three or more plans going simultaneously.

Read more: BNPL’s Dark Side: Younger Consumers Face Credit Trouble Ahead

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Emerging Trend: Soft Pulls for Credit Card Applicants

Consumers often worry that too much shopping around for a card will damage their credit ratings. The report notes that there is a negative impact, traditionally, with credit card applications, but not with mortgage applications.

For this reason, one of the key selling points of buy now, pay later providers has been that they would not do a hard pull of potential borrowers’ credit records.

Some credit card issuers — among them Apple Card and Discover — also use soft pulls. The report indicates this is a growing practice.

However, the CFPB expressed concern that creditors using soft pulls often reveal to applicants only that they have been approved or denied, without providing a precise annual percentage rate or credit line. Disclosing those two factors “could provide consumers with an important means of comparing credit card pricing and credit line amount without negatively impacting their credit scores.”