More than any other factor, rewards programs for credit cards drive usage and interest in signing up for new accounts. But research by J.D. Power indicates that rising credit card debt and the continuing deterioration of consumers’ overall financial strength have tainted how satisfied people are with their card rewards.

Among the seven factors that the research covers to assess overall satisfaction with cards, the rewards people earn came in dead last.

The annual study separated satisfaction with rewards earned from satisfaction with rewards redemption for the first time. The latter scored higher.

Getting a handle on any dissatisfaction with rewards is critical to issuers because, as J.D. Power found in its 2023 U.S. Credit Card Satisfaction Study, the leading reason why consumers switch to a new card is to enroll in a better rewards program.

A 2022 study by LendingTree found that 87% of Americans who use credit cards have at least one that includes some type of rewards program. The most popular choice of rewards was cash back (71%).

J.D. Power found that dissatisfaction with rewards programs was especially strong among cash back cardholders.

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Satisfaction with Credit Card Rewards Deteriorates as Debt Rises

Several recent studies show that the level of credit card debt among U.S. consumers has surpassed $1 trillion, which is a record. J.D. Power’s study found that just over half — 51% — of all American credit cardholders now revolve their card debt. And among cardholders who are classified as “financially unhealthy” that percentage is even higher — 69%.

Consumers’ frustration with their rising debt level and their overall increased dependence on needing credit cards to make ends meet has made them look askance at what they are getting as rewards.

Card marketers have been working very hard to come up with new features and benefits, but lately they haven’t gotten the traction for it that they expected.

“Consumers have continued to increase their expectations around rewards and grown used to getting something back for using their credit cards,” says John Cabell, managing director of payments intelligence at J.D. Power in an interview with The Financial Brand. “What used to be an amazing 2% cash back offer is now table stakes.”

Cabell notes that some issuers are upping the ante significantly, sometimes with additional tie-ins. He says Capital One, as one example, is offering 8% cash back for trips, if they are arranged through the bank’s travel service. Besides increasing the percentages, the purchase categories eligible for cash back has been growing, he says, with multiple institutions adding categories like grocery shopping and dining out to the cash-back-eligible list.

Read More: The Coming War for Credit as Gen Z Finally Embraces Plastic

Credit Cards from Fintechs vs. Traditional Issuers

Perceptions also play a part. Given the ongoing impact of inflation on people’s wallets, and the feeling that those wallets are thinner, credit cardholders are less happy with the same old, same old, as interest rates on their cards climb.

How consumers receive their rewards is another factor in satisfaction.

“For cash back cards the most frequent redemption method is statement credit. That’s not very exciting compared to having a points-mile credit card where maybe you’re obtaining an airline ticket for a trip you wanted to take or obtaining a special discount at a retailer. Something that’s a little more exciting than statement credit.”

—John Cabell, J.D. Power

An interesting wrinkle is that fintech-connected credit card programs tend not to offer rewards and that doesn’t hurt their popularity, according to J.D. Power research. In fact, Cabell notes that fintechs are enjoying success and putting pressure on some aspects of card programs from traditional bank and credit union issuers. The average fintech credit card outpaces bank card programs in satisfaction.

That said, the difference between the primary audiences may be a factor. Many people who apply for credit cards through a fintech are primarily interested in building or re-establishing credit, Cabell says. So, for them, having an account and being able to use it are by themselves big pluses.

The study also found that card customers using fintechs see them as more trustworthy and customer-driven, when compared with how the card customers using banks see their own providers. On the other hand, the fintech issuers are generally also seen as less financially stable than traditional issuers.

Read More: Current ‘Sifts for Gold’ in the Low FICO Scores Banks Shun

Card Issuers Should Promote Payment Plans More Aggressively

The takeaway for banks and credit unions is to focus on the perception of value. Cabell says the availability of payment plans — which are embedded in the credit card payment experience and help save on interest by converting the balance to a short-term, fixed-rate loan — could help with this.

“Traditional issuers have to work with cardholders to build the value perception of their cards,” he says, “particularly in an environment where we have more revolvers and more consumers with debt than those without, because that tends to drain satisfaction.”

He advises issuers to explore marketing the payment plan options that some have added to their lineups. Among the offerings are Citi Flex Pay, Chase My Plan and American Express Plan It. Use of these options — which work much like buy now, pay later within the card credit line — is often at a lower interest rate.

The J.D. Power research shows that when cardholders actually use such payment plans, their satisfaction rating goes up by an average of 102 points — a jump equivalent to 10% of the 1,000-point scale. However, comparatively few consumers surveyed say that they use the plans. Among the institutions in the study offering plans, usage ranged from 9% to 23%.

Yet 41% of the most vulnerable consumers told J.D. Power that they would consider a BNPL plan from a different lender. Some research has indicated that some consumers don’t consider BNPL plans to be debt.

Read More: Credit Cards Evolve Toward All-Purpose Financial Services Accounts

Redefining CX Through Innovative Social Media Strategies for Financial Services

Learn how Sprinklr is redefining success in the financial sector by harnessing the potential of tailored content and personalized engagement.

Read More about Redefining CX Through Innovative Social Media Strategies for Financial Services

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

What Influences Satisfaction with Airline Rewards Cards?

Co-branded airline cards are in something of a separate category. They were seen by survey respondents as rich in benefits and rewards, and they had higher satisfaction levels for both earning and redeeming rewards. However, consumers tended to be especially negative on their terms, including interest rates and fees.

What sets these programs apart is that, in spite of the hard feelings about the cost of credit in these programs, they tend to be sticky, according to the study.

“Airline cardholders are less likely to switch than non-airline cardholders,” the study states, “suggesting they have to tolerate relatively unsatisfying card terms because of their loyalty to the airline,” J.D. Power writes in the study.

“They kind of have to live with the good and the bad,” says Cabell. “They have to be willing to live with the terms and accept a spoonful of bad-tasting medicine for whatever rewards they might be getting.”

Loyalty for airline cards comes down to a blend of several factors. For example, after having built up mileage balances towards a trip, the cardholder has a vested interest in staying with the program, even if their current perception of the airline isn’t what it might have been.

However, overall satisfaction with these programs hinges not only on the card program itself, but the airline providing the initial travel and the resulting mileage credit.

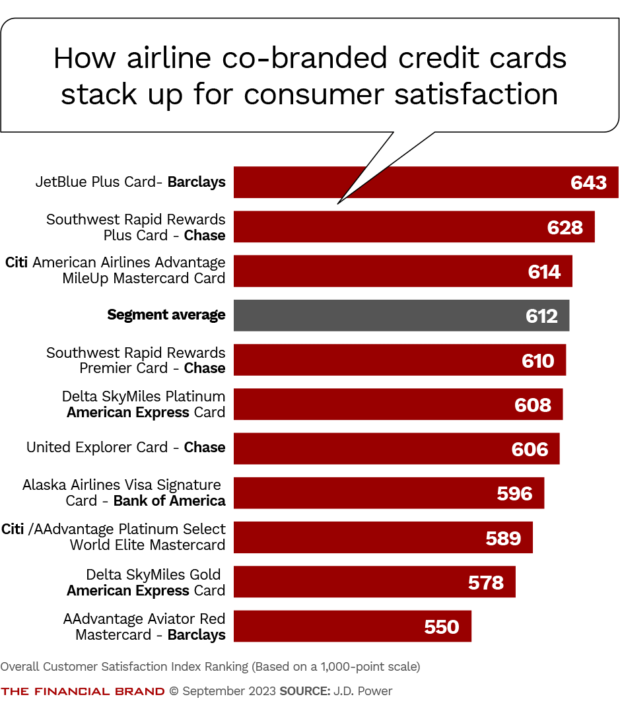

“Airlines really have a big influence on the consumers’ satisfaction with a card,” says Cabell. “JetBlue is the top performer in terms of the airline card segment with the Jet Blue Plus Card [issued by Barclays]. And JetBlue also has the top reputation rating among cardholders of an airline that’s a co-brand partner.”

Note in the chart above that the category-leading JetBlue Plus Card has a satisfaction score of 643 out of 1,000. The AAdvantage Aviator Red Mastercard from American Airlines is at the bottom, at 550, nearly 100 points lower than the JetBlue Plus Card. Both cards are issued by Barclays — but while JetBlue, the airline, tops the reputation ratings, American Airlines is next to last in reputation.

But there’s a blending of sentiment about card-related factors and the airline itself at work. Two other card programs affiliated with American Airlines score more highly, including a Citibank offering that is in third place (614) and another Citi offering that is in eighth place (589).

Read More:

- Will FedNow and BNPL Dent Credit Card Use?

- Apple Pay Later, Tech Giant’s BNPL Entry, Off to Strong Start

Ranking the Co-Branded Credit Cards from Apple, Amazon and Walmart

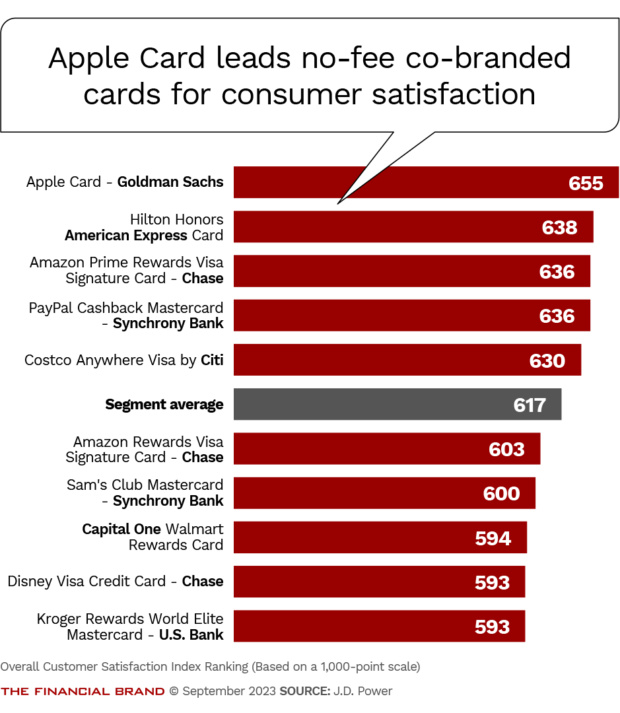

A separate part of the credit card satisfaction study looked at co-branded cards that don’t charge fees. (This category excludes the airline co-branded cards.)

This is worth a look because of some of the brands in the ranking, including programs co-branded with Apple, Amazon and Walmart.

The Apple Card, offered with Goldman Sachs, ranked highest in this category, at 655. Among other strong showings were the Amazon Prime Rewards Visa, offered with Chase, which tied at 636 with Synchrony Bank’s PayPal Cashback Mastercard.