When Amazon and Synchrony Bank introduced a secured credit card offering called Amazon Credit Builder, Margaret Keane, CEO of the bank, portrayed the product as an assistance to lower-income consumers who wanted to shop on the ecommerce site while establishing or rebuilding credit.

“Not everyone buys into the secured-card talking points. On his broadcast, consumer advocate Dave Ramsey attacked the Amazon/Synchrony product.”

Shopping online is easier with a credit card, Keane said, and for lower-income consumers with poor credit, having a secured card represents a way to have credit to do so. Secured cards entail the consumer making a deposit with the creditor, the deposit becoming the credit limit on the card. Unlike a prepaid card, loaded with the consumer’s own cash, the security deposit serves as collateral and the transactions are treated as credit. Pay it back, the theory goes, and you eventually demonstrate creditworthiness and graduate to unsecured credit cards. In a sense it’s an update on the old passbook loan concept.

Keane also said that lower-income consumers could be working multiple jobs, and have little time for traditional shopping, making the convenience of 24/7 ecommerce invaluable to them through the secured card. The card is available both as a baseline Amazon store card and as an Amazon Prime card, which features discounts and cashback benefits.

“The reality is that we have a lot of people in the U.S. who don’t have credit, and can’t get credit,” said Keane. Amazon has been attempting to widen its customer base by bringing more lower-income people into the fold, and there was speculation ahead of Prime Day, held in July, that some of Amazon’s marketing moves were intended to demonstrate the value of Prime accounts to people who would also use the secured card.

Not everyone buys into the secured-card talking points. On his broadcast, consumer advocate Dave Ramsey attacked the Amazon/Synchrony product.

Think about it, he urged his listeners: “A credit card that lets you get into debt with your own money.”

That statement was just a mild introduction to Ramsey’s feelings about Credit Builder:

Addressing his listeners, Ramsey warned, “When you give someone $1,000 so they can lend you $1,000 at 28.24%, you’re stupid, and they’re screwing you and it’s your fault, and it’s their fault.”

Added Ramsey: “Gosh, I hope I wasn’t unclear.”

“This is not a service to poor people,” Ramsey declared. “You should not screw poor people and call it a good business practice.”

Mind you, Ramsey built his name on being anti-consumer credit overall, including traditional credit cards. He believes consumers should strive for a credit score of 0, meaning that they don’t use any credit. (He’s tolerant of mortgages if you pay them off quickly.) He does like Amazon, however, but always uses his debit card when he shops there.

Read More: Why Chase Bank’s CEO Loves Branches, Admires Bezos & Questions Facebook

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Secured Credit Cards Are a Well-Established Niche

While Ramsey is highly quotable, other consumer advocates favor secured cards, at least to a degree. They recognize that for many people not using consumer credit in some fashion in modern times can be difficult. Many routine elements of travel, for example, can be harder without a credit card.

“Visa notes that 45 million Americans are ‘credit invisibles,’ having no score at all because they have insufficient credit history.”

The importance of a credit score goes beyond payments and buying optional goods and services. In a blog, Visa points out that: “Many organizations require credit checks on job applications, impacting the ability of someone with a low-to-no credit score to find employment. A strong credit score provides access to affordable credit that can be used to manage liquidity, meet unexpected expenses, purchase a home or start a small business. ”

Visa notes that 45 million Americans are “credit invisibles,” having no score at all because they have insufficient credit history. Even as alternate credit-granting criteria have begun to be used, a lot remains to be said for demonstrating that you’ve paid somebody back. Among the “invisible” are new immigrants to the U.S., young adults who haven’t used credit before, and people who have been avoiding use of credit for so long that they’ve gone from visible to invisible.

Secured credit cards are actually a longstanding niche product that the Amazon-Synchrony announcement throws a spotlight on. Many financial institutions offer them. The online rating service NerdWallet regularly publishes its picks for the best. It said that the Amazon’s Credit Builder card could be a good deal for some.

The Consumer Financial Protection Bureau’s biennial research indicated most recently that interest in secured cards has picked up considerably. Among issuers surveyed, the bureau found that 21% more applications were filed in 2016 over 2015. It’s been suggested that the advent of third-party card recommendation sites has stimulated more interest in secured card offerings by letting people know they existed. Some institutions tended to keep secured options under the counter, so to speak, in order to make a counter-offer when an applicant didn’t qualify for a traditional unsecured card. While these programs were historically pretty basic, in recent years, the bureau reported, more innovative product design has occurred. While the relatively lower charge volume makes reward programs less dramatic, more institutions have introduced rewards — a feature of the Prime Credit Builder account.

Affinity secured cards have also been introduced, such as U.S. Bank’s Harley-Davidson Visa Secured Card. “Earn rewards without great credit,” the promotions promise. Every 2,500 points earns a $25 Harley-Davidson gift card, redeemable at dealers or on the company’s website. Every purchase made on the card enters the user in a drawing for a free Harley, and members of “H.O.G.” — Harley Owners Group — get entered twice.

Read More: Is Apple’s New Credit Card The Next Big Thing in Banking?

Secured Credit Is a Stepping Stone for Some

Not all consumers who take out secured cards graduate to unsecured credit cards, but research in the 2017 CFPB study on card trends indicates that some consumers do have success.

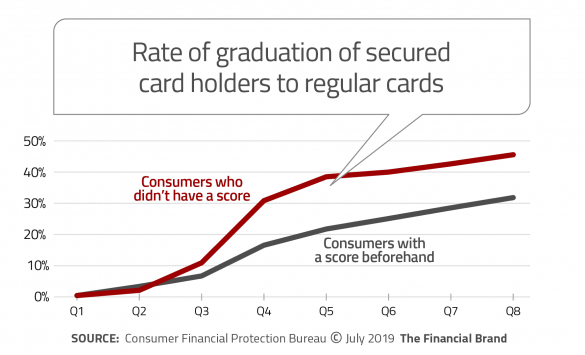

Graduation was common among consumers in the sample CFPB used for its study. “Around one-third of accounts originated to consumers with scores and nearly half of those originated to consumers without scores graduated by the end of their second year on the books,” the bureau reported. Further, CFPB said that additional consumers not judged ready to graduate within two years had “meaningful opportunities to graduate thereafter.”

“Research indicates that one in four previously unscored unsecured card holders turn out to be super-prime consumers. Sometimes they get targeted by outside lenders seeking to poach good customers.”

Even during the time that the consumer has a secured card, there’s an important difference between using a secured card and a prepaid card, even though one is secured by your own money and the other is loaded with your own money. In a paper for the Philadelphia Federal Reserve Bank, Larry Santucci, Senior Research Fellow, points out that purchases made with a secured card are still loans from the card issuer. As such, balances and delinquencies are reported to credit bureaus. By contrast, prepaid cards merely turn cash into plastic and electrons, with no credit performance impact. While their history, going back to the 1970s, was spotted in the early days and subject to legislation, Santucci says there has been much maturing of this niche business.

“Secured cards are considered a gateway product to mainstream credit access” now, he explains.

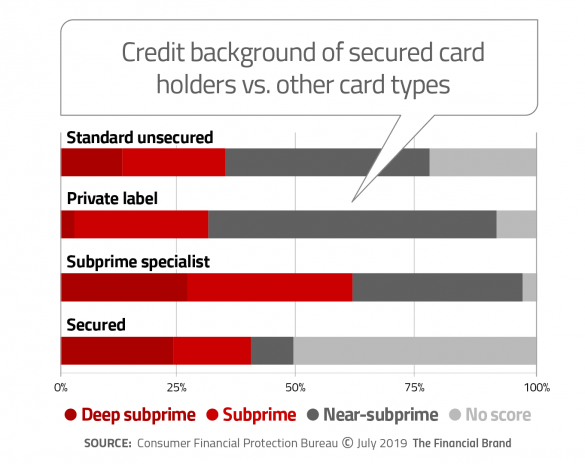

The CFPB study also found that the profile of applicants for secured cards differs from other card categories. For example, cards specifically designed and marketed as subprime cards see roughly two-thirds of their users coming from the subprime and deep subprime consumers. By contrast, a bit over half of the consumers with secured cards have no credit score and therefore don’t fall into any credit tier before trying to improve their situation by using the secured card. Santucci has studied secured cards extensively in multiple projects and confirms the bureau’s research, saying that in his work he’s found that consumers lacking a credit score at the outset of opening a secured card relationship are much more likely to graduate within 24 months of opening the account, compared to consumers who go into the relationship hoping to improve poor credit.

Indeed, among the initially unscored consumers who graduate, Santucci says, one in four turn out to be super-prime consumers. In his research he has found that sometimes such consumers build up a sufficient credit record that get “targeted by outside lenders seeking to poach good customers from incumbent secured card issuers.” As a result secured card issuers may lose such consumers before they’ve made much profit from them, he notes. In essence, issuers of secured cards, he says, have an incentive to take advantage of nonpublic data they have about good accounts “by graduating them before they can be poached.”

On the flip side, Santucci’s research has also found that many consumers who express interest in or apply to secured cards don’t always complete the process because they can’t, ultimately, come up with the cash for the deposit that must be established to secure the credit line.

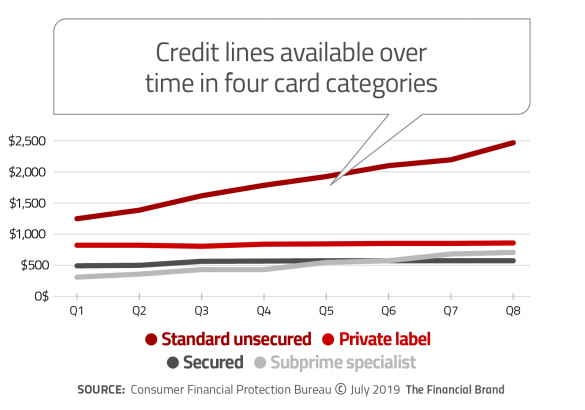

The CFPB study also looked at the history of the types of cards studied over the two-year period. As shown in the chart below, while holders of standard unsecured cards had their credit limits increased as they demonstrated performance, the limits of the secured cardholders barely moved. Not surprising, because it was entirely in their control, set by the size of the deposit they were willing to make.

Read More: Six Major Trends in Lending for Financial Marketers

Looking at Secured Card Programs for Your Institution

As mentioned, the bulk of secured card volume lies with the largest issuers. CFPB’s study found that some of these large issuers report that their secured programs are profitable on their own, but that this isn’t their main motivation. Consumer loyalty is.

“Consumers who graduate to an unsecured product may feel some degree of gratitude or loyalty to the issuer that facilitated their credit entry or credit score rehabilitation,” the bureau report states. “At that point, the issuer may be able to interest them in other products.” Clearly, the Amazon-Synchrony secured card has potential pluses for both the ecommerce company and the card specialist bank.

One of the boosters for secured card programs in banks and credit unions is the Financial Health Network, formerly known as the Center for Financial Services Innovation. In an extensive 2016 project, “Innovating at the Intersection of Savings and Credit,” that the organization undertook with Visa, it notes that 108 million consumers lacked the credit scores necessary to obtain affordable, quality credit. The network sees secured cards as a way to serve consumers who would otherwise be seen as too risky to lend to.

“The potential market for secured credit cards is huge,” the report states. “Despite their many benefits, secured credit cards are underutilized by the population that would most benefit from the opportunity to build credit.” The report suggests that issuers view these programs as a long-term investment that could widen their bases and swell their cardholder ranks. The report noted that while major institutions were refining their longstanding offerings, smaller banks, many credit unions, and some issuers of prepaid debit cards have expanded their efforts in this area.

The report has several overall recommendations for institutions that want to enter this specialized credit card niche:

- Work harder on visibility. Often consumers who could use these cards don’t know they exist or don’t know an institution offers them. Marketing to explain the service and the concept of the security deposit would help.

- Do more customization. While secured card programs are already a specialty, consumers come to these programs with different needs. More segmentation and tailoring would help them fit those needs better.

- Offer guidance on using the card. The report indicated that many consumers aren’t clear on how best to use their newly acquired credit line, not only for their needs, but in order to produce the best credit record using this tool.

- Make the deposit about more than collateral. “Providers can help customers increase their savings by positioning the deposit as an accomplishment on which to build a savings habit.” The group’s research indicates that consumers anticipating graduation frequently hope to put the deposit into some form of savings, but few issuers formally offer to set that up.