Amazon Prime Day has become a cultural phenomenon in the short time since the ecommerce company created it. The now two-day event is part megasale, part brand marketing event, and part Prime account recruiting drive, all rolled into one. It may be one of the most successful commerce-created “holidays” ever. Amazon promised over a million deals globally.

It’s a big day for financial institutions and their products, as well, because all those juicy bargains consumers slaver over have to be paid for. Prime Day generated an estimated $4.19 billion in sales globally in 2018 and Coresight Research projects it could hit $5.8 billion in 2019.

Numerous consumer websites and even some business sites go bargain crazy, publishing tips and tricks for maximizing discounts and gaming the various cash back, percentage-off, rewards granting, price protection and other variations on payment card features during Prime Day and similar events.

“Marketed almost as much, if not more, than Black Friday, Amazon Prime Day has forced financial services brands to shift their marketing strategy and create buzz ahead of time,” writes Alexa Dalessandro, Research Analyst at Comperemedia, a Mintel Company, in a recent report.

Institutions from giant JPMorgan Chase down to smaller credit unions tie in marketing efforts to Prime Day.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Prime Day’s Roots and What It’s Really About

In the 1970s a forgettable TV movie had the premise that the U.S. had finally replaced Christmas with “Commerce Day.” The scriptwriters must have been prescient, but creating a day to buy stuff isn’t new, nor even exclusively American.

In 2010 American Express began playing a big role in nationalizing the idea of shopping local with the “Small Business Saturday” concept, creating a national day that Main Street sellers, local financial institutions and local business groups could tie their own marketing into. In 2018 this “holiday,” now called “Shop Small,” is estimated to have driven $17.8 billion in spending at independent retailers and restaurants. Amex and partner organizations set the day to celebrate and promote small firms, and placed the event between Black Friday and Cyber Monday.

In China, “Singles Day,” on Nov. 11 each year, is a similar huge ecommerce shopping day, chiefly due to Alibaba.

However, “Amazon Prime Day is the first event of its kind to create a phenomenon that sets itself apart from Black Friday,” observes Lierin Ehmke, Senior Digital Marketing Analyst at Comperemedia. In 2018 Amazon sold more on Prime Day than on both Cyber Monday and Black Friday combined. But Ehmke believes that it’s a mistake to think of Prime Day as just a megasale — “It’s also an effort to showcase what you can get with a Prime membership.”

Further, Ehmke believes that this year Amazon intends Prime Day to be a play to lower-income households that have tended to not sign up for Prime, which carries an annual fee, typically $119. And she says this in turn ties in with the Amazon-Synchrony Credit Builder store card, a secured-card offering backed by a consumer’s deposit. Such programs are designed to help create a favorable credit history and eventually graduate users to mainstream cards.

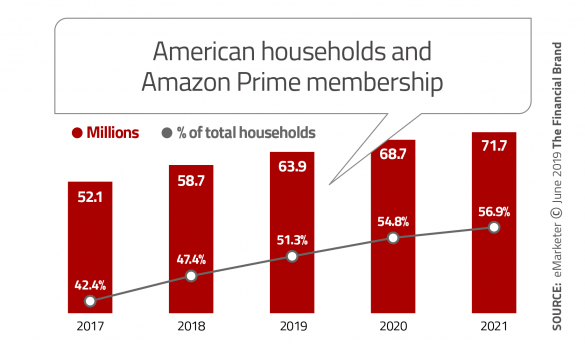

Prime Day deals are open only to Prime members, which eMarketer reports to be 51.3% of American households, and projects to hit 56.9% in 2021. A poll of Amazon Prime members by The Ascent site found 80% plan to buy something during the event.

Ehmke suggests that Amazon is approaching a new phase, where it will be harder to build higher Prime membership levels, and additional strategies like Credit Builder and Prime Day showcasing will be needed.

Read More:

- Why Chase Bank’s CEO Loves Branches, Admires Bezos & Questions Facebook

- Crafting Amazon-Like Banking Experiences Easier Said Than Done

Prime Day Halo Covers More and More Retail and Payments

Prime Day has gone far beyond its origins. Originally a one-day special sales event on Amazon itself, it’s now a two-day event, with some deals being announced in advance and some being made available early. Special Prime Day entertainment, a rock concert featuring Taylor Swift and others, began streaming before Prime Day — part of the showcasing Ehmke referred to.

The competitive sales pressure created by Prime Day —has driven other major retailers to launch sales blitzes both live and virtual before and during the Amazon event.

- Walmart bracketed Amazon’s event with an extra day on both sides, with free two-day and next-day shipping for qualifying orders.

- Macy’s introduced “Black Friday in July,” running right up to Prime Day, with a 25% online discount code on top of sale prices.

- Old Navy is holding a one-day online half-price sale on July 15.

- Target is holding its “Target Deal Days” concurrent with Prime Day, and offering a half-price sale on memberships in its Shipt shopping service.

And taking the snarky marketing prize, eBay set July 15, the first day of Amazon’s event, as “Crash Day.” It chose that moniker because Amazon’s site crashed during its 2018 Prime Day. “If history repeats itself and Amazon crashes … eBay’s wave of can’t-miss deals on some of the season’s top items will excite customers around the world,” the site gushed.

eBay even used a social media video featuring a live girl named “Alexa” who educates her father about what Prime Day is: “Prime Day is a holiday Amazon totally made up to get people excited about their parade of deals,” she says, putting air quotes around “parade.” Then, “At least real parades don’t charge a membership fee.”

When Dad asks Alexa how she knows so much, she smiles and says, “I’m always listening.”

Financial Institutions Pile into Prime Atmosphere

“Prime Day isn’t just an Amazon holiday anymore,” according to Taylor Schreiner, Principal Analyst at Adobe Digital Insights. Schreiner says research indicates that over 250 retailers have geared up to compete with Prime Day.

With the event’s “halo” becoming about more than Amazon, the dimensions of financial institution involvement increase.

During Prime Day, both the Amazon Store Cards, issued by Synchrony, and the Amazon Rewards Card, issued by JPMorganChase, will offer a bonus for Prime members. Purchases made on Amazon and its Whole Foods subsidiary earn 6% rewards, instead of the usual 5%, during Prime Day.

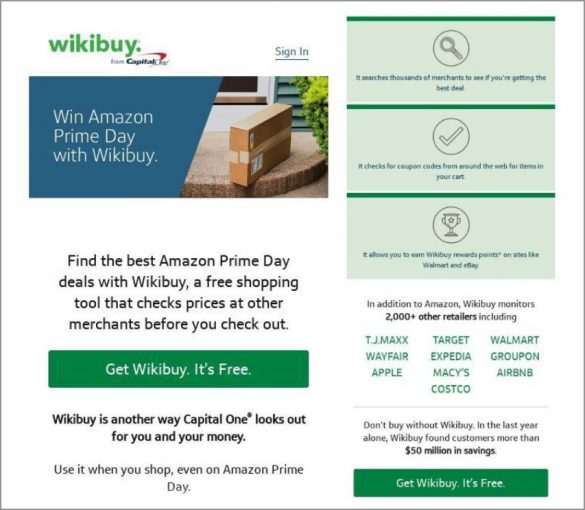

In the runup to Prime Day, Comperemedia’s Emke notes, Capital One “flipped Prime Day on its head.” The bank acquired Wikibuy in late 2018. Wikibuy scans more than 2,000 retailers to provide price comparisons. The bank emailed card members ahead of Prime Day, using the messages “Don’t overpay on Prime Day” and “Don’t shop on Amazon Prime Day without it.”

The bank urged consumers to check with Wikibuy, which is included in their card services, before assuming a Prime Day deal is the best available. (Wikibuy runs a check before the card holder finalizes their purchase.)

Some of Capital One’s emails relating to Amazon purchases are personalized, featuring a consumer’s recent purchase from the site, suggesting that Wikibuy might have pinpointed savings. “Capturing customer data such as purchase behavior provides relevancy and keeps engagement high,” states a Comperemedia report.

“They were telling consumers, ‘Make sure you do your research first’,” says Ehmke. She adds that promoting Wikibuy bolsters Capital One’s position as a transparent and technologically savvy brand. Research by Tinuiti indicates that among Amazon shoppers, comparison shopping resonates with many — most strongly with Millennial-aged parents that shop on the site and least with Generation Z shoppers. Regarding the former, Tinuiti comments that “given the legendary financial challenges faced by this generation, it’s no surprise that these savers are hungry for the best deal, whether or not it’s on Amazon.”

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Alexa Dalessandro’s report indicates that both card issuers and other lenders promoted their services in conjunction with Prime Day.

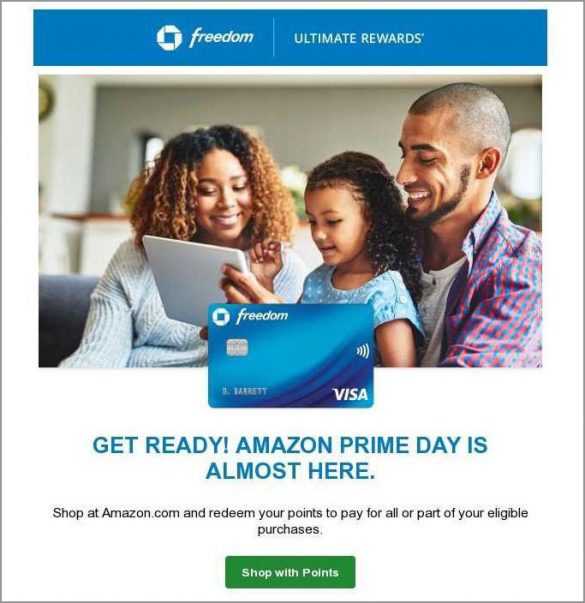

- Chase emails suggested cardholders use points to pay for all or part of their Prime Day purchases.

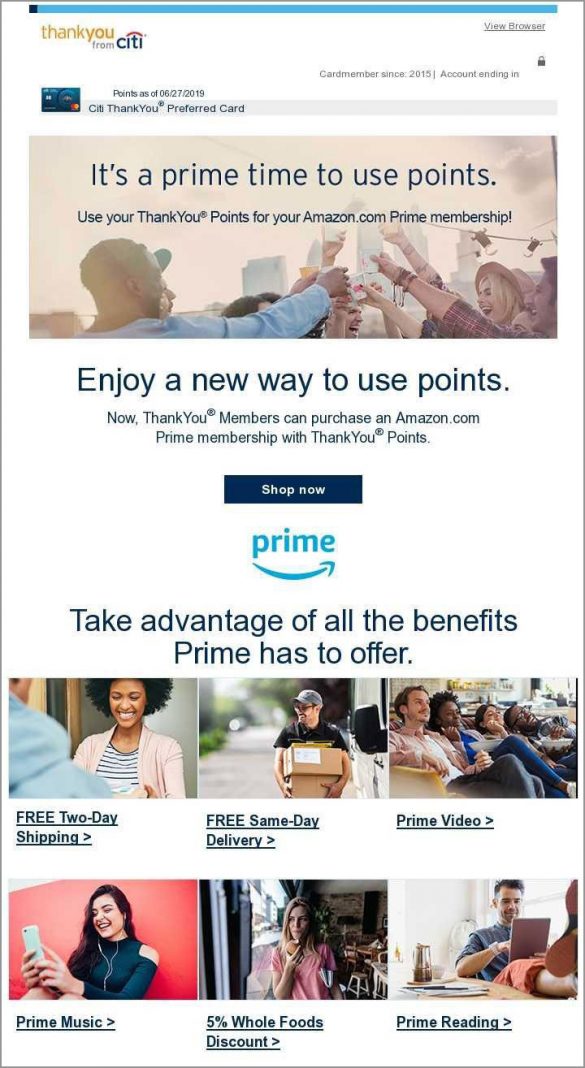

- Citibank emails promoted the idea of paying for Prime membership with card points, and highlighted the advantages of Prime membership.

- Synchrony emails not only promoted its card, but provided a button for signing up for Prime.

- Quicken Loans made a blog about maximizing saving on Prime Day the top item in an enewsletter about personal finance.

- Allstate themed an email for its rewards program to redemptions in Amazon gift cards and timed the top item to coincide with Prime Day.

Credit Unions See a Prime Opportunity to Build Volume

It’s not necessary to be a major bank to tag onto Prime Day for promotions. Credit unions were especially active. For example…

• Central One Federal Credit Union announced that it would automatically enroll any cardholder using their card on Prime Day in a drawing for … what else? Amazon gift cards, the grand prize being a $250 card. Financial Edge Credit Union offered a $100 card. Summit Credit Union offered a $500 card.

• CO-OP Financial Services published guidance for credit unions on how to become the default payment option for consumers’ Amazon accounts for Prime Day and beyond.

• Goldenwest Credit Union announced that any purchases made with its credit card on Amazon during Prime Day would receive triple points. When the credit union tried this for Prime Day 2018, it more than doubled volume from the previous Prime Day.

• Evansville Teachers Federal Credit Union offered members with its platinum credit or debit cards five times normal points for Prime Day transactions. In addition, it held drawings for five free Prime memberships.

Holiday Shopping Gambits Financials Can Try Next Prime Day

“Brands want in on what has become the Black Friday of the summer,” says Dalessandro. Retailers want sales and financial institutions want volume.

So more financial brands may choose to tie in with Prime Day and its halo in the future, now that we have “Christmas in July.” Comperemedia analysts note that there are many strategies used by financial companies in the traditional holiday season that many financial brands aren’t tapping widely yet. These include store perks with retailers besides Amazon, promotional APRs and debit card rewards.