7. Content Marketing

Content marketing can be one of the best tools financial services organizations can use for earning trust, building brand, generating website traffic and finding qualified leads. According to the Content Marketing Institute, 65% of the most successful content marketers have a documented strategy. This usually begins with a content marketing assessment that identifies primary goals and strategies to meet these goals.

Done well, content marketing from a financial institution should discuss optimal uses for a bank’s or credit union’s products and services and why this can lead to financial success. With a content strategy focused on a consumer reaching financial stability (or more), trust and loyalty can be gained.

According to John Hall, Co-founder of Calendar.com, “Companies need to get creative and enthusiastic about getting their content in front of the right people. Passive distribution — or, worse, distribution done as an afterthought once you realize no one is engaging with your content — won’t cut it. Don’t let your investment in content go to waste by sitting on some of your most valuable marketing assets.”

Combined with AI, machine learning and hyper-personalization, content marketing can serve as an additional strategy to build engagement.

( Read More: 5 Key Financial Marketing Priorities for the Post-COVID Economy )

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

8. Geolocation Targeting

Geolocation is the feature of the devices that enable you to know the location of a customer or prospect. The location of the mobile device can be accessed via various mediums like Bluetooth, Wifi, IP address, and GPS.

Under this approach, a financial institution can push a message designed especially for a group of users within a particular geographic region in real time. The technology also allows a financial institution to push a personalized message to consumers of a particular demographic or financial profile within a geographic area.

In addition to using a consumer’s current location, a bank or credit union can track consumer behavior on the basis of a series of previous locations. With insight collected over time, a financial institution can predict locations where the user frequently visits and extend personalized offers using that criteria.

( Read More: 4 Ways Financial Institutions Can Build Better Personalization Strategies )

9. Voice Search

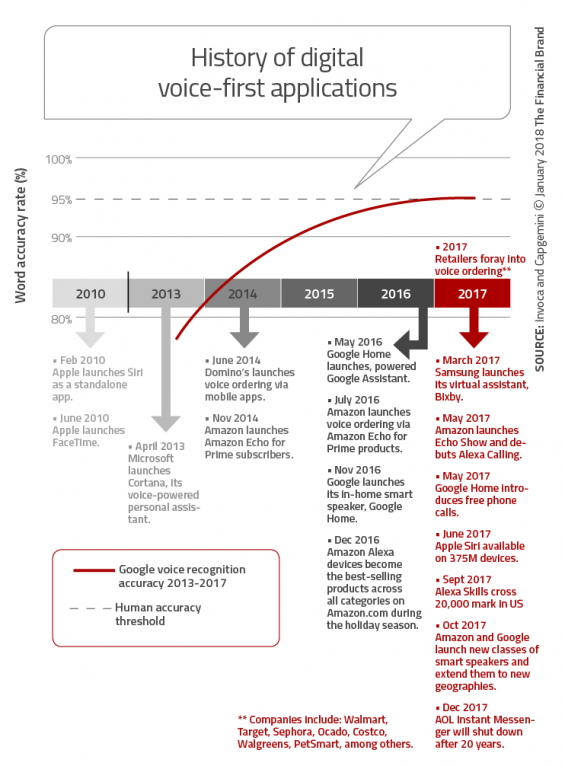

The advances made in recent years in the fields of natural language processing, conversation interfaces, automation, machine learning and deep learning processes have enabled virtual assistants to become increasingly intelligent and useful.

ComScore estimates that by 2020, half of all search queries will be voice-based. Almost one-third of the 3.5 billion searches performed on Google every day are voice searches now, with personal assistant devices leading the way. Even if a financial institution is not building a voice-first strategy, it is important to understand the nuances of voice search.

Voice search differs from the typical desktop or mobile search. When a consumer opens Google on a browser and types in their search query, they’ll see hundreds of pages of search results. Your organization will probably be one of them.

But, when a consumer uses a digital assistant, it will give them only a few results. Sometimes, it will give the consumer only one result. Therefore, tailoring your SEO strategy for voice search is more complicated and more essential.

As a result, financial institutions will need to pay attention to how customers speak to optimize their websites for voice search. SEO for voice search digs deeper into the user’s intent and explores the answers to how, when, where, and why.

Voice search and SEO are not the next big thing – they are today’s big thing.

Financial marketers are under pressure to generate a strong return on investment. Marketers will rely on advanced technology more than ever to handle the increasing complexities of financial marketing with a minimum of staff, hoping to satisfy consumers’ need for convenience and to abide by increasingly complex regulatory rules.

Understanding and leveraging the changing trends and advanced tools will be central to the bottom lines of banks and credit unions going forward. Relying on the tools and tactics of the past will no longer be sufficient.