Financial marketers are increasingly adopting data-centric, targeted digital strategies to improve program performance and meet consumer demands for personalization. That’s no surprise given that more than half (52%) of consumers surveyed by Yes Marketing said relevant content would influence them to switch to a financial services provider they’ve never used before. For financial institutions looking to improve the relevance and efficacy of their marketing campaigns, data is the most powerful tool.

But what’s the best tool to use given the many options? Here are four smart ways financial services brands are using data to create highly targeted campaigns, improve segmentation, and provide customer experiences that drive results and deepen connections with consumers. We begin with a foundational strategy and build from there.

1. Demographic Personalization

Financial marketers have been customizing content for their customers based on demographic data (e.g., age, gender, marital status, presence of children) for many years. Today, some may consider this strategy to be “segmentation 101.” However, financial brands use demographic personalization for their customers for many reasons — operational efficiency, better performance, testing and more.

Ultimately, there are plenty of ways for financial brands to get creative with demographic personalization (while remaining compliant) — like combining multiple demographic datapoints to define customer segments more narrowly. And let’s face it, the content that resonates with a retiree will differ from what moves their grandchild.

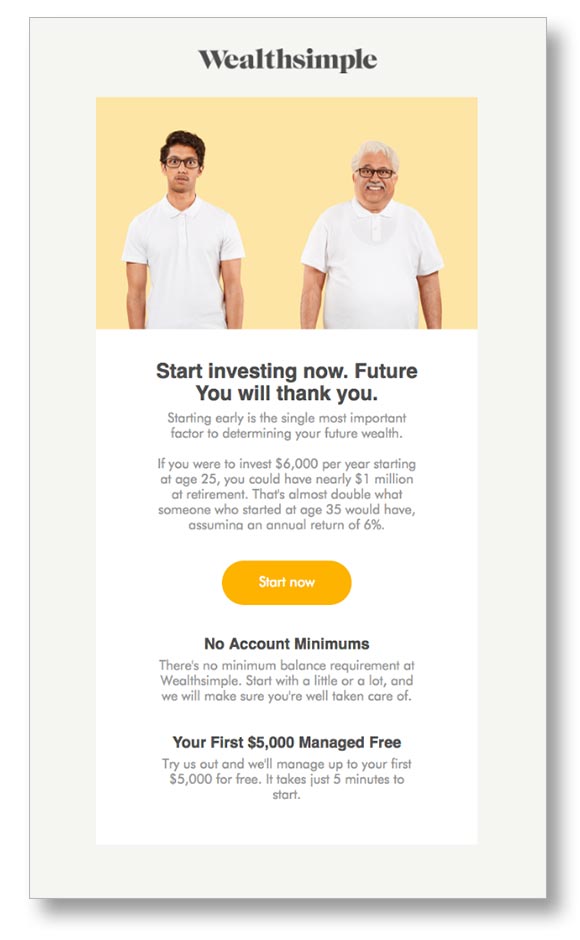

Brand Example: Wealthsimple. Online investment services company Wealthsimple targeted young customers with this email that educates about the value of investing early. With the subject line: “Time is your greatest ally,” the email calculates the value of investing $6,000 per year at the age of 25 to give young people a compelling incentive to engage their services.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

2. Location-based targeting

In a recent survey, Infogroup found that 87% of consumers said they use search engines to find businesses near their current location or include a ZIP code/city with their searches. For years research has identified the No. 1 reason consumers switch banks is because they moved to a new home. Yet, a study by Unicast indicates that only 35% of banks and credit unions are using location data in their marketing campaigns, indicating a missed opportunity. Financial institutions can use location data to improve personalization and customer experience in several ways, including:

Geo-targeted campaigns. Banks and credit unions with multiple locations can create local pay-per-click ads with radius targeting to define a specific area around branches. And the institution can then boost relevance and personalization by driving consumers in those areas to unique landing pages by location.

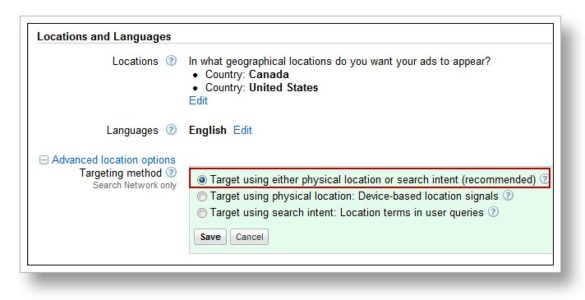

Ad platforms have multiple settings to control how a brand’s ads are geo-targeted. For example, Google AdWords offers the ability to target based on a consumer’s physical location or based on search intent, which can be determined by keywords in their search terms (e.g. mortgage loan Evanston, IL) or based on implied location from previous searches.

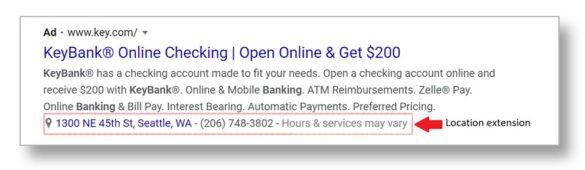

Location Extensions. Google and Microsoft Bing allow brands to add location extensions and call extensions to text ads, which display a business address, a phone number (mobile users can click to call) and a map marker that links to directions. When this option is enabled, the ad platform will dynamically select the most relevant branch locations based on a consumer’s location data or search criteria.

This feature creates a seamless experience for consumers and allows them to easily find the retail locations for financial institutions. To ensure business information is up-to-date in major ad platforms, review sites, and mapping platforms, financial brands can work directly with data providers to manage their business listings.

Brand Example: Key Bank. The Midwest regional uses location extensions to guide consumers to their closest bank branch.

Geofencing and beacons. Mobile banking is estimated to grow to two billion users in 2020, according to Juniper Research. As financial brands work to connect with the mobile generation, many are using geofencing and beacons to deliver their messages on mobile devices. Campaigns that use these two features are activated the moment a consumer enters a specific area — then content, display ads, or push notifications are sent to the consumer’s device.

Geofencing content is delivered within a pre-defined radius of a fixed location based on GPS data from the consumer’s phone. Campaigns using beacons are activated when a consumer nears a Bluetooth device that detects when they are within the vicinity.

Both geofencing and beacons can run into a hiccup when a consumer’s GPS settings or Bluetooth are turned off, but they still pack a powerful punch for financial services brands, especially considering the large number of consumers that actively use the apps created by their financial institution.

Brand Example: Citibank. Citi used beacons to boost their customer experience at select branches in Manhattan. To help customers access ATM lobbies when branches are closed, the brand enabled beacon technology to give the option to enter the building using an Apple watch or smart phone to unlock the doors. In addition, the beacons sent push notifications to customers asking if they want to unlock the lobby door, and enabled notifications for special events and offers from the branch location.

3. Behavioral targeting

Financial services brands can use behavioral data to target consumers based on such measures as web activity, email clicks and opens, and marketing campaign engagements. It’s estimated that ads informed by a consumer’s behavior are twice as effective as those that are not, and plenty of financial institutions are driving growth by targeting marketing messages based on behavior.

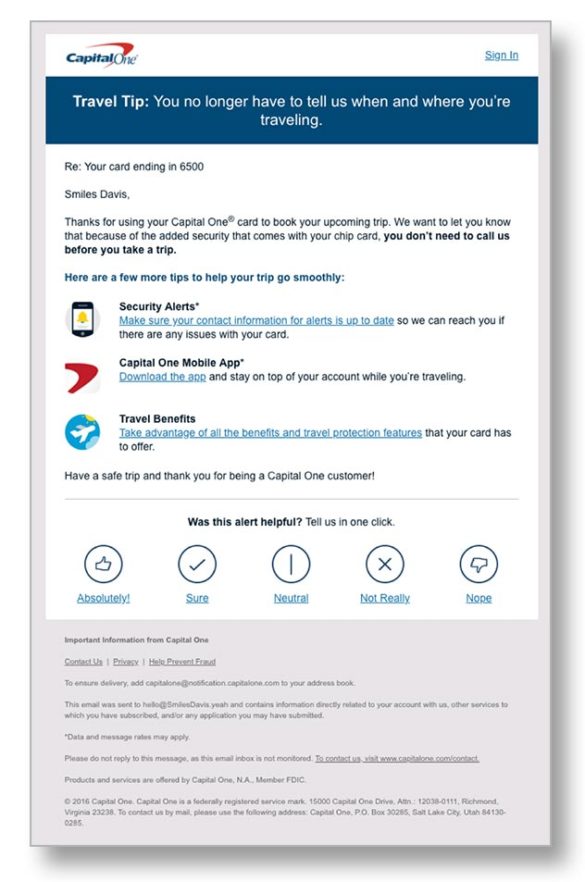

Brand Example: Capital One. In its card marketing, Capital One sends an automated email which is triggered when a customer uses one of their cards to book an upcoming trip. The email explains that one of the benefits of the Capital One card used to book the trip is that customers don’t need to alert the brand about their upcoming travel. The email provides additional helpful information — outlining the travel protection features of the card and providing a link to the brand’s mobile app.

To deepen the brand’s connection with customers, Capital One could also create unique content and emails for customers who travel frequently.

Read More: Digital Marketing Strategies for Community Financial Institutions

4. Psychographic targeting

Psychographic data is used to paint a picture of consumer traits like attitudes, interests, values, and lifestyle. It is the most complicated of the four approaches we cover here, because it requires an analysis of multiple datapoints from many sources. (A few years ago, only 13% of financial brands were using psychographic data to build customer segments.) Brands perform psychographic analysis based on their customer database, information collected from transactional data, web data, surveys and information from third-party data providers.

Brand example: TD Bank. To accurately target interest for the brand’s Green Banking options, TD Bank uses a psychographic analysis to identify customers and prospects who are environmentally conscious. Alternatively, if a financial brand determined that a large portion of their top customers held this value, they might consider offering products and green investment options that address this segment.

To thrive in a market with intense competition and changing consumer needs and values, banks and credit unions must harness data and advanced targeting methods, such as those described, to improve marketing ROI and grow their customer base.