The wealth management industry is in a state of transition, as the baby boomer generation (born between 1946 and 1965)

enters retirement age. At the same time, the millennial segment is increasing their impact across all financial services products as they age and garner more income and wealth.

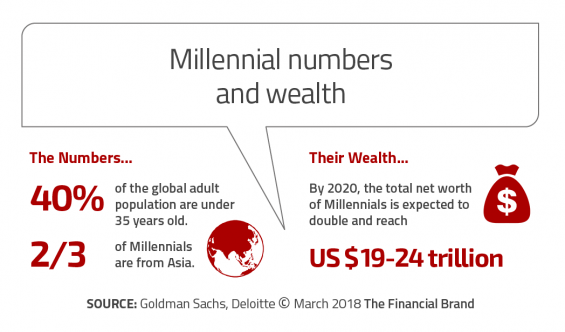

While still in the early years of wealth accumulation, the size of the segment makes them important to the banking industry. According to Deloitte, Millennials represented 40% of the global adult population in 2015. According to Deloitte, “Until 2020, the aggregated net worth of global millennial populations is expected to more than double compared to 2015, with estimates ranging from $19 to 24 trillion.”

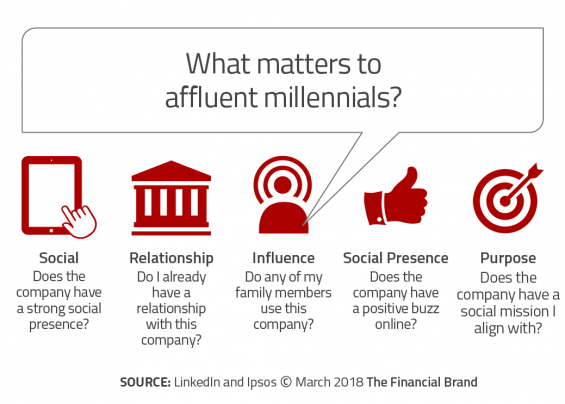

Affluent Millennials are different from preceding generations in their behaviors. According to a LinkedIn and Ipsos study of this segment:

- They are eternal optimists about their own financial future.

- Nine in ten affluent Millennials use social networks to seek opinions and comments regarding financial markets.

- They value relationships with companies they frequent.

- They are more active savers than generations before them.

- They are influenced by relationships that family members have with companies.

According to an excellent report from Efma, The Rise of Affluent Millennials, affluent Millennials have different financial needs than other generations as well:

- Nearly seven out of ten affluent Millennials are likely to consider non-traditional financial offerings.

- They envision a cashless, sharing-based economy, with 33% believing they won’t even need a bank.

- They are conservative when investing money, with 52% of their assets being cash.

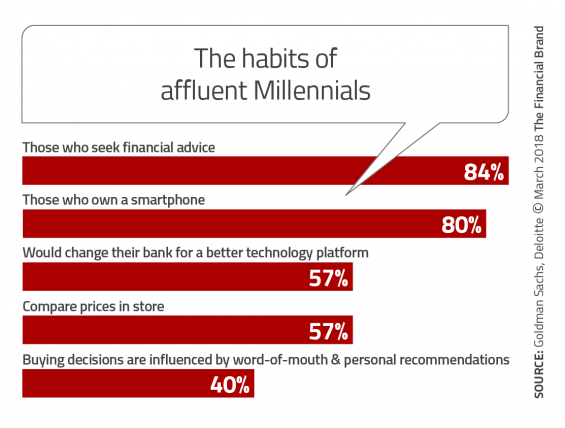

- 84% seek financial education and advice from a financial institution or financial advisor.

- 47% would move to a financial services firm with a better technology platform.

- They are twice as likely as other generations to invest in companies with a stated social or environmental impact.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Read More: Banking On The Mass Affluent: Millennials With Money

Digital Wealth Management No Longer Optional

”Digital technology has already become an essential means to manage the financial lives of Millennials.”

According to PWC, wealthy investors (especially Millennials, expect online and digital functionality in all aspects of their lives. “They are willing to exchange personal information to be able to enjoy highly personalized services,” the report explains. “Online technology has already become an essential means to manage their financial lives from banking to investments. Taking all these factors together, it is no longer tenable for the wealth management industry to suggest that their client base does not need or want digital functionality in the management of their assets.”

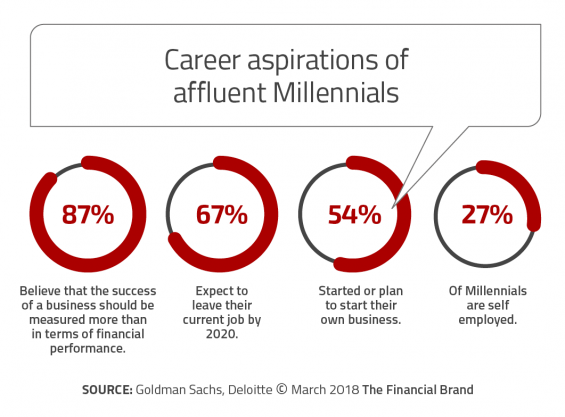

Research shows that Millennials want financial advisors who are digitally connected and can assist in the financial education desired. That said, Millennials want to make their own decisions to support and execute their own transactions. If this form of self-directed digital engagement is not available, they are willing to move their relationship based on a strong digital platform.

The change in consumer expectations and the rather slow response by traditional financial services organizations has opened the door for non-bank investment management alternatives. This ranges from testing out new providers to engaging with new business models, such as social investing. Combined with the loyalty many wealthy Millennials have once they select a wealth management partner, this can create a shake-up in the traditional wealth management industry.

According to EY, start-ups have taken advantage of an opportunity to leverage their high-tech talent to build out simpler and cheaper methods of delivering financial advice in an innovative way. “These companies are digital registered investment advisors (RIAs) seeking to provide simplified financial solutions through sophisticated digital platforms, eliminating or reducing the need for face-to-face interaction,” explains the EY report. The impact of the acceptance of digital engagement models can be seen with the success of platforms like Betterment and other offerings.

Serving the Affluent Millennial Consumer

”Millennials are looking for a financial consultant as opposed to an account manager.”

Financial services organizations of all sizes need to evaluate how they will serve the affluent millennial consumer in the future. This includes basic transactional services (mobile deposit capture and digital account opening) to more advanced functionality, such as digital wealth management. Playing catch-up is not a great position to be in, but the bar is getting higher when we consider the advances of alternative financial providers.

Here are areas that the Efma Digest suggests financial organizations focus on to succeed with affluent Millennials in the future:

- Establish trust and improve transparency. Banks and credit unions must focus on pricing transparency, personalized advice and authentic personal relationships that are supported by digital technology. Fees should be clear and reasonable while advice should be customized.

- Communicate effectively. Millennials want to interact with their financial services provider on their terms. They want to have access to insight that applies to their specific situation, but they want to make their own decisions. There is a desire for a consultant as opposed to account manager.

- Personalize and socialize engagement. Banks must model against the likes of Amazon, engaging with consumers using demographic, contextual and behavioral data to learn about customers. According to a Comarch-Efma report, “The engagement should include tailored portfolio alerts, product recommendations and investment ideas based on clients’ preferences oand online activity tracked via dedicated mobile apps.”

- Change wealth manager mindsets. Efma recommends that financial firms must recruit for skill sets, but also recruit personalities who can build relationships and work well with digital technology.

- Collaborate with fintech firms. As stated in other articles and research reports, traditional banks and credit unions must collaborate with fintech start-ups that are positioned to innovate wealth management products and delivery of services.

- Embrace technology. Digital technologies and advanced innovations such as robo-advisors are gaining increasing traction. Organizations including Bank of America, BMO, Charles Schwab, Deutsche Bank, RBC Financial Group, UBS, US Bank, Vanguard and others are already offering or developing robo capabilities. Some of these firms have partnered with Betterment, eTorro, Wealthfront and others to offer a lower-fee service for tech-savvy, fee-conscious clients. It needs to be remembered, however, that affluent Millennials still desire some forms of face-to-face financial education and engagement.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Future of Wealth Management

The wealth management industry is changing as both the behaviors of existing clientele and the demographics of new clientele transform. Baby Boomers are shifting their investment objectives from growth to protection and are passing their wealth to their children. At the same time, the massive Millennial segment is quickly becoming the core client base. This generation is vastly different than previous generations. They’re digital natives, well educated, hands-on, and cautious investors.

According to Celent analyst Ashley Globerman, “The wealth management landscape is influenced by Millennials, who have grown up during a time of technological change, globalization and economic volatility, which has influenced their behaviors and experiences. Millenanials are tech-savvy, encumbered with debt, philanthropic, financially risk-averse, and have a culturally inclusive worldview.”

Building a digital sales and service model for the millennial segment is no longer optional. Even if your firm is not actively targeting the Millennial segment with wealth management services, transforming your products and engagement model to a digital platform is the only way to serve all segments more efficiently and effectively. This is especially true since all generations are quickly embracing the power of mobility and digitalization in all life engagements.

Recent Wealth Management Marketing

The following are examples of marketing done recently targeting affluent consumers by traditional financial institutions. These examples are provided by Comperemedia in conjunction with their ‘Marketing to Affluent Households’ report that is available to subscribers.