The ranks of the Mass Affluent are swelling. According to the Spectrem Group, there are over 30 million Mass Affluent consumers in the U.S., up from just over 24 million in 2007.

Mass Affluents are much more profitable for banks and credit unions than Mass Market consumers. Research and consulting firm Strategy& estimates the profitably of Mass Affluents in the banking sector at six to ten times that of the Mass Market segment. They generate up to 70% of total retail profits even though they only make up less than 30% of the customer base.

This is clearly what makes Mass Affluents such an attractive demographic for banks and credit unions. It’s also why the competition to attract and retain these well-educated, tech-savvy consumers is so tough. Financial marketers must understand what makes them tick — from what technology they like to what products they use.

According to the Digital Enablement for Retail Banking survey fielded by Nielsen, Baby Boomers make up 41% of the Mass Affluent market, while Millennials make up only 9%. Obviously, as Millennials age and enter their peak earning years, the percentage of Mass Affluent Millennials will increase.

Mass Affluents didn’t inherit their wealth. They tend to be savers who invest for the future. They value education, and while many worry about paying for their children’s education, they are not opposed to loans and having their kids pay for at least part of their own education. But since they are younger, the Mass Affluent Millennials are less likely than Boomers to have deep relationships with financial institutions.

Key Takeaway: Mass Affluent Millennials are the future. Financial marketers need to attract them while they are still young — before they start making commitments to wealth managers and investment firms. Once inertia sets it, it can be nearly impossible to get people to switch providers.

Read More: The Mass Affluent: What Financial Marketers Need to Know

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

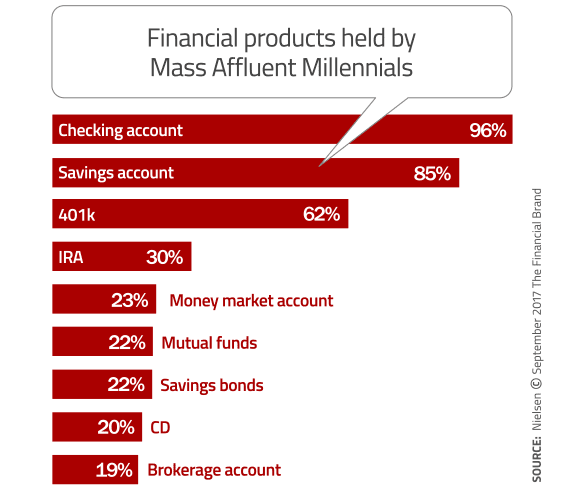

Mass Affluents of all ages tend to use the same basic financial products. However, upscale Millennials are savers. According to Nielsen, Mass Affluent Millennials are more than twice as likely as the average consumer to have variable-rate interest money market accounts and CD accounts.

81% of Mass Affluent Millennials feel it’s very important to use a highly reputable and well-known financial institution when choosing financial products like mortgages.

The differences between older Mass Affluent consumers and younger ones become more apparent as you look at more complex financial products. When it comes to IRAs, brokerage/asset management accounts, and annuities, Mass Affluent Baby Boomers are much more heavily invested than Millennials.

There is less of a gap between Baby Boomers and Millennials with respect to company-provided retirement accounts such as a 401k. While 73% of Baby Boomers invest in a structured retirement plan, 62% of Millennials do the same.

38% of Mass Affluent Millennials are still paying off their student loans, creating a golden opportunity for banks and credit unions to offer debt management programs, something that institutions like Fifth Third Bank are doing. Fifth Third’s app, called Momentum, lets Millennial consumers round up debit card purchases to the next dollar (or add a dollar to every purchase) and apply those funds to repaying their student loan.

Key Takeaway: Attract Mass Affluent Milllennials by offering student loan debt management, and helping them save for the future.

“The tech-savvy Mass Affluent Millennials frequently search online for debt consolidation, making these young consumers a prime audience for creative, new student loan debt management solutions in the digital space,” Nielsen wrote in their report.

Mass Affluent Millennials are more likely than their less affluent counterparts to own a smartphone or a tablet. About 93% of Mass Affluent Millennials and 73% of Baby Boomers own a smartphone, compared to 71% of the total mobile population over the age of 18. While only one-third (33%) of the total mobile population own a tablet, that percentage increases to 42% of Mass Affluent Millennials and 38% of Mass Affluent Baby Boomers.

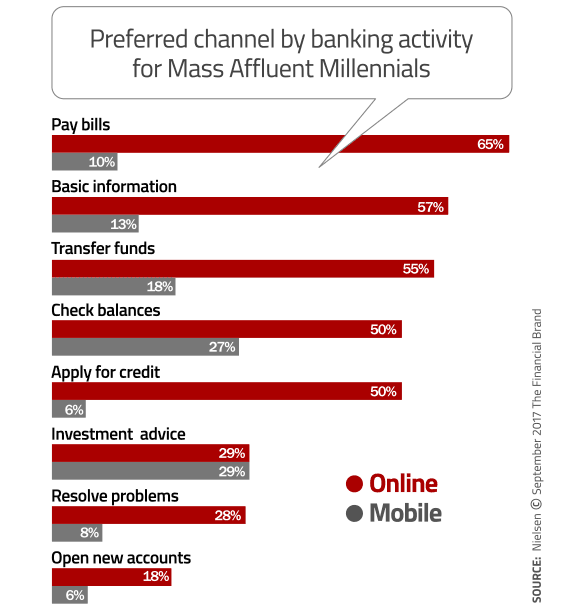

Translation? They are among the most active digital bankers in the world today. For instance, Mass Affluent Millennials are the most likely to use alternative digital payment methods such as Amazon Flexible Payments, Checkout by Amazon, Google Checkout, and PayPal.

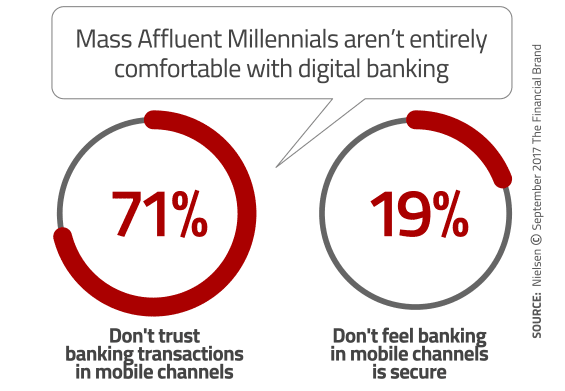

Mass Affluent Millennials are more apt to use a mobile banking app than Baby Boomers, but even these Millennials have a few bones to pick about mobile banking. One of the most striking statistics is that 71% of Mass Affluent Millennials say they don’t feel that they can trust in mobile transactions, which is higher than the number of Mass Affluent Baby Boomers who cite security as a barrier (67%).

Millennials know how to use mobile banking but say that speed and previous problems also make them think twice about using their smartphone for banking. For Mass Affluent Boomers, the barriers to mobile banking are more about not knowing how to use the mobile app (20%), not owning a smartphone (16%), and saying that mobile is just not a convenient option (16%).

Key Takeaway: Mass Affluent Millennials want to use their smartphones for everything. For Mass Affluent Millennials, stress security of your mobile app. For older Mass Affluents, show them how to use it.