Amid a period of tremendous economic prosperity in the United States, multiple studies indicate that many Americans, especially Millennials, are financially stressed and often confused over what to do about it and where to go for help.

A whopping 76% of Millennials say they are experiencing financial stress, up 23 percentage points from 2018, according to the PwC 2019 Employee Financial Wellness Survey. The angst is more widespread than just Millennials. Over that same period, Gen Xers in financial stress rose 15 percentage points to 65%, and Baby Boomers rose 16 points to 51%, according to PwC.

When asked what they feel causes them the most stress in their lives, more consumers cite financial matters than any other life stressor combined, including their jobs and relationships, the study notes.

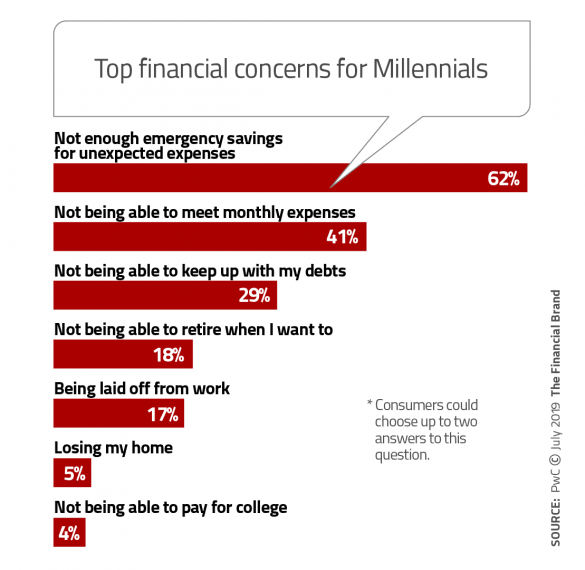

Cash flow and debt issues play a major part in the stress, the consulting firm finds. The ripple effect of not being able to save sufficiently adds more worry. People feel their compensation isn’t keeping up with their spending and they struggle to meet basic household expenses.

Millennials are much more likely to be having difficulty meeting household expenses compared to other generations, according to the PwC study. Three out of five say they have trouble, and one in three uses credit cards to pay for monthly needs because they lack funds to pay otherwise. 63% of Millennials consistently carry balances on their credit cards and two out of five have trouble making minimum monthly credit card payments.

Related to that, about half of Millennials carry student loans and of those two out of five say the loans significantly hit their ability to meet other goals and nearly the same portion cite moderate impact.

All this creates a deep need for guidance and assistance in coping with financial stress and managing their affairs to minimize the stress.

According to PwC, the two times consumers most want financial help or guidance are:

- When facing a major financial decision, such as buying a home or determining how to save or invest.

- Dealing with a financial crisis, such debt problems, unexpected expenses, loss of income or employment, and lack of financial liquidity.

Both are areas in which most financial institutions could provide useful guidance and other assistance. Consumers would likely be receptive.

Just over half of PwC’s sample — 57% — want to make their own financial choices, but with someone validating their decision. Nearly a third, however (31%), prefer to be told what they should do. Only 12% of consumers say they don’t need any help.

Banks and credit unions have several reasons to be more active in getting involved in financial wellness efforts.

First, they increasingly promote themselves as potential advisors to consumers, especially as digital channels take on more routine matters. Second, consumers who make better financial choices ultimately make better borrowers, savers, and more. Third, financial employers’ own workforces aren’t exempt from the economic trends that produce consumer economic angst.

A business case can be made for financial institutions offering consumers financial wellness services, but staff needs to be smart about money too, states a paper by the Filene Research Institute that was focused specifically on credit unions

“How can we expect credit union staff to help members address their financial concerns if the staff are struggling with their own finances?” the paper asks.

Taking on the role of improving financial wellness is a natural progression for banking brands. “When consumers are in need of financial information, their number one resource is their primary financial institution,” writes Lynne Cornelison, a Raddon researcher, in a blog. Citing a study by the firm, she notes that consumers who receive training will often come back for more help, especially Millennials.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

What Does ‘Financial Wellness’ Mean?

Raddon’s research has determined that Americans think much more of their financial literacy than they ought. Nearly half in a survey claimed to be extremely or very financially literate. But Raddon gave respondents a financial literacy test. Only 6% scored an “A” or better.

“Financial wellness” differs from “financial literacy,” but not everyone agrees on where to put the dividing line. A reasonable place, however, is that financial wellness reflects the application of what people learn by improving their financial literacy.

Vishal Jain, Head of Financial Wellness Strategy & Development at Prudential Financial, suggests that in time the term financial wellness will become a “metric of good living.” He says: “The goal of financial wellness isn’t to amass valuable assets, but rather to take advantage of your finances in a way that helps you live a life full of value.”

For consumers, the top aspect of financial wellness, cited by 34% of PwC’s sample, is simply “not being stressed about my finances.”

Other aspects of financial wellness from the entire sample:

- Being debt free, 18%.

- Having enough savings that I’m not worried about unexpected expenses, 16%.

- Financial freedom to make choices to enjoy life, 16%.

- Being able to meet day-to-day/monthly expenses, 12%.

Read More: Americans’ Love/Hate Relationship With Money

Financial Stress Becomes a Multi-Generational Challenge

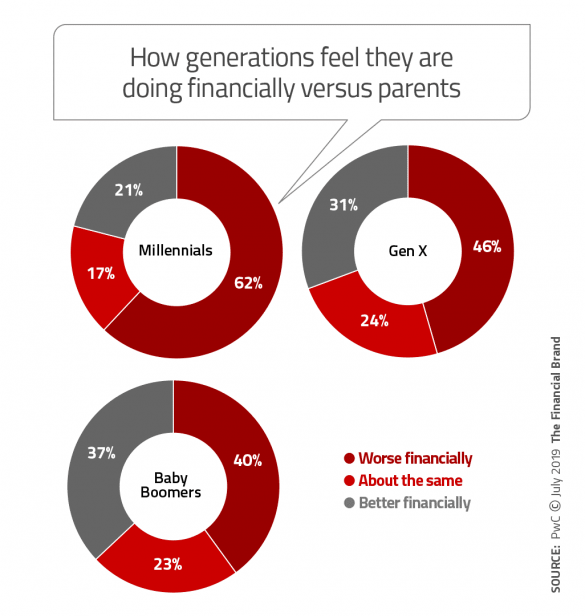

While studies tend to look at each generation’s financial worries separately, research is also beginning to indicate that an inter-generational dynamic is beginning to fall into place that may have long-running implications.

Experts are already concerned about Baby Boomers’ ability to retire on what they’ve put aside, but adding to that concern is that many Boomers are drawing on their resources now to help their Millennial children plug the holes in their finances.

PwC’s survey finds that “nearly half of employees with adult children are willing to sacrifice their own financial well-being for their kids, and 42% of employees with adult children are already providing them with financial support. Nearly half (48%) of employees who provide financial support to adult children say it’s likely they’ll need to raid their retirement plans for non-retirement expenses.”

Raiding 401K plans or borrowing against them is a concern among employers. “Human resources professionals are concerned that matching funds in 401K programs are being used to meet short-term emergencies, undermining an expensive benefit program,” states a report by the Consumer Financial Protection Bureau. The PwC project finds that 56% of consumers withdrawing prematurely from retirement funds do so because they can’t otherwise meet unexpected expenses.

Economists once spoke of the ongoing cycle of poverty. But these statistics argue for an ongoing cycle of indebtedness. This suggests that, ultimately, successful financial wellness programs can’t deal solely with a single generation’s issues.

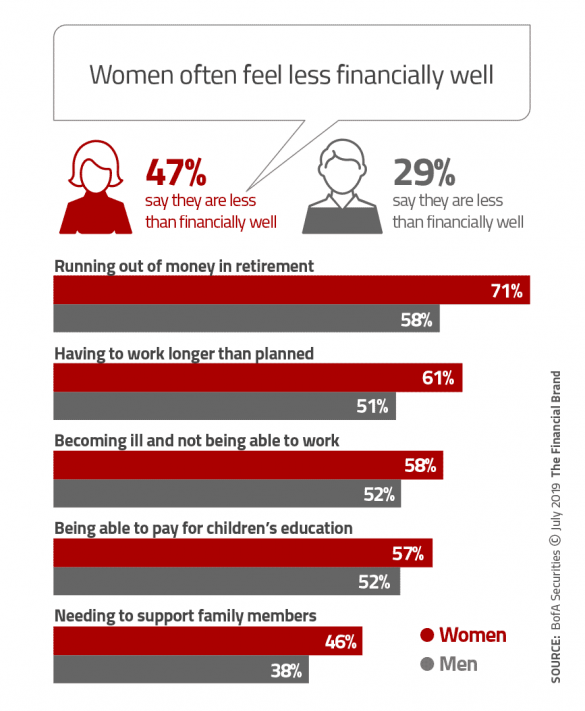

A gender-specific impact on financial wellness is also seen and working that out may prove more complex. The BofA Securities 2018 Workplace Benefits Report found that women are 14% more likely than men to say that they feel stressed by their finances, and, as detailed in the chart above, they are much less likely to say that they are financially well than are men.

Read More: Millions of Americans Enduring Financial Nightmares in Secret

What Will Help Stressed Consumers?

Studies point out that compared to other benefits given by employers, financial wellness programs are relatively new, and in many companies they are either still in the pilot stage or have not yet been frequently used by consumers. Financial wellness programs tend to be offered by larger companies, yet small business remains the leading source of employment in the U.S. So many consumers in need of wellness help have not received any at work.

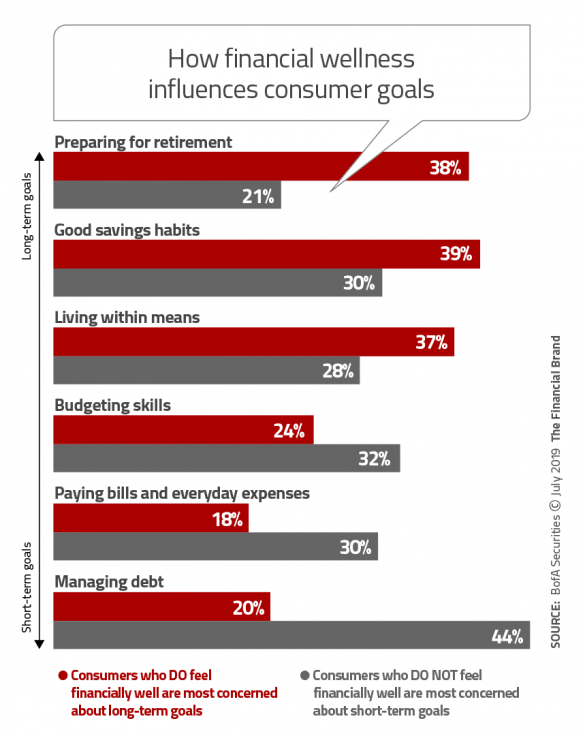

The BofA Securities study reports that a disconnect exists between what consumer-employees would prefer versus what employer-driven programs offer. Employees tend to focus on end goals, the report states, while employers tend to focus on tactics. It’s a matter of perspective. For example, companies think in terms of training people to budget and handle income and expenses. Consumers tend to think of saving and investing.

Something that comes up in the studies is a desire to deal with human advisors, but with an important caveat. The PwC study indicates that the leading preference among consumers for a financial wellness related benefit is “access to unbiased counselors.” 27% of the sample has that preference. This was the top answer among Gen Xers (30%) and Baby Boomers (28%), though the leading choice among Millennials (37%) is a student loan repayment benefit. Millennials are concerned that unless a counselor is unaffiliated, their “advice” may just be the entrée to refinancing student debt with a fresh creditor.

Clearly many of the financial stresses out there lie beyond what a proactive mobile app can help. Such technology may keep future consumers out of the quicksand, but many folks need help out now.

Banks and credit unions working in the financial wellness space take a number of approaches to it. Working with vendors specializing in financial literacy and wellness programs is one route.

Community First Credit Union, for example, partnered with Everfi to offer a series of personalized educational models on various consumer financial services. According to a case study, the project not only assisted members, but served to recruit new members to the credit union.

Among banks, HSBC also partnered with the same vendor, to offer educational offerings. In addition it offers a classroom-based wellness education program in partnership with a nonprofit, Greenpath Financial Wellness.

As employers reach out for additional help with their programs, additional opportunity will open up for financial institutions to take part in putting consumers on the best financial path.

In time, wellness may be a nucleus for financial product design. Writes blogger Vishal Jain of Prudential, quoted earlier: “Today, you buy investment products, retirement products, insurance products, annuities; you start a college fund for your kid. What if we combined all of these into personalized holistic ‘wellness’ solutions?”