Americans are leading double lives when it comes to money — seemingly flush with cash and confidence on the outside, but shivering with financial fears on the inside.

Americans are leading double lives when it comes to money — seemingly flush with cash and confidence on the outside, but shivering with financial fears on the inside.

This is the sobering conclusion from Nonfiction Research in its report, “The Secret Financial Lives of Americans and the Future of Financial Services.”

More than 2,200 consumers were surveyed for the massive 117-page report, including interviews with banking executives (and even one bank robber). Researchers concluded that the usual indicators of people’s financial status — where they live, where they vacation, what they shop for, and what you see on their social media accounts — send misleading signals. Financial marketers that aren’t careful can quickly find themselves pointed in the wrong direction.

The research also revealed that many Americans are financing the visible parts of their lives by draining their savings and running up debt. They need help, but many mainstream institutions seem to either feel it isn’t their job, or that they can’t make money by getting involved.

“Staggering numbers of Americans are leading double lives when it comes to money,” the report said. “To their friends and neighbors their lives look normal, even prosperous. But privately, behind closed doors, Americans are badly in need of help with money and the emotions that surround it.”

Indeed, almost no mainstream institutions offer the kinds of services and help that people most need to straighten out their financial lives. Third-party budgeting apps are only one small part of the solution to growing financial distress among large numbers of U.S. consumers. But savvy financial marketers will look at the situation and see opportunities to ask, “Where can we step in and help?”

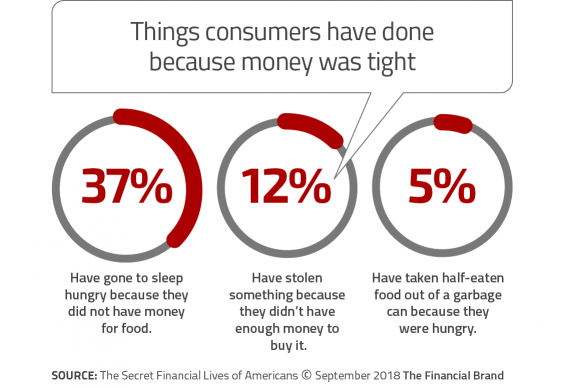

One way to understand how Americans wrestle with finances is to hear about the things they didn’t do specifically because they were worried about money, the report says.

For instance, one heart-wrenching example from the survey verbatims:

“I was given tickets to the second-to-last game ever played at the old Yankee Stadium. I couldn’t take my son because I didn’t even have the money for two hot dogs, a couple of sodas, and a box of Cracker Jacks.”

“Because these behaviors are often invisible — none show up in store sales, pricing models, common survey responses, or attendance numbers — they’re too often missed by conventional research,” Nonfiction Research warns.

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Americans’ Self-Inflicted Financial Wounds

Nonfiction Research also points out that large numbers of Americans fall under the sway of social media lifestyle expectations, often spending money they don’t have to be able to make themselves look better off than they really are. 28% of Millennials admit to intentionally making themselves look wealthier in their social media posts.

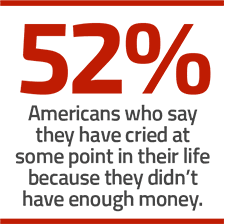

At the same time that Americans are spending more money on travel and real estate, and spending more time on social media, the report notes, their finances are being eviscerated, which their friends can’t see. That situation leads to statistics like this:

Visible financial indicators are booming:

- Travel revenue is up.

- Real estate investment is up (and has surpassed stocks as the best performing asset class).

- The number of images posted to social media is soaring, many showing off travel and new “things.”

But privately, financial indicators are sagging:

- Savings rate is at an all-time low.

- Almost twice as many Americans have credit cards (76%) as have retirement accounts (47%).

- Almost 20 million Americans have a shopping habit that jeopardizes their relationships or careers.

- American credit card debt hit an all-time high of $1.02 trillion in January 2018.

- 44% of Americans couldn’t handle a $400 emergency without borrowing.

- 33% of non-retired Americans have nothing at all saved for retirement.

- 71% of Americans are stressed by money.

The Nonfiction Research survey quantifies similar observations drawn by the Center for Financial Services Innovation’s U.S. “Financial Diaries” project. The seven-year research, a joint venture with New York University, followed the lives of 235 middle- and low-income families and individuals over the course of a year and described in detail the financial distress of many consumers. (The results are captured in the book The Financial Diaries.)

Looking For Help, But From Whom?

The good news is that Americans are open to getting help with their financial lives. Some areas of help are familiar and banks and credit unions can readily provide them. For example, 39% of Americans want additional help in planning financially for end-of-life issues. Other areas where consumers say they need help include:

- How to maximize their salary at their current job (or another one)

- Knowing if they’re being paid fairly (particularly important for women)

- Monthly budgeting, to ensure they’re saving enough

- Right-sizing their debt

- Planning affordable vacations

- Having someone to talk to holistically about their financial life

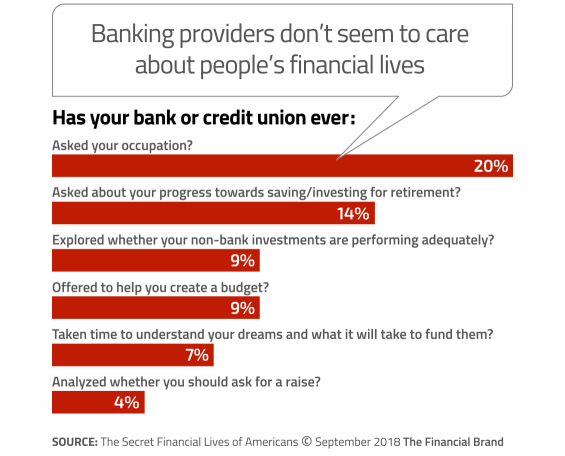

- Dealing with the spending pressures of social status

Unfortunately, the kind of things consumers want help with are not on most traditional financial institutions’ radar. In fact, none of these financial needs are being met by mainstream financial institutions. Furthermore, no bank or credit union in the study said they were planning to offer any new services aimed at helping everyday consumers tackle their financial nightmares.

The researchers who authored the report openly concede that several of these needs aren’t typically considered “financial services” by most retail bankers. One of the banking executives interviewed for the study bluntly stated: “We’re a bank. That’s not our job.”

That leaves consumers to rely on the hodgepodge of siloed specialists including financial advisors, financial coaches like Dave Ramsey, and subject-matter specialists (e.g., mortgage, tax, and accounting). Several of these providers cater mainly to higher income people and focus mainly on investments, and all of them, according to Nonfiction Research, are totally disconnected from mainstream financial institutions.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Americans Need Their Own ‘Personal CFO’

Nonfiction Research warns traditional banks and credit unions that if they cannot find a way to provide services that help people answer their money management questions, it’s likely that a new entrant will. This could further exacerbate the reshaping of the banking industry.

In Nonfiction Research’s opinion, financial institutions need to address the areas in which consumers want help most — even those areas that seem beyond the scope of most banks and credit unions, such as career advice.

“There is no one who coordinates the financial wellness of the household,” the report points out. “America is lacking the financial equivalent of a primary care physician or personal trainer.”

Nonfiction Research calls this role a “Personal CFO” — a money coach for everyday consumers. Their report identified five reasons why banks and credit unions should consider providing this sort of financial concierge service.

1. Build trust with consumers. The frequency of communication and the intimacy of discussing life goals could foster a deep sense of trust that makes financial management easier and help uncover consumer assets on the balance sheets of other financial institutions.

2. Financial institutions can completely own and control the entire financial relationship. Once someone begins to trust their “Personal CFO”, it gives their banking provider ultimate influence over all possible revenues tied to financial services, including those generated downstream.

3. Direct revenue. One model is a flat fee, possibly on a sliding scale. Grove, which offers many Personal CFO-type services (in addition to financial planning and advising) charges $600 a year.

4. Indirect revenue. A personal advisory service would be a loss leader for many banking providers, but could help to pull in consumers from competitors and, again, tease hidden assets of existing customers up to the surface.

5. HR and cultural upside. Nonfiction Research indicates that there is an appetite among banking employees to do work that is both financial and socially positive.

Jennifer Tescher, president and CEO of the Center For Financial Services Innovation, believes that helping improve people’s financial well-being will become a key point of differentiation among banking providers — provided the motivations for offering such services are genuine.

“Financial health represents the future basis of competition,” says Tescher. In her view, traditional competitive levers like branch convenience and price won’t matter. Engagement around financial well-being will be paramount. According to Tescher, a drive to help consumers improve their financial health must be in a financial institution’s DNA. If they are just out to sell another product, their efforts will ring hollow and fall short, she says.

Ultimately, Tescher doesn’t think there is any product-based tool or solution that can fix the situation. “If mere products were the answer to improving people’s financial health, we’d be there by now,” Tescher explains.