Bank of America has been touting electric vehicles for at least three years — tactics it sees as an investment in the future.

In an annual online event, called EVolution, it hosts experts on various aspects of electric vehicles, from economic forecasts about their share of market to the outlook for the national grid, in terms of the need for charging stations. This is on top of maintaining an online EV resource center that addresses consumers’ questions about electric vehicles.

BofA sees education as a key element of financing the nation’s pending transition to electric vehicles, something that not only ties into its auto lending, but also aligns with its corporate environmental goals.

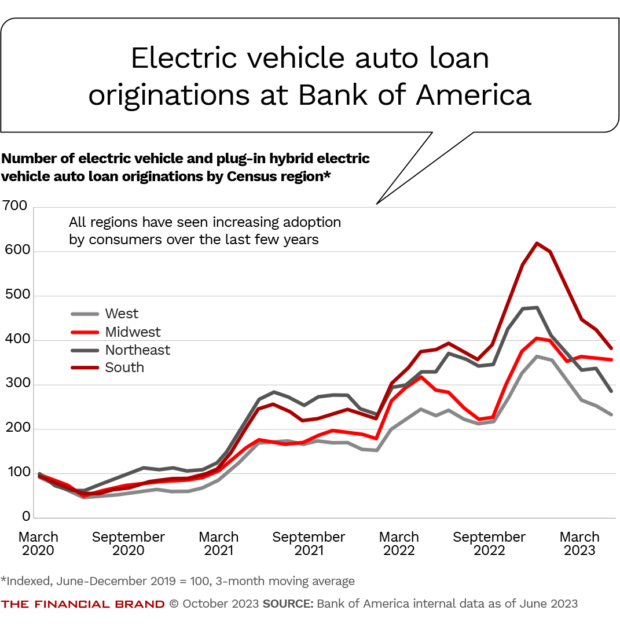

In a July analysis by the Bank of America Institute, an internal think tank, researchers projected that the country’s penetration rate for EVs could be as high as 21% by 2025. That would be nearly a four-fold increase from 2022 levels.

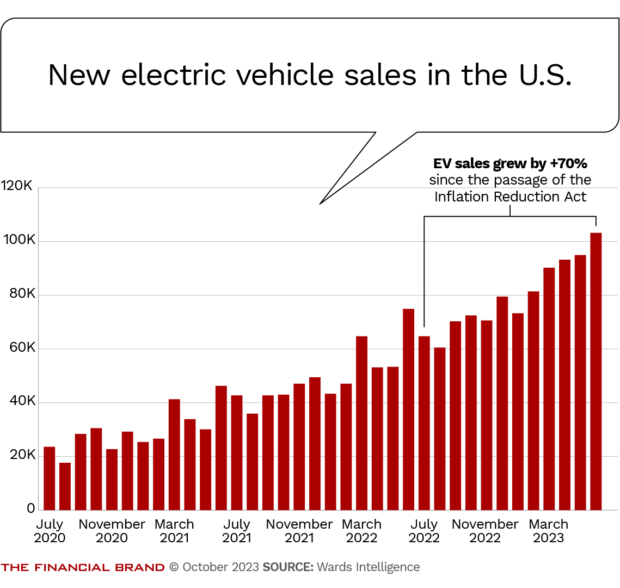

The institute also projects that new electric vehicle launches in model years 2024-2027 will outpace new models of traditional vehicles for the first time. It cites incentives contained in the federal Inflation Reduction Act as a key driver of the rapid rise in demand for EVs. Some states also offer incentives to buyers.

S&P Global Commodity Insight forecasts that 1.3 million all-electric and plug-in hybrid EVs will be sold in the United States in 2023 — a 52% increase over 2022.

But as impressive as those numbers may sound, there’s still a long way to go before EVs reach critical mass. There are 2.7 million EVs on U.S. roads today — which is only 1% of the total, according to Experian’s extensive EV database. On the other hand, Experian reports that 7.5% of new retail vehicle registrations from June 2022-June 2023 were for EVs.

“EVs are a strategic direction for us, as part of our overall sustainability goals at the bank,” says Fabien Thierry, the head of consumer and small business vehicle lending product at BofA. “Years ago, we identified that the market will eventually move to EVs and that this was an area where we wanted to have solutions for our clients.”

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

How Bank of America Tackles the Electric Vehicle Market

Much of Bank of America’s effort has involved applying approaches already used in the auto market to the EV sector, often with new players who were never a factor in the U.S. automobile market prior to the advent of EVs.

EV financing is not treated as a separate business line, Thierry explains in an interview with The Financial Brand, but as an opportunity for evolution and expansion.

In some ways EVs lend themselves to established tactics in the auto market. Subscription financing — essentially a short-term lease with additional features, where permitted by state law — is one example. The high price tag of many EV models favors this approach. It can be used completely in place of a traditional loan or as an option for people who want to try out an EV for a while before they commit.

But the unique nature of EVs also opens up additional financing opportunities. A 2022 TransUnion study indicates that more than half of people who own or who were considering buying an electric vehicle were interested in financing a home charging station.

The same study suggests that the higher level of pre-ordering that happens with EVs and related factors make it imperative for lenders that are not auto company captive financing arms to find ways to stand out online to would-be EV shoppers. This is partly the impetus behind BofA’s strategy of becoming an online resource on EVs.

Down the road — pardon the pun — the bank expects there will be opportunities beyond those associated with gas- and diesel-powered vehicles. Thierry points out that there are two aspects to EV battery life. One is how far the car can go on a charge, but the other is how long the battery will last. J.D. Power research indicates that, depending on the make and model, replacements for EV batteries can run anywhere from $4,000 to $20,000.

And then there is another twist, which began in Asia, according to Thierry, and is now beginning to surface in the U.S. This is battery swapping, where, instead of plugging in to power up, drivers can pull into special booths that automatically remove depleted batteries. Robotic systems pop in a fully charged replacement battery in much less time than it takes to charge up from even a rapid charger.

It’s the closest you can get to topping off your tank in two or three minutes at your corner gas station.

Read more: Why Elon Musk Put Banking on His To-Do List

The Size of the EV Market and the Typical EV Buyers

BofA’s outstanding auto loans totaled $55.2 billion as of the end of the third quarter. That’s up from $52 billion the year earlier and $54.7 billion at the end of the second quarter. The bank has not reported how much of the lending is for EVs.

But it does try to boost consideration in several ways, such as by offering some credit cardholders a discounted interest rate on EV loans.

BofA has found the typical applicant seeking financing for an electric vehicle leans towards the prime credit tier, according to Thierry. This holds true for direct loans made through bank branches and other retail channels, as well as indirect loans through dealerships.

“That’s no change of direction for us, in terms of strategy,” he says. “If anything, it complements what we are currently doing. Bank of America is known to be a prime-credit lender in the auto space.”

A quarterly Experian report called Automotive Consumer Trends and Analysis offers a comprehensive picture of the EV market and the drivers who buy or lease EVs. There are two tiers of EVs in terms of pricing, although all of these vehicles across the board are pricier than traditional ones. In the higher tier are Tesla, a pioneer overall, and luxury brands such as Lucid, one of BofA’s financing partners. The EVs from traditional automakers typically are at the lower end of the pricing spectrum.

In the 12 months ended June 2023, new electric vehicle registrations heavily favored the luxury segment, which made up 77.3% of the total, compared with 22.6% for the non-luxury models, according to Experian’s report for the second quarter of 2023.

In the luxury segment, Tesla accounted for 81.61% of the registrations. In the non-luxury segment, Chevrolet and Ford were the bestselling brands, with each accounting for 24%. Trailing those two U.S. manufacturers were Volkswagen (15.77%), Hyundai (15.22%) and Kia (9.17%).

The buyers skew toward people with household incomes of $150,000 or more, perhaps not surprisingly given the dominant market share of the luxury models. The “personas” for the five most common types of EV buyers have these telling labels: “American Royalty,” “Cosmopolitan Achievers,” “Philanthropic Sophisticates,” “Couples with Clout,” and “Fast Track Couples.”

Which One Is the Spare?:

Experian research finds that 85% of electric vehicle owners have a gasoline-powered vehicle in their garage as well. This suggests that reaching out to past auto loan customers might yield some takers for EV loans as they shop around.

Leasing EVs is more popular this year than in the past because of federal incentives under the Inflation Reduction Act, according to Thierry, who serves as vice chair on an industry committee on auto lending. “It’s not only a Bank of America trend; it’s an industry dynamic,” he says.

A tax credit is actually granted to the lessor of the vehicle, which may pass that on to the EV customer in the form of a rebate or a reduction in the lease cost. Another tax credit provision applies to EV purchases, subject to multiple restrictions and qualifications, including income level.

Read more: How Auto Lenders Can Help the Growing Ranks of Troubled Borrowers

BofA Bundles Financing for EV Charging Stations into Its Auto Loans

Thierry suggests that hybrids have been very popular because they are a transition between traditional vehicles and EVs. (A regular hybrid runs on gasoline alone, but recaptures energy via “regenerative braking,” that charges the battery whenever drivers use the brakes. A plug-in hybrid can be charged from an external source.)

Hybrids are “like stepping stones” to fully electric vehicles, he says.

“I’m anticipating that EVs in the long run will be the solution as the battery technology keeps improving,” Thierry adds. “You’ve already seen some manufacturers achieve EV battery technology that has surpassed 500 miles. So I’m betting that it’s just a question of time before the full transition to EV.”

The availability of charging stations is still an open issue and one of the concerns holding some consumers back from going electric. There are memes on the internet poking fun at EVs, such as one showing an EV with a dead battery being recharged on the side of the road by a portable gas generator, complete with pull cord.

Another Opportunity for Lenders:

A favored piece of auxiliary equipment is a home charging station, which can cost several thousand dollars, but is a significantly faster way to recharge an electric vehicle than plugging it into a standard wall outlet.

Motor Trend estimates the cost of the home charger and the electrical work necessary to make it functional can run between $1,150 to $2,750, with the labor making up most of that. The figure is based on 2023 data.

BofA announced in February that consumers can finance their purchases of home charging stations as part of their auto loans. The bank expects rising demand for charging stations to result in nearly 27.5 million homes having one by 2030, up from 1.3 million in 2021.

Read more about Bank of America:

- Bank of America CEO Brian Moynihan: ‘We Won’t Have a Recession’

- BofA Ups Digital Prowess with Marketing & Digital Banking Combo

- Why Bank of America Believes Financial Health is the Future of Banking

Like Changing the Batteries in Your Flashlight

An alternative that is just beginning in this country is the concept of swapping out batteries instead of charging. One of the world’s leaders in this is Nio, an EV carmaker based in China. In fact, the company offers “BaaS” — battery as a service — via drive-in automated battery swap stations.

Moving beyond China, Nio began introducing the swap stations across the European Union in 2023. It plans to have more than 2,000 swap stations globally by the end of the year — a drop in the world bucket, for sure, but beyond an experiment.

One U.S. provider is Ample, which introduced an improved swap station in May. When its customers approach a station, their vehicle is recognized. The station door opens and they drive into pre-arranged slots. The driver then orders the swap from a mobile app. The company promises the vehicle will be back on the road in five minutes. It first deployed stations in 2021 and has been testing them with fleet partners such as Uber.

Could this become an opportunity for banks in the future? In time, as EVs catch on, there will be fewer purchases of gasoline using credit cards and digital wallets. Financial institutions wanting to make up that volume might find some of it, at least, in paid charging stations and battery swap stations. Or annual battery subscriptions could be financed, as BofA is doing with home charging stations now.

See all of our latest coverage on the topic of loan growth.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

BofA Partners with Carmakers to Offer Loans to EV Buyers

Beyond the traditional direct and indirect channels for auto lending, Bank of America has been developing connections with electric vehicle manufacturers that want to have their own captive finance companies. For example, Lucid Group, a U.S. carmaker, and Polestar Automotive USA, which has a Swedish parent company, engaged BofA to be the lender behind their financial services subsidiaries.

Lucid sells its luxury EVs through “studios,” and one of the bank’s roles is providing seamless financing digitally, complete with e-signed “paperwork.”

Another developing alternative to traditional lending and leasing is an EV auto subscription, which BofA has also explored. The subscription plans enable people to try out EVs for shorter periods of time, or they can be used by people who simply want a new car every so often to ensure they always have a state-of-the-art vehicle to drive.

Thierry says that a growing number of firms — two examples are Autonomy and Borrow — have been set up to offer these types of short leases. The concept, which started with traditional vehicles, is proving to be a fit many consumers in what is still the early days of EVs. (BofA already works with Care by Volvo, which offers this option on both traditional and electric vehicles.)

“I wouldn’t call them fintechs per se, but they are a new type of financing company entering the market that functions somewhat like a mini fleet,” says Thierry. “They provide a short-term lease that looks more like a subscription model.”

From the archives: