A storm is brewing in the auto lending sector, but banks and credit unions that take steps to help stressed borrowers now stand to benefit in both the short and long term.

Consumers are facing strong headwinds, including persistent high gasoline prices, continuing inflation, and a corresponding uptick in credit card debt. Forecasters say the next economic blow to hit consumers will be a recession.

As the Federal Reserve continues to battle inflation, the result is pain in the form of tightened lending, lower capital expenditures and job losses. Several tech companies have announced job reductions, including 18,000 by Amazon in January 2023. This is the largest number of layoffs in the company’s history. Unfortunately, this may just be the beginning, not only for tech but the global job market as a whole.

For consumers who have taken out a loan to purchase a vehicle, these factors have conspired to undermine their overall financial health. The average car payment hit an all-time high in July 2022, according to Cox Automotive. Subsequently, auto delinquencies have begun to rise again. Unfortunately, with the pandemic loan-accommodation programs coming to an end, the worst may still be coming.

Tough times don’t last, but customers have long memories. If auto lenders can find ways to guide their borrowers through their struggles when unexpected economic hardships arise, research shows that they can expect be rewarded with greater customer loyalty when conditions improve while reaping the benefits of lower delinquencies and lower expenses in the meantime.

Lenders need to be proactive, and there’s no better time to start than now.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Assessing the Financial Health of Auto Buyers

The true scope of customers’ real-world struggles is jarring, according to J.D. Power’s recent data on the financial health of American car buyers.

Less than one-third of customers who financed a vehicle in the past three years report being very comfortable with the amount of savings they have to cover long-term needs, which can include car payments and vehicle maintenance costs. Additionally, less than half (44%) of captive finance company borrowers and only 33% of people who borrow from banks and credit unions feel their debt is completely manageable.

Both measures are down significantly year over year. Among those consumers, the ability to cover six months of living expenses has significantly declined year over year as well.

These financial struggles aren’t confined to one demographic. While a slightly greater percentage of men say they are always able to pay their bills on time (59% vs. 57% for women), both groups report a significant year-over-year decline in meeting their monthly commitments. This is down from the 64% of men and 60% of women seen in 2021.

In a 2022 survey, less than half of men (41%) said they could cover living expenses for six months or more, and only a third of women said they could do so.

Read More:

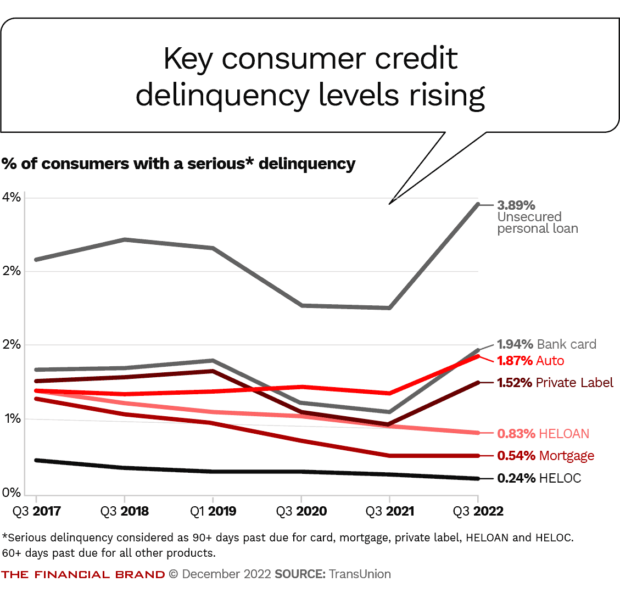

- 2023 Consumer Loan Trends: High Demand, Rising Delinquencies

- Why Banks Need Real-Time Loan Data to Survive a ‘Credit Recession’

How to Proactively Help Troubled Auto Loan Borrowers

What can automotive lenders do to help their customers in this increasingly tenuous situation? Learn from the past.

Understanding each customer’s unique challenges allows lenders to better understand the pressure that customer is experiencing and what steps could provide some relief. A major opportunity discovered during previous periods of disruption — including in the pandemic and in the wake of natural disasters — was a call to be proactive in providing a financial lifeline to those in need.

Such solutions can range from a simple discussion around account status to arranging for a payment extension. However, quite often auto loan borrowers don’t even know that options exist.

Borrowers Often Don't Get Key Messages:

In 2020, nearly 70% of mass-market auto finance customers weren't aware of their lender’s response to the pandemic — and more than 50% of premium customers didn't know.

Auto finance lenders that made significant efforts to effectively communicate potential options and advice to customers facing challenges were rewarded with greater customer advocacy, as demonstrated by their significantly higher Net Promoter Scores. For mass-market lenders, their NPS increased 54% and premium lenders’ scores increased 54%. (The NPS is a measure of customer loyalty, based on the percentage of customers who are likely to recommend the company and its products to others.)

This is a win-win situation for lenders who engage in effective outreach. They maintain their customers in good standing with lower delinquency rates, while improving customer satisfaction.

Read More:

- 2023 Forecast: Auto Lending Will Rev Up — But at a Price

- Timely Advice Beats a Rate-Only Mortgage Lending Strategy

How to Tell Troubled Borrowers About Available Help

So how do lenders increase the chances of a successful communication campaign?

The first step is understanding what actions consumers will look to their lenders to offer. Once again, we need to look to past disruptions and learn from what happened during the first year of the pandemic.

The solutions are the same for both mass-market and premium-market customers. Most of the lender actions that auto borrowers cited revolved around providing financial advice, waiving fees and charges, and arranging payment extensions.

Don't Wait Until Someone Asks:

It's up to lenders to start the conversation to determine the best solution for each borrower.

Truly understanding the customer and their needs and providing options beyond just stopgap measures will cultivate a long-term relationship and foster repeat business.

The second step in creating an action plan is to identify customers’ preferred channel of communication.

For 50% of borrowers, the J.D, Power data indicates that personal email is the preferred channel, but text, calls or mail may be the preference for others. Ideally, lenders should be identifying this preference during customer onboarding.

By using the preferred channel, lenders increase the chances their communication efforts won’t go unnoticed. That’s half the battle.

To be a port in this impending economic storm, lenders need to leverage the treasure trove of data they have at their disposal, from payment history to previous challenges faced, and tailor available solutions directly to each individual.

Understanding both what customers need, and how to properly build awareness for the solutions available, allows lenders to help their customers navigate these turbulent times.