The burst of financial services innovation seen over the last decade is typically credited to the use of new technologies like the smartphone by fintechs and big techs. However, Acting Comptroller of the Currency Brian Brooks says a good deal of the momentum should be credited to consumers and business owners who no longer feel the need to obtain all of their financial services from one primary financial institution. They are willing to access “best of breed” services from multiple providers, rather than settling for a single provider’s variable offerings.

“What’s been coming to banking is a great unbundling,” says Brooks. “It turns out that certain things that banks historically have done maybe can be done more efficiently or more cheaply or at better scale in a specialty company.”

Brooks, an attorney, has more than an academic knowledge of these dynamics. He became Acting Comptroller in late May 2020, after having served briefly as Senior Deputy Comptroller and COO at the national bank regulator. Prior to joining OCC, he was Chief Legal Officer at Coinbase Global, a cryptocurrency firm, and before that he was EVP, General Counsel and Corporate Secretary at Fannie Mae and Vice Chairman at OneWest Bank, N.A., where the prior Comptroller, Joseph Otting, was President and CEO. Before that Brooks chaired the financial services practice at O’Melveny & Myers LLP.

He also strives to keep current on what’s going on. At the time The Financial Brand interviewed him he had just completed a two-week stint in Silicon Valley, spent in discussions with fintech founders and investors.

Brooks’ views on unbundling dovetail with his observations of the future role and structure of banking and that of financial regulation. He sees major changes coming for banks, fintechs and big techs involved in financial services. Some of this will be facilitated by the fintech charter, officially known as special purpose national banking charters for financial technology companies.

The fintech charter has been challenged in court and written off by many. Not only is the specialized charter not dead, but it and a new variation on the theme will play key roles in the evolution of banking into a mix of generalist institutions and very specialized firms — all chartered institutions. Brooks expects to start seeing applications from fintechs and other firms in the very near future.

And he has an unusual fix, for now, for the current court challenge.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Portrait of an Industry Changing on Multiple Fronts

Brooks foresees a period where many institutions will break up into narrower parts, some of which may wind up combining with similar components of other organizations that break themselves up. The pieces and parts may evolve into new creatures as time goes by.

It will still be “banking,” in the broad sense of the word, but “it doesn’t have to be done inside of a depository housed in a Greek-temple building,” says Brooks.

A parallel situation has been playing itself out in communications, Brooks points out. Back in 1982 AT&T broke up into a long-distance company and nine local service operating companies. Since then a massive evolution has taken place. On one hand you have Verizon, a player in telecommunications, internet, cable and mobile, which also now owns Yahoo. On the other hand, AT&T, for its part, expanded so far that it is not only a carrier but a content provider, with its acquisition in 2018 of what is now WarnerMedia.

“I don’t know why we wouldn’t see something like that in banking,” says Brooks. “It won’t totally disrupt banking. There will be parts of banking that in 20 years will look very much as the industry does today. But there will also be parts that look very, very different.”

Brooks says such change is and will be driven by markets themselves.

“We’re in the early innings, but already we see fintech teaching us that there’s a lot of demand for a different kind of financial service, one that is digitally native as opposed to digitally adaptive,” says Brooks. Coming out of the cryptocurrency business most recently, Brooks says that in time direct transferal of financial value between people without an intermediary will be possible.

End of All-Things-to-Everybody Banking

Understand that Brooks isn’t predicting a complete shift to unbundled services. He foresees many different styles and structures will evolve.

“There’s always going to be a place for the incumbent bank model. You’re always going to have some version of JPMorgan Chase because there is such a thing as a money center,” says Brooks. “But the biggest banks, at some level, and community banks, with deep, deep community ties, will have the advantage there. There will be other banks that don’t have a clear strategy and that lack scale, that will find themselves under pressure to consider unbundling or spinning off various functions.”

“What’s been going on with fintech came about precisely because people don’t feel like they’re getting the best experience at the [traditional] one-stop shop.”

— Brian Brooks, Acting Comptroller of the Currency

Brooks thinks mid-sized banks, especially, struggling to find an identity as financial services change, may discover that their component businesses are more valuable separated than they are together.

“Some leaders of incumbent banks are going to see this as a huge opportunity and they will embrace it,” says Brooks. “They will make investments based on this idea and they will do corporate spinoffs to unlock value. The smart corporate leaders will realize that they’re not in the business of preserving their franchise. They are in the business of responding to customers.”

“Banks breaking themselves up is a good formulation,” Brooks continues, but he stresses that the point is that they will do this on their own in a free-market environment.

“I’m not a believer in the idea that the government should decide to break up a company that otherwise isn’t violating antitrust law,” says Brooks. “But what’s been going on with fintech came about precisely because people don’t feel like they’re getting the best experience at the [traditional] one-stop shop.”

Brooks says Stripe, the payments company, makes a clear example. “It exists because small internet startups found using banks to process their online payments to be too clunky and expensive,” says Brooks. “So Stripe showed up and took advantage of that.”

Another example is Venmo. Brooks cites the P2P payments service as an example of consumers applying pressure on financial firms to unbundle. “The consumer is saying, ‘We don’t like the experience of payments over here. We don’t want checkbooks and checks from our bank anymore. We’d rather use Venmo’.”

Brooks notes that he has had personal experience in regard to unbundling. He used to serve on the board of a fintech that had developed two focuses: marketplace lending and white-label software for banks.

“At one point we realized that those were really two different value propositions and we decided to separate them into two companies,” says Brooks.

Read More:

- Are Challenger Banks on the Rocks? Or Will They Rock You?

- A Hybrid Fintech Startup Foretells Banking’s Future

Fintech Charters are as Necessary as They are Doable

The OCC’s fintech charter, first introduced as a concept for discussion in late 2016, was formally announced as a live option in mid-2018. In the most recent legal challenge, a federal district court upheld the New York State Department of Financial Services attack on the charter. That has been seen as at least a pause on the charter, pending appellate arguments.

“Once you get to be successful enough, it’s not possible to be unregulated. Once you get big enough, somebody is going to notice you.”

— Brian Brooks, Acting Comptroller of the Currency

However, in The Financial Brand interview, Brooks says he is open to applications under the charter. He believes this, and another option we’ll discuss in a moment, are essential to the regulatory framework necessary to support the industry evolution that he foresees. In the case of the original fintech charter, he says that will be made possible by “geo-fencing” New York, at least while the appeals process runs its course. This would create a 49-state specialized national banking charter, in effect.

“A number of companies, led by experienced founders, have come to us and said that they want a prefiling meeting, and we’ve got several of those prefiling meetings scheduled already,” says Brooks.

In Brooks’ “past life” in fintech he had the experience of being with a company that did business in 50 states and as a result had to have 50 state-level money transmitter licenses as well as other types of licenses. The company also had to have a dozen or so examinations by different state agencies each year. Sometimes they were checking for compliance with rules that contradicted other states’ rules, according to Brooks.

Brooks already has OCC staff working on a variation of the fintech charter, the so-called payments charter. He has spoken of there being two stages for this, a “1.0” version and a “2.0” version. “Payments charter 1.0” would be a simple national version of a money transmitter license, enabling the holder to operate under one set of rules across the country. “Payments charter 2.0” would be an enhanced version that would incorporate access to certain Federal Reserve services.

Historically fintech companies often tried to operate independent of traditional regulation, but Brooks says many now realize that once they attain any significant size, that isn’t possible.

“Once you get to be successful enough, it’s not possible to be unregulated,” says Brooks. “Once you get big enough, somebody is going to notice you.”

What is different about these specialized charters, he says, is that companies that don’t lend directly will not be expected to maintain capital at the level that a traditional bank assuming credit risk would. Different types of activities would fall under differing standards.

In fact, Brooks sees the specialized charters as essential to the health of the financial system — especially as unbundling accelerates.

“If the bank charter isn’t flexible enough, a lot of the risk we currently supervise and help to manage will leak out of the banking system and go into a relatively unregulated world, where we can’t guarantee safety and soundness anymore,” says Brooks.

“We need room enough in the banking charter to allow unbundled activities to stay within the OCC’s ambit.” Beyond safety, he says, this ensures fair competition.

Read More:

- What Varo Money’s Deal with Moven Means for Challenger Banks’ Future

- It’s Time for Banking Providers to Stop Faking Digital

A Regulator Makes Innovation Possible, but Doesn’t Do the Innovating

The Comptroller’s Office has carried the torch for innovation among federal regulators, beginning with former Comptroller Thomas Curry, who held extensive hearings about fintech and banking, and on whose watch the fintech charter was conceived. Curry also originated the OCC Office of Innovation, which works with fintechs and other players.

The fintech charter became a reality during Joseph Otting’s term, though he made the point that some fintechs, originally interested in that path into banking, backed off when they heard more about the obligations of being a chartered institution.

Brooks supports innovation and sees it as necessary to banking. However, he draws the line at pushing innovation. That may seem contradictory, but he distinguishes between what he thinks is coming and what he makes possible as a regulator. Brooks appears to prefer the role of referee to that of shepherd.

“My role here is to create a framework that maximizes the ability of customers to obtain financial services that they want in the way that they want,” Brooks explains. This includes working to make sure the system is sound, ensuring equal access to services and facilitating multiple choices.

“I don’t have a view [as a regulator] on whether it’s better to pay with Venmo or to write a check. I don’t think it’s my job to have a view,” says Brooks. “My job is to create an environment where checks clear expeditiously and safely. And to be sure that Venmo has cybersecurity standards that prevent people from being hacked.”

Adds Brooks: “And if, over time, more people want Venmo than want to use checks, then the market for checks will just dry up.”

So, he says, financial executives won’t see OCC push them into blockchain or artificial intelligence. But he says he intends that the agency will be out ahead enough to give institutions clarity about what it expects when they venture into a new area. It’s a matter of handling risk.

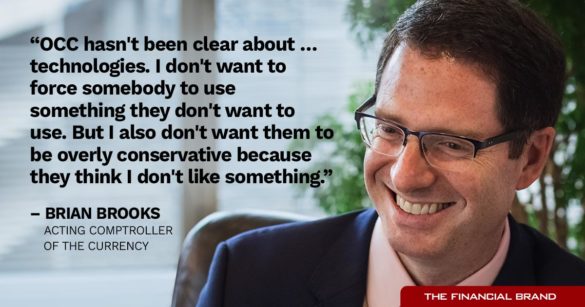

“OCC hasn’t been clear about what we think about these technologies,” says Brooks “I don’t want to force somebody to use something they don’t want to use. But I also don’t want them to be overly conservative because they think I don’t like something.”

Brooks has been spending time looking at policies still extant at OCC that interfere with innovation. In early July 2020 OCC issued an advance notice of proposed rulemaking that encouraged input as the agency reviews its regulations in light of the state of the art of banks’ digital services.

Read More:

- Financial Institutions Taking Innovation Shortcuts with Fintech Deals

- CRA: Empty Bank Branches Do Not Help Communities

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Considering the Future of Bank Branches

In July Brooks was quoted by the Financial Times concerning not using COVID-19 as an excuse to close branches. Some have taken that as OCC’s insistence on keeping branches open in the face of digitization of banking.

Asked about the comment, Brooks noted that he considers branches important. Not as important as they were in the 1980s, but still a factor. Then he expanded on that answer.

“But what I do worry about is both in real life and in the optics, is the fact that when banks close and consolidate branches, they always start at the bottom of the economic ladder,” says Brooks. “You know, if you’re going to close a branch, the first thing you’re going to do is close the least profitable branch. You’re going to close the branch that generates the least good loans or whatever. Those tend to be the branches in the poor neighborhoods.”

Brooks explained that this thinking was behind his comment: “We’re in the middle of a lot of uncertainty for a bunch of reasons we all know about. And I don’t want this uncertainty to be magnified by banks set to close down branches in the very neighborhoods that are generating these protests. They’re all about financial inclusion. We just can’t have that. We need to have an orderly process for thinking about that versus banks saying, ‘Hey, we’ve got to pull out of the inner city.’ Or, ‘We’ve got to pull out of rural America because it’s not profitable.’ Then we just double down on these problems.”

Brooks has strong hopes for a project OCC has started called Project REACh — Roundtable for Economic Access and Change — which is gathering together representatives from banking institutions, urban groups, and more to attempt to solve access issues.

One idea that Brooks puts high importance on is expanding the universe of people who have credit scores. Millions of Americans now lack them and as a result cannot obtain loans.

If that structural barrier can be eliminated, says Brooks, “that alone will be an achievement for a lifetime.”