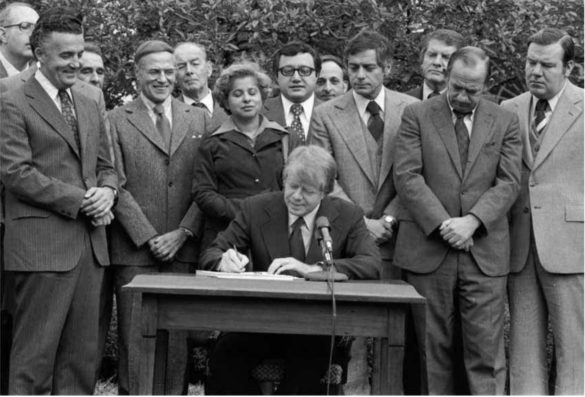

In 1977, Congress enacted the Community Reinvestment Act (CRA) to encourage financial institutions to “serve the convenience and needs of the communities in which they are chartered to do business,” with an emphasis on low- and moderate-income (LMI) communities. While the legislation brought some measurable structure to lending to LMI communities, there has been significant debate on the act’s effectiveness over the years. Unfortunately, with the exception of reducing some of the onerous documentation requirements in the 90s, only modest changes have been made to CRA in recent years.

During the Obama administration, I had the opportunity to visit the White House to discuss areas where financial regulations needed to be revised. The CRA statute and implementing regulations were considered one of the areas in most need of modernization, especially considering the significant change in branch visits as a result of digital banking options and the false idea that a branch was a viable metric for community investment.

President Jimmy Carter signs the Housing and Community Development Act of 1977, which contained the Community Reinvestment Act (CRA)

In December 2019, FDIC and the Office of the Comptroller of the Currency (OCC) announced a proposal to modernize the agencies’ regulations under CRA.

The Office of the Comptroller of the Currency (OCC) released a final rule strengthening and modernizing the agency’s regulations under the Community Reinvestment Act (CRA) in late May. The rule (which has not been signed by all regulating bodies) is intended to benefit communities, businesses and banks by:

- Clarifying what qualifies for CRA consideration.

- Updating how banks define assessment areas for both branch-based and digital banks.

- Evaluating CRA performance more objectively.

- Making reporting more transparent and timelier.

- Providing greater support for small businesses and other entities.

Interestingly, while lending and investment continues to be the foundation, keeping branches open still is a cornerstone component that the government falls back to.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

OCC Warns Banks Not to Close Branches

In an interview with the Financial Times, Brian Brooks, who is the Acting Comptroller at OCC, said that banks should not use COVID-19 as a reason to shut branches or to modify lending policies.

With branches temporarily shut down throughout the U.S. because of the pandemic and consumers becoming increasingly comfortable with digital options, financial institutions hope these recent changes will reinforce the rationale to close branches that have the lowest level of foot traffic.

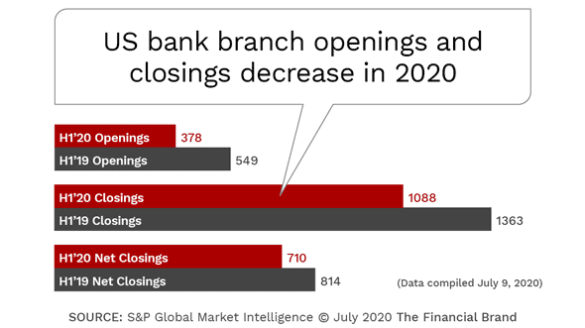

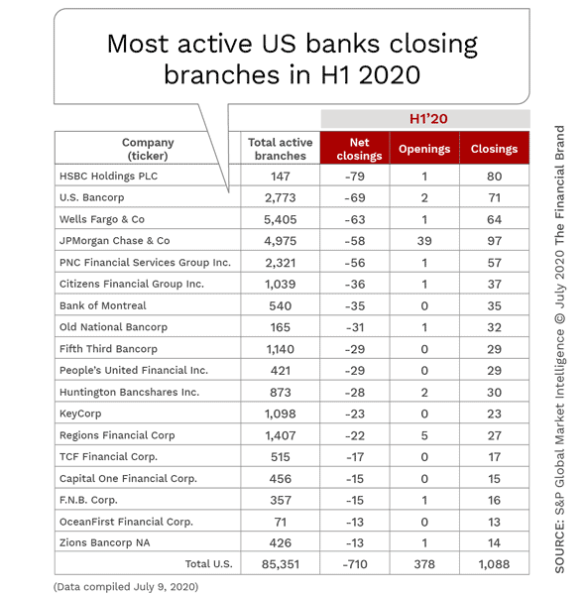

Even though branch closures had slowed in the first half of 2020, according to S&P Global Market Intelligence, branch traffic continues to plummet, reinforced by the COVID-19 crisis.

“I think the idea of, ‘we’ll just go ahead and let branches abandon our cities’ — I think we’d regret that on the back end of this,” he told the Financial Times. The pandemic, he said, was a “one-time event that . . . has affected a relatively small sliver of society compared to the number of people who depend on financial services and branches.”

Despite the ongoing challenge of community groups protesting the closure of almost any branch, this is not the best way to enforce the original intent of the Community Reinvestment Act. There is very little community value of an empty branch compared to other options available to communities, financial institutions and the government. The effective communication of alternatives to keeping dormant real estate open needs to be a priority.

Better Ways to Help Main Street USA

In the changes to the CRA recently proposed by the OCC/FDIC, financing for large-scale infrastructure projects that would benefit a wide range of communities, or lending to hospitals and other large institutions that similarly serve broad families in Opportunity Zones, would qualify. But this is only a start – and more direct options may be needed as a result of COVID-19.

Some additional options the OCC should allow as opposed to keeping branches as banking facilities:

- Community Centers. While the pandemic will certainly impact the success of any community center, there needs to be more facilities available beyond public libraries or Starbucks, where people can meet, use free WiFi, and relax outside of their home. A bank branch is already equipped with much of what would make a community meeting place succeed.

- Adult Learning. The pandemic makes it clear that the world is quickly embracing new technologies and digital talents. There is an immediate need for adult education to prepare yesterday’s workers for tomorrow’s opportunities. Branches could be used for this purpose and/or financial institutions could provide funding for the needed learning options.

- Small Business Investment. There is no doubt that hundreds of thousands of small businesses will be negatively impacted or need to close as a result of the COVID-19 crisis. Many may have not been prepared to move to digital alternatives that could keep them open. Instead of keeping unproductive branches, financial institutions could be required to invest in local small businesses or provide grants to small businesses that can provide digital capabilities to other small businesses (multiplier effect).

- Alternative Storefront Use. While the lending and community investment components of CRA should remain, there may be many more viable options for the physical facility. Usually positioned on prime real estate, these branches could be offered at no cost to alternative businesses that could make better use of the building. From restaurant to retailer, removing the cost of rent could help many small businesses survive.

I have no doubt our readers could come up with dozen better options than to keep nonviable branch offices open simply to meet an outdated regulation’s (or regulator’s) stipulations.

Stop Using Branches as a Component of CRA

Any form of modernization of the CRA must have measurable analysis of community value at the foundation. In addition, effective communication and measurement criteria is needed to respond to community groups who oppose any branch closure. It is hard to imagine the ‘value’ placed on an empty banking branch so long that lending and investment in the community continues.

The ways that “value” are measured must be shared with all interested parties (local government, communities, local social organizations, etc.) so that the impact on the community can be monitored over time.

That said, stop requiring banks and credit unions to carry costly, dormant overhead that contributes little to local economies. There are much better ways.