The report: Future of Fintech: SVB’s Outlook on Innovation in the Fintech Industry

Published: October 2023

Source: Silicon Valley Bank

Why we picked it: This is the latest edition of the “Future of Fintech” report (previously called the “State of Fintech”).

SVB has deep knowledge about the fintech sector and access to proprietary data. The bank is also working to reassert its value to the startup and fintech communities after its collapse and subsequent acquisition by First Citizens. In one of its first reports since those events, SVB is looking at the industry it arguably let down.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Executive Summary

Years of low interest rates and rapid growth in mobile banking made fintech a favored sector over the past decade. By 2021, fintech companies accounted for a fifth of all U.S. venture capital investment, according to SVB.

However, the industry is now two years into a slowdown. Slower funding, a crowded marketplace and growing scrutiny from regulators have complicated the picture for fintech founders and investors. Nonetheless, SVB asserts that there are reasons for optimism.

Key Takeaways

• Many fintechs are tuning their businesses to adjust to higher interest rates and shifting revenue models toward their most profitable products.

• As tough market conditions compress valuations and increased competition for the best deals, investors are now focused on quality.

• It is a buyer’s market for M&A, as a backlog of IPO-ready fintech companies is pressuring founders to accept less favorable deals.

Quotable: “Our findings show that while fintech companies are facing obstacles to growth, they are also finding opportunity. For example, the demand for regulatory technology is growing as federal agencies set new rules for financial technology. Payment companies are primed for growth as the shift toward embedded finance continues, and the emergence of artificial intelligence (AI) is driving efficiencies across fintech subsectors.”

Our Take on the ‘Future of Fintech’ Report

What we liked: Before its collapse, Silicon Valley Bank sat at the center of the fintech ecosystem. It has deep knowledge about the sector with insight into fintech trends and publishes impressive reports on private equity, tech, innovation — even the wine industry.

What we didn’t: The report has some notable findings, but they are sometimes hard to find. Readers may have to flip back and forth between pages to connect the dots among a flood of charts, more than 40 jammed into 22 pages.

Things that made us go “Hmm:” The two all-too obvious goals of the report occasionally feel at odds: On one hand, SVB wants to offer an authoritative diagnosis of the state of fintech while at the same asserting SVB’s enthusiasm for and support of the industry that it’s reporting on.

Read more:

- Neobank Winners & Laggards Point to Long-Term Fintech Strategic Shift

- With Fintechs Under Pressure, It’s Time to Assess Partnership Risks

The Backstory

The role of inflation: Inflation is retreating from its recent highs of the past year, but fintechs born in near zero-rate environments still face considerable hurdles to their business models. These companies often rely on high-volume transactions to overcome steep customer acquisition costs. Now these costs are rising as interest rates make it hard to find creditworthy borrowers.

Trading profit for growth: For years, low borrowing costs enabled fintech companies to build products with less-than-ideal economics. However, the rising cost of capital is now pressuring fintech companies to adopt more profitable practices or seek new revenue sources. SVB notes that revenue growth rates at publicly traded fintech companies have contracted from 29% year-over-year in 2022 to 20% in 2023.

One subsector especially exposed to high interest rates is alternative consumer lenders. For example, according to SVB, the lending-as-a-service platform Upstart is experiencing higher charge-off rates and lower originations, and the buy now, pay later lender Affirm is offsetting dwindling loan revenues with higher merchant fees.

Six Critical Issues from SVB’s Report

In addition to rising rates and less funding availability, the fintech industry faces other challenges.

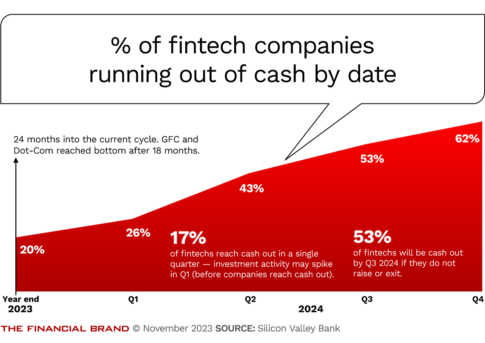

Low on cash: As of the second quarter of 2023, 43% of U.S. fintechs had less than a year’s worth of capital on hand. Lagging revenues and investments combined with rising expenses have drained cash levels across the board for all subsectors. The share of U.S. fintech startups with less than 12 months runway has been on a steady climb since 2021, and over half (53%) will be out of cash by the third quarter of 2024, if they do not raise or exit altogether.

“The troublesome trend is that runway continues to fall across the board for all stages and subsectors, as capital coming in through investment and revenue lags capital going out through burn.”

Fines and fraud: 2023 was a busy year for new regulations and fraud complaints. Notably, SVB says an astonishing 93% of fintech companies paid compliance fines last year, with 60% fined $250,000 or more, citing a survey by the regtech firm Alloy. While more than half of fintechs are using AI for compliance in 2023, federal agencies are cautious about the new technology.

Layoffs: Given the changing environment over the past 18 months, fintech startups have had to quickly pivot their businesses to hit key operating metrics. Many have started by cutting what is typically their biggest line item: headcount. Many companies that overhired in 2020 and 2021 are now downsizing to adapt to slower-than-expected growth. SVB argues that such cuts not only extend the runway, but can put companies on a path to profitability.

Slow growth: Reduction in burn improves efficiency and profitability, but it can also lead to lower growth rates. While 90% of U.S. V.C.-backed fintech companies were growing in 2021, that number has fallen to only 71% today.

Tougher terms for founders: SVB says M&A activity has remained strong as investors see more opportunities in buying companies than building them. While acquisitions are on pace to surpass 2020 levels, the few deals disclosed suggest founders are facing tougher terms. Only 14% of fintech acquisitions disclosed deal terms in 2023, down from 41% in 2021. Among those disclosed, several acquisitions were below the total amount of V.C. capital raised.

Significant opportunities in payments: There is still significant momentum in payments and embedded finance with growing investor interest. Nearly 70% of surveyed consumers in 2022 said they preferred contactless payments, up from 22% in 2020. SVB notes the potential revenue pool is ripe for companies across the embedded finance value chain.

Read more:

- Where Ribbit Capital Sees Fintech Opportunities

- Banks Should Scavenge Troubled Fintechs Talent and Technology

One Bright Spot for Fintech: Blockchain

While the overall fintech market struggled through a downturn in 2023, SVB says blockchain-based startups have seen more investment and development than their peers. The high-profile collapse of several companies, including FTX and Terra, put a dent in the public image of the digital asset space. However, the number of daily active wallets and weekly developers is now above 2021 levels, indicating the market may be entering a new long-term growth cycle.

Bigger blockchain deals: Venture capital and private equity funding for blockchain technology spiked to $25 billion in 2022, up from $500 million in 2019. While the volume of investments steadily declined in 2023, the valuation of reported deals has climbed. For example, the median pre-money valuation for a Series A deal was $95 million, a 56% increase from last year.

But the U.S. lags: So far, in 2023, U.S.-based companies have only accounted for 38% of global venture capital, down from 53% last year. Most of these deals are in Europe, and the U.K. a concentrated hotspot, which holds 17% of the value of blockchain unicorns, such as Revolut. The U.K. — along with Japan, India, and Singapore — is set to pass digital asset regulations this year, while the U.S. is still considering how it will govern digital assets and what compliance measures will apply.

See all of our latest coverage of fintechs.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Final Verdict

The “Future of Fintech” report works hard to simultaneously acknowledge the mounting challenges facing fintech while still digging out nuggets of opportunity. The authors explicitly say, “We remain committed to the lasting viability of the fintech space. Innovation isn’t always a straight line, but our enduring view remains optimistic.”

Craig Guillot is a longtime contributor to The Financial Brand who specializes in technology. He often writes about IoT, cybersecurity and SaaS. His work has appeared in The Wall Street Journal, Entrepreneur and elsewhere.