There’s often a tradeoff between capital and independence. Brian Hamilton is experiencing that first hand, having just agreed to have his innovative neobank, One, become part of the fintech joint venture of Walmart and Ribbit Capital.

He’s already spending a lot of time trying to convince skeptical customers that the banking app they love won’t disappear into corporate oblivion.

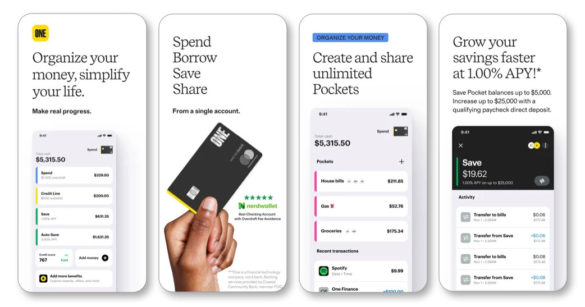

One Finance introduced its consumer banking accounts in September 2020, the intent being to bring middle-class consumers a convenient new form of banking account and credit card service at lower rates than traditional card issuers offer. Also built in are elements of “shareable finance,” the ability for people to cooperate financially, as well as budgeting aids. The emphasis is on no fees and no minimums (One relies on a banking as a service arrangement with Coastal Community Bank, which currently works with around 28 fintechs.)

Independence is critically important to Hamilton, founder of multiple fintechs. And though his One neobank is being acquired by Hazel (the name of the Walmart-Ribbit joint venture), he says the deal will continue to give ONE, the merged company, the ability to develop its suite of products with considerable latitude. There will be more capital muscle behind it — $250 million will be added to the balance sheet for future growth — and there will also be entrée to two major audiences of potential customers: 1.6 million Walmart employees in the U.S., and 100 million+ weekly shoppers online and in stores.

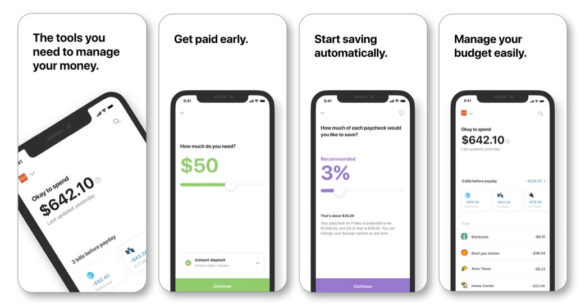

Hazel is in the process of acquiring One Finance, which offers deposit, credit and payment services via banking as a service, as well as Even Responsible Finance, which specializes in payroll advance plans combined with financial wellness offerings, offered through employers. (A major one is Walmart. Even’s consumer base will also provide potential customers.)

The combined company will be called ONE. Omer Ismail, formerly head of Marcus by Goldman Sachs and brought aboard early on as Walmart invested in the joint venture, will serve as CEO. Hamilton and David Baga, CEO of Even, will remain in key leadership positions.

Since the joint venture was launched in January 2021, it has been in self-described “stealth mode.” Even revelation of the Hazel name came about via a reporter’s delving in trademark applications.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Sudden Announcement Shakes Up the Fanbase

But no sooner had the One and Even deals hit the news in late January 2022, the social media mill began. Hamilton assured faithful One customers, who raised concerns about the pending acquisition on Twitter, that the app they love won’t change its character. Among the points raised by customers:

“Is it possible for a financial institution to truly disrupt without being acquired by a major conglomerate? Definitely apprehensive. Just know if the reasons I joined One go away, so do I.”

Others complained that they had moved to One after BBVA acquired and later killed the Simple banking app.

Hamilton tweeted reassurances from his personal Twitter account to underscore responses from the company’s own account.

One example: “Don’t worry! This is not a bank acquisition. We are still an independent company, brand and product, and will continue to deliver the same One products you know and love.”

Also this: “The autonomy and independence provided by this structure are incredibly unique. Let us show you what we do with it, and as always we expect customers to vote with their feet.”

At one point Hamilton tweeted that he is a man of his word and that he wanted to assure people that ONE will only change for the better, with assistance of “jet fuel” brought to the deal by Walmart and Ribbit.

“I think Walmart’s been very smart. They’ve been very clear about independence and autonomy for the brand and its products. That’s because they know that if you want to be a broader part of a customer’s financial life, what you offer can’t only work at Walmart.”

— Brian Hamilton, One

Jim Marous, CEO of the Digital Banking Report and Co-Publisher of The Financial Brand suggests that much bigger plays than the One-Even deal are on the horizon. The Walmart-Ribbit announcement only said that M&A was one possibility for building the fintech’s team, and that new partnerships will come in time.

“These deals are small potatoes,” says Marous. “They didn’t acquire the talent from Goldman to build small. They may be in the market for a data and analytics company, for instance, if the needed talent is not already available internally.”

John Furner, President and CEO, Walmart U.S., and a member of the fintech’s board, said in a statement that consumers have made it clear they want more from Walmart in financial services and that a money management app “is the natural next step toward fulfilling that.”

The Learning That Comes with Scar Tissue

Hamilton has had his share of post-acquisition disappointment. He founded the business fintech Azlo, which launched with a majority investment by a fintech business incubator owned by BBVA. In time, Hamilton found, Azlo was increasingly treated as part of the bank, which held back things he’d wanted to try. Once he realized that the constraints would continue under a banking umbrella, he left. Indeed, later on, as part of the runup to the purchase of BBVA USA by PNC in June 2021, both Azlo and Simple were shuttered.

“This deal couldn’t be more different than the experience of becoming wholly owned by a bank,” says Hamilton. He thinks much of the media coverage of the deal is focused on Walmart’s involvement, “because it’s so big it creates its own weather.” As a result, he says it’s missed that Walmart has set this up for a fair degree of independence with the advantage of a huge opportunity for distribution.

“My scar tissue came from acquisition with Azlo and other experiences. Walmart tried to get into financial services directly a couple of decades ago and they still have some scar tissue from that. Everybody realizes that a fully captured brand and financial product underneath the Walmart umbrella is not the right answer.”

— Brian Hamilton, One

He characterizes the investment as having “a bet on the table” rather than trying to accomplish the same goal in-house. Walmart has tried virtually every avenue into financial services, including several partnerships, such as its Walmart MoneyCard offered with Green Dot that is now a full-fledged checking account. Way back, now, it attempted to form its own industrial bank, an effort that went down in flames in Washington.

The acquisitions are expected to be completed in the first half of 2022, with the deals subject to review by the Federal Trade Commission and the Department of Justice.

The Advantages of Being in the Walmart Universe

Hamilton sees entrée to the giant retailer’s physical and digital presences as a huge advantage for growth and the opportunity to work with employees at Walmart and at Even’s other customer companies adds to it.

The merged fintech will be able to tap the physical Walmart store network in multiple ways. Hamilton says some services may be delivered right at the store register — being able to deposit cash would preclude any need for branches and the need to rent cash deposit ability from Green Dot or another such network. The Walmart Money Centers that are in many stores would add the new operation’s products to their menu, offering cross-selling opportunities.

These are among the merely obvious. Hamilton suggests that fresh approaches to customer recruitment could also be experimented with. He points to the growing role of buy now, pay later financing at the point of sale, both in-store and online. This form of borrowing is still evolving, and is coming under review by the Consumer Financial Protection Bureau.

The new ONE could develop its own, consumer-friendly form of BNPL financing that would be a first connection to Walmart shoppers who don’t have ONE accounts.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Is Walmart Building Towards a Super App?

The matter of BNPL financing brings Hamilton to his belief that Americans want to reintegrate their use of financial services, rather than continuing in the do-it-yourself, mix-and-match mode that has become commonplace today.

Hamilton says looking at the fintech community underscores how many players offer narrow solutions. Historically Americans tended to obtain many of their services from their primary financial institutions, and, even when they did not work seamlessly together, there was a level of simplicity and convenience that’s been lost, for many.

“We can start to bridge that gap by pulling all those pieces together,” says Hamilton. “There’s a rebundling and reintegration of financial services that is part of the value prop for us.”

What's Coming Next:

There's been much talk about the new company becoming the nexus of a Walmart-oriented super app.

In the official announcement Walmart and Ribbit spoke of providing users with “an all-in-one financial services app to holistically manage their finances in one place.” In an interview with the Wall Street Journal, Omer Ismail, referred to the opportunity “to build a financial services super app.”

Just what a super app really is remains somewhat in the eye of the definer. In a Forbes blog about the Walmart-Ribbit deals, Cornerstone Advisors Ron Shevlin wrote skeptically about designs on a super app.

“Just selling a lot of different types of products and services on a mobile app does not make an app a super app,” Shevlin wrote. “Super apps are ecosystems. They’re enclosed experiences that make it easy to accomplish a wide variety of tasks — as long as the tasks occur within the walled garden.”

Currently, these don’t exist in the U.S., not in the form seen commonly in China, Shevlin continued. To truly produce a super app, he says, there are many elements from the Walmart organization that must be integrated.

Hamilton sees the ongoing reintegration of financial services as a challenge that will go on for a while, in any event.

“Just bringing all the bases back together is still an opportunity,” says Hamilton.

A Charter for the Latest Walmart Financial Foray?

Given changes in the atmosphere in Washington, Hamilton doesn’t see a bank charter anywhere in the combined companies’ immediate future.

“We really want the freedom to do innovative financial services at scale,” says Hamilton. A charter would more likely be a sea anchor than a sail right now. Consider that the recent conditional charter approval for SoFi specifically barred the company from expanding into crypto services without checking with the Comptroller of the Currency.

Meanwhile, will the Walmart-Ribbit joint ventures plans shake up the banking industry? Marous has his doubts.

“If legacy banks haven’t changed their stripes because of Chime, Varo and Current,” he says, “what would make them change now?”